Sage Accounting updates: The way you work just got a lot easier

This month, Adrian Malpass, Product Manager at Sage, covers some exciting updates to Sage Accounting.

At Sage, we’re here to support you and your business during uncertain times and we want to make sure you can get the most out of your business software when you need it most.

With that in mind, we’ve made a number of enhancements to Sage Accounting that will make a noticeable difference to you.

Time is precious and finding ways to streamline how you manage your business admin and finances is key.

Here’s how Sage Accounting can help you with this.

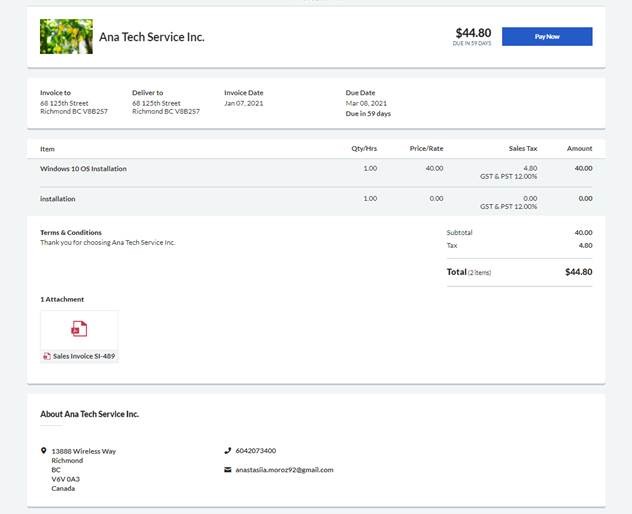

Add attachments to sales transactions

One of the highest requests on the Accounting Ideas portal (see the ‘Got a product improvement idea’ section below for more on this) was: “It would be really helpful to be able to add a document to a quote.”

And further to this was: “I might just want to attach a document but choose not to send it – just keep it as a record.”

In response to this feedback, sales attachments are now available for you to use.

You can streamline the communications between you and your customers by adding attachments to all your sales transactions (be it a sales invoices, sales credit notes, quote, estimate, or recurring invoice).

As requested, you can choose whether to make the attachments visible to customers. By sending your invoices from within Accounting you can easily track the progress of your invoice.

Attach a variety of documents to your Sage Accounting transactions

Here’s what Alison Church from Jackson Church Structural Engineering has to say about this Accounting update…

“I want to thank you because it works really well and makes life significantly easier. I was going to use it to attach detailed terms and conditions but now I also have COVID guidance to send to clients, so it really makes a difference when managing quotes and invoicing.”

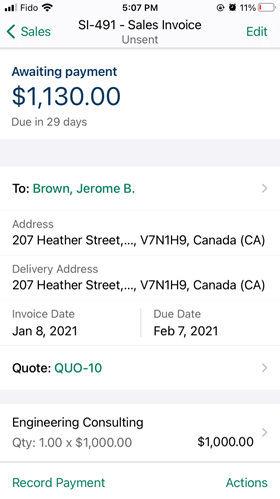

Run your business effectively on the go

The latest updates made to the mobile Accounting app give you even more flexibility to keep on top of your accounts in the moment.

This means your tasks won’t build up, helping to reduce anxiety and allowing you to use your time effectively.

Here are some of the latest enhancements that you can take advantage of:

- Instantly attach your supporting documents to your customer receipts and supplier payments.

- Easily add carriage/shipping charges to your sales.

- Create, edit and delete a purchase or sales credit notes from within the app as well as link a credit note to a purchase or sales invoice.

- Working in the construction industry? Handling your CIS deductions just got easier as these deductions are now automatically calculated on your mobile app transactions and payments. This allows you to stay on top of your accounts from any device, on-site or from anywhere.

Check your sales invoices on your mobile phone while you’re out and about

If you haven’t downloaded the Accounting app yet, it’s time to give it a try.

Here’s what Mark Timmins from M Timmins Leathers has to say about the mobile app…

“Best app on my phone bar none, I can run my business and accounts from my phone anywhere.”

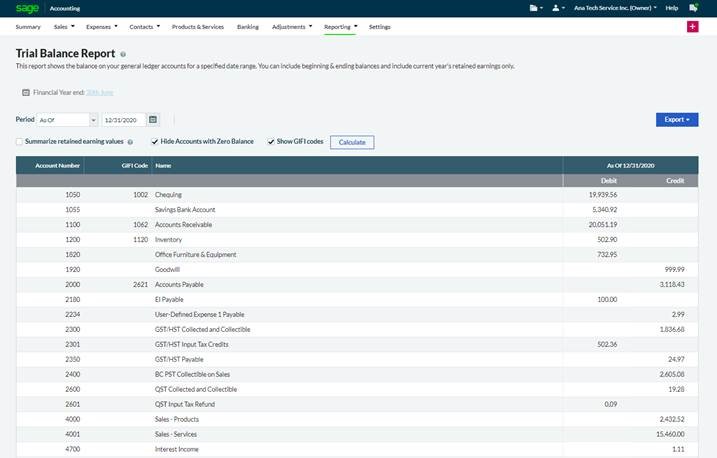

Easily validate the accuracy of your accounts

This improvement is in response to a request from our valued accountants.

Given the reliance accountants and professionals have on the Trial Balance report, to prepare end of year accounts and tax filings, we’ve enhanced the formatting of this report.

Now you can run reports for a select period to get a snapshot of what your nominal ledger account balances are up until that date or select the period you would like to analyse.

This is helpful to accountants in three ways:

- You can easily view a breakdown of retained earnings

- You’re able to choose to hide zero balances accounts

- By clicking on any of the account balances, you can drill down to the transactions that make up that balance – ensuring the accuracy of your customers’ accounts.

Additional flexibility in the way you analyse your Trial Balance report

Sam Mitcham is the founder of SJCM Accountancy. On the topic of the Trial Balance report, she says: ”As accountants, we have been asking Sage for further functionality of the Trial Balance report within Accounting.

“As usual, Sage has listened to our constructive feedback and have vastly improved how the Trial Balance can be manipulated to show the exact period we require, with or without opening balances, as well as enabling an optional summarised view of retained profit.

“This enables us to ensure the accuracy of our clients’ bookkeeping records and view the data in a way which complements the task in hand.”

Got a product improvement idea?

We’re committed to continuously listening, empathising and solving the Sage Accounting issues that matter most to you.

One of the ways we’re doing this is by asking you to share your requests and ideas with us on the Accounting Ideas portal, or vote on other ideas that have already been submitted.

We’ll then keep you updated on the ideas you’ve contributed to.

So far, we’ve delivered on 10 of these ideas. We’ve got another 10 great ideas in the works and our product team is actively reviewing another 354 ideas.

Final thoughts

We hope these new features and updates help to make life easier for you as you manage your business admin.

To use them, simply log in to Sage Accounting (or take a free trial if you’re not already a customer).

Editor’s note: This article was first published on 10 November 2020 and has been updated for relevance.

Ask the author a question or share your advice