Growth & Customers

5 best practices for financial services firms to recover faster from COVID-19

COVID-19 continues to impact the global economy in profound ways. In financial services, firms need to understand the current health of their own firm, as well as their investments, as they react to the constant stream of new information on shutdowns, reopenings, unemployment figures, recession data, and government programs. When the crisis first started, almost every firm “hunkered” down and focused on how to stabilize their business by improving cash flow, cautiously “feeding” winner investments, and selectively “pruning” poor investments.

Your instincts may be telling you to continue to hunker down and suspend any new investments or proactive action until the crisis is over. However, that isn’t the optimal strategy to recover faster. According to an extensive HBR study of 4,700 companies in recessions since 1980, you need a “balanced” approach between defense moves (e.g., cost cutting) and offense moves (e.g., investments). Everybody does the defensive, cost-cutting moves in a crisis. However, most do not consider proactive, offensive moves until the recovery is fully underway — but that is too late.

Investing before the end of the crisis can have a huge impact on your business. The study found that companies using a balanced approach with proactive moves before the crisis ends have a 76% higher chance1 of pulling ahead of the competition when times get better than just doing cost-cutting alone.

Let’s explore the five proactive moves you can take before the crisis ends to ensure a faster recovery.

Action #1: Invest in your customer experience

Customer experience touches every interaction with your customers, from the depth and breadth of your products to how you deliver your services and provide on-going support. As your customer needs and sentiments change over time, it’s critical to update your customer experience. This crisis has certainly affected you and all of your customers, possibly creating a “new normal” that will persist after the crisis ends.

To understand the short-term impacts, take the time to pick up the phone and actually talk to customers. What are their biggest concerns? Where do they need help? Are they concerned about security, managing risk, or recovering faster? These concerns should spur ideas to change your service delivery or maybe create new products. Some short-term actions/solutions you could implement could be:

- For people upset by the market losses, you might create a new investment vehicle that limits downside impacts from severe economic shocks.

- For those who want to recover faster, you might create special investment vehicles that focus on companies that enable remote work.

- For companies that faced large revenue declines recently, you could design new business continuity insurance that can cost-effectively reduce the impact of major shocks like this crisis.

- You might consider services to help your customers navigate the crisis, especially in seeking new funding from the government or other non-traditional sources.

Let your customers inspire you to innovate on your products and services. Some of these innovations may not be relevant past the recovery, while others might become part of your long-term product/services portfolio.

Look at how fintech is driving innovation across financial services, including customer service, financial advice, payments and transactions, lending, insurance services, and account management. Whether you are a traditional financial services firm or a fintech company, study the innovations produced by other fintech companies, as they can also ignite new products or services for you to start working on before the crisis ends. However, you will want to make sure that you do not invest too early (unproven concept) or too late (you are at a competitive disadvantage). According to the Economist, a “fast-follower” strategy might be the best approach for many companies, as first movers only capture 7% of a market. The secret to success may be to constantly monitor innovations by key fintech startups and consider a “fast-follow” after the startup achieves product-market fit before they start to significantly scale.

To spur some ideas, let’s review a few examples where fintechs are making a notable impact on the customer experience, especially in convenience and personalization:

- Omnichannel experience. An omni-channel experience that meets new consumers’ demands involves not only mobile, but social media and multiple messaging channels – email, live chat and SMS. The need to facilitate customer communication through any channel is marking the path forward for companies aiming to achieve true customer-centric operations. For users in banking, an omni-channel experience means customers can get consistent and seamless interactions online; no matter what device they use, as well as offline – with “smart” branches that effortlessly integrate with digital services. A critical capability in a COVID-19 world.

- Financial advice, automated. Robo-advisors or virtual assistants typically deliver automated messaging through live chat and other communication channels and can be triggered by consumer behaviors – to power sales and customer engagement. These automations can deliver basic advisory information, offer data-driven insights for more tailored services, and automated systems for customer onboarding. With a hybrid approach between human and machine, these automations can help financial advisors and agents in wealth and asset management, for example, to capture leads, build relationships with customers, and deliver a more comprehensive service offering.

