Strategy, Legal & Operations

Admin sinkholes: How your clients can avoid them

It’s a story as old as the hills: admin overhead is throttling business and preventing growth. However, research commissioned by Sage shows it might be especially true in today’s world – and potentially devastating to business growth.

The Sweating the Small Stuff report, created by Plum Consulting on behalf of Sage, analysed research carried out with 3,000 small and medium-sized companies across 11 countries. It found that, on average, small businesses currently spend 120 days a year on admin.

The admin load varies by country and the report reveals that this can translate to the equivalent of a full-time member of staff within US businesses simply to deal with administration and regulatory requirements.

Even in Ireland and Australia, which the research indicates have the lowest admin burden, there’s still a requirement for the equivalent of one-quarter of a member of staff simply to deal with admin rather than focusing on the core aspects of the business.

Productivity costs unveiled by the research are also incredible. Measured as a loss in productivity, the report estimates a $335.3bn cost in the US. And an estimated £39.9bn in the UK.

Splitting the admin load

The report identifies two kinds of administrative burdens: operational and regulatory. The latter isn’t required for the success or otherwise of the business but is required by governments to register or monitor it.

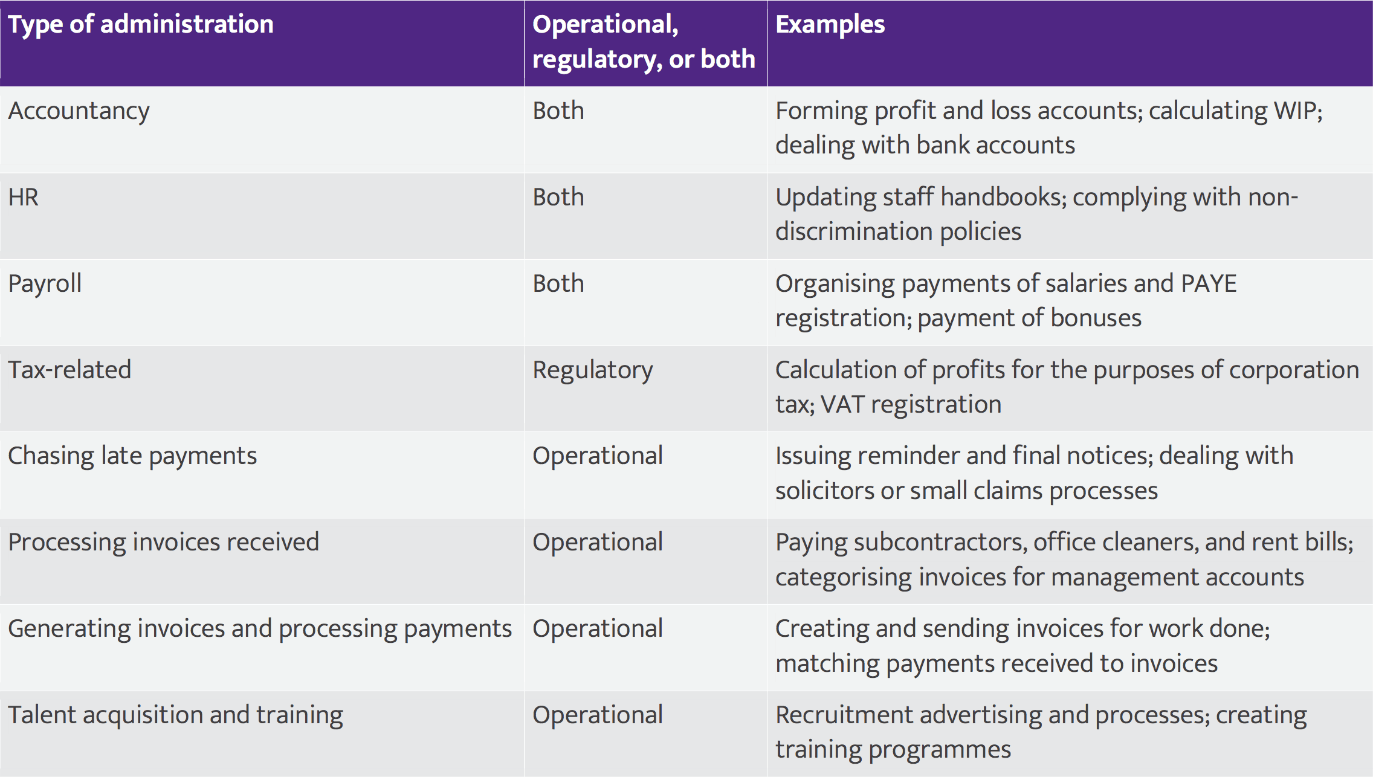

The admin burden breakdown is as follows (taken from Table 3-1 within the report):

