Money Matters

Why business intelligence can help you improve cash flow

Do you think business intelligence is something just for large companies to use? Actually, your business can use it too.

For small and growing businesses, there are few tasks more important than ensuring you’re paid on time and managing your cash flow.

Let’s face it, your startup capital or the money you currently have in the bank is not enough to fund the day-to-day expenses of your business indefinitely, and so you need to be able to plan for cash coming in and going out as accurately as possible.

Without doing so, you place yourself at risk of manning a sinking ship—as the decisions you make aren’t based on accurate financial data and it’s likely that you’ll end up spending more cash than you’re earning.

There are many ways business intelligence can help guide you towards better and smarter business decisions, ensuring you get paid timeously and ultimately safeguarding your cash flow. Here are a few that stand out:

Use business intelligence to know exactly who owes you cash and how much

Keeping track of who owes you cash and how much they owe you can be hard, especially when you’re focused on grinding out sales or services to keep your business going.

However, without following up on customers and their unpaid or partly paid invoices, your business can quickly run into financial difficulties.

With business intelligence, you’re able to get a quick overview of your debtors and easily identify who you need to reach out to so you can ensure you get the cash that’s owed to you.

Better yet, great business intelligence solutions will empower you to instantly dig into the details behind who owes you cash and discover what they owe you for, who you need to contact to get that cash and, most importantly, how long it’s been outstanding.

This could potentially save you up to 15 days a year in chasing late payments.

