Strategy, Legal & Operations

The Practice of Now 2019: An essential report for accountants

Editor’s note: The Practice of Now 2020 report has been launched. We’ve created a new article where you can learn more about it.

Now in its third year, the independent research within The Practice of Now 2019 report provides a snapshot of the accounting landscape as we enter the third decade of the 21st century. It’s necessary reading for anybody within the profession.

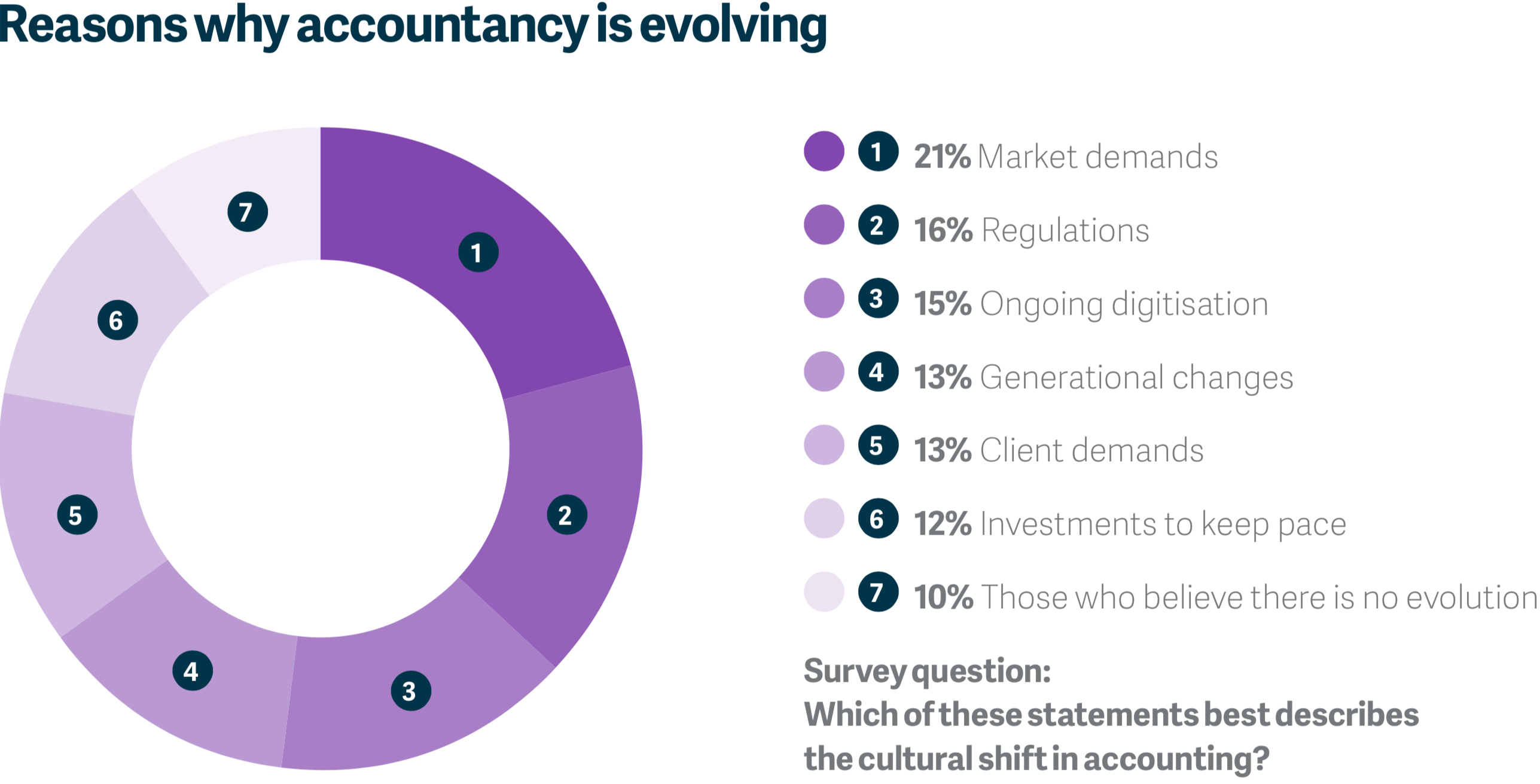

Highlights from the report include the fact that 90% of accountants we spoke to worldwide believe there has been a cultural shift in accountancy.

