Strategy, Legal & Operations

Top 5 takeaways from Accountex 2019 for your practice

Accountex 2019 provided lots of food for thought for accountants. Here's five topics to take away and use within your own firm and plans for the future.

Accountex 2019 is now over and, in addition to the free stickers, USB sticks and fluffy toys, there was a huge amount of information at the London event for accountants to take home with them.

How will your practice evolve and adapt given what was said? There were some very strong themes evident at the show. Here they are.

1. Making Tax Digital has landed

It should hopefully come as no surprise to accountants across the UK that Making Tax Digital (MTD) is now a big part of their professional lives. Since 1 April 2019, it’s been mandated by law for businesses above the VAT threshold when they commence their VAT period that follows that date.

Needless to say, the topic dominated Accountex keynotes and seminars. HMRC put in an appearance to both provide some fascinating updates and also offer some welcome technical support sessions. It even had its own modest booth at the show.

HMRC’s director of MTD for business, Theresa Middleton, gave an opening keynote speech where she shared a progress report and took questions from the floor. Some highlights included the following:

MTD take-up

170,000 businesses have signed up for MTD for VAT, although this number is increasing all the time as new VAT periods start for the more than 1,000,000 businesses registered for VAT.

At the time of publication of this article, the first big crunch time has just passed, when the first tranche of monthly filers submitted via software in early May 2019. HMRC reported its systems would be ready and it’s confident everything will run smoothly.

Penalties

Theresa confirmed the statement made by the Chancellor of the Exchequer that there would be a “light touch approach to penalties in the first year”. HMRC has no interest, she said, of penalising companies who have “tried their best to get it right but haven’t done so”.

MTD for income tax and corporation tax

Theresa also discussed Making Tax Digital for income tax service accounts (ITSA), which is the next frontier for MTD.

Although technically still a pilot programme for limited types of income tax, and not mandated until 2021 at the earliest, she indicated it’s a very real option for the majority of relevant traders (and she also indicated that the types of businesses that are included will be expanding soon to increase numbers).

The chief holdback, she said, was a lack of support within accounting apps. MTD for corporation tax still hasn’t gone through the consultation phase, she added, essentially confirming that it’s a ball that’s been punted into the longest of the long grass.

Mandation in 2021 is essentially impossible but its success will “will depend on how well the VAT service lands and how well we’re able to stimulate the income tax market”.

HMRC, the chartered organisations and software vendors such as Sage offered advice on technical topics such as signing up for the Agent Services Account (ASA), which is central for accountants wishing to file VAT returns for clients.

A useful nugget of technical help from HMRC concerned problems encountered by accountants signing up for an ASA. In most of these cases, a HMRC rep reported, it’s because the accountant has already created an ASA account in order to undertake a task such as registering a trust online.

Remember that an ASA isn’t limited to MTD, and is a key plank of HMRC’s online services moving forward. All the affected accountant needs to do is dig out their older government gateway account details, or perform a password reset.

Key takeaways

What’s the takeaway for you from all the talk and advice around MTD? Well, you need to start your clients on a digital accounting path right now.

This isn’t just about VAT. You need to start preparing for MTD for both income tax and corporation tax. 2021 is only two years away and if you start your clients on the journey today, you could save yourself a lot of pain in the coming months and years.

For example, many at Accountex complained that HMRC’s phone lines were jammed, making it hard to get vital help when they needed it.

This is undoubtedly because of the majority of the UK’s accountants raising queries. Why not get your own process completed earlier than the absolute deadline, so you avoid the crush on resources such as support lines?

Starting the journey with your clients can be as simple as opening a discussion around accounting technologies, and choosing a suitable platform for your practice.

But it could also mean investigating the partner programmes that software companies offer so you can become a vendor and create a new revenue stream from the work you do converting clients to up-to-date digital accounting technologies.

2. Training is changing

Several seminars discussed accountant training. For example, Ian Selby of CIMA discussed how their latest research had led them to overhaul their training and certification offerings. The world of accountancy is changing, he said, and certification bodies have to evolve to ensure the skills needed are present in future candidates.

This mirrors the finding in Sage’s own Practice of Now 2019 report, which was launched at Accountex with the opening keynote from Jennifer Warawa, who is the Executive Vice President – Partners, Accountants and Alliances at Sage.

Surveying more than 3,000 accountants worldwide to get a view of the accounting landscape, we found 62% of accountants agree that today’s accountancy training programmes will not be enough to run a successful practice by 2030.

