Strategy, Legal & Operations

How shrewd food and drink data insights offer a valuable advantage

Chocolate lovers in the UK may have felt like they’ve been short-changed in recent years following revelations that many of their favourite treats have been victims of “shrinkflation”, where food manufacturers reduced the weight of products without shrinking the price.

The BBC analysed 19 products over the past four years from high-street supermarket chains and discovered that 18 of the 19 products had been slimmed down. A Snickers bar, for example, had decreased by 28.1%, while it was 25% for a Toblerone, and a packet of Jaffa Cakes had been cut from 12 to 10.

The reductions in size highlight one of the challenges food and drink manufacturers have – brands such as Nestle and Mondelez International point towards factors like the cost of ingredients, international health regulations, exchange rates, and even distribution factors such as packaging and transport as the causes for shrinkflation.

It’s a tough time to be a food and drink manufacturer, with prices being driven down, profit margins razor-thin and people spending a smaller proportion of income on food. You need to do more for less and that means re-evaluating the way your business works and utilising food and drink data insights to take advantage of new opportunities.

So, what are some of the biggest food and drink challenges for large businesses today and how can you meet them?

With prices being driven down, food and drink manufacturers have numerous challenges to overcome

Understanding and handling changing customer tastes

A few years ago, McDonald’s started a huge restructuring plan after years of decreasing sales growth, with an admission by the chief executive that it hadn’t kept up with changing customer tastes.

This is an area of importance for all food and drink companies, with consumers now motivated to purchase products for consumption that are thought of as healthy and better for the environment.

In a world of digital and social media, food and drink businesses need to be transparent, particularly with a millennial audience that expects authenticity and honesty. In the past, consumers may have trusted brands without question but now they’re thinking more about the real stories behind these businesses.

Millennials are more likely to question how the food and drinks they consume are made, who has made them, and how a business treats its environment and employees.

With brand perception, it’s the giant food and drink manufacturing corporations that may be at a disadvantage – the smaller manufacturers can potentially speak to the millennial audience in a more authentic and relevant way.

Another big brand that has recently fallen out of favour with millennials is Budweiser, which slipped out of being one of America’s top three beers. A legacy brand, it has fallen out of style with drinkers, ceding ground to newer, more trendy craft beers, wines and spirits.

For a giant brand such as Budweiser, this is not an easy thing to fix. One option is to diversify – and that’s what its operating company AB InBev is doing. In 2017, it announced a four-year, $2bn capital investment that will add capacity to 12 craft breweries, expanded its non-alcoholic beer range and aggressively pushed its other brands such as Stella Artois.

Food and drink manufacturers are advised to build a close relationship with their customer base, keeping a close eye on millennial trends and desires, with a goal to unlock creative ways to reach that audience. They need the ability to be quick, nimble and innovative, with a goal to have products move from research and development to the shelf as quickly as possible.

One recent example of a food manufacturer creating a new product catering to changes in customer demand is when Mondelez International launched Oreo Thins, a thinner, lighter version of its popular biscuit. They resulted in being the fourth most popular food and drink of 2016, making $110.2m.

Janda Lukin, senior director of Oreo for Mondelez International, said the slimmer biscuits were rolled out in China to address tumbling sales, generating $40m in the first eight months. She noted that it took months for the company to perfect manufacturing of the Thins – early on, 60% of the biscuits were breaking but after research and development, the rate came down to 3%.

Considering changing dietary requirements is important for food and drink manufacturers

Understanding changing dietary needs

Food manufacturers also need to think about changing dietary needs. With 64% of the world’s population now actively excluding foodstuffs from their diet, they need to tailor their products, allowing retailers to provide more relevant food choices that are tailored to the needs of customers.

Markus Stripf is the co-founder and CEO of Spoon Guru, a company that works with companies such as Tesco in providing food searches that are tailored for an individual’s nutritional needs.

He says: “In this day and age, we should be able to cater for people’s needs regardless of whether they have a nut allergy, follow a vegan diet, or simply prefer healthier options. We need to make it easy for consumers for their individual and specific needs, tastes and preferences.