- “Mashup” innovation for new products and services. Increasingly, financial firms are engaging with fintech innovators to integrate new products and services to addressed varied customer needs. Fidor Bank in Germany, for example, can connect to existing banking platforms – via an open API — to offer a range of services in lending, arranging emergency loans, and sending money via Twitter. Customers can now enjoy unmatched flexibility in accessing funds.

If fintech follows the trajectory of other disruptive technologies, a hybrid model will likely dominate. Consider the impact of eCommerce on traditional brick-and-mortar retail. At first, it was either online or bricks-and-mortar for retail. But in the last five years, a hybrid model of online and brick-and-mortar retail has emerged to provide a seamless customer experience. Even Amazon, the biggest eCommerce player by far, now has bricks-and-mortar with Amazon Go and the purchase of Whole Foods. Major brick-and-mortar players like Walmart, Target, Home Depot, and Lowes have hybrid models. If you buy online, you can return at a physical store, which is a unique capability and offers an additional element of convenience and delight to customers.

The eCommerce website also enhances the physical store experience. You can order a product to be shipped to you (traditional eCommerce), shipped to the store for pickup in a few days (great for expensive to ship items, not in stock), or be ready for pickup at a physical store in a couple of hours (streamlined physical store checkout process). If you choose to pick up an item at the store, the eCommerce website at Lowes or Target even lets you know the exact aisle and shelf in the physical store to find it so you get in and out of the store faster. Relating this back to financial services, fintech (like eCommerce) was designed to disrupt or eliminate traditional services. However, how can you potentially use fintech to enhance your face-to-face traditional services?

These enhanced business models suggest that industry winners will be those that offer a value-driven hybrid model of new and traditional technologies and services the fastest. For instance, in financial services, how do you combine robo-investing technology with human advisors to deliver the best balance of investment performance, service, cost, and convenience? So, as you look at doing a “fast-follow” innovation, consider doing a hybrid iteration that brings the best of fintech and traditional financial services. If you are lucky, you might be able to create a breakthrough (ala “1+1 = 3”) model.

To summarize, consider innovating with new products and/or services before the crisis ends. The inspiration for the new products may come from reacting from the crisis or from longer-term trends in fintech.

Action #2: Increase operational efficiency and financial visibility

So, how do you fund the investments in customer experience suggested above? Increases in operational efficiency free up the capital, headcount, and management bandwidth needed for new product and customer experience innovation. At most financial services companies, automation through operational applications and technology typically lead to the biggest operational efficiency gains. These technologies can also improve business visibility, so you can see the impact of shift in customer and market behavior early and react faster with new products.

Where do you start? Consider auditing all of your manual processes, especially ones done in spreadsheets. If you are doing the same task in a spreadsheet (e.g., budgeting and planning, revenue recognition schedules, multi-entity consolidations, inter-company eliminations, bank reconciliations) more than a few times, it is a candidate for automation. If the process is already automated, benchmark it across key metrics: elapsed time, steps required, cost, errors, and so forth. Can you reduce DSO (Days Sales Outstanding) by 20-40% or close time by 40%-60%? This will often expose additional automation opportunities. Enter all those potential automations in a spreadsheet and prioritize them by potential business impact (e.g., cost, revenue, NPS). Then, start to methodically work through your automation list, updating and reprioritizing as needed. See if you can start on 1-2 automation projects before the crisis ends.

As noted earlier, look at fintech and AI for inspiration, as well for ideas on what to automate. As fintech innovations can deliver positive and dramatic improvements to customer experience (these same innovations can greatly minimize or eliminate internal transactional processes. For example, underwriting, claims and finance processes are jam-packed with low value transactional processes and wasted costs. In fact, in underwriting, up to 80% of sales time is spent on administrative tasks. These processes often rely on heavy manual workarounds, including cutting and pasting of information onto multiple systems. Fintech innovations, today, can eliminate these redundancies.