It’s a looming crisis but there are signs the chartered bodies are responding.

In addition to CIMA’s work above, the ACCA in the UK has already said it is evolving its qualification to take into account “technical and ethical abilities, intelligence, creativity, digital skills, emotional intelligence, vision and experience”.

The AICPA in North America has also said it’s consulting on revising its certification because of changing client expectations and technical innovations.

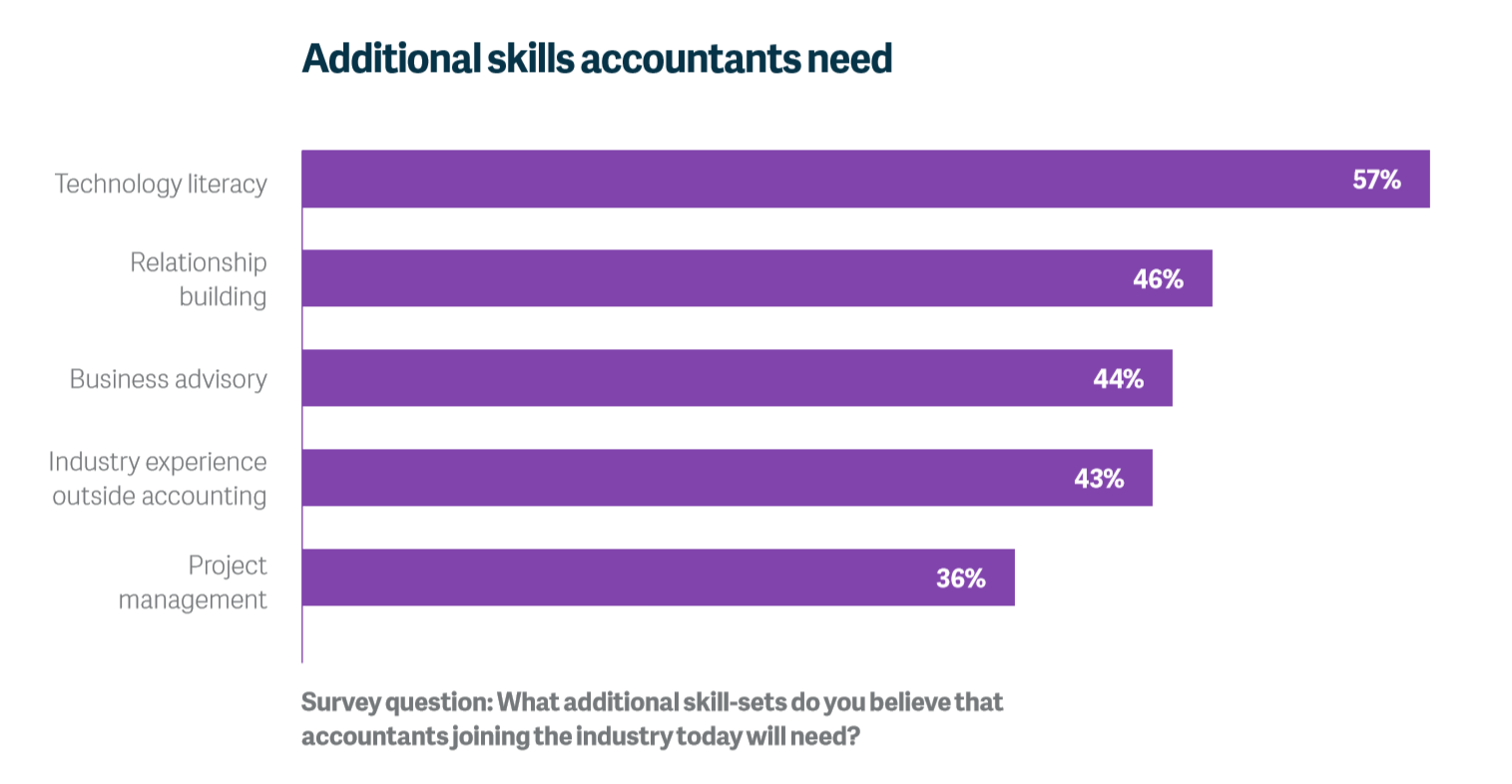

Within the Practice of Now survey, we asked accountants what additional skills they believe those joining the industry needed. The results are in the graph below.

Topping the list by a large margin is technological literacy, as we might expect, but listed beneath that are relationship building skills, and the old stalwart of business advisory skills. All of this again indicates a subtle shift within the industry, in which accountants are simply closer to businesses they work for.

