Early-stage FinOps best practices: the pros and cons of having multiple systems vs a single source of truth

Learn the best practices for optimizing your finance operations and FinOps team to increase efficiency and drive success in your SaaS startup.

As a new CFO of a SaaS startup, your financial operations will play a vital role in the company’s success. To ensure you’re on the right track and stay on top of your company’s financial health, you need to implement best practices, optimize your operations, and leverage the right tools and technology.

This article will explore what financial operations are, why they matter, and how you can use automation and other best practices to streamline your operations.

A deep dive into financial operations: what it is, why you need it, and best practices

We’ll begin with the basics around operational finance and then get into specific FinOps best practices you should follow.

What is financial operations (FinOps)?

In a nutshell, financial operations, also known as FinOps, refers to the process of managing and optimizing the financial aspects of a business. It involves everything from budgeting and forecasting to cost allocation and cloud financial management. This ensures that a company is using its financial resources in the most efficient and effective way possible.

Recording and analysis can occur with past, present, or future transactions. With transactions that have already occurred, the role of operational finance is to store, organize, and report on those transactions as seamlessly as possible.

Unfortunately, many businesses struggle to obtain sufficient clarity around these crucial processes. The consequences of this can range from lost time and profits all the way to regulatory audits and fines. As a CFO, it’s your responsibility to steer the company away from that scenario.

Why FinOps is important for SaaS businesses

Companies might know in the abstract that they should invest more in their finance operations. But they often overlook the concrete benefits of doing so.

For SaaS startups, FinOps is particularly important because it helps them understand and manage their cloud spending. Cloud services can be expensive, and it’s easy to overspend if you’re not careful. FinOps provides SaaS startups with the tools and processes they need to save money and optimize their cloud services, for instance.

Additional reasons FinOps is critical for SaaS businesses include:

- Regulatory and tax peace of mind

- Streamlined reporting and forecasting

- Significantly reduced time expenditures

- Elimination of manual accounting errors

- Stronger profits and performance as a result of more complete data

Business processes tend to go more smoothly when best practices are observed, and operational finance is no exception. Let’s look at a few that you should be following as a forward-thinking CFO.

FinOps best practices

To optimize your financial operations, first make sure your finance team is aligned with your product team. They need to work together to develop budgets and forecasts that accurately reflect the company’s financial situation. Next, it’s important to invest in financial planning software that can automate some of the number-crunching work. Sage Intacct is an excellent option for SaaS startups. Finally, make sure you have a solid FinOps foundation in place. This includes building a FinOps team, developing a target operating model, and following best practices for budgeting and forecasting.

To ensure the success of your SaaS startup, you should base any operational finance decisions on a few core principles. Four of the most important are:

1: Automate every FinOps process that can be automated. Invest in financial planning software that can help you automate budgeting, forecasting, and financial reporting.

2: Establish a robust control architecture for transactions. Build operating models that provide transparency into financial data and help you make informed decisions.

3: Use role-based dashboards to maximize efficiency. Leverage cloud financial management tools that allow you to track your cloud spending in real-time and optimize cloud cost management.

4: Ensure that any operational finance tools and processes are scalable. Digitize your core financials with a cloud-native financial management system that seamlessly integrates with other business systems for scalability as your company grows.

Here’s a quick but useful guide to financial operations for SaaS startups.

A SaaS startup guide to optimize financial operations

Since most SaaS companies operate as recurring revenue firms, they have unique challenges and opportunities regarding operating model finance.

Knowing how to capitalize on these is something that any SaaS CFO should know how to do–let’s get started.

Is FinOps just number crunching?

Optimizing financial operations requires a combination of people, processes, and technology. FinOps is not just about number-crunching; it’s also about identifying opportunities for operational finance automation.

FinOps acts as a vital profit driver by:

