When you are a small business, there are so many things to think about, including:

- Winning contracts

- Hiring staff

- Exceeding customer expectations

- Buying equipment

- Advertising your services.

With all this going on, it can be difficult to find the time to keep up with financial reporting responsibilities and maintain accurate balance sheets.

A balance sheet is a business statement that shows what the business owns (assets), what it owes (liabilities), and the value of the owner’s investment (owner’s equity) in the business.

This report forms part of your financial reporting and is vital not only for lending purposes but also to ensure that your books balance.

As with a trial balance (a report that summarises the debit and credit balances of each account on your chart of accounts during a period of time), the balance sheet must always balance and the formula used is assets – liabilities = owner’s equity.

Assets and liabilities are subdivided into short term and long-term obligations.

Short-term obligations are values that will be paid/settled in the current financial year, and long-term obligations are values that will be paid over a length of time exceeding the financial year.

When looking at a balance sheet, one assumes all necessary information has been entered and that:

- All transactions entered actually took place

- All entries have been posted accurately

- All transactions have been entered in the correct period

- All transactions have been processed to the correct account.

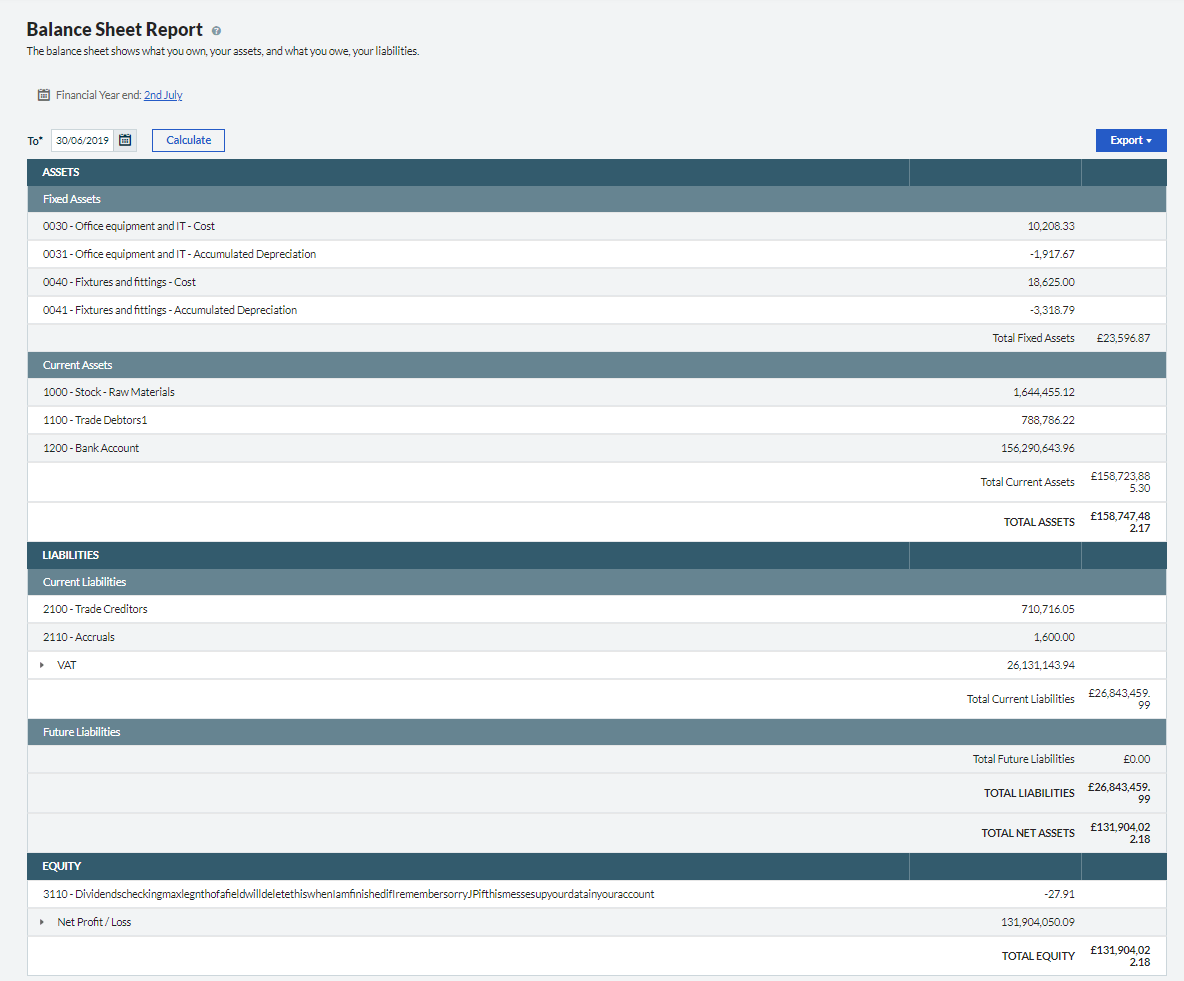

Example of a balance sheet

The balance sheet is a snapshot of a business’s financial records at a given date. The total of the owner’s equity is the book value of your business as at that date.

This report helps a small business owner quickly understand what their business is worth.

A balance sheet can help you identify trends in your business’s finances, particularly when it comes to relationships with customers and suppliers.

Are your customers taking longer to pay you? Is your debt collection out of control? Are you taking longer to pay your suppliers due to cash shortages? Are you over/under stocked?

You can run a balance sheet report from within Sage Business Cloud Accounting so you can answer these questions.

For a visual display of your profit & loss and balance sheet data look at the business snapshot dashboard in Sage Intelligence, which is accessible from within the “Reporting” section of Accounting.