“The good news is that we are seeing an influx of innovation from manufacturers in the vegan space [such as Beyond Burger and Impossible Burger], to supermarkets heavily investing in artificial intelligence to be better positioned to offer highly personalised services to their customers, tracking their customers across multiple channels.”

However, Markus believes retailers struggling with e-commerce services are holding back food innovation by slowing down development cycles. He adds: “They have no advanced data-mining capabilities to understand customers’ individual dietary preferences and tastes, let alone use that knowledge to provide personalised and targeted services.

“If I have been buying only vegetarian foods from my retailer for the last 10 years, why are they still promoting a turkey to me before Christmas? It’s annoying to me as a customer and a complete waste of real estate from a marketing perspective.

“Customer segmentation [down to the segment of one] plus being able to infer customer preferences from their implicit and explicit interactions with a retailer across multiple channels are the future of retail. I just don’t know how long it will take for us to get there.”

Food and drink data insights can offer a competitive advantage

How food and drink data insights can help

Although retailers have a way to go, there is a lot that food and drink manufacturers can do for themselves. Thanks to Industry 4.0, they are starting to understand the huge amounts of data generated from products and their daily operations can be turned into insights – offering a competitive advantage through actionable information, inefficiency and the driving of improvement.

Enterprise systems can help by managing complex and operational data to provide executives and employees with the means to connect day-to-day tactical operations and strategic goals – essentially digitising operations and benefiting from the data.

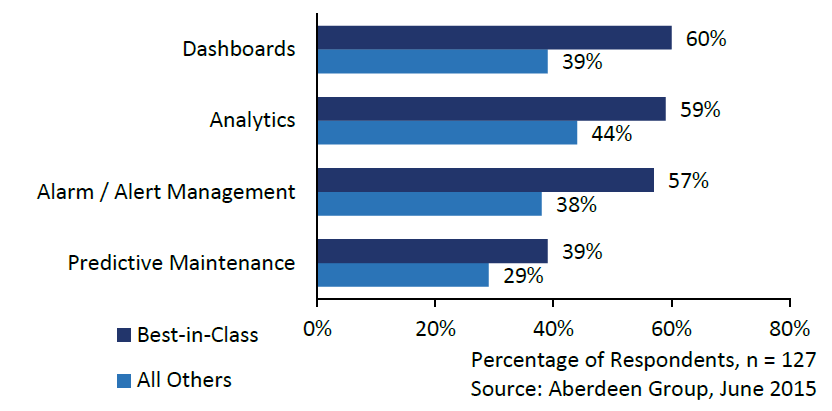

Successful companies provide tools to turn data into actionable evidence, according to Aberdeen:

Source: Data will drive the future of food production, Aberdeen Group

From here, analytics can provide executives with the information they need to make the right decisions when it comes to the future business strategy. Applications summarising data from multiple business units can help food and drink businesses plan their purchasing, production and maintenance.

Ensuring quality and compliance

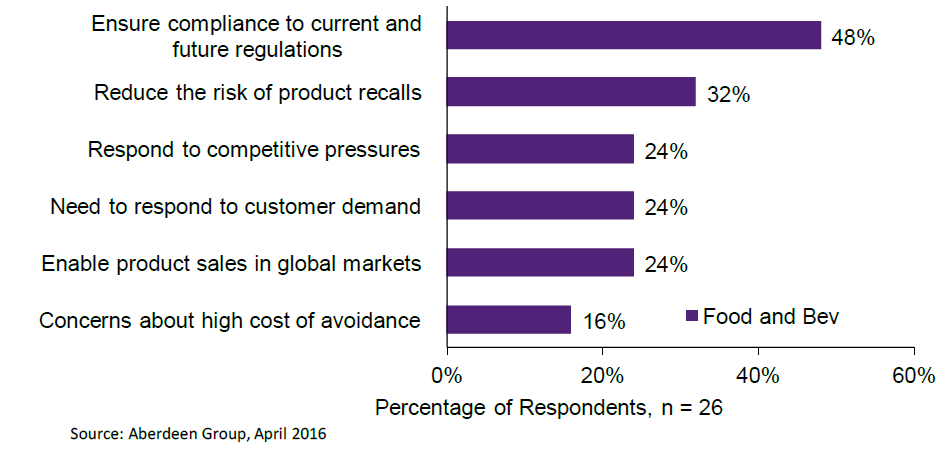

Food and drink companies need to juggle changing customer demands and competitive pressures but also make sure the basics are right – such as compliance with current and future regulations and avoidance of product recalls, according to Aberdeen Group. In 2016, food and beverage manufacturers were asked to select their top two pressures:

Source: Food and Beverage Manufacturers Updated ERP to Ensure Quality and Compliance

In the US, the 2011 Food Safety Modernisation Act is a mandate that requires manufacturers to focus on preventing contamination rather than just containing it, causing manufacturers to change how they designed food products and acquired materials.

