Money Matters

VAT domestic reverse charge checklist for construction firms

Use this VAT reverse charge checklist for building and construction services to ensure your processes adhere to the new legislation.

If your construction business is part of the Construction Industry Scheme (CIS) then the way you handle and pay VAT is likely to change.

The VAT domestic reverse charge for building and construction services affects the supply of certain kinds of construction services in the UK. Both contractors and subcontractors are affected.

The legislation came into force on 1 March 2021.

It means VAT registered subcontractors (suppliers) who provide a service and any related goods to a VAT-registered contractor (customer) who’s CIS-registered no longer need to account for the VAT.

Instead, the customer accounts for the VAT as an input tax, as if they’ve made the supply to themselves.

This includes any building and construction materials used to supply the services (although not materials bought and sold without related services).

The VAT domestic reverse charge for building and construction services is mandatory, therefore you can’t opt in or out, or choose to apply it only to certain invoices.

It’s also worth noting that new CIS rules are coming into force in April 2021. Read this CIS blog to find out more:

VAT domestic reverse charge for construction checklist

To support you with the VAT reverse charge, we’ve created this checklist so you can ensure your processes are in order. It will help you do the following:

Understand what the 5% disregard for VAT reverse charge is

Work out which business processes to adapt

Ensure you have the right software

Ensure your invoices are updated

Figure out who is impacted

If your business is signed up to the Construction Industry Scheme (CIS) and is either of the following then the VAT reverse charge for construction applies:

- Contractor (your business employs subcontractors)

- Sub-contractor (your business is employed by contractors).

It doesn’t apply for services supplied to non-VAT registered individuals or businesses, so work done for homeowners/domestic users should be invoiced in the standard way.

Nor does it apply to work done overseas. It’s limited to UK companies providing construction services in the UK.

If your business operates under the Flat Rate Scheme then reverse charge supplies are excluded and should be accounted for in the usual way (notably this may change your desire to stay on the Flat Rate Scheme, and you might wish to consult a professional adviser).

Flat Rate Scheme users who receive reverse charge supplies have to account for the VAT due to HMRC.

The VAT reverse charge for construction doesn’t apply to temporary workers your business supplies and is responsible for paying (employment agencies or similar are effectively excluded).

Figure out what is impacted

The scope of what’s covered by the VAT reverse charge is closely aligned to that defined as construction operations under the CIS.

HMRC says the following list of construction services are included – but you should remember that the VAT reverse charge applies both to these services as well as any construction materials used directly while providing them:

- Construction, alteration, repair, extension, demolition or dismantling of buildings or structures (whether permanent or not), including offshore installations

- Construction, alteration, repair, extension or demolition of any works forming, or to form, part of the land, including (in particular) walls, roadworks, power lines, electronic communications apparatus, aircraft runways, docks and harbours, railways, inland waterways, pipelines, reservoirs, water mains, wells, sewers, industrial plant and installations for purposes of land drainage, coast protection or defence

- Installation in any building or structure of systems of heating, lighting, air conditioning, ventilation, power supply, drainage, sanitation, water supply or fire protection

- Internal cleaning of buildings and structures, so far as carried out in the course of their construction, alteration, repair, extension or restoration

- Painting or decorating the internal or external surfaces of any building or structure.

If supplied on their own the following are excluded from the VAT reverse charge (again, this list is provided by HMRC, which notes that it is not exhaustive):

- Drilling for, or extraction of, oil or natural gas

- Extraction (whether by underground or surface working) of minerals and tunnelling or boring, or construction of underground works, for this purpose

- Manufacture of building or engineering components or equipment, materials, plant or machinery, or delivery of any of these things to site

- Manufacture of components for systems of heating, lighting, air conditioning, ventilation, power supply, drainage, sanitation, water supply or fire protection, or delivery of any of these things to site

- The professional work of architects or surveyors, or of consultants in building, engineering, interior or exterior decoration or in the laying out of landscape

- The making, installation and repair of artistic works, being sculptures, murals and other works which are wholly artistic in nature

- Sign writing and erecting, installing and repairing signboards and advertisements

- The installation of seating, blinds and shutters

- The installation of security systems, including burglar alarms, closed circuit television and public address systems.

If you make a mixed supply containing a reverse charge element then you should apply the reverse charge to the entirety of the supply.

Projects that started before 1 March 2021 but that ended on or after that date are affected.

Read more about construction and VAT

- VAT domestic reverse charge for construction: 23 things you need to know

- Construction Industry Scheme: How VAT changes affect you

- How to register for VAT

- What is VAT? UK VAT basics

- How to understand and manage VAT for your business

Understand what the 5% disregard for VAT reverse charge is

The VAT reverse charge says certain work undertaken by a subcontractor must have the reverse charge applied if that work falls under the CIS.

A general list of the work that does fall under the CIS, and the work that doesn’t, can be found on the government’s website.