- Helping companies track and improve their SaaS KPIs

- Acting as “connective tissue” between the company and its stakeholders

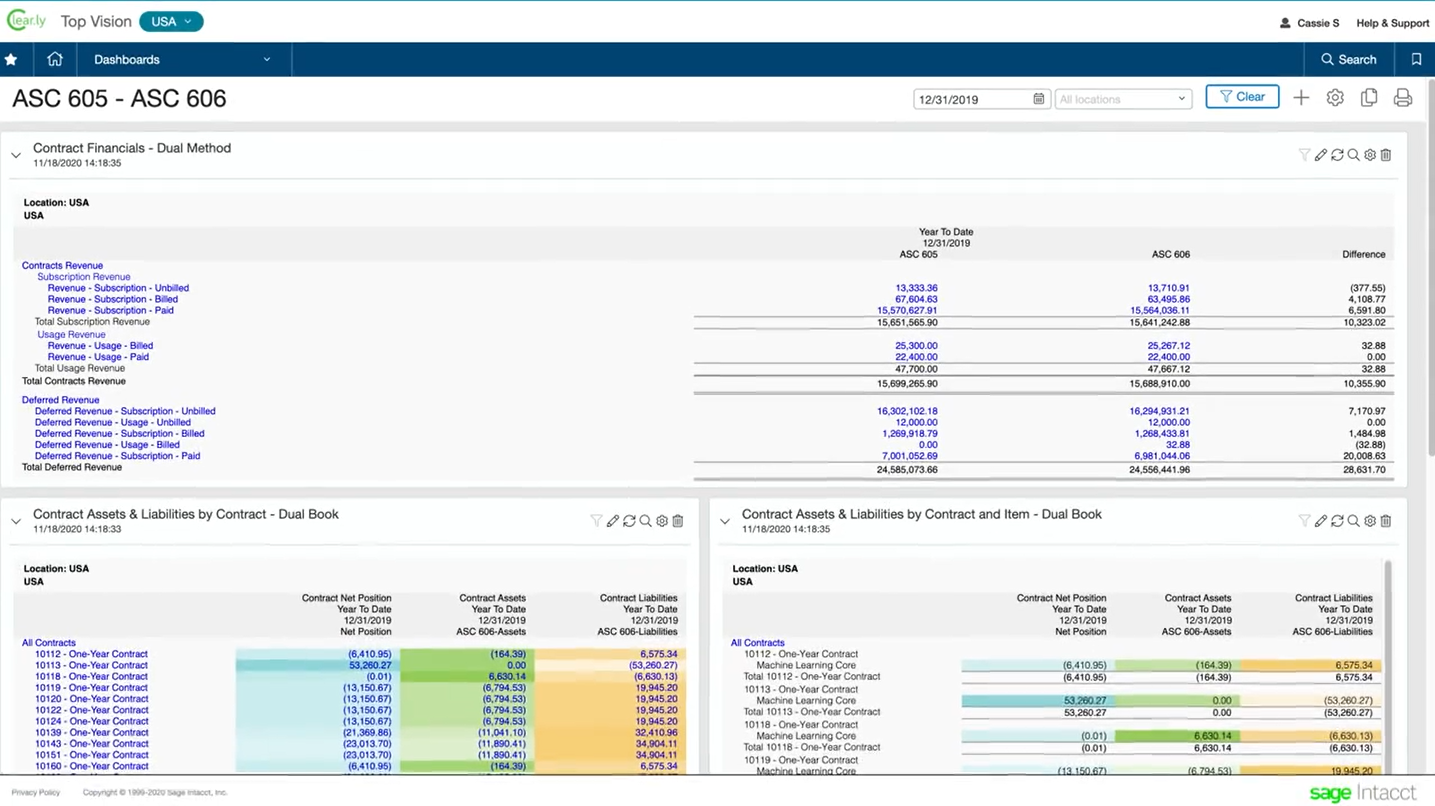

- Assisting with the often-complex requirements of ASC 606 and IFRS 15

- Speeding up the cash flow cycle and shortening close time

Clearly, FinOps has a substantial role to play in modern companies.

Operational finance automation opportunities

One of the keys to optimizing financial operations in a SaaS startup is automation. The right tools will enable you to track your cloud spending in real-time and make informed adjustments as needed.

What are some of the main incentives and opportunities awaiting accounting teams who embrace FinOps automation?

- Seamless expansion into profitable overseas markets

- Hassle-free global multi-entity accounting

- Flexibility around billing models, including hybrid billing

- The ability to capitalize on cost data patterns and fight churn

Operational finance automation is all about giving teams the freedom and agility to meet whatever challenges might be coming down the pike. By automating tasks, SaaS startups can save money and optimize their resources.

FinOps tools and tech stack

When optimizing your firm’s financial operations as a CFO, nothing matters more than your choice of FinOps tools and tech stack. Let’s see why it’s important to get this choice right as early as possible.

Need for financial planning software

As mentioned earlier, financial planning software is essential for SaaS startups. Sage Intacct is a great option because it’s easy to use and helps finance professionals increase efficiency and drive growth for their organizations.

An ideal tech stack will be able to handle the rigorous demands and heavy regulations involved in operational finance. Without financial planning software, SaaS companies will find it difficult to achieve four very important goals:

1: Pull off a smooth and profitable IPO.

2: Stay out of regulatory trouble.

3: Stay at the industry’s forefront as tech continues to evolve.

4: Present investors with data-supported reasons to back the firm.

For these reasons and many others, companies that choose to go without an automated tech stack are setting themselves up for long-term failure. However, as a SaaS CFO, you can steer your company in the other direction.

By implementing FinOps best practices, optimizing your financial operations, and using the right tools and tech stack, you can ensure that your startup stays on track financially. This will enable you to focus on growing your business and achieving your long-term goals.

Sage Intacct: Making SaaS accounting easy

Sage Intacct uses start-to-finish automation to help CFOs and finance teams turn operational finance into a source of increased profitability and productivity.

If you’d like to know how it feels to successfully bridge the gap between finance and operations, this brief product tour shows you the 5 Must-Haves in building your FinOps Tech Stack.