Compliance

SARS administrative penalties: What you need to know

The Tax Administration Act stipulates that SARS can issue administrative penalties for outstanding tax returns. Until recently, SARS could only levy penalties if the taxpayer had two or more outstanding returns between 2007 and 2020. The law has since changed and, from 1 December 2021, SARS can levy administrative penalties if there is only one tax return outstanding from the 2021 tax year of assessment.

These penalties can be quite harsh and are charged monthly (up to a maximum of 35 months, or 47 months if the taxpayer’s address is unknown) for every month or part thereof that the tax return is outstanding. This adds up very quickly and can be a huge shock!

SARS can raise administrative penalties if a taxpayer is non-compliant in a specific area of their tax affairs, including income tax (CIT or PIT), value-added tax (VAT), or Pay as You Earn (PAYE).

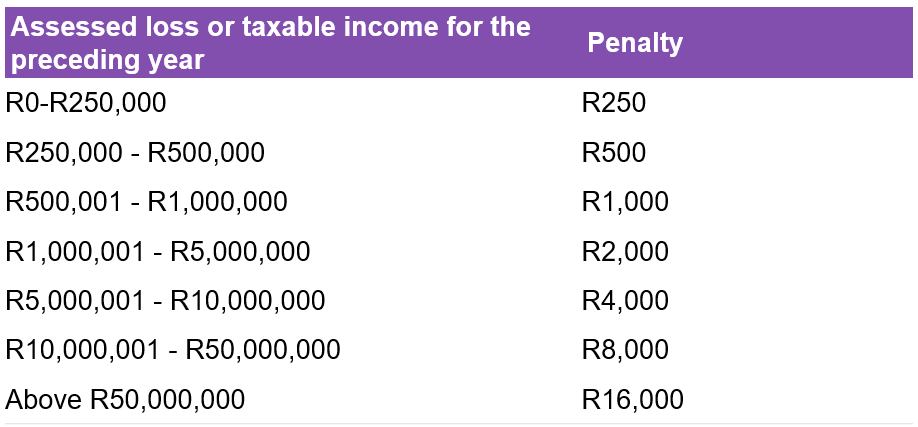

Fixed penalty scales used by SARS

SARS uses the following scales to calculate admin penalties, subject to certain conditions:

Here’s an example

Scenario: Let’s say your taxable income was R1,250,000 for the preceding year of assessment, with two outstanding income tax returns.

Penalties: SARS will levy a R2,000 fine for each outstanding return every month. That’s R4,000 in penalties every month. SARS will keep penalising you until you submit your outstanding returns, up to a maximum of 35 months from the date SARS assesses the penalty (or 47 months if the taxpayer’s address is unknown).

It’s clear that this administrative penalty can quickly become a significant financial burden.

How to fix this?

I suggest contacting an accountant or tax practitioner to help you complete your tax returns as soon as possible to ensure your company is fully compliant. Once this is done and your company is fully compliant, you might be able to apply for a request for remission.

Important to note: There is a misconception that you don’t need to submit returns if your company is dormant. You must submit zero returns to SARS for dormant companies or risk accumulating penalties.

What happens if I ignore SARS’s notifications?

If you ignore notifications from SARS, it will keep levying the administrative penalties and the company will have a non-compliance tax status.

Can I get administrative penalties reversed?

It is possible to convince SARS to reverse the administrative penalties – and we’ve done this successfully for many clients – but there is no guarantee that SARS will do so.

When applying for a reversal of administrative penalties, we ask the following questions:

- Was the company dormant? If yes, SARS will generally consider the reversal in favour of the taxpayer since it never lost any tax income.

- Did you receive a refund on submitting your income tax return, or was there a zero payable amount? Again, since SARS never lost out on tax revenue, it will generally consider a reversal in this case.

- Did you need to pay money in on your tax assessment? If you owe SARS money, it’s unlikely to reverse the admin penalties levied. However, there’s no harm in trying because SARS will sometimes consider partial reversals.

Remember, there is NO GUARANTEE that SARS will reverse penalties.

Better safe than sorry

I do believe that prevention is better than cure.

If your company is dormant but may become active again in future, speak to your accountant or tax practitioner about keeping the company compliant by submitting zero tax returns.

If your company will not actively trade again, receive income and/or incur expenses, ask your accountant or tax practitioner to deregister your company with the Companies and Intellectual Property Commission (CIPC) and with SARS for various types of tax.

Above all else, aim for compliance. It has never been more important.

Very informative