Strategy, Legal & Operations

VAT domestic reverse charge for construction: 23 things you need to know

What is the VAT reverse charge for construction, which started on 1 March 2021? How does it work? Get the answers to these questions and more.

Those working in the UK’s construction industry might have to handle and pay VAT in a different way following the introduction of the new VAT reverse charge system.

Here are the answers to some frequently asked questions.

1. What is the VAT domestic reverse charge for construction services?

2. When was the VAT reverse charge for construction services introduced?

3. What if my construction project began before the reverse charge but ended after it came in?

4. What VAT rates does the VAT reverse charge for construction services apply to?

5. Why is the VAT reverse charge for construction services being introduced?

6. Who does the VAT reverse charge for construction services apply to?

8. What construction services does the VAT reverse charge apply to?

9. What’s exempt from the VAT reverse charge for construction services?

13. What if I’m invoicing for mixed supplies that includes a VAT reverse charge component?

15. Can I choose whether to apply the VAT reverse charge for construction services?

17. Will the VAT reverse charge for construction still apply after Brexit?

18. Do invoices need to change when the VAT reverse charge for construction comes in?

19. How is the VAT reverse charge for construction affected by Making Tax Digital for VAT?

20. How does the construction reverse charge impact businesses on the flat rate scheme?

22. How can I check if a business is VAT registered and/or registered for CIS?

23. Is there a minimum threshold from which the VAT reverse charge for construction should apply?

Bonus question: What is the 5% disregard for VAT reverse charge?

1. What is the VAT domestic reverse charge for construction services?

The VAT domestic reverse charge for building and construction services, to give it its full title, is a change in how VAT is handled for certain kinds of construction services in the UK, along with the building and construction materials used directly in those services (although it doesn’t apply to building and construction materials supplied separately and independently of any construction services).

The VAT reverse charge for construction is effectively an extension of the Construction Industry Scheme (CIS) and applies only to transactions that are reported under the CIS and are between VAT-registered contractors and sub-contractors.

The scheme means those supplying construction services to a VAT-registered customer no longer have to account for the VAT.

Instead, the customer accounts for the VAT (that is, it’s considered input tax for them, as if they’ve made the supply to themselves).

In even simpler terms, for services they provide, sub-contractors require the contractor employing them to handle and pay the VAT directly to HMRC.

The payment received is for the cost of the work done (plus materials used), net of any CIS deductions for tax and National Insurance but no VAT will be paid on the invoice.

2. When was the VAT reverse charge for construction services introduced?

The VAT domestic reverse charge for construction came into force on 1 March 2021.

It was initially planned to start from October 2019 but was postponed to October 2020 to “avoid the changes coinciding with Brexit” and “to help businesses and give them more time to prepare” according to HMRC.

However, due to the impact of the coronavirus outbreak on the construction industry, HMRC extended the October 2020 date by a further five months.

3. What if my construction project began before the reverse charge but ended after it came in?

It depends upon when the tax point is. In most cases, this is the date of issue of the VAT invoice, or the receipt of payment – whichever occurs first.

However, if a prepayment was made then it will be the date that the supplier received payment. And if there is no invoice or the invoice was issued 15 or more days before the work is finished, it’s the date that the work was finished.

This is known as the “Time of Supply” rules.

If the tax point is on or after 1 March 2021 then the reverse charge should be applied. If the tax point is before that date, current VAT rules apply.

4. What VAT rates does the VAT reverse charge for construction services apply to?

It applies to both standard and reduced-rate VAT supplies. It doesn’t apply to zero-rated supplies.

5. Why is the VAT reverse charge for construction services being introduced?

HMRC says it will combat fraud, whereby construction businesses charge VAT for the services they supply but then disappear without paying their VAT bill – essentially taking with them a 5% or 20% additional profit that doesn’t belong to them (and very likely having provided the work at an uncompetitive and unfair discount because of this).

The construction industry is targeted by organised criminals in this way.

By moving the VAT charge down the supply chain, HMRC intends to make this kind of fraud impossible.

The introduction follows the success of similar, although not identical, reverse charge schemes for the likes of mobile phone and computer chip retailers, and wholesale energy suppliers.

6. Who does the VAT reverse charge for construction services apply to?

It applies only to VAT-registered businesses who are supplying/receiving services that are reported under CIS.