Administrative sinkhole table

Business departments such as Human Resources (HR), for example, are typically hit by both operational and regulatory administrative requirements as they seek to produce results that are good for the business – but that also comply with government legislation intended to protect and provide rights for employees.

Some administrative sinkholes are entirely regulatory in nature, such as the requirement to pay taxes.

However, the report doesn’t just identify the problem of administrative sinkholes. It also identifies the best possible solution – and provides data to back up the assertion.

Digitisation

The report asked to what extent the businesses surveyed have applied technology across eight core administrative tasks likely to be found in virtually all businesses. The businesses were invited to choose from three possible answers – Fully, Partly or None – and from this a “digitisation score” was produced.

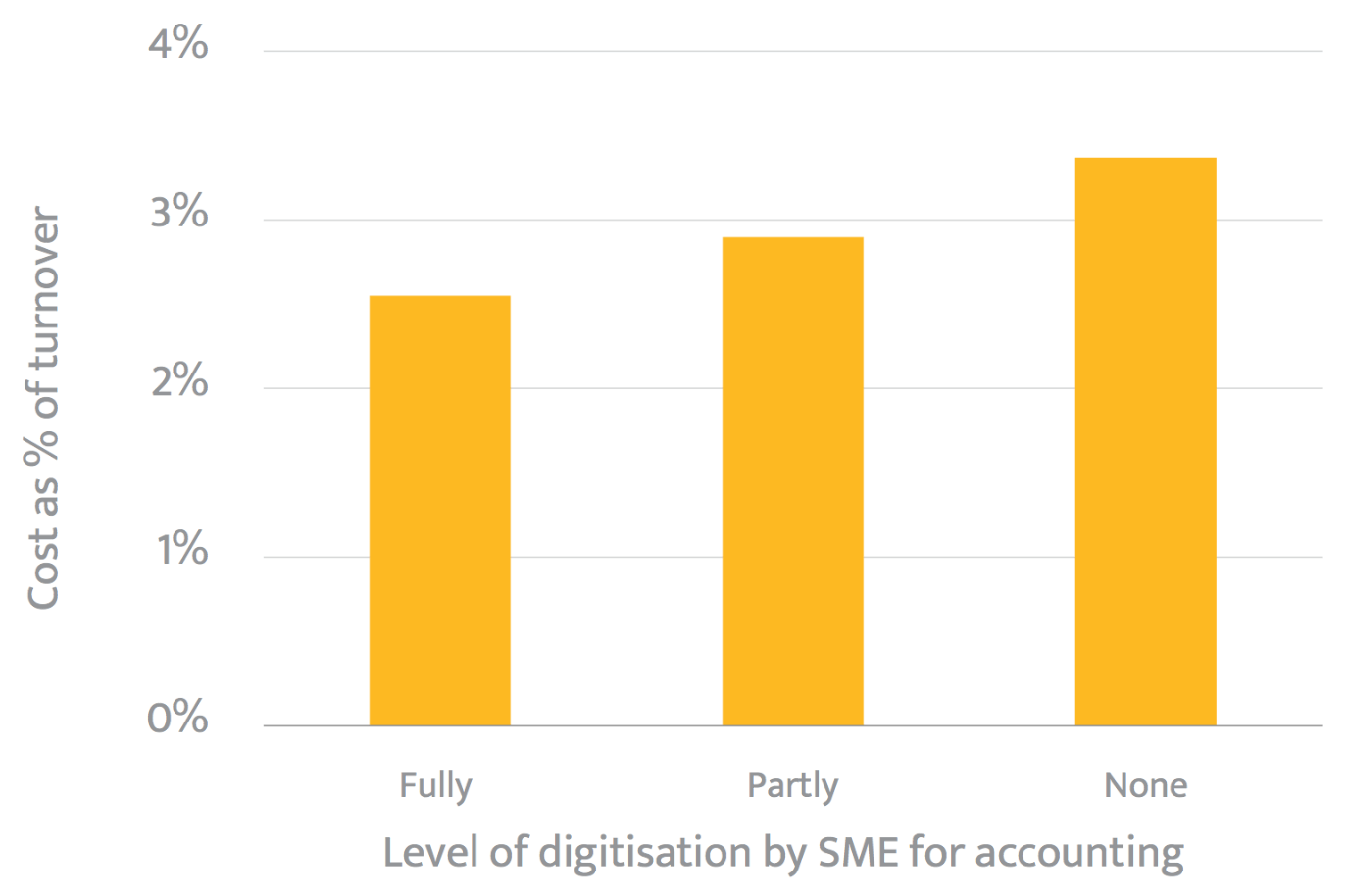

The results should come as no surprise. Generally speaking, businesses with a higher digitisation score had lower admin costs, expressed as a percentage of turnover.

Nowhere is this clearer than within the largest of the administrative tasks: accounting. By applying digitisation, the cost as a percentage of turnover can be reduced significantly, as is demonstrated by Figure 5-7 within the report:

Cost as a percentage of turnover

Many businesses might think they’ve already applied digitisation. After all, it’s rare for every employee not to be provided with their own computer nowadays. However, while this kind of digitisation was revolutionary when it began in the 1980s, in recent times there’s been a second revolution – and one that’s every bit as important. It pushes the admin sinkhole cost savings even further.

With that in mind, here are some ways to apply even smarter digitisation – and in doing so, fill-in those admin sinkholes.

Choose integrated software

Only those living under a proverbial rock will not be aware of the masses of business software out there. However, a lesser-known fact is that not all software is created equal when it comes to integration – that is, accessing sources of data outside of itself or different systems.

For example, there’s a profound time and labour-saving benefit for an accountant who’s able to send a client’s tax statement to HMRC with the click of a button, within the software they’re already using for their general accounting.

The earlier computing revolution certainly sped things up compared to posting pieces of paper to HMRC. But nowadays, it sounds positively antiquated to talk of processes where you might output a report as a file, visit the HMRC website and manually upload it.

