Purchase orders: Different types and templates

Explore different purchase order types and templates for your business. Download our free purchase order template for Excel.

A purchase order serves as a formal confirmation of the buyer’s intended purchase. When a vendor accepts a purchase order, it becomes a legally binding document that clearly outlines the details of the transaction and ensures understanding between both parties.

Most importantly, a purchase order supports procurement by creating an auditable record of a transaction. Each one includes a unique PO (purchase order) number that also appears on all related documentation including the invoice, payment confirmation, and shipping record.

Using a standardized purchase order template simplifies the procurement process for small and mid-sized businesses while also providing legal protection and creating an audit trail.

A well-structured purchase order documents all the essential details about the transaction in a straightforward format, including information about the buyer, vendor, goods or services, and payment conditions.

In this guide, we explain how a PO works, why you use it, and the different types of purchase orders you’ll encounter as you do business. We also include a free purchase order template for you to download.

Here’s what we’ll cover:

How does a purchase order work?

Purchase orders are a key part of procurement.

The process begins when a department identifies a need for goods or a service. The department then prepares a formal request (known as a purchase requisition), which it submits to procurement.

Once procurement approves the purchase requisition, the team then issues a purchase order. The procurement team assigns it a purchase order number for tracking and auditing.

Then, the team sends the purchase order to the vendor. After accepting the purchase order, the vendor confirms the sale with the buyer, often by issuing a sales order.

The vendor then issues an invoice to the buyer, specifying the goods and services purchased, the amount due, and the payment terms. The invoice includes the PO number to allow for easier tracking.

After receiving the order, the team verifies the PO number against the packing slip. When processing payments, the buyer’s procurement team checks this unique identifier against the invoice.

Three-way matching is a critical internal control that supports compliance with Sarbanes-Oxley (SOX) and other financial reporting standards, reducing the risk of fraudulent or erroneous payments.

Although SOX compliance is only required for publicly traded companies, three-way matching is a strong internal control every company should use.

The purchase order remains active throughout most of the procurement process. It’s typically closed once the purchase is received and the invoice is paid.

Why should you use a purchase order?

When you first start a business, you might use a more informal process for purchases and payments. As your business grows and your needs become more complex, it’s better to introduce a more robust process and you should consider using POs for the following reasons:

1. Protect your business with a legally binding agreement

An informal purchasing process can leave your business without legal recourse. If the goods you receive don’t match those that you ordered and paid for, you might not be able to efficiently address the discrepancy.

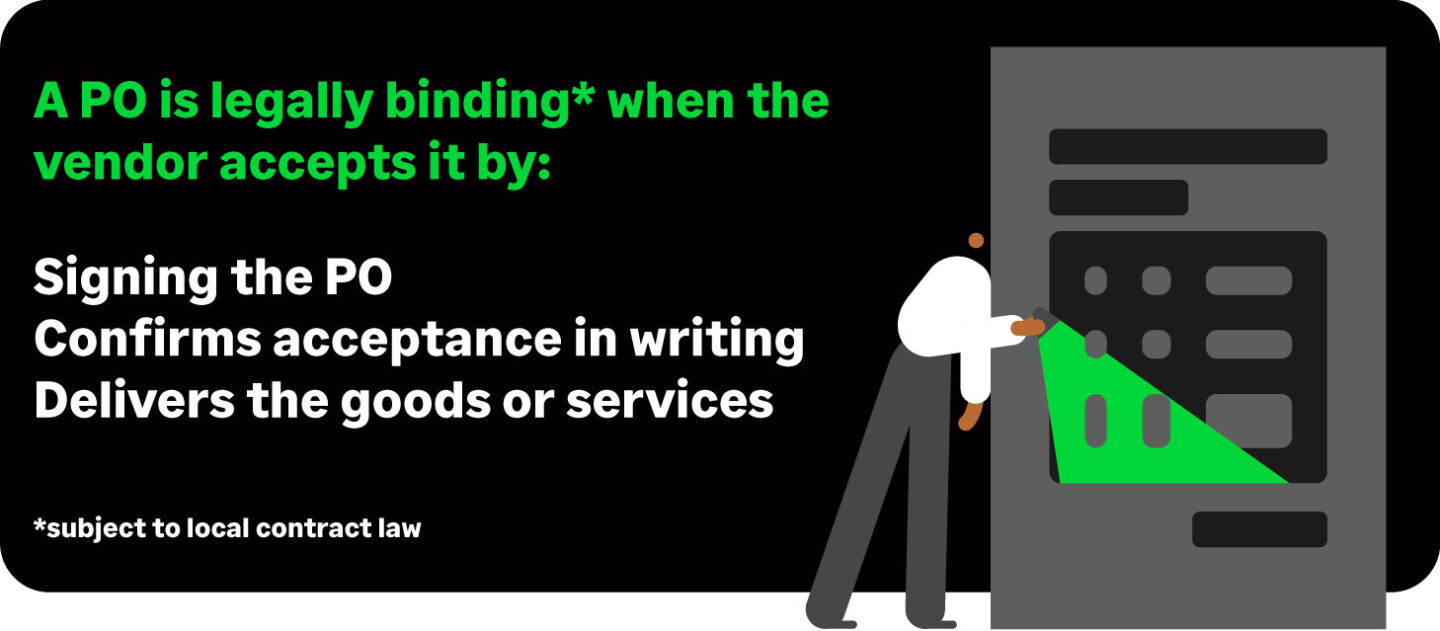

With a purchase order, you have a contract. This document may become legally binding when the vendor accepts it in writing, by signing, or by performing the order (e.g., shipping goods), depending on local contract law.