In other words, it applies to services supplied between the majority of construction sub-contractors and contractors in the UK.

If your CIS business is the recipient of construction services, and receives an invoice with the reverse charge applied, then you account for the VAT amount as part of your overall input tax, as if you’ve charged it to yourself.

If your business is not VAT registered then the reverse charge can’t be applied to you, and standard VAT rules apply for the supplier (so they will charge you the VAT and account for it as usual).

If you’re not VAT registered, you should make it clear to the supplier in writing.

Crucially, reverse charges don’t contribute to a company’s potential VAT threshold. So if you aren’t registered for VAT then any attempt to apply the reverse charge won’t push you over the limit.

Notably, the reverse charge also doesn’t apply to end users, such as the people who use a building that’s been constructed by the provided services, and nor does it apply to some of those connected to them, such as landlords or tenants.

For sake of clarity, HMRC says the VAT reverse charge for construction doesn’t apply to sub-contractors unless the answer to all of the following questions is positive:

- Are any of the supplies you are making within the scope of the CIS?

- Is the supply standard or reduced-rated?

- Is your customer VAT registered?

- Will your payment be reported under CIS?

- Are you sure the customer is not an end user?

7. What do I do if the VAT reverse charge for construction services doesn’t apply to the services I provide?

Normal VAT rules apply, which is to say, you should invoice for the VAT and account for it in your VAT return.

Read more about construction and VAT

- Construction Industry Scheme: How VAT changes affect you

- How to register for VAT

- What is VAT? UK VAT basics

- How to understand and manage VAT for your business

8. What construction services does the VAT reverse charge apply to?

According to HMRC, the reverse charge applies to the following, with the inclusion of any services that form an integral part of the items below, or are preparatory to them, or are for rendering them complete (for example, site clearance or earth-moving excavation):

- construction, alteration, repair, extension, demolition or dismantling of buildings or structures (whether permanent or not), including offshore installations

- construction, alteration, repair, extension or demolition of any works forming, or to form, part of the land, including (in particular) walls, roadworks, power lines, electronic communications apparatus, aircraft runways, docks and harbours, railways, inland waterways, pipelines, reservoirs, water mains, wells, sewers, industrial plant and installations for purposes of land drainage, coast protection or defence

- installation in any building or structure of systems of heating, lighting, air conditioning, ventilation, power supply, drainage, sanitation, water supply or fire protection

- internal cleaning of buildings and structures, so far as carried out in the course of their construction, alteration, repair, extension or restoration

- painting or decorating the internal or external surfaces of any building or structure

Remember that the reverse charge applies to the services listed above plus any construction materials used directly for those services.

This is different to the CIS scheme, which does not cover materials.

9. What’s exempt from the VAT reverse charge for construction services?

HMRC lists the following as some examples of exclusions if they’re supplied on their own, although the list isn’t exhaustive:

- drilling for, or extraction of, oil or natural gas

- extraction (whether by underground or surface working) of minerals and tunnelling or boring, or construction of underground works, for this purpose

- manufacture of building or engineering components or equipment, materials, plant or machinery, or delivery of any of these things to site

- manufacture of components for systems of heating, lighting, air conditioning, ventilation, power supply, drainage, sanitation, water supply or fire protection, or delivery of any of these things to site

- the professional work of architects or surveyors, or of consultants in building, engineering, interior or exterior decoration or in the laying out of landscape

- the making, installation and repair of artistic works, being sculptures, murals and other works that are wholly artistic in nature

- sign writing and erecting, installing and repairing signboards and advertisements

- the installation of seating, blinds and shutters

- the installation of security systems, including burglar alarms, CCTV and public address systems

10. I’m a sub-contractor. What does the VAT reverse charge for construction services mean for my business?

If you’re a sub-contractor (i.e. you supply CIS-regulated construction services) then, it means very little because when you issue your VAT invoice you will merely be passing on the VAT charge that you would have had to account for in any event.

You will, however, need to expect a change to the way your reconcile customer’s payments against invoices issued, as any VAT registered customers will be withholding the VAT element for any CIS related supplies.

This may require an update to your accounting software if you do not use cloud software.

It might also affect your cash flow because the VAT you previously held before passing it monthly/quarterly to HMRC as a payment is no longer available for any uses you might have put it to.