Just under half of accountants surveyed have formerly examined their business practices in the past year, and the majority believe the industry needs to pick up the pace of technological adoption.

Training and recruitment are identified as issues, with most firms open to the idea of hiring outside traditional accounting backgrounds, and most accountants agreeing traditional accountancy training is no longer adequate.

The report includes commentary from expert voices within Sage, as well as those working within the accountancy profession.

Commissioned by Sage, Viga carried out independent research surveying 3,000 accountants from across the globe (based in the US, UK, Canada, Spain, France and Australia) to understand what the landscape for accountants looks like today and will look like tomorrow.

The report offers practical advice on how today’s accountants can continue to thrive and become the Practice of Now.

Our report offers data-driven insight and advice into:

- The changing landscape for accountants in 2019 and beyond

- How client expectations are driving changes within the profession

- What accountants need to do and know to prepare for the coming decade.

Excerpt from The Practice of Now

Forty-nine percent of accountants have formally examined their business practices in the past year. This is in relation to customers and the evolving marketplace. A further 26% have formally examined their business practices in the past five years. All the signs point to a profession building for the future.

Accounting and bookkeeping remain the dominant service offering in practices worldwide – although payroll (25%), personal and corporate tax management (24%), and compliance work such as final accounts/company registrations (20%) are all popular, albeit with some large fluctuations by country depending on the individual business and accounting cultures.

Business advisory services (17%) and outsourced CFO (5%) remain a significant growth opportunity.

For Chris Downing, a former senior accountant who is now global director of accountants at Sage, the increasing digitisation of tax – mandated by governments or legislators worldwide – is partially the cause for accountants examining their business practices.

He says: “Legislation is now mandating how businesses operate, requiring them to take the digital route to submitting tax returns online.

“It’s a landmark change in terms of how accountants interact with their clients. Accountants are receiving data more efficiently, which also means that actually they’re engaging with clients more often.”

Technology is undoubtedly driving change in accountancy practices.

The majority of survey respondents (56%) cite the increased productivity allowed through technology advances as the main benefit of technology, with a further 27% viewing the time-saving aspect as its most important value, as it relates to allowing them to focus on customers.

More than a third of accountants surveyed (35%) regard their firms as early adopters of technology, investing readily in the best technology available in order to stay ahead of competitors and diversify their offerings.

A further 58% are moving more slowly, only buying what they need to keep up or to satisfy client expectations.

