Strategy, Legal & Operations

Is your accountancy practice ready for the next decade?

What will the accountancy practice of 2030 be like? We look at The Practice of Now survey results and offer tips to get your firm ready for the future.

What do you think the accountancy practice of the future will look like, and what kind of businesses will it serve?

It will certainly be different, but the Practice of Now report suggests it could be radically different in some key ways.

Our report found that 90% of the 3,000 accountants we surveyed believe there’s a cultural or evolutionary change happening right now within their profession.

In this article, I’ll share three things that I believe will give you a chance to prepare. All of them come from the report findings, so we’re limiting our crystal ball gazing and working from real-world feedback from accountants.

The first thing I’ll share is what’s happening with the businesses of tomorrow. Where they are heading and what impact that has on the overall business landscape and environment.

Secondly, I’ll share some information about the workforce of tomorrow, and how the speed at which it is changing is having a huge impact on the accounting profession overall.

And finally, given the rapidly changing landscape, I’ll give my perspective on what this means for you as an accounting professional.

The pace of change

First, it might be useful to get a sense of perspective. I speak to many accountants around the world and often I hear this feedback: “Things are moving too fast.”

But are they really? As AICPA President and CEO Barry Melancon recently told me: “This is the slowest pace of change that we will see for the rest of our lives.”

That’s profound.

The leader of one of the biggest accountancy certification bodies in the world says the pace of change right now is actually the slowest it’s likely to be.

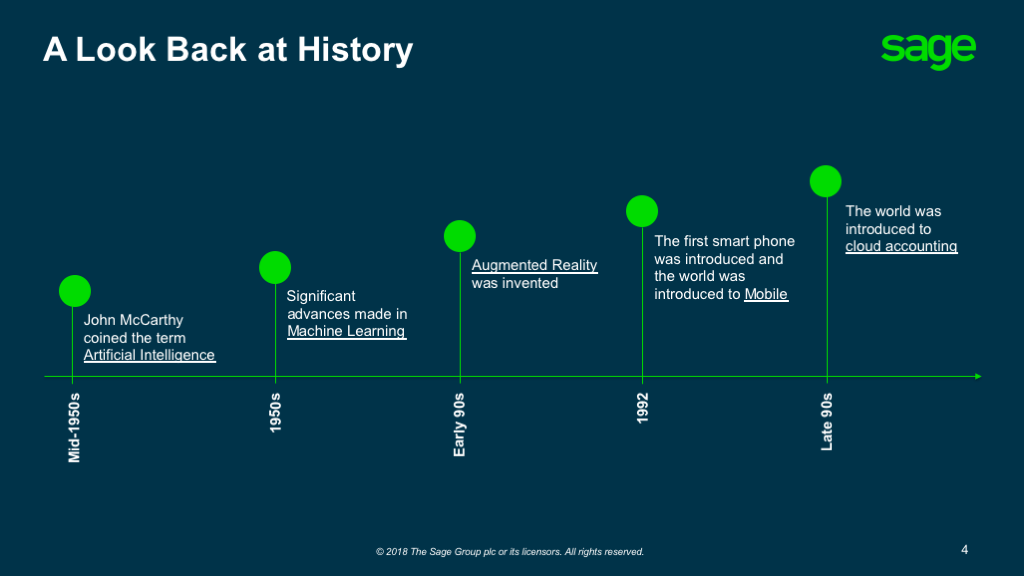

But what about all that new technology beating at the door? Artificial intelligence. Cloud computing. Well, is it so new? Why are we calling it “emerging technology” when some of it’s been around since the 1950s?

For so many decades, all of this technology was only available to large corporations. It wasn’t necessarily available to small or mid-size businesses.

But now it’s available to even the smallest startup business. Perhaps the reason we still talk about this technology as “emerging” is because, as a profession, we’re behind the times. We’re not where we need to be.

In fact, according to the Practice of Now report, 85% of accountants stated: “We need to pick up the pace of technology adoption in order to be competitive in the international landscape.”