Advancements in AI have transformed every aspect of the financial services industry. By using AI to identify transaction anomalies, firms can better mitigate fraud and money laundering risk. Capital market firms can make faster, smarter trade decisions based on sophisticated analyses of past market performance data. Organizations can conduct customer sentiment and mood analyses and personalize customer experiences based on individual customer profiles — such as suggesting customized portfolio solutions based on each individual’s risk appetite.

Action #3: Make working remotely a competitive advantage

There’s plenty of hard evidence that shows that committed and engaged employees lead directly to better performance and higher profits. It pays to invest in your people. It also happens to be the right thing to do.

You are doing your best to react to the crisis with your team now working remotely. However, what additional investments or changes could you implement to bolster morale and productivity from good to great once the crisis eventually ends?

Take the time to do a deep dive on team processes and tools impacted by remote work. Here are some suggestions to increase engagement and well-being among your staff in a “new normal” likely to include more remote work:

- Working from home (WFH). Determine how you can be more efficient in a new world that will likely have more remote work (WFH). If you are going to allow WFH, determine if you will have specific WFH days or will it be flexible. Maybe designate certain days of the week where everyone is in the office. If WFH remains a significant option after the crisis, you can re-configure your office layout and maybe reduce office/lease costs.

- Internal / external meetings. Well-run meetings are always important, but they are absolutely critical when everyone is not in the same room. Be sure to have a clear agenda with clear next steps and deliverables. Identify which meetings can be shortened or eliminated. To help meetings start on time, consider shortening hour-long meetings to 55 minutes to allow bio-breaks before the next meeting. These ideas might seem obvious, but you would be surprised by the opportunities for improvement at most companies.

- Meeting etiquette. In a remote world, it is even easier for a few people to dominate a meeting and disenfranchise the rest of the team. Consider these tactics to engage the entire team:

- Go round-robin on a group call so everyone has a chance to contribute

- Create the meeting agenda together as a team (instead of the boss only) at the beginning of the meeting on a shared virtual document

- Have the most senior person speak last

- Collaboration

- Incorporate the use of chat tools like Teams or Slack.

- Have guidelines on when to communicate via text, chat, email or phone. It might be obvious to some people, but it is surprising how often this can become an annoyance and productivity killer.

- For instance, no one wants to be bothered by a phone call on a simple yes/no question that can be easily answered via a text or chat message. Alternatively, most people would rather resolve an issue with a quick phone call or virtual meeting instead of an endless email or chat thread.

- Filesharing. Set clear guidelines on filesharing to ensure that key stakeholders can access important data and collaborate on documents in real-time when working remotely. This should help to eliminate generating multiple copies or allowing only one person at a time to work on a collaborative spreadsheet or document.

Many of these issues may seem trivial on the surface, but when they occur dozens of times a day per person, they can drag down productivity and morale in big ways.

Your goal is to manage by the business results your employees are driving for the business, not by what tasks they have completed, or by who is sitting at their office desk. Empowering employees to contribute on an individual and group level results in happier and more engaged employees, who are ultimately more loyal and emotionally committed to the firm.

The fact is companies with the happiest employees increase the bottom line too.

Engaged and committed employees:

- Are up to 20% more productive.

- Keep customers happy and can increase sales by up to 37%.

- Take 10 times fewer sick days.

Action #4: Pursue opportunistic M&A

From an investment perspective, this can be a good time to acquire assets likely to appreciate quickly in a recovery at a discount. As banks are foreclosing on other businesses and selling the assets for next to nothing, you can take advantage of this with minimal-to-no financial sacrifices. Take the time to actively develop relationships now (and ongoing post-crisis) with bankers and other lenders to learn about new assets they are looking to unload. Consider strategic divestitures and adjust your metrics and benchmarks. Update your deal funnel for various scenarios and keep communications with key stakeholders top of mind. And explore where to restructure debt and how to maximize working capital.

From the operational side, consider opportunistic M&A to:

- Enter a new/adjacent market: While entering a new market (especially high growth ones) can be attractive on the surface, often the investment and risk can be daunting if you are starting from scratch. Acquiring a player in a new market can dramatically speed up the process with the talent, technology, and/or customers to compete immediately. Expanding in new markets provides diversification if a specific market suffers a downturn, and it can expand the product portfolio, leading to higher client “share of wallet” and lower churn. Today, there is a rise of ecosystems that are forming unconventional deals across the financial services landscape. As an example, Japan’s Softbank Group continues to acquire subsidiaries and is making investments in sectors such as telecommunications and technology to expand its market footprint and long-term endurance.

