Ten cost-saving opportunities in the fixed assets lifecycle

Which best describes your fixed asset management process: A struggle to accurately log and report fixed assets, or a system that facilitates confident reporting and forecasting for opportunities to cut costs and take advantage of tax breaks? Challenges with managing fixed assets using spreadsheets Spreadsheets and legacy software can only take your company so far […]

Which best describes your fixed asset management process: A struggle to accurately log and report fixed assets, or a system that facilitates confident reporting and forecasting for opportunities to cut costs and take advantage of tax breaks?

Challenges with managing fixed assets using spreadsheets

Spreadsheets and legacy software can only take your company so far when it comes to managing fixed assets. As shown in the image below taken from Aberdeen research, version control is the biggest challenge to managing fixed assets with spreadsheets. Often passed from employee to employee, it is difficult to tell which version is the most current.

Spreadsheets lack audit trails. Beyond the last person to access the file and date it was modified, all changes made must be manually logged. This leaves spreadsheets vulnerable to accidental and intentional changes that materially affect data integrity for large and small organizations alike.

Top obstacles when managing fixed assets with spreadsheets

Drivers for adopting a fixed asset management solution

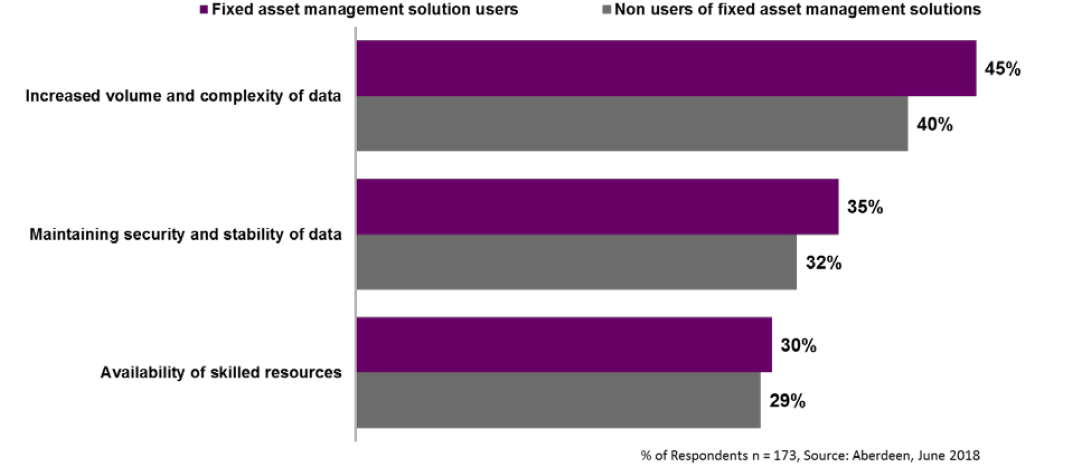

Numerous pressures drive organizations to focus resources on a fixed asset management solution. These include increased volume and complexity of data, maintaining security and stability of data, and leveraging the limited availability of skilled resources.

As shown in the image below, 45 percent of organizations use a fixed asset management solution to deal with the increased volume and complexity of data. Employing the right tools is critical to accurately account for each asset. Understanding the risk factors throughout the life cycle of each asset is key to identifying hidden cost-saving opportunities. What you don’t know about your company’s fixed assets can be costly to your business.

Top drivers for adopting a fixed asset management solution

Here are 10 ways to mitigate risks throughout the asset lifecycle and other opportunities to save with fixed asset management:

Opportunities as fixed assets depreciate

Depending on the technology features available with the solution you are using, you could be missing opportunities to save during depreciation. Manual processes make it difficult to mitigate risks and seize opportunities in these areas:

1. Accurately registering all fixed assets

Your register for all your fixed assets should include location, purchase price and date, useful life of the aspect, and anticipate value at the end of its lifecycle to summarize both accounting and deductible taxation depreciation expense.

2. Compliance with up-to-date federal tax rules

Keeping up with compliance to avoid penalty fees is obviously the focus. The same Aberdeen research shows that 35% of fixed asset management software users specifically site compliance with new and/or changing regulatory requirements as a key driver in minimizing risks. However, remaining up-to-date with federal tax rules can shine light on tax breaks and credits to your businesses’ benefit.