Notably, because you no longer pay VAT on your sales you might find you become what HMRC calls a repayment trader—a business whose VAT return means they claim money from HMRC, rather than making a payment.

HMRC suggests such businesses apply to move to monthly returns, to speed up payments received from HMRC and therefore benefit cash flow.

When it comes to completing your VAT return, you must not enter in Box 1 of the VAT return any output tax on sales to which the domestic reverse charge applies. But you must enter the value of such sales in Box 6.

11. I’m a contractor. What does the VAT reverse charge for construction services mean for my business?

If you’re a contractor (i.e. purchase CIS regulated construction services) then, it means you need to ensure that when you receive reverse charge VAT invoices you correctly account for them.

You need to pay any VAT due directly to HMRC as part of your normal VAT settlement process instead of paying the VAT on CIS related supplies to your supplier.

This may require an update to your accounting software if you do not use cloud software.

You may gain a cash flow benefit because the VAT you previously had to pay when paying sub-contractors, but could not reclaim until your next VAT return, is simply netted off in your VAT return. There should be no net impact on your overall VAT bill.

However, to ensure you don’t pay too much or too little VAT, make sure the invoice you receive is correct, especially with regard to the correct VAT rates, and ensure the services listed are eligible for the reverse charge.

When it comes to your VAT return, enter in box 1 of the VAT return the output tax on purchases to which the domestic reverse charge applies. But don’t enter the value of such purchases in Box 6.

You may reclaim the input tax on your domestic reverse charge purchases in Box 4 of the VAT return and include the value of the purchases in Box 7, in the normal way.

12. Does the VAT reverse charge for construction services apply to work provided for home/domestic users?

No. It only applies to VAT-registered businesses registered for the CIS.

If the services are provided for non-VAT-registered individuals or other kinds of ordinary non-business individuals then standard VAT rules apply.

13. What if I’m invoicing for mixed supplies that includes a VAT reverse charge component?

In this case, apply the VAT reverse charge for the whole invoice. This is intended to make the system as simple as possible to administer.

14. Does the VAT reverse charge for construction services apply to work undertaken overseas by my company?

No. It’s limited to UK companies providing construction services in the UK to VAT registered customers.

15. Can I choose whether to apply the VAT reverse charge for construction services?

The VAT reverse charge is mandatory in situations as discussed above.

The only time a decision might have to be made is if a service has been supplied on a construction site and the VAT reverse charge has already been applied by that sub-contractor.

Assuming both parties agree, the sub-contractor can choose to continue to use the VAT reverse charge on that site.

16. I’m unsure whether the VAT reverse charge for construction services applies to the services my business provides

The first step is to seek professional guidance on this issue. Speak to a VAT specialist, or directly to HMRC.

Notably, HMRC says it will apply a “light touch” to any mistakes made in the first six months with relation to errors encountered with the VAT reverse charge. However, this isn’t an excuse to ignore the requirements or to make deliberate errors.

HMRC adds the following guidance: “If still in doubt, provided the recipient is VAT registered and the payments are subject to CIS, it is recommended that the reverse should apply.”

17. Will the VAT reverse charge for construction still apply after Brexit?

This is a domestic VAT rule, applying only to the UK, so continues to be in force following the UK’s exit from the European Union.

18. Do invoices need to change when the VAT reverse charge for construction comes in?

Yes. Invoices should clearly indicate the reverse charge applies using the correct terminology. HMRC suggests businesses use any of the following:

- Reverse charge: VAT Act 1994 Section 55A applies

- Reverse charge: S55A VATA 94 applies

- Reverse charge: Customer to pay the VAT to HMRC

It should be clear on the invoice that the reverse charge mechanism has been applied.

Your invoice should still show all the usual information required for a VAT invoice.

Within your accounting software, it makes sense to create new invoice templates for use with reverse charge supplies, with all the information above listed as standard.

However, you may find your accounting software includes functionality to account for the VAT reverse charge for construction and will therefore output the correct type of invoice.

Although, note that the construction industry VAT reverse charge is just one of several VAT domestic reverse charge procedures and each one has different rules.

19. How is the VAT reverse charge for construction affected by Making Tax Digital for VAT?

Making Tax Digital only changes how businesses submit their VAT returns, and how they record their VAT accounting – both of which must now be done digitally using functional compatible software.