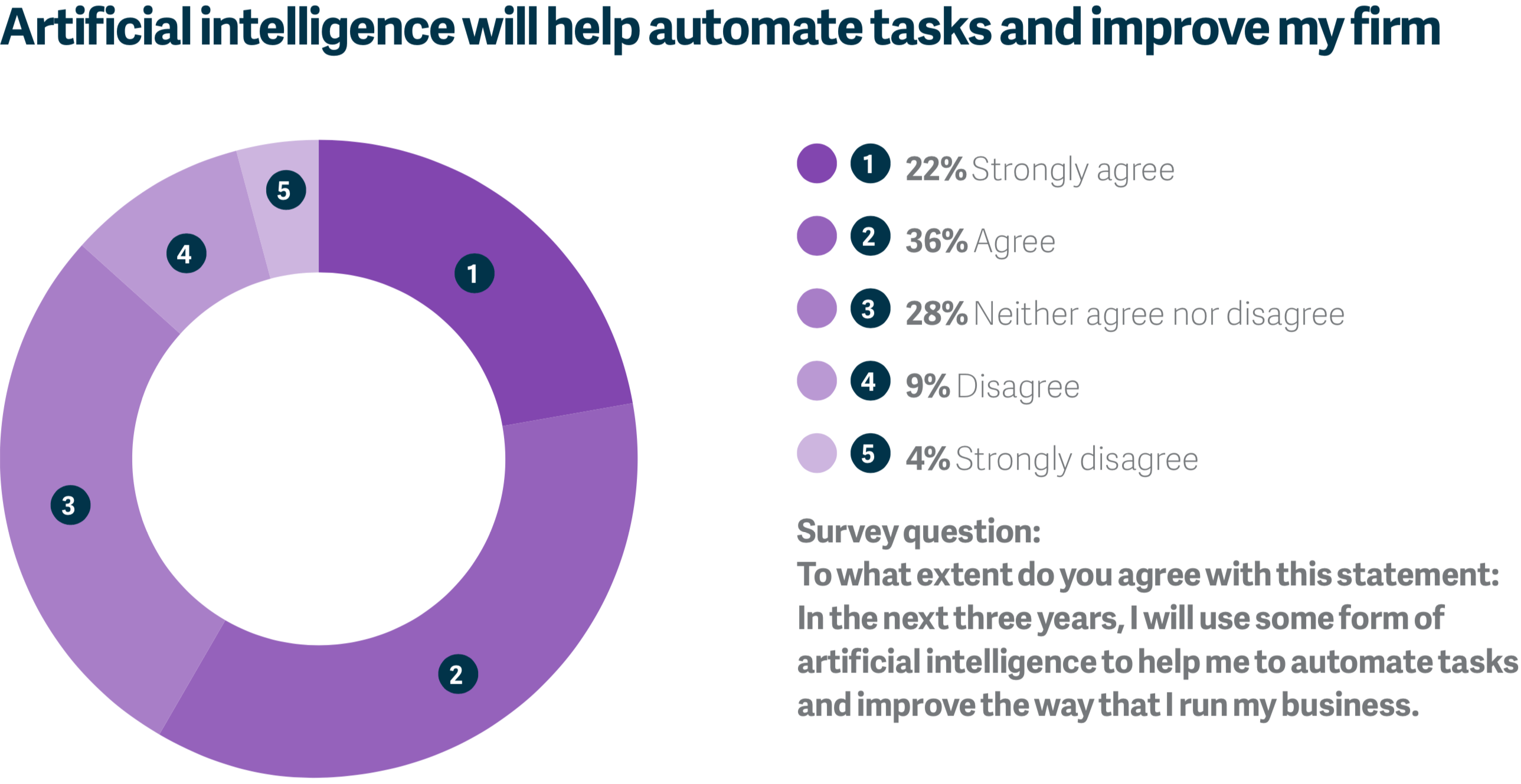

Emerging technologies also have a part to play in modern accountancy.

More than half (58%) of the survey respondents look forward to adopting relevant artificial intelligence (AI) applications, which they believe will be made available in the next three years.

Respondents envision a wide variety of ways in which AI could aid them, with the most interest being in ways to cut out some of the drudgery of data entry, number crunching and routine communications.

Make no mistake, our survey indicates that accountants understand what technology offers and are ready to exploit its benefits.

The practice of the future – in 2030

- No manual data entry: Data will flow automatically from clients and their bank accounts into accountants’ systems. Manually keying in data will become rare with legislation, such as the digitisation of tax, forcing businesses to change.

- Real-time relationships: The relationship between accountants and their clients will be near-instant. The accountant will have a real-time view of their client’s business and will be able to interact with that client in real- time. The accountant will be a trusted partner or even a constantly present companion.

- Proactive alerts and notifications: Accountants will know instantly when things change for a client. For example, the accountant is alerted when their client suddenly incurs a lot of bad debt resulting from a big order placed by the client’s customer whose credit rating is low.

- Pre-emptive problem solving: Accountants’ time will be spent proactively looking at business problems and seeing errors before they manifest themselves into year-end error corrections.

- Higher fees but better value: Accountants will charge more to clients than they do today because of their increased value due to their advisory services. Fees might not grow by that much, of course, but accountants will be able to monetise better.

Jennifer Warawa, a former accountant, is the EVP of partners, accountants and alliances at Sage. She concludes: “Over the next decade I think firms will need to become more rounded in terms of skill set.

“They’re going to start to identify functional expertise that’s needed to take their business to the next level, such as marketing and sales.

“It won’t just be about accounting work any longer – diversity will become important. Firms will start to leverage diverse backgrounds and experiences to gain a competitive advantage.”

The Practice of Now research from 2019 provides the most useful signposting an accountancy practice could receive as they enter the third decade of the 21st century.

The outlook for accountants is positive, and their appetite to adapt and evolve is high. However, it’s also clear that to be successful in the years to come, accountants need to embrace change.

The Practice of Now

Discover how accountants and bookkeepers are preparing for the future and learn what you can do now to keep your practice successful.

Ask the author a question or share your advice