Money Matters

SoAmpli: Why you need to understand your cash flow

SoAmpli founder Maz Nadjm explains how automated tools for tasks such as payroll management helps him to focus on his company's long-term goals.

Want your business to move in the right direction? It helps to have a good understanding of your cash flow. In this interview, which is a part of a series in partnership with content creators the Startup Van, SoAmpli founder Maz Nadjm shares his experiences and advice on cash flow, costs and investment.

If you ask Maz Nadjm what he considers to be the three key priorities for a successful small business, he’d say customers, cash flow and quality assurance.

He applied his expertise in social media and content marketing to that principle to start his company, SoAmpli, four years ago. And though he isn’t an expert at managing cash flow or payroll, investing in expert tools and resources to do so has helped his company to break even and become financially self-sufficient.

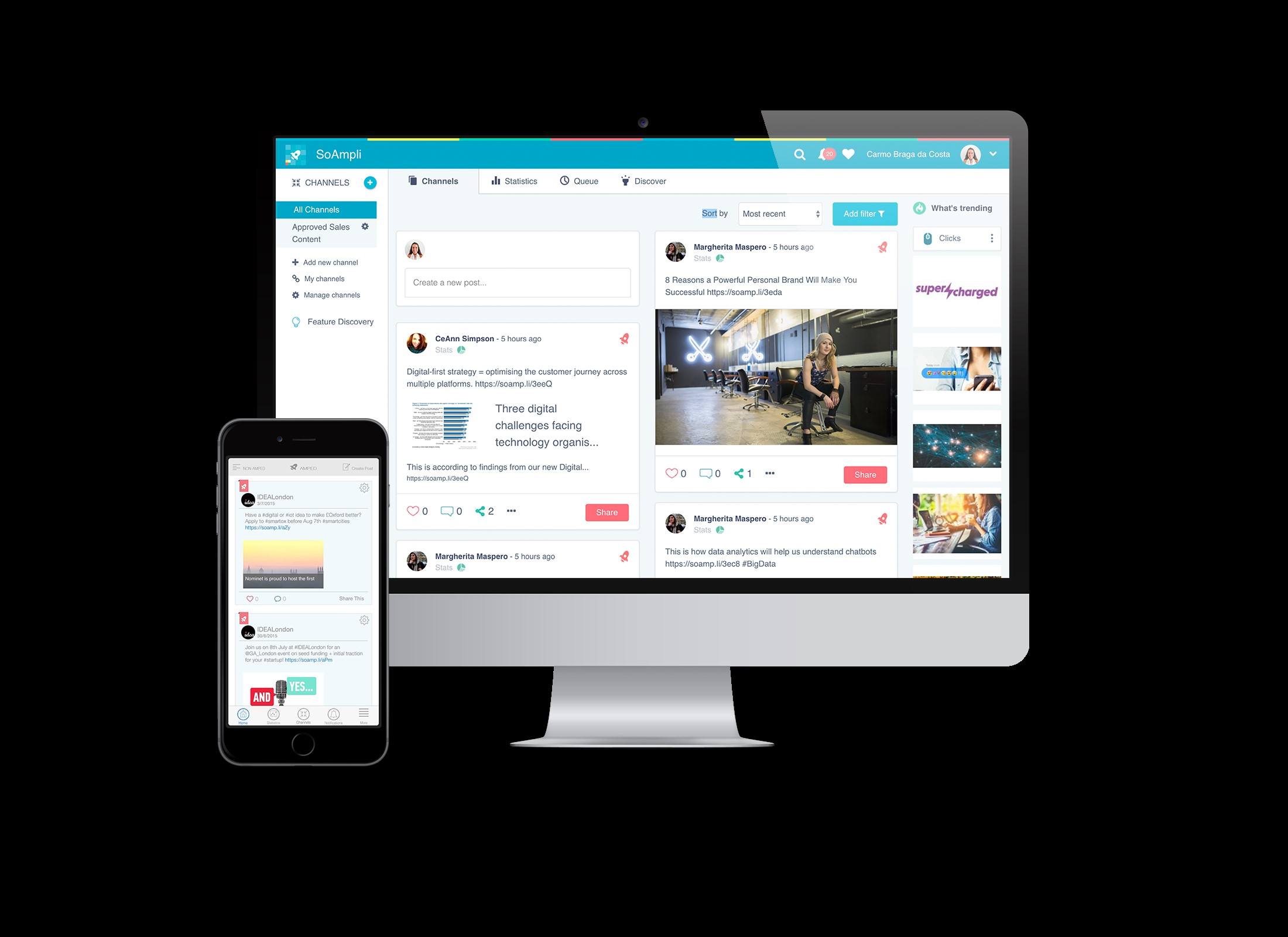

SoAmpli enables organisations to generate sales leads through brand advocacy on social media. The SoAmpli platform automates the best content and time to share on social media for the best engagement with the target audience, which elevates the brand’s thought leadership and builds a network of warm leads for the sales team.