Therefore, Making Tax Digital for VAT has no direct bearing on the VAT reverse charge other than the fact any reverse charges must be recorded digitally, along with the rest of your VAT accounting.

20. How does the construction reverse charge impact businesses on the flat rate scheme?

Reverse charge supplies are excluded from the flat rate scheme so should be accounted for and reports the same way that transactions are accounted for and reported under the standard scheme.

This reduces the amount of turnover that’s used as a basis for reclaiming VAT under the flat rate scheme and sub-contractors may want to discuss this with their professional adviser to reassess which of the standard or flat rate schemes are most beneficial.

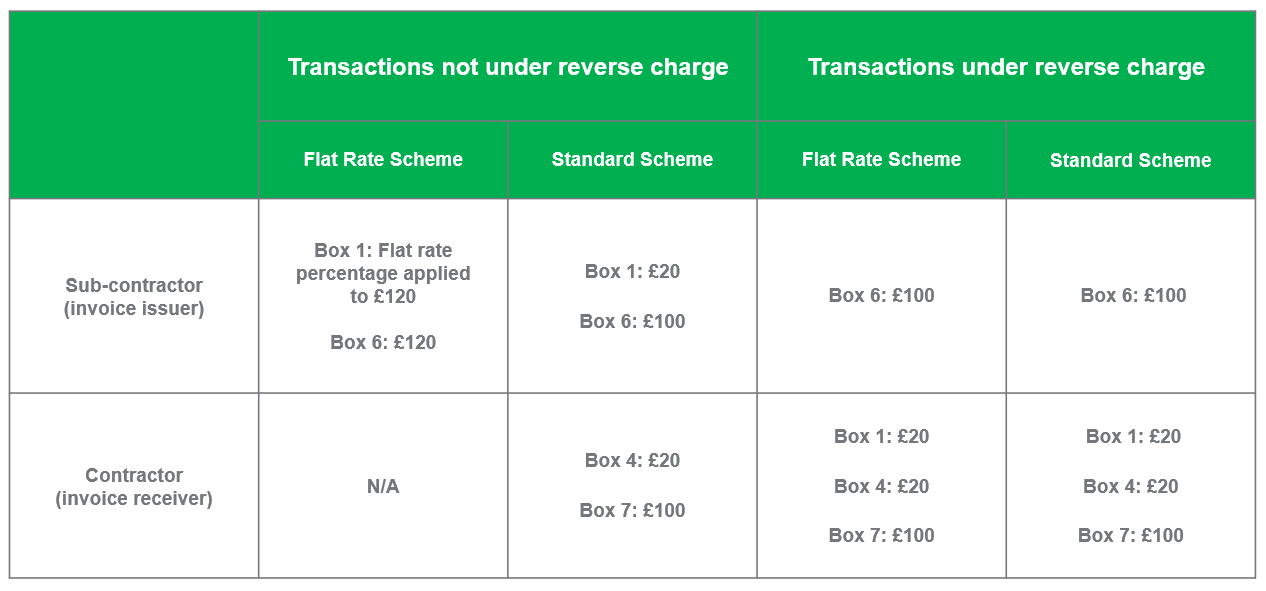

As an example, the table below explains how an invoice for a £100 service that is for standard rate VAT should be reported in the next VAT return.

21. I run an agency or other temporary employment business that supplies construction staff. Does the VAT reverse charge for construction impact what we do?

If your business supplies temporary workers and is responsible for paying them, then you’re not subject to the VAT reverse charge.

This is because your business is not considered a building or construction service for VAT purposes, and the individual workers are paid not by the construction business that uses them to provide construction services.

22. How can I check if a business is VAT registered and/or registered for CIS?

To check if a business is VAT-registered you can simply ask them, or consult correspondence or their online materials.

HMRC says businesses don’t need to verify the CIS registration of existing customers for the purposes of the VAT reverse charge for construction, although businesses might want to review that existing documentation is present and correct, such as a deductions certificate.

Sub-contractors can verify CIS registration by asking the contractor for details, and should retain a copy of any documentation received.

Contractors should use the CIS verification system or their CIS software when taking on new sub-contractors.