As a legal agreement, this requires the vendor to fulfill the order and your business to issue payment.

2. Create an audit trail and simplify financial compliance

Purchase orders automatically create paper trails that can make audits significantly easier to navigate. Because PO numbers appear across the purchase order, the invoice, the payment, and the packing slips, auditors can easily cross-check every step of the process.

Without a purchase order system, audits can be much more challenging. They often require manually matching vendor emails with invoices, receipts, and shipping slips.

3. Keep better track of business purchases

When your procurement process revolves around purchase orders, you also have an easier time tracking all goods and services your business buys, as well as when it arrived and when the invoice was paid.

By adding relevant PO numbers to each transaction, you can identify and monitor orders throughout the procurement cycle. And because purchase orders help you account for all the goods and services your business buys, you can avoid unnecessary repurchases.

4. Maintain control over spending and forecasting

If your business lacks a formal purchasing process, employees and executives may feel empowered to buy the goods and services they need without seeking approval. This can lead to unauthorized expenses and budget overruns.

With purchase orders, however, you retain control over business spending and keep records of upcoming expenses. This can help you more accurately forecast cash flow, allowing your business to meet time-sensitive payments related to payroll, rent, and debt.

5. Build stronger relationships with vendors

When you create purchase orders, you establish clear communication with vendors. This makes misunderstandings less likely and helps vendors plan production and delivery schedules.

Using this formal process also makes it easier for vendors to forecast demand. This can be helpful for building long-term relationships with vendors.

When should you use a purchase order?

While purchase orders are essential for many business transactions, they aren’t necessary for every purchase. For example, routine or low-cost items like office supplies purchased by an office manager may not require a PO. Using purchase orders for every transaction can create unnecessary paperwork and slow down procurement.

That’s why most businesses establish procurement procedures that define when a PO is required. These internal policies help streamline the process while ensuring control over more significant purchases.

Here are common scenarios where a purchase order is typically required:

- Inventory purchases: when buying materials or goods that are tracked as part of inventory.

- Large dollar purchases: for example, ordering spare parts or equipment in a manufacturing setting.

- Capital expenditures: such as machinery, IT infrastructure, or other high-value assets.

- Bulk or recurring orders: when purchasing large quantities of the same item or initiating a long-term supplier agreement.

For smaller purchases or incidental expenses, businesses often rely on expense reports, petty cash, or corporate cards. But for transactions that affect your bottom line or require vendor accountability, a purchase order adds an essential layer of control and documentation.

Establishing clear guidelines for when to use a PO helps your business stay efficient while maintaining financial oversight.

What are the different types of purchase order?

Apart from a standard PO, there are a few other types of purchase order you can use for different types of purchase agreements.

The following are the most common procurement scenarios.

Standard purchase order (SPO)

A standard purchase order (SPO) is the most common type for a reason. It’s best for placing orders when you know exactly what your business needs and when you need the goods or services to arrive.

Also known as a basic purchase order, this form works for any one-time or occasional purchase that has clearly defined deliverables and delivery dates. It includes space for the item description, quantity, unit prices, PO number, signature, and other details.

Blanket purchase order (BPO)

A blanket purchase order (BPO) is for longer-term agreements and recurring purchases. Also known as a standing order, this form is for purchases over a set period of time, typically when you need to reorder the same item from the same vendor multiple times.

While you could use multiple SPOs instead, a single BPO creates less paperwork. Most BPOs also include maximum limits to keep spending under control.

BPOs are used by companies that value flexibility and reduced administrative overhead such as tech firms, hospitality businesses, and some public institutions.

Planned purchase order (PPO)

Unlike a blanket purchase order, which allows for recurring orders over a period, a planned purchase order (PPO) is used when the timing and quantity of delivery are estimated in advance, often in anticipation of future needs.

It differs from a contract PO (CPO) in that it contains preliminary order details, while a CPO establishes only the legal framework without specific deliverables.

As the buyer, you typically confirm the details and issue an authorization to ship once you know your specific needs. This makes a PPO helpful for planning ahead and reducing the risk of either stockout or overstocking.

PPOs are used by companies that require structured and predictable procurement cycles, often due to high-volume, recurring, or long-lead-time purchases. These types of companies could include automobile manufacturing, large retailers or apparel brands, hospital supply chains, or large contractors.

Contract purchase order (CPO)

A CPO is for long-term, ongoing purchases for which your business doesn’t yet have final details. It establishes a legal framework for future purchases, which become binding when you issue the finalized purchase order.

Instead of serving as a legally binding agreement, it typically includes a reference to a signed contract with the vendor. A CPO is best for high-value purchases that require strong vendor relationships.