- Accelerate an existing business: An acquisition could expand geographic reach (e.g., enter the West Coast of the US or Europe), add new features/tech/products to an existing product line, expand distribution channels and upgrade talent or expertise. For example, BlackRock’s acquisition of Barclays Global Investors (BGI) in 2009 (during a downturn). Through the acquisition, BlackRock expanded from its core business of active management into passive-investment management. BGI included iShares, a leader in exchange-traded funds (ETF). The iShares ETF business had high recurring revenues and low capital requirements. BlackRock accurately predicted that ETF would have a major impact on the asset management industry. In the decade since it acquired BGI, BlackRock has grown to become the world’s largest fund manager.

According to a PWC analysis, companies that can leverage available capital and make deals early in a downturn could see better returns than others in their industry. The key is to focus on best practices and to address deal strategy and leadership, capital, customer experience, operations, and workforce. If done correctly, optimal business outcomes occur, says PWC. Seven percent of companies that made acquisitions during the 2001 US recession saw higher shareholder returns than industry peers one year later. And returns were even better for ten percent of companies that announced deals in the first half of that downturn.

Action #5: Optimize Your Talent Pool

In this environment, you may have to eliminate bonuses or reduce staff, so looking to acquire new hires is probably the last thing on your mind. Yet, this downturn may offer a unique opportunity to secure top talent that you would likely never be able to attract before (or after) the crisis. Consider available candidates with exceptional skills that include strong customer service, flexibility, and good collaboration capabilities – in addition to the technical skills needed for specific jobs.

In software, there is the concept of the 10x engineer, who has the 10x productivity of the average engineer. Can you find 10x hires that can be game changers for your business? Perhaps a curve-busting investment professional, a top-notch marketer, or a rain-making salesperson? To enter a whole new market, consider hiring a new leader that can bring a fully functioning team and full book of business without the cost of formally acquiring an entirely new business. In good times, these people probably would not return your call, but now you might have a real shot at hiring them.

Looking forward…

As we make our way to the other side of this crisis, we will adopt new behaviors, have new expectations, implement new processes, and test new business models.

The secret to recovering faster and locking in long-term competitive gains is to balance cost-cuts with proactive actions before the crisis ends. It will mean making “smart” cost cuts, while investing in new capabilities and increased productivity that better enable you to weather the volatility better and to take advantage of new trends.

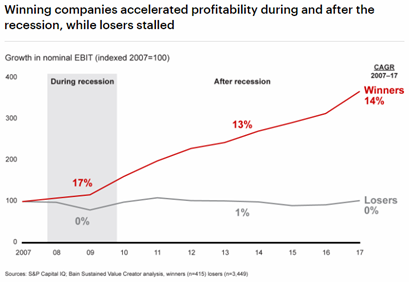

Bain & Company studied over 3,900 companies from the last recession and found that this strategy in a crisis led to long-term performance gains. According to Bain & Company’s analysis, “Winners locked in gains to grow at an average 13% CAGR in the years after the downturn, while the losers stalled at 1%.” This difference in growth can have a huge impact with winners doubling revenue in about 5-6 years, while losers seeing revenue remain almost flat over the same timeframe.

For more information on how to find the right balance today and beyond, consider how smart strategic moves coupled with technology advancements can help. Check out the eBook: CFO 3.0 – Digital Transformation Beyond Financial Management for additional insights. As we all continue to respond to this crisis, please let us know if there are additional topics that you would like us to address.

1 The Harvard Business Review found that progressive companies (offense & defense) have a 37% chance of pulling ahead of their competition while prevention-focused (defense) companies only have a 21% percent chance of pulling ahead at the end of a recession. So progressive companies are 76% (37%/21% – 1 = 76%) more likely than prevention-focused companies to pull ahead of their competition after a recession.

Ask the author a question or share your advice