This requires you to have placed an order with the sub-contractor before use, but HMRC says that for this purpose, you can tick the box even if no order has been placed.

To check a sole trader for the VAT reverse charge for construction, you need to input the following details, that you might need to request from them:

- their name

- their Unique Taxpayer Reference

- their National Insurance number.

To check the partner in a firm for the VAT reverse charge for construction, you need:

- the firm’s name

- the partner’s name

- the firm’s Unique Taxpayer Reference

- the partner’s Unique Taxpayer Reference, or partner’s National Insurance number (if the partner is an individual)

- the company’s Unique Taxpayer Reference or registration number (if the partner is a company).

To check a company for the VAT reverse charge for construction, you need:

- the name of the company

- the company’s Unique Taxpayer Reference

- the company registration number.

23. Is there a minimum threshold from which the VAT reverse charge for construction should apply?

There are no minimum or maximum thresholds.

Bonus question: What is the 5% disregard for VAT reverse charge?

The VAT reverse charge says certain work undertaken by a subcontractor must have the reverse charge applied if that work falls under the CIS.

A general list of the work that does fall under the CIS, and the work that doesn’t, can be found on the government’s website.

This is true if a subcontractor invoices for a mixture of work – so called mixed invoices – of which some falls under the CIS VAT reverse charge rules, but the rest doesn’t. In this case, the VAT reverse charge should be used.

But there’s an important exception.

If the component of the invoice for work that falls under the CIS VAT reverse charge rules is just 5% or less of the total amount invoiced, then the normal VAT rules are applied, and the CIS VAT reverse charge isn’t used.

For example, installing a security system does not fall under the CIS reverse charge rules. Installing lighting does.

So, if an electrician were to visit a site to wire a security system and also took care of some lighting wiring while there, and the latter work represented 5% of less of the invoice amount, then the CIS VAT reverse charge should not be applied to the entire invoice.

But if the lighting wiring work was 10%, for example, then the VAT reverse charge should be applied to the entire invoice.

Conclusion on the VAT reverse charge

You should attempt to become familiar now with what is (and isn’t) included under the VAT reverse charge, and communicate with any contractors who regularly use you to ensure they also understand the requirement.

As a contractor, you might want to contact your regular sub-contractors and discuss the matter with them (if you haven’t already).

Of course, the reverse charge might have to be stated in any contracts that are drawn up and you also need to ensure your IT systems are prepared fully, such as ensuring your accounting system is able to process reverse charge invoices.

For further advice on how to proceed with the VAT reverse charge, consult a VAT specialist or speak directly to HMRC.

Editor’s note: This article was first published in July 2019 and has been updated for relevance.

Tackling the Construction Industry Scheme with Sage Accounting

Learn about the Construction Industry Scheme and your legal responsibilities, and find out about the new VAT reverse charge for construction.

I have received an invoice from a CIS sub contractor that has charged VAT and not reverse charged the invoice. Is the correct procedure to return the invoice asking for it to be produced correctly?

Many thanks

We are a manufacturing & installation company and registered for CIS as a sub-contractor. On checking our customers to see if they are also CIS registered, thereby triggering the new reverse charge VAT scenario, we are being told they are not declaring us on their CIS return as do not consider it appropriate. If we have that confirmation do we accept that decision and continue with standard rate VAT invoicing? Many thanks for any help.

Hi Julie,

This is something HMRC will need to discuss with you. You can contact them directly to discuss this here http://1sa.ge/bDjv50BBhom or on 0300 322 9434.

You can find the answers to common CIS Reverse Charge questions here http://1sa.ge/VO4450DU9TH and join our CIS Domestic Reverse Charge VAT Webinar to learn more at https://www.sage.com/en-gb/cp/cis-domestic-reverse-charge/

Regards,

Paul

Sage UKI

I have some invoices for work that was completed in February but payment isn’t due till the end of March. Do I reverse charge the VAT?

Hi Peter,

This is something HMRC will need to discuss with you. You can contact them directly to discuss this here http://1sa.ge/bDjv50BBhom or on 0300 322 9434.

You can find the answers to common CIS Reverse Charge questions here http://1sa.ge/VO4450DU9TH and join our CIS Domestic Reverse Charge VAT Webinar to learn more at https://www.sage.com/en-gb/cp/cis-domestic-reverse-charge/

Regards,

Paul

Sage UKI

Hi,

We provide a sports line marking service to our clients as part of a main contract.

