What are Five Steps to Drive Your Company from Early to Growth Stage?

This article is originally published by BetaKit. Whether fundraising or spending for scale, startup finance leaders are critical members of the team. While titles might be different depending on the size and stage of the startup, from CFO to VP Finance to Controller, the demands are similar: investors want to see a validated business model, […]

Showing the right foundation

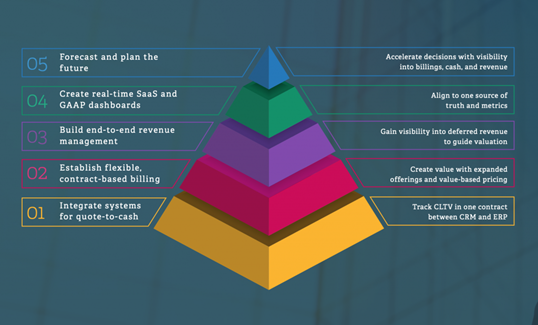

At the early stages, startups must focus on validating their revenue model. From Bessemer’s perspective, a key metric for validation is if 75 percent of your sales team is able to hit their quota. That provides room for human error and learning, but offers confidence that things are going in the right direction. Beyond hitting revenue targets, investors and internal stakeholders will want data to help them understand the quality of the revenue coming in the door. To measure revenue quality, Bessemer advises SaaS finance leaders to understand how repeatable their sales process is, have a grasp on unit economics, and ensure a clear, compliant financial foundation for the business. From a financial perspective, a repeatable sales process is about the speed of your quote-to-cash process. Bessemer notes that a quick quote-to-cash process frees up salespeople to focus on selling more instead of chasing clients down that haven’t paid, which is key to scaling. From there, SaaS financial leaders need to show promising initial unit economics. In simplest terms, the report defines unit economics as “the time that it takes to earn back the cost of acquiring a customer,” which is calculated by dividing customer lifetime value (CLTV) by the cost to acquire a customer (CAC). A repeatable sales process is in many ways a simple calculation: it’s just proving that you can acquire customers for less than they are worth. The challenge becomes understanding the data and leveraging real-time metrics. Matt Hodgson, CFO at Vidyard, calls this focusing on a “fully-loaded CAC,” which includes not just the salesperson’s salary but any other costs associated with closing a customer like support, onboarding, and even marketing resources. With a real-time understanding of how quickly cash comes into the business from new sales and the unit economics of each customer, SaaS financial leaders need to focus on a solid financial foundation. Regulations such as IFRS 15 and other local compliance laws are best tackled early. Adding more and more contracts to a shaky foundation sets the company up for problems later on, which can impact the company’s ability to scale strategically or fundraise. According to David Appel, the Head of SaaS and Subscription Verticals at Sage Intacct, one thing that early-stage startups should be aware of, but not totally prioritize, is churn analysis. Even though retaining clients is critical to long-term success, Appel cautions against focusing resources on tracking it early on, instead suggesting that it’s easy to keep an eye on while focusing on more critical foundations. “When you’re small, you’re just so busy getting customers, they haven’t necessarily had time to leave you yet,” said Appel. The report also lays out five steps for businesses to achieve their growth-stage goals.