Manufacturers see dollar signs in service—but only when CFOs see beyond risk

For manufacturers today, making products is becoming less important to their long-term survival than servicing those products. But switching to a service-centric business model is a sea change for business leaders accustomed to selling physical products—and one CFOs may resist for several reasons. For one, many doubt whether a traditional manufacturer can generate significant revenue […]

For manufacturers today, making products is becoming less important to their long-term survival than servicing those products. But switching to a service-centric business model is a sea change for business leaders accustomed to selling physical products—and one CFOs may resist for several reasons.

For one, many doubt whether a traditional manufacturer can generate significant revenue from activities typically handled by third-party providers. What’s more, moving to a service-centric model, or “servitization” in industry lingo, can take years to yield financial benefits.

Many years, in fact.

From a finance perspective, the move toward services is often viewed as too big a risk for a company to shoulder amid pressing challenges like digitalization, globalization and skilled labor shortages.

“Manufacturers that have been selling physical things for decades, or even a century, can find it difficult to start selling something they can’t really see,” says Ali Ziaee Bigdeli, senior research fellow for The Advanced Services Group of Aston Business School (U.K.). “But building revenue streams through services is a longer-term play for manufacturers.”

That patience can yield huge rewards, as several global manufacturers can attest:

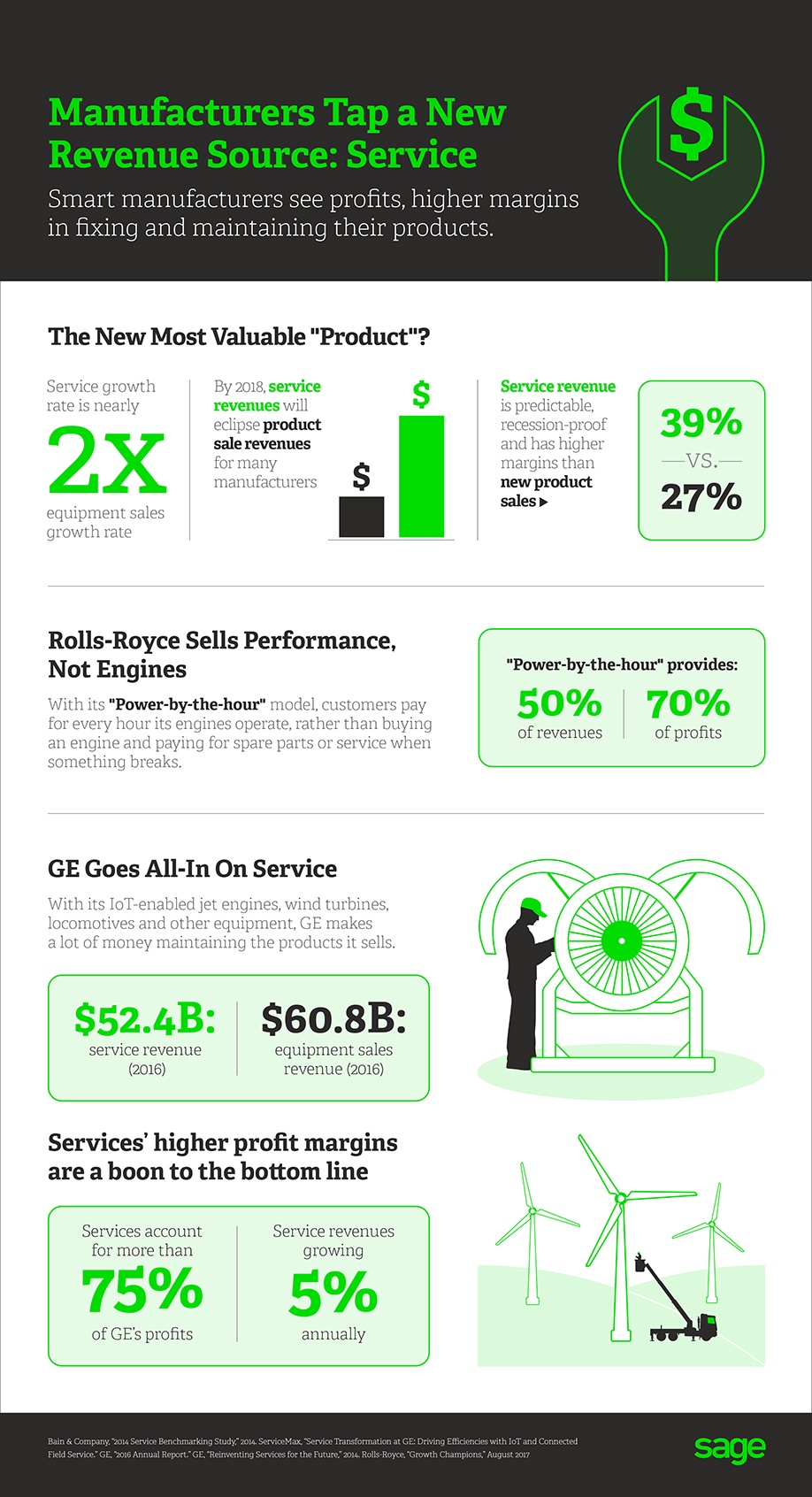

- GE reports that 75 percent of its profits come from servicing the jet engines, trains, wind turbines and other products its customers buy. The company’s service business is growing steadily at 5 percent.

- Rolls-Royce, a pioneer in bundling services and product, attributes more than half of its revenues and about 70 percent of its profits to its TotalCare service business model, which provides airlines with “power by the hour.”

- Kone, an elevator and escalator manufacturer, derives about 45 percent of its US$10 billion in annual revenues from its services business.

Reaching a point of profitability with a service-centric business model wasn’t quick or easy for these manufacturing stalwarts. Like any major business transformation, servitization is an arduous process. It requires significant investments in digital technologies, such as predictive analytics, remote communications, and mobile platforms. It also requires a major mindset change for the entire workforce—and Ziaee Bigdeli says the onus is on finance leaders to set an example:

“They are selling the capability, not the product, anymore. If management doesn’t help to guide the organization through this change, and train people properly, the risk of failure is high.”

A path to financial stability

Difficult as the process may be, servitization is the obvious future for many manufacturers.

“Products are becoming a commodity, so manufacturers need to think about the next stage. What can they do to become financially sustainable and operationally scalable?” Ziaee Bigdeli says. “Many are starting to realize that adding value to how their product is operating in their customers’ environments is the way forward.”

Finance leaders have a critical role to play in helping manufacturers navigate the challenges of servitization, while also ensuring the business doesn’t sit on the sidelines as the latest industrial revolution evolves.

Servitization, according to Ziaee Bigdeli, is about creating and capturing extra value by getting closer to the customer, addressing their previously unrealized needs and enabling them to do more in their business. And manufacturers integrating their operations with customers is a key ingredient to achieving financial stability.

“When manufacturers take the time to truly understand a customer’s needs, and work closely with the customer to solve problems, they are deepening the relationship with that customer,” Ziaee Bigdeli says. “Contracts for advanced services can last for five, 10 or 15 years. Through servitization, manufacturers are building customer relationships that can last much longer than more traditional, transaction-based relationships.”

Business and strategy consultant Melvin Brand Flu, a partner at consultancy Livework Studio, explains in a recent presentation on finance leaders and innovation that CFOs are the ones who should sponsor, lead or own service innovation in their organizations. Financial leaders, Flu says, are “uniquely positioned” to help the business “lower the risk of failure, achieve better business performance, and foster greater internal collaboration.”