Even more than this, however, software that provides a single access point and shared data across all departments of a business again saves time and effort. A payroll run that will be reflected instantly within the accounting side of the software means there’s no need to spend time exporting or importing data – and no need to stress about the fact the many different systems might not be in sync.

Go mobile

The modern business computing revolution can be found in your pocket or bag. It’s a revolution that most of us have already accepted in our personal lives yet many just haven’t made the connection that it can also be applied to business.

We’re talking here, of course, about mobile phones and tablet computers. Apps and the cloud computing services they rely upon are used by the smartest businesses because they encourage more rapid growth – and that’s before we discuss the basic time and efficiency savings.

Fundamental to this is cloud computing, which provides always-on access to data, and access from anywhere and using virtually any device – whether that’s a PC in the office or a tablet computer in a coffee shop.

Compare and contrast to the aforementioned earlier computing revolution that, while incredible at the time, ultimately chained us to a single desktop computer within the four walls of an office.

The physical freedom of using mobile devices simply increases the opportunity to perform admin tasks when it best fits your schedule, or needs. Emails can be answered on the way home on the train. Schedules can be drawn up as you grab a coffee before starting work. VAT returns can be filed from a motorway service station. There really is no limit in that virtually everything you previous did on a desktop computer can now be done using apps, wherever you happen to be.

Embrace the future

The introduction of mobile accounting apps brings more than just convenience and time-saving. Technology is ushering in different kind of accounting processes for clients, at least – and the only reasonable response is to embrace this.

For example, mobile apps bring with them the ability to make instant payments for services, as well as track purchases by simply snapping a photograph of a receipt.

What this means is the age-old concepts such as double-entry bookkeeping are no longer relevant to clients. Invoices can be generated and paid instantly, so there’s no need for clients to have an accounts receivable department or to discuss interest accruals.

Today, clients expect and demand this kind of convenience – and accountancy firms are able to respond with their own integrated client management software that can keep up.

Professional invoice templates

Getting paid on time is vital. Download our set of professional, VAT-compliant invoice templates to make sure you make a good impression and get paid faster.

Ask the author a question or share your advice