Does line marking come under the CIS scope? Our supplier says it doesnt and will invoice us with VAT.

I presume that as the line marking is part of mixed services (i.e supply & install hardwood flooring etc) it will be invoiced as VAT reverse.

Thanks.

Hi Lisa,

This is something HMRC will need to discuss with you. You can contact them directly to discuss this here http://1sa.ge/bDjv50BBhom or on 0300 322 9434.

You can find the answers to common CIS Reverse Charge questions here http://1sa.ge/VO4450DU9TH and join our CIS Domestic Reverse Charge VAT Webinar to learn more at https://www.sage.com/en-gb/cp/cis-domestic-reverse-charge/

Regards,

Paul

Sage UKI

Can you advise me,

We are a large Sub Contractor carrying out work on a site that has confirmed to us they are an end user.

We are using our own PAYE operatives and a sub contractor with his operatives to carry out the work on this site.

When we receive payment from our client the reverse VAT does not apply as they are the end user.

The sub contractor we used, invoices our company for work on this site, (not the end user) as we pay his invoice should reverse VAT apply as we are not the end user. Thank you

Hi Yvonne,

This is something HMRC will need to discuss with you. You can contact them directly to discuss this here http://1sa.ge/bDjv50BBhom or on 0300 322 9434.

You can find the answers to common CIS Reverse Charge questions here http://1sa.ge/VO4450DU9TH and join our CIS Domestic Reverse Charge VAT Webinar to learn more at https://www.sage.com/en-gb/cp/cis-domestic-reverse-charge/

Regards,

Paul

Sage UKI

Please can you advise which SAGE version I need to use for invoicing for VAT Domestic Reverse Charge. Your advisor said I could find uner Mysage.co.uk but unable to locate

Tanks

Hi Haley,

Sage 50cloud Accounts v26 and above deals with the CIS Reverse Charge changes, including new tax codes that have been created to assist with processing for this new legislation. You can find out more and download and install any necessary updates here http://1sa.ge/qJch50EkIA6

Regards,

Paul

Sage UKI

Which version of Sage 50 accounts can deal with reverse charge?

Hi Simon,

If you’re using Sage 50cloud Accounts v25 or below we recommend that you install the latest version of Sage 50cloud Accounts via our Installation Hub at http://1sa.ge/KV3650DUaKb to have all the tools in the software to process the new CIS Reverse Charges.

You can find the answers to common CIS Reverse Charge questions here http://1sa.ge/VO4450DU9TH and join our CIS Domestic Reverse Charge VAT Webinar to learn more at https://www.sage.com/en-gb/cp/cis-domestic-reverse-charge/

Regards,

Paul

Sage UKI

I need to produce my first DRC invoice to the end user, I thought there would be an invoice template for reverse charge invoicing, but nothing has come up on my template list regarding reverse charge invoice. Do I have to edit my own? (I am working remotely).

Hi Jane,

If you’re using Sage 50cloud Accounts v25 or below you can install the latest version of Sage 50cloud Accounts via our Installation Hub at http://1sa.ge/KV3650DUaKb to bring the relevant invoice layouts through.

Or, you can edit your invoice layout to show Domestic Reverse Charge in Report Designer. Full steps on how to do this here http://1sa.ge/60Uv50DUaKa

Regards,

Paul

Sage UKI

What happens if I’m doing a private job for the person who lives in there own property will they have the facility to be the vat to source and if they don’t will the HMRC fine my company or is this only Constructin to Constructin were the reverse vat is applied?

Hi James,

This is something HMRC will need to discuss with you. You can contact them directly to discuss this here http://1sa.ge/bDjv50BBhom or on 0300 322 9434.

You can find the answers to common CIS Reverse Charge questions here http://1sa.ge/VO4450DU9TH and join our CIS Domestic Reverse Charge VAT Webinar to learn more at https://www.sage.com/en-gb/cp/cis-domestic-reverse-charge/

Regards,

Paul

Sage UKI

Appreciated your blog, it is very informative, entertaining and a straight shooter. Thank you for sharing your thoughts. Opening a business set up in Dubai is one of the best decisions I have ever had, DAFZA was the best platform in this.