For example, the 2018 Bipartisan Act provided tax extenders from 2017 for empowerment zone businesses, motorsports entertainment companies, renewable energy companies, and those in horse racing. This allowed an additional $35k in expensing through 2017 for empowerment zone businesses, investment tax credits for various energy properties, and extended energy efficient commercial building deductions.

Not capturing these changes could mean a missed opportunity for the many business types that qualify.

3. Accurate tax and generally accepted accounting principle (GAAP) depreciation calculations

Juggling multiple depreciation methods and calculations for different types of fixed assets can be time-consuming and costly if done inefficiently. Modern solutions that automate tax changes improve accuracy, free up staff that could be better invested elsewhere, and eliminate the most common productivity drains that plague growing businesses. Automation can also help your business easily take advantage of tax provisions like the changes to the alternative depreciation system (ADS) rules as part of the Tax Cuts and Jobs Act.

Businesses can capitalize on depreciation changes and eliminate accounting for assets that are no longer in service and the overpayment of taxes and insurance costs associated with them.

4. Accurate reporting for IRS forms, general ledger, depreciation expense, and roll forward reports

Incorrect data on IRS forms 4562 and 4797 impacts period closing, financial statements, and tax reporting. Accuracy here saves your business from hefty penalty fees and debilitating cracks in the financial foundation.

Sage Fixed Assets – 2021 Year-End Planning

It’s time to start thinking about year-end close.

Join us on Thursday, October 28 at 2 PM ET to make sure you are prepared for year-end activities related to your company’s capital assets.

Cost advantages of closely monitoring asset status

For physical inventories, detailed reporting for fixed assets at the end of their lifecycle can shine a light on savings opportunities. Support from a robust solution can make reconciliation easier and reduce insurance fees and taxes as a result.

5. Accurately accounting for disposals, retirements, transfers

This is where ghost and zombie assets hide and rack up costs. 15-30% of fixed assets are ghost assets, meaning they don’t exist. Ghost assets are those that are visible on the books but can’t be physically located. Zombie assets are those that are physically present but don’t have a track record on the books.

Businesses can easily carry tens of thousands of dollars in untracked assets if the asset lifecycle isn’t monitored closely and analyzed frequently. With the right management system, you can dispose of, retire, and transfer 10,000 assets as easily as you would 10 assets.

6. Workflow integration for efficient fixed asset management

Spreadsheet formulas can break when passed from one employee to another, and improper cell references can lead to inaccurate values. It’s easy for these inaccuracies to lead to bigger problems.

Integration with your organization’s purchasing or accounting software adds another layer of control and simplicity that you won’t get from using spreadsheets. Purchasing data is automatically loaded from one business stream to the other, reducing human error and ensuring accuracy at each touch point. You can even attach an invoice to one or 10 newly purchased computers, for example.

An integrated accounting and fixed asset reporting system eliminates the need to duplicate entries or export data between systems.

Forecasting and early cost control opportunities

Some of the most important opportunities to save with fixed assets management present themselves before the asset even exists:

7. Plans to expand the business and start new projects should include fixed asset forecasting

This keeps accountability for new assets at the forefront and improves traceability later.

8. Set and control budgets for all fixed assets

Budgeting for fixed assets adds another layer of accountability and visibility to reduce overpayment/underpayment errors as assets depreciate.

9. Track realized costs and identify spend against budget

You can reference these reports as you plan for future projects and need to forecast budget for new assets accordingly.

10. Closely manage and monitor asset status

Assets should seamlessly migrate from the planning phase to in-service and depreciating.

As your business grows and acquires more, it will become necessary to upgrade to a more powerful and robust to streamline the above processes and much more. Doing so can give your company more insight into its fixed assets, minimizing their TCO while simplifying operational and financial workflows.

New product intelligence offers a better way to manage fixed assets at scale while ensuring cost savings and increased productivity for those responsible.

Sage Fixed Assets – 2021 Year-End Planning

It’s time to start thinking about year-end close.

Join us on Thursday, October 28 at 2 PM ET to make sure you are prepared for year-end activities related to your company’s capital assets.