This is in addition to global standards designed to improve supply chain visibility constantly changing, bringing the threat of non-compliance in the form of fines.

In the UK, there are plenty of laws and regulations around the production, processing, packaging and labelling of food stuffs, many of which originated in the European Union (EU).

This has been in place for 30 years but food manufacturers should be aware that the UK’s Food Standards Agency believes it hasn’t kept pace with changes in the food industry and is not flexible enough for changing needs.

Problems with “one-size-fits-all” regulation

The Food Standards Agency says: “The existing ‘one-size-fits-all’ approach to regulating food businesses is ill-suited to the incredibly diverse nature of the industry.

“In recent years, we have witnessed large numbers of new players enter the global food and food safety landscape; for example, online retailers, food delivery services, private auditors, independent food safety certification schemes.

“However, the current regulatory approach doesn’t allow us easily to focus our effort on changing risks. For the UK to continue to be a strong, credible player in the global food economy, the regulatory regime needs to keep pace with rapid changes in that economy.

“Leaving the EU will change patterns of food production, trade and consumption, emphasising the need for a flexible and responsive regulatory system.”

Food and drink manufacturers are advised to look at the technology they use closely, and understand whether it’s up to the task of supporting new best practices in areas such as product traceability and quality, supporting changing regulatory requirements, as well as providing technology such as cloud analytics to deal with changing consumer tastes and needs.

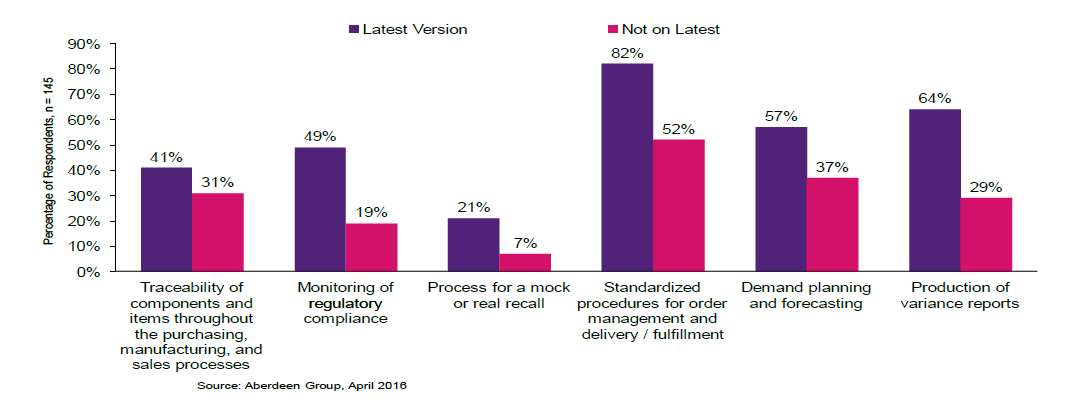

This could mean upgrading their ERP systems to enable additional technology capabilities. The graph below shows the improvements that can be made, supporting issues such as tight margins, changing consumer preferences, increased regulations and complex supply chains.

Source: Food and Beverage Manufacturers Updated ERP to Ensure Quality and Compliance

Become a data-driven food and drink manufacturer

Food and drink manufacturing is becoming increasingly complex – and it looks like one way for businesses to not only survive but thrive is to become data-driven.

It’s always been the way that good products and operational efficiency were incredibly important but a critical differentiator will be taking advantage of data to hold to win that edge over the competition.

The key to success? Embracing technology and innovation, adapting capabilities and digitally transforming to become data-driven, smart and connected.

Ask the author a question or share your advice