What does this mean for you or your practice? It could be as simple as asking some fundamental questions, and seeking the training or certification necessary to fill in the gaps. This is the advice Michael Office, Global VP of Accountants at Sage, offers in the Practice of Now report:

“[Ask yourself] how do I engage with my clients more deeply, and in a real-time way? How do I provide advisory services? How do I become their success coach?

“As a profession, we need to either think about how we evolve the way we train accountants to address the gaps made by the development of technology, or we complement traditionally trained accountants with skills that address the gaps within your practice.”

3. Technology, technology, technology

When walking around the Accountex show floor, or attending the keynotes and seminars, there can be no doubt about the importance of technology within the field of accounting.

The majority of the booths were technology vendors of some kind, and from fintech and blockchain to encryption and the cloud, many of the keynotes and seminars were dedicated to discussing digital transformation.

With the implementation of Making Tax Digital for VAT there was a sense this year that technology once considered exotic had ceased to be an option for practices and had become simply a fact of life.

After all, MTD for VAT means that no business registered for VAT can avoiding using a computer for their accounting. No accountant can feasibly avoid a cloud-connected practice either.

Emily Smith of Finlayson & Co talked about how she not only undertook her practice and her client list on a digital journey, kick-started by MTD for VAT’s requirements, but how the practice took a zero-tolerance approach with its VAT clients.

If any business simply refused to make the move to digital accounting then they were dropped from her practice’s list (albeit after much discussion and attempted coercion):

“One hundred percent digital is our dream,” said Emily. “We’ve seen what it can do. We’ve seen how efficient we’ve all become. We’ve seen how MTD digitalisation is just the start and we know somewhere in the future accounting going to be a 100% digital anyway. So, why not try and do it now?

“When income tax and corporation tax admissions come in, we’ve got nothing to worry about because all of our clients will be on software.”

Watch out for Emily’s story in a separate article, but ultimately you should be asking yourself if your practice is positioned correct for the digital future—not only for the benefit of your own business, but also your clients.

4. Diversity – or lack of it

A handful of keynotes and seminars this year discussed diversity within the profession.

Helen Thornley of the Association of Taxation Technicians discussed how it’s been 100 years since the profession was finally opened to women upon the passing of the Sex Disqualification (Removal) Act in 1919, and mentioned some pioneers such as Ethel Ayres Purdie, the first woman to join a professional accountancy body.

Claire Harvey from Reed discussed gender diversity in accounting and finance, providing helpful advice to women looking to break through the glass ceiling.

Once again, diversity is something that the Practice of Now report also reported upon based on our survey data.

Just 30% of firms told us they’re actively seeking to diversify their workforce. Only 28% of the respondents had a written policy on, or written commitment to, diversity and inclusion.

While matching your practice’s workforce to the diverse clients it represents can only be strengthening, the Practice of Now research also found that the reputation of the firm was the key reason why recruits join it over its competitors.

And the way your firm will get a better reputation in future is by having a diverse workforce that appeals to the new generation of millennial recruits and business owners.

There are obvious and basic ways forward if you want to increase diversity within your practice; here are a few examples:

- You might create a written policy on diversity and inclusion.

- You might start offering training.

- You may examine existing policies and procedures to see how they can further diversity, and take a look at your recruitment practices too.

Just like all the other issues mentioned here, a progressive approach diversity demonstrates how accountancy is undergoing an evolutionary change as it prepares for the coming decade.

5. Advisory services

There’s little doubt that advisory services have been topmost in the minds of accountants for the past few years but this year saw an evolutionary leap to actually discussing how this can be achieved.

Various keynotes and round-table discussions shared ideas and ways forward that have been tried and applied to existing practices.

Again, this is more evidence that the profession of accountancy is moving and preparing for the years to come in a world where client relationships have also evolved due to smarter use of technology.

There’s no turning back from the sea change that is Making Tax Digital, so this is also not a time to be a stick in the mud in not adding to core compliance work. Clients simply expect more.

Speaking in the Practice of Now report, Michael Office hit the nail on the head: “Accountants are starting to understand that a successful firm is actually a relationship management business.

“Engaging with clients, managing the relationship, making sure that accountants contribute towards their clients’ success—this requires firms to have different skill sets within their practice.”

The Practice of Now

Discover how accountants and bookkeepers are preparing for the future and learn what you can do now to keep your practice successful.

Ask the author a question or share your advice