This is true if a subcontractor invoices for a mixture of work – so called mixed invoices – of which some falls under the CIS VAT reverse charge rules, but the rest doesn’t. In this case, the VAT reverse charge should be used.

But there’s an important exception.

If the component of the invoice for work that falls under the CIS VAT reverse charge rules is just 5% or less of the total amount invoiced, then the normal VAT rules are applied, and the CIS VAT reverse charge isn’t used.

For example, installing a security system does not fall under the CIS reverse charge rules. Installing lighting does.

So, if an electrician were to visit a site to wire a security system and also took care of some lighting wiring while there, and the latter work represented 5% of less of the invoice amount, then the CIS VAT reverse charge should not be applied to the entire invoice.

But if the lighting wiring work was 10%, for example, then the VAT reverse charge should be applied to the entire invoice.

Work out which business processes to adapt

Depending on whether you’re a contractor or sub-contractor, changes in your invoicing and accounting procedures are required, as follows (which is not comprehensive):

Contractors

Businesses that employ CIS-registered sub-contractors need to do the following at a minimum:

Communication

Ensure CIS and VAT-registered subcontractors are aware of the VAT reverse charge for construction and the changes it’s introduced.

This could involve contacting each one separately. Smaller businesses in particular, such as sole traders, might not be aware.

Accounting changes

Now the VAT reverse charge has taken effect, you have to pay VAT and CIS registered sub-contractors net of VAT (i.e. without paying the VAT).

This could mean a cash flow benefit because you’re no longer paying this VAT amount to the sub-contractor, and can hold it until the next return along with the rest of the VAT accounting.

You need to keep accurate records of this accounting, in addition to tracking how much CIS tax is withheld from subcontractors as per standard requirements.

Checking suppliers and invoices

On an ongoing basis, you need to ensure that:

- subcontractors are eligible for the reverse charge (are they VAT-registered and part of the CIS?)

- and that the invoices that claim VAT reverse charge include work that falls within the remit (see above).

A vital point to be aware of is that mixed supplies from a subcontractor should have the VAT reverse charge applied to the entirety of the invoice.

VAT Returns

The way you complete VAT Returns has changed following the introduction of the VAT reverse charge.

Box 1 of the VAT Return should contain output tax on purchases to which the domestic reverse charge applies.

Do not enter the value of such purchases in box 6.

You can reclaim the input tax on their domestic reverse charge purchases in box 4 of the VAT Return and include the value of the purchases in box 7, in the normal way.

If in any doubt consult an accountant, VAT specialist, or HMRC.

Sub-contractors

When working for a CIS-registered contractor, you will need to do the following at a minimum:

Communication

Contact any existing CIS and VAT-registered contractors to ensure they’re aware of the VAT reverse charge. Ensure you’re able to follow any additional requirements they may have.

Educate yourself and your staff about the changes

With the VAT reverse charge, it’s down to you to ensure you get your invoicing and accounting correct, and there are numerous small requirements and issues that are easily missed.

This could lead to an increase in administrative work.

Accounting changes

Now the VAT reverse charge has taken effect, you have to issue VAT reverse charge invoices to CIS-registered contractors, and these differ from standard VAT invoices (see below).

You also no longer receive the VAT component of the payment from a CIS-registered contractor.

You should prepare for a potential cash flow impact because you no longer have this money available before it’s passed it to HMRC monthly/quarterly.

You might even become a repayment trader—a business that claims money from HMRC on its VAT Return, rather than making a payment.

If this is the case, you might want to switch to monthly VAT Returns to improve your cash flow.

As soon as possible, you should consult an accountant, VAT specialist or HMRC to learn more about this.

VAT Return

The way you complete your VAT Returns has changed following the introduction of the VAT reverse charge.

You must not enter in box 1 of the VAT Return any output tax on sales to which the domestic reverse charge applies.

Instead, enter the value of such sales in box 6. If in any doubt consult an accountant, VAT specialist, or HMRC.

Ensure you have the right software

Both contractors and subcontractors may need to update their accounting software so that VAT reverse charge for construction accounting is facilitated, and that appropriate invoices can be issued.

With cloud accounting software that supports CIS and VAT, this update will happen automatically (if it hasn’t already).

With software that’s manually installed on a computer, you might need to apply an update. Contact the software vendor for more information.

Be aware that there are several different kinds of VAT reverse charge, with each varying in the requirements and industries they apply to.

You need to ensure your software is specifically updated for the VAT domestic reverse charge for building and construction services.

As well as updating, you need to ensure the VAT reverse charge for construction is applied within the accounting software. Again, contact your software vendor to learn how to do this.