CPOs are typically used by organizations that want to establish long-term agreements with suppliers without committing to specific quantities or delivery dates upfront. This could include multinational corporations, federal agencies, utility companies, and engineering and construction companies.

What information must be included in a purchase order?

All SPOs follow a standard format. They include the following information:

- Buyer details: the buyer’s name, address, phone number, and email address.

- Vendor details: the vendor’s company name, address, phone number, and email address.

- PO number: the unique number attached to the transaction.

- Issue date: the date the buyer submitted the order.

- Item description: details about the item, including any vendor-designated identifier.

- Item quantity: the number of items the buyer intends to purchase.

- Item price: the price of the item.

- Delivery date: the date when the buyer wants to receive the order.

- Terms: any shipping or payment timelines to which both parties must agree.

What is the difference between domestic and import POs?

While domestic purchase orders are requests to purchase goods or services within the same country, import purchase orders are requests to bring goods or services to another country from overseas.

Domestic and import purchase order forms are identical aside from the purchase order description. A domestic purchase order details the item, including the description, quantity, price, and identifying number.

Import purchase orders include the same item-level details as domestic POs but also require additional information for customs and international shipping, such as Incoterms (i.e., delivery terms), country of origin, and customs references.

Purchase order template to download

Purchase Order template

Grab your free purchase order template—simple, ready to use, and built to help you stay in control.

How to complete your purchase order template

When filling out a purchase order template, wording and attention to detail are essential. Complete our standard domestic purchase order download by customizing it with your business’s contact information and Tax ID number.

Then, input the following details:

- Purchase order number.

- Date of issue.

- Payment terms (e.g., net 30).

- Ship to address, including the recipient’s name, address, phone number, and email.

- Vendor details, including the vendor’s contact name, address, phone number, and email.

- Item details, including number, description, commodity code, quantity, unit price, and amount.

- Special instructions related to warranties, packaging, labeling, or delivery.

- Total costs, including total net, shipping, other costs, discounts, taxes, and total.

If the transaction involves a third party (e.g., a reseller), include the authorized issuer’s name, email, and phone number as well as the vendor Tax ID number, reseller ID, reseller location, and shipper details.

When filling out our overseas import purchase order, replace the vendor details with the import details. Include the importer reference number, customs representative, Incoterms, shipping method, port of dispatch, and country of origin.

Final thoughts

When businesses are tracking and preparing financial documents manually and decentralized, it’s a recipe for mistakes. And it isn’t a practical process as a company scales. If they are using an outside tax or financial professional for tax compliance or advisory, a manual process like this will be a challenge.

As a company grows it’s good practice to use accounting software that can avoid duplication of PO numbers, ensure documents are not altered, and easily track which POs are outstanding.

Sage accounting software can help with every step of your procurement process, including automating procurement with purchase order software.

FAQs

What’s the difference between a purchase order and an invoice?

An invoice requests payment, while a purchase order requests goods or services. Both forms play an important role in a typical procurement process.

The buyer issues the purchase order, which details the goods or services requested from the vendor. Then, the vendor issues the invoice after fulfilling the terms of the purchase order.

The two forms include similar information, including the PO number, the price, and the item description. The invoice may also include additional information like the vendor’s preferred payment methods.

What’s the difference between a purchase order and a sales order?

A purchase order requests items from a vendor, while a sales order confirms the terms of the sale for the buyer. Both occur in a standard procurement workflow, with the sales order as a response to the purchase order.

The buyer creates the purchase order as a formal request for the vendor. The vendor then reviews the purchase order. After accepting it, the vendor issues the sales order as a commitment to complete the sale.

However, the sales order does not serve as a request for payment. The vendor then issues an invoice to request payment from the buyer.

Is a purchase order a legally enforceable contract?

Yes, a purchase order becomes a legally enforceable contract under certain circumstances. It is not a legal contract when the buyer issues it.

However, it becomes a legally binding contract when the vendor accepts it by signing the purchase order, confirming acceptance in writing, or delivering the goods or services.

Can a purchase order be cancelled?

Yes, either party can cancel a purchase order under several circumstances, such as when the buyer no longer wants to purchase the item or when the vendor is unable to fulfill the order. Because it’s a legally enforceable contract, however, terms may apply.

The buyer or vendor can cancel a purchase order without consequences if the vendor hasn’t yet accepted the request, which is required to make it a legally binding agreement.

Once the vendor accepts the purchase order, the nature of the cancellation determines the terms:

- Cancellation for cause indicates that one of the parties has breached the contract. Unless the purchase order specifies otherwise, the party that cancels the purchase order is not liable for payments.

- Cancellation for convenience indicates that one of the parties requests to cancel for non-contractual reasons. The buyer may be liable for any costs the vendor has already incurred, such as production or processing fees.

This article was verified by a US-based Certified Public Accountant (CPA). However, information and legalities are updated on a regular basis and we recommend you always seek accounting advice from a qualified CPA or tax professional.

Purchase Order template

Grab your free purchase order template—simple, ready to use, and built to help you stay in control.