Technology & Innovation

Four key SaaS metrics portfolio companies should track for long-term growth

Some challenges private equity (PEs) and venture capital (VCs) companies face in providing strategic operational and financial guidance to SaaS and subscription businesses is determining what metrics they want their portfolio companies to track. Here we’ve outlined four key metrics that most businesses can benefit from.

SaaS and subscription business metrics are nuanced and can have slightly different meanings depending on context. Understanding the annual and monthly recurring revenue that is the driving force behind B2B (or B2B2C) SaaS and subscription-based businesses is both complex and critical, particularly in the early stages. While recurring revenue is integral to long-term financial health, early- and growth-stage businesses may not yet understand the total cost of acquiring new customers, what it takes to keep them or the impact of losing them.

Some challenges private equity (PEs) and venture capital (VCs) companies face in providing strategic operational and financial guidance to SaaS and subscription businesses is determining what metrics they want their portfolio companies to track. Here we’ve outlined four key metrics that most businesses can benefit from.

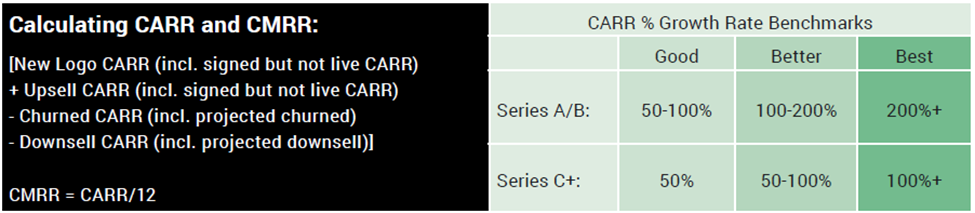

1. Committed Annual Recuring Revenue (CARR) and Committed Monthly Recurring Revenue (CMRR)

Annual recurring revenue (ARR) and committed monthly recurring revenue (CMRR) should be tracked by all SaaS and subscription businesses. CMRR can be an indicator of that continual, predictable growth that PEs and VCs are looking for. Though, committed annual recurring revenue (CARR) is equally as powerful and tells a more comprehensive story about financial health. CARR and CMRR are calculated by combining current recurring revenue with future recurring revenue from committed new bookings and contracted expansion (commitments to purchase your product), then subtracting known future contraction and churn. These metrics help businesses and investors define whether churn is cutting into CARR or CMRR and to what degree.

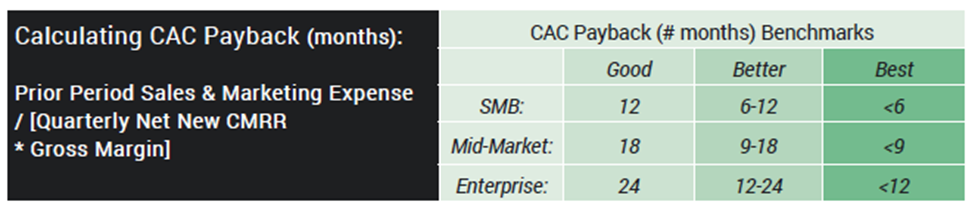

2. Customer Acquisition Cost (CAC) and CAC Payback

The marketing and sales expenses associated with acquiring a new customer are known as CAC. When evaluating CAC, SaaS and subscription businesses should review the expense of marketing staff and programs and any effort put into closing sales (like advertising, free trials and sales staff). This key SaaS and subscription metric helps PEs and VCs know whether a portfolio company’s growth is reliant on high marketing and sales spend, and where that spend lies. By tracking CAC, it can provide insight into the cost-effectiveness of your sales and marketing spend and helps gauge the success of your go-to-market strategy.

CAC Payback period extends the value of tracking CAC by identifying the time it takes to recover the cost of acquiring a customer. It provides a timeline (in months) for when the average customer will move to generating a profit after they have generated enough to cover the initial cost of acquisition.

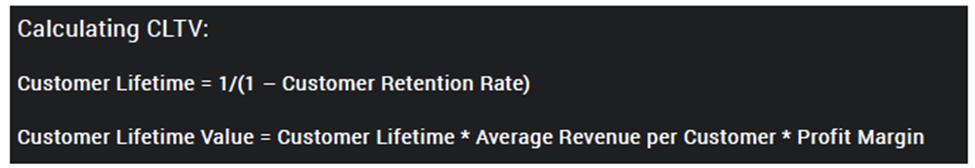

3. Customer Lifetime Value (CLTV)

The total amount of profit a SaaS or subscription business can make from a customer over the course of the relationship is known as CLTV. This is notable for PEs and VCs to recognize because it shows how much a customer contributes towards the company’s revenue or profitability more precisely over their lifetime. CLTV can also be assessed by subsets of customers that share similar attributes like tenure, demographics, industry vertical or product line. Exploring CLTV by cohort helps businesses decide which customer segments are most beneficial.

4. CLTV-to-CAC Ratio

The relationship between CAC, the cost of acquiring a customer, and CLTV, the lifetime value of that customer, is depicted by the CLTV-to-CAC ratio. If CAC is high, then CLTV will also need to be high to cover the cost of acquisition. A CLTV:CAC ratio of 1x implies that the portfolio company is spending too much on acquisition and will most likely result in breaking even. Less than 1x means that the customers lifetime revenue generated will not cover the cost to acquire them, resulting in a broken business model. PEs and VCs look for 3-5x, which indicates the industry standard for a good-to-great ratio.

While greater than 5x is extraordinary, it may also indicate that a business has the potential for higher growth momentum and can invest more in sales and marketing.

This key SaaS and subscription metric helps PEs and VCs determine an appropriate CAC threshold and how much it makes sense to spend on CAC to effectively calibrate profitability and growth.

Businesses should consider investing in a portfolio accounting software solution tool that can automatically capture, categorize, compute and analyze data. Another feature to look for is reporting on a comprehensive set of SaaS and subscription analytics that are essential for businesses over their lifetime.

SaaS Intelligence is an automated portfolio accounting software solution built on Sage Intacct that is specifically designed for SaaS and subscription businesses. PEs and VCs can evaluate the health of the SaaS and subscription businesses in their portfolios during their entire growth life cycle by using SaaS Intelligence, which delivers both a comprehensive set of industry-standard metrics as well as deep, granular insights. With the help of SaaS Intelligence, businesses can identify the right financial metrics and KPIs to make informed business decisions that can attract investors and propel growth.

Ask the author a question or share your advice