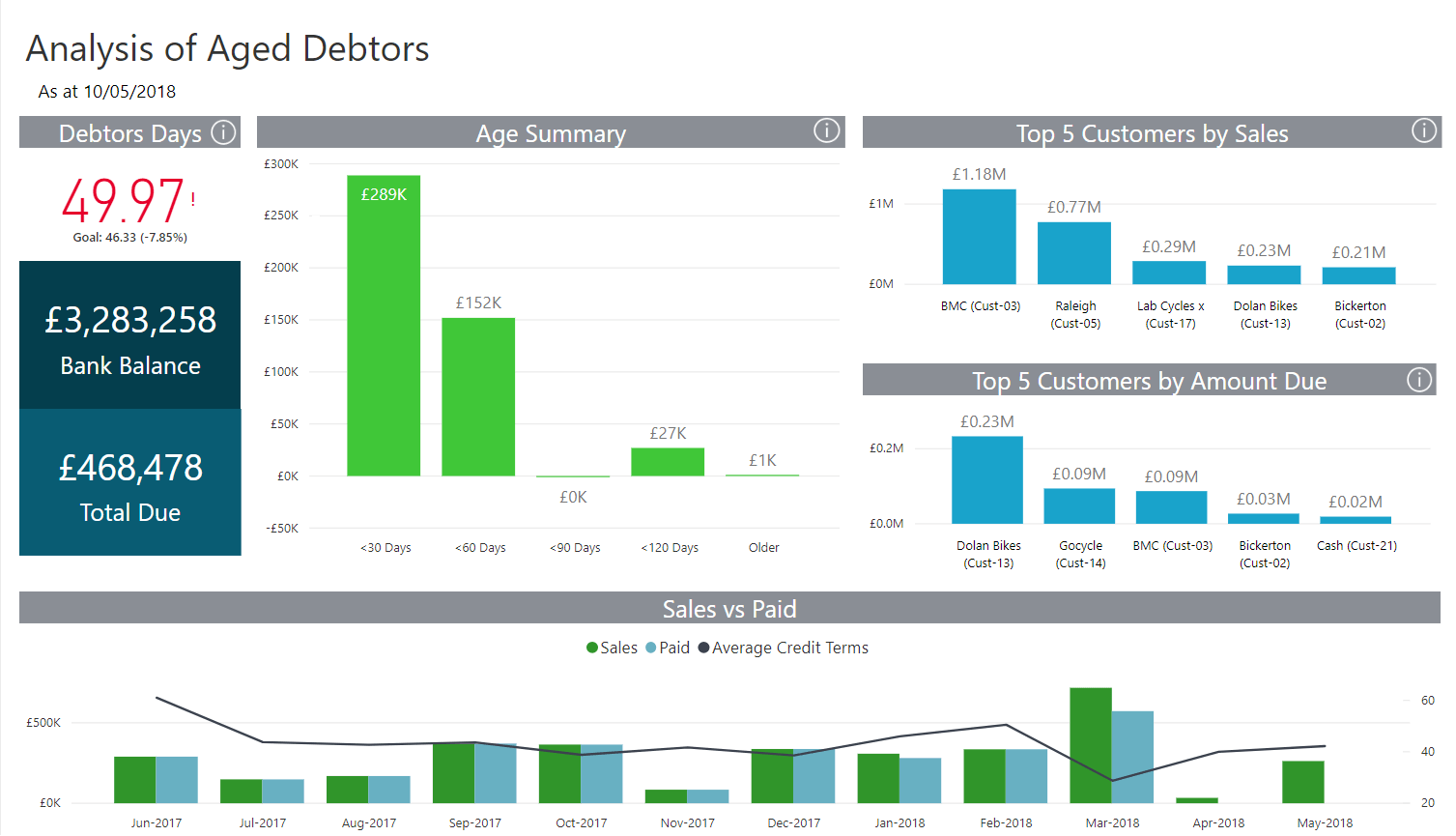

An Analysis of Aged Debtors dashboard should quickly tell you how much cash you’re owed, who owes you this cash and when it’s due

Get visibility into when that cash is due

While insight into who owes you cash and how much certainly helps, the true power of business intelligence when chasing payments lies in its ability to present you with information on due and overdue invoices.

Access to this information in a visual and easy-to-understand format is vital when you’re following up on payments, as it equips you with the knowledge and insight you need to approach your customers and ask them to pay up.

If you notice a certain customer is often late with their payments, reach out and attempt to come to an agreement with them. Communication based on accurate information always yields better results than confrontation based on speculation.

And keeping your finger on the pulse of your company’s cash in-flow is much better than wondering when the next “ping” from your bank is going to hit your mobile phone.

Read more about cash flow and late payments

- Late payments: 18 great tips to get paid on time

- A free guide to managing your cash flow

- 7 top tips to avoid a cash flow crisis

Identify how much cash you owe your creditors

Getting paid on time is one of the top priorities in any business. However, it’s called cash flow for a reason, and ensuring you pay your creditors is also an important aspect of your company’s success.

Just like business intelligence gives you a quick overview of who owes you cash and how much, it can also provide an insight into who you owe cash to and how much.

This is especially important to consider when planning for the month or period ahead because you need to ensure that what you’re expecting to be paid is enough to cover what you’re expecting to pay out.

Being able to quickly and easily identify exactly how much is owed to your creditors and which creditors are owed this cash empowers you with the knowledge to make smarter business decisions.

The next point then empowers you to act on those decisions.

Know when you have to pay your creditors

So, you now know who you owe cash to and how much, but do you know when you need to pay that cash over?

Businesses often run into cash flow problems when they don’t have visibility into this information because they end up paying the wrong creditors at the wrong time.

For example, you may think a payment is due for stock at the end of the month and so you quickly scrape together cash (you may even take out a loan) to get it paid.

However, this payment may only be due at the end of the following month, and so you could have delayed the payment and planned ahead to ensure you turn whatever stock you have left into cash to easily cover the payment.

Insight into when you have to pay your creditors is priceless because it can also empower you to further bolster your cash flow by renegotiating terms if necessary—more on that next.

Renegotiate credit terms if necessary

Sometimes cash flow will be tight no matter how hard you work in following up with payments owed to your business and ensuring you pay the right creditors at the right time.

However, with the accurate insight that business intelligence gives you into this information, you’re empowered to contact your creditors and attempt to renegotiate your credit terms if necessary.

Most creditors will be open to hearing you out, especially if you’ve been sticking to your current terms and communicating with them often.

This is because creditors would rather be paid regularly than not at all, and this also ensures your relationship with them remains in good standing.

Renegotiating these terms over a slightly longer period will help free up your cash flow if your business is going through a rough patch.

By using business intelligence to regularly keep track of the cash that you’re owed and the cash you owe your creditors, you empower yourself to take control of your company’s cash flow.

You give your business a much greater chance of being successful because you have accurate information at your fingertips.

With this information, you can make smart decisions about the cash that’s coming into your business and the cash that’s going out.

You’ll know exactly how much will be in your bank account at the end of the month and how much of it you have available to spend—minimising your risk and helping to avoid any nasty surprises.

Manage your cash flow

Need help managing your cash flow? Read this guide for advice on how to ask for payments and 10 tips to stay on top of your business finances.

Ask the author a question or share your advice