Three ways your small business can plan for tomorrow

Where do I want my business to be in five years, 10 years — or even 20 years? For small and mid-sized business leaders, the long view is important. To chart a course for tomorrow, they analyze data from hundreds of thousands of transactions and use the insights they’ve gleaned to map out critical decisions […]

Where do I want my business to be in five years, 10 years — or even 20 years?

For small and mid-sized business leaders, the long view is important. To chart a course for tomorrow, they analyze data from hundreds of thousands of transactions and use the insights they’ve gleaned to map out critical decisions for future expansion and greater market share. But even the best-laid 10-year plans are meaningless if business leaders can’t make the smart decisions that are needed to secure and grow their businesses right here, right now.

So how can businesses harness the power of “now” to respond quickly and strategically to new challenges and opportunities as they arise? Here are three ways that businesses can stay agile in the moment:

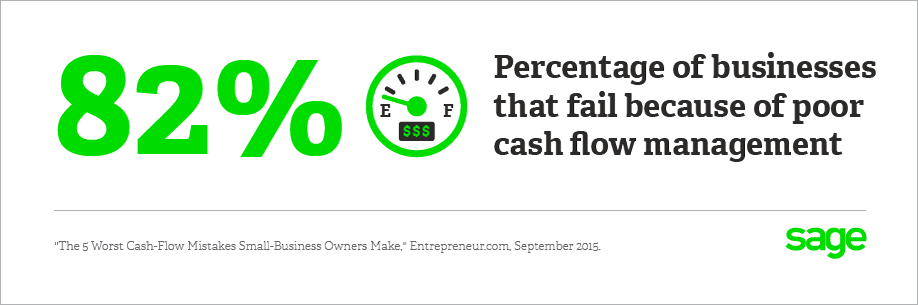

Forecasting cash flow

Research suggests that 82 percent of businesses fail because of poor cash flow management. The challenge isn’t simply understanding funds coming in and going out: It’s keeping detailed financial records and analyzing those records intelligently. It’s taking a hard look at every expenditure and doing an honest cost-benefit analysis. Most importantly, it’s creating and maintaining an accurate and up-to-date forecast for expenses and income to chart a path to sustainability and growth for the business. Even a slim margin between under-forecasting and over-forecasting can mean the difference between success and failure.

Keeping the right customers

All customers are valuable, but not all customers are worth the investment it takes for a business to retain them as your business and the market evolve. Customer attrition is a fact of life in the marketplace. Business leaders need to make smart, data-driven bets on which customers will prove most valuable in the future—and thus which ones to devote more time, energy and resources toward retaining by keeping them satisfied and engaged. Feedback from sales and support teams, customer surveys and other ancillary business data (such as delays in accounts receivable payments) can all be valuable tools in assessing customer satisfaction.

Finding working capital

New projects such as product launches and regional expansion need capital to drive their growth. A business focus on the “now” will use financial data to gauge whether funds are available for growth right away. For example, finance leaders can improve their ability to monitor accounts receivable, such as the most lucrative customers, their invoice status and their average days to pay. They can also optimize accounts receivable processes to automate time-consuming billing and invoicing functions. With day-to-day monitoring of accounts receivable, businesses can ensure they have working capital ready when the right opportunities for growth present themselves.

Today, companies face a greater urgency than ever before to take advantage of new opportunities and manage unexpected risks. Investors and markets demand faster results. Poor decisions, driven by a lack of insight and analysis, can short circuit a business’s ability to reach goals that are years down the road. Smarter, faster decision-making can help businesses capture “now” opportunities before they disappear—or before they’re snatched up by the competition.

Small business survival toolkit

Get your free guide, business plan template, and cash flow forecast template to help you run your business and achieve your goals.