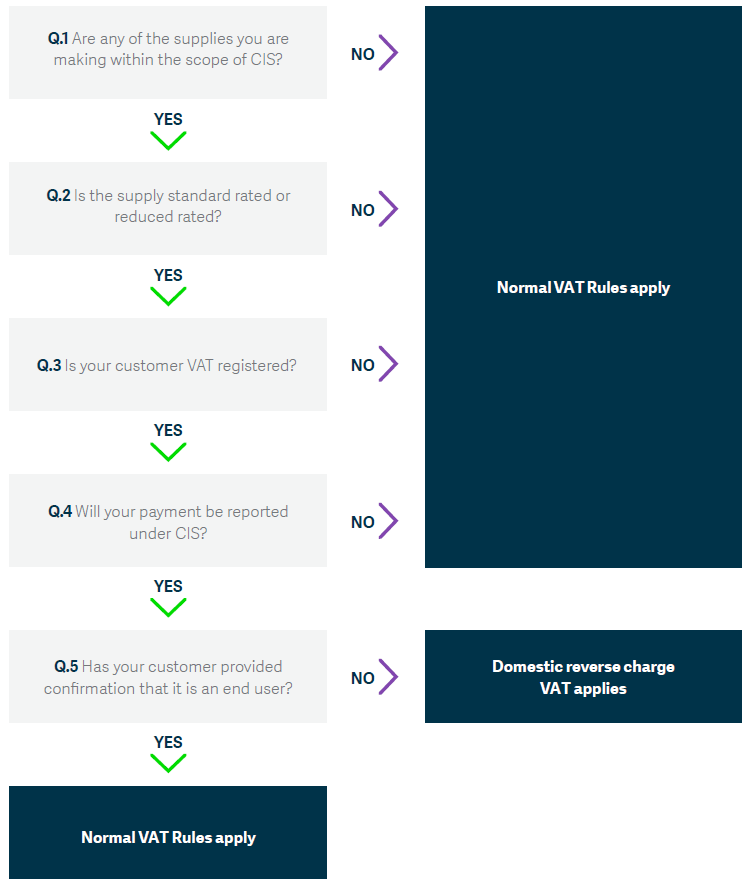

Using this flowchart, you can see how you would decide whether to apply normal VAT rules or apply the domestic reverse charge

Ensure your invoices are updated

Updating your accounting software and activating the VAT reverse charge feature should ensure your invoices are outputted in the correct format.

If you don’t use accounting software to issue invoices – perhaps favouring printing them off in Microsoft Word, or even handwriting them – you need to ensure the invoice templates you use are updated to reflect that the reverse charge is applied.

The invoice should show the standard information required for a VAT invoice, such as your VAT number. However, it also needs to clearly state that the VAT reverse charge is applied.

HMRC suggests any of the following fulfil the legal requirement:

- Reverse charge: VAT Act 1994 Section 55A applies

- Reverse charge: S55A VATA 94 applies

- Reverse charge: Customer to pay the VAT to HMRC

You should make it clear on the invoice that the customer is required to account for the VAT.

Final points to consider

The VAT reverse charge applies to all jobs completed on or after 1 March 2021. However, it could apply to work that was commenced before this date but completed afterwards.

The acid test is when the tax point is, which is to say, the date of issue of the VAT invoice or the receipt of payment (whichever occurs first).

If the tax point is on or after 1 March 2021 then the reverse charge should be applied even for work commenced before this date. Otherwise, current VAT rules apply. Annual tax points are no different.

Editor’s note: This article was first published in July 2019 and has been updated for relevance.

Tackling the Construction Industry Scheme with Sage Accounting

Learn about the Construction Industry Scheme and your legal responsibilities, and find out about the new VAT reverse charge for construction.

Will Sage be introducing new tax codes for “reverse charge on purchases” and “reverse charge on Sales” ? Otherwise how will these figures be included in VAT return? I know there is a Tax Code of T21 – is this to be used on Sales or Purchases? Please advise on what Tax Codes are to be used on Reverse Charge Purchases and which to use on Reverse Charge Sales. Thank you

Will Sage be introducing new tax codes for “reverse charge on purchases” and “reverse charge on Sales” ? Otherwise how will these figures be included in VAT return? I know there is a Tax Code of T21 – is this to be used on Sales or Purchases? Please advise on what Tax Codes are to be used on Reverse Charge Purchases and which to use on Reverse Charge Sales. Thank you

I would like to know an answer to Tanya’s question below and I would like to know when this will take place for clients on the cloud based Sage and Sage 50C?

Will Sage be introducing new tax codes for “reverse charge on purchases” and “reverse charge on Sales” ? Otherwise how will these figures be included in VAT return?

I am glad HMRC have now postponed this until 01.10.20 as with just two weeks if we were to get this ready for 1st Oct 19 there would be very little time to adapt. I have had no notification from Sage on how we account for this within their software, as per Butterfly Jak’s comment below, simple instructions on how we post these particular transactions would be very helpful. I have registered for a Sage webinar on this so I hope this will shed some light on this.

I understand the government has delayed the scheme for a year. It would appear that this article was updated on the 7th after Sage’s latest newsletters with this link.

Why have you stated 1 Oct 2020, change comes into effect 2019??? Some simple instructions on how to post invoices on sage would be helpful!