Maz reveals his company wins customers and ensures quality assurance by aligning its key performance indicators with those of its clients.

He says: “The key measurement that we look at is the return on investment. People don’t spend their money just for the sake of it. They spend their money somewhere where they can see value for them.

“The return on investment [for our customers] is are they seeing more leads from social media, is there an increase in brand awareness and are we building their internal capabilities and educating their sales force on social media?”

Maz adds: “In the past four-and-a-half years, we have worked really hard to understand our customers, our product market set, our sales cycle, our [profit] margin, the types of customers we need to go after and the value that we add. At the moment, we have 95% client retention, which we’re extremely proud of. At this stage, we are just about to go for a scalability investment.”

Managing payroll in the right way helps Maz to have a happy team

The balancing act

Ramping up for growth, however, presents a new challenge: balancing growth efforts and everyday business tasks to keep the doors open. Tasks such as managing payroll are equally important. Small business owners can’t afford any mistakes when it comes to paying staff or suppliers, even if you aren’t a payroll expert.

Maz says: “I wouldn’t call myself an accountant. I know that money needs to be brought in and it needs to be spent but the other details I don’t have the expertise.

“It’s a mixture of in-house [knowledge] and outsourcing for us. We have an accountant and a bookkeeper, plus we use software to help us manage payroll. As a small business, we’re always looking for opportunities to run processes in a way that cost us less and help us run more efficiently.”

Growth tips

Here are four pieces of advice from Maz for small businesses looking to grow while simultaneously maintaining day-to-day activities.

1. Own your cash flow

“Stay on top of your cash flow like there is no tomorrow. You do need a good software and good people who you can work with to make sure all the details are there. Whatever gets you organised and gives you that support. There is no excuse for not knowing your cash flow. Even if you have to do it manually, it might be more painful, but it has to be done.

“I recommend working with someone who knows how to manage cash flow because they’re worth every business. Not knowing – at least a working knowledge – will cost you your business and have you make silly business decisions that are particularly costly for a start up.”

Maz applied his expertise in social media and content marketing to start SoAmpli

2. Be constantly evolving

“It’s very black and white: if they don’t find your solution to be a necessity, they don’t buy it. Are you a painkiller or just a vitamin? If the sales cycle is taking too long or the customer doesn’t want to buy your product, you have to analyse what it is about your solution that isn’t meeting your customers’ needs.

“It’s not a knee-jerk reaction. It could be that you need to find a way to attach to the customer emotionally, perhaps by explaining what you offer differently or pivot differently in approach. Understand what type of customer you are going after and understand what it takes to become a necessity to them.”

3. Ask for investment

“Never stop asking for money when it comes to investment. We all need money to grow. There are some companies who remain self-sufficient for many years and those are happy times, but always think about potential investors.

“You should be talking to investors all the time. Yes, it will take time away from your day-to-day responsibilities but in this instance, it is worth it. If one invoice is late by one month, you could be suddenly all over the place. It’s hard work to make sure those invoices come in, and sometimes the larger the customer, the later the payment.

“Can you grow if you don’t have access to cash? Can you create those features and enhancements to your product that you know you can upsell? That must come from investment or another sort of cash income like a really lucrative customer.”

4. Be cautious with operational costs and efficiency

“Be cautious about where you focus your resources, financial and human. Don’t spend money left and right. We’ve strategised very carefully over the past four-and-a-half years so we have a solid plan to target our low-hanging fruit with our investment costs.

“Do we need a chief operating officer? Yes, to bring governance. Do we need additional technology to add to our solution to bring in new customers? Yes. So, we know exactly where our investments are going and it’s only toward the places where customer benefit and business growth intersect.

“We’ve done a lot of homework on the channels that will bring us sales and at what costs. We’ve estimated and guessed before but it wasn’t until we were deliberate with our costs and strategy that we became self-sufficient. There’s nothing wrong with taking risks and making mistakes but try to minimise that as much as possible because if you don’t, suddenly you don’t have salaries to pay.”

How do you juggle business growth while doing the day-to-day stuff to keep your company ticking along? Leave your tips in the comments section.

Startup Stories

Facing business challenges and want some inspiration to overcome them? In this free guide, a group of business owners share their experiences and offer advice that can help you keep moving your business forward.

Ask the author a question or share your advice