Technology is one of the drivers behind the 90% of accountants who believe the profession is undergoing a cultural change.

Other reasons cited include market demands, changing regulations, generational changes and client demands.

What I think is really fascinating is that these are all external forces.

As a profession we’re being forced to change, and that can be really hard for any profession, not just accounting.

But keeping this sense of perspective will help.

The business of tomorrow

We need to plan for what our clients will look like tomorrow and in the future, not just for today.

Some of your clients today will go out of business. Some of them will retire. But these aren’t the only threats to your client list.

According to a study by Salesforce, 64% of businesses are willing to leave the brands they work with if that brand doesn’t anticipate their needs.

The same study reported that 70% of consumers agree that technology has made it easier than ever to take their business elsewhere.

There are two key takeaways. Firstly, what businesses expect is changing. But secondly, notice the phrasing: “If the brand doesn’t anticipate their needs.”

It’s not just about meeting their needs today. It’s about anticipating what they will need tomorrow.

Read more about modernising your accountancy practice

- 3 important steps to modernise your accountancy practice

- Top 5 takeaways from Accountex for your practice

- 5 positive ways artificial intelligence will impact accountants

Do you anticipate where your clients are going – and what they’re going to need in five or 10 years? How is your firm’s business model and the services you provide changing to meet those needs?

Technology will be one of those drivers in the wider business world, of course, just like it is in our own profession. This should feature in what you anticipate clients needing.

But don’t make the mistake of believing that technological innovation in itself will define the business of tomorrow.

Andy Grove, the founder of the computer chip maker Intel, said the following: “Disruptive threats came inherently not from new technology but from new business models.”

Have you heard about Flippy, the burger-flipping robot used in a California burger chain? Surely automating the creation of burgers can only be successful. You reduce staff costs. You standardise food production.

Yet the burger chain had to switch off Flippy after just one day as it created problems in the workflow for the staff.

They needed to be trained to work with Flippy but subsequently it was realised that the high turnover rate of burger joints made this problematic.

What had happened, in my opinion, is that Flippy changed the burger joint’s business model. Suddenly, fundamental assumptions were called into question.

Yet the people who operated the burger joint thought they were just automating a single, basic task.

The moral of the story is that it’s the business models and not the technologies that accountants need to watch and anticipate.

The workforce of tomorrow

What’s the biggest age demographic in western countries right now? Baby boomers? Gen-Xers?

It turns out that it’s millennials – often cited as those born after 1981, but with a particular focus on those born in the 21st century – a group sometimes hived off into their own age demographic called Gen-Z.

Did you know that 2018 was the first time that those born after the millennium came of age?

Of course, arguably this age group began entering the workforce from their teenage years onwards, so we’re aware of them already.

The workforce of tomorrow will increasingly consist of millennials and Gen-Zers. In fact, by 2020 more than half the entire workforce population will be made up of them.

It’s critically important that you think about a strategy for handling millennials/Gen-Zers and what they anticipate. I’ve spent many hours in focus groups with them talking about what it is they want when working at an accountancy firm.

They don’t feel like they have a voice. Senior accountants have been heard saying things like: “I started in the mail room – they’ve got to start at the bottom and work their way up just like I did.”

This just doesn’t wash with the millennial generation. They won’t stay.

This doesn’t mean they need to start at the top but it does mean they need to have a voice. Yet when you think about how diversity can lead to a much richer business model and business plan for you, giving a voice to this group is actually to your advantage.

Here are a few stories to illustrate the nature of the challenge.

My friend’s father Ken is 88 years old and wanted to finally get himself online, so after much thinking about his needs, Ken was given an iPad.

Obviously, my friend acted as a makeshift tech support line for his father and one of the first calls was asking how to email some pictures to his daughter.

His daughter had emailed Ken already a few times, so her contact details were right there.

It’s easy, right?

But Ken didn’t know this. Why would he make such an assumption?

This really shows the fundamental barriers presented by modern technology for the older generation.

Now, let’s talk about Molly. She’s three years old. One day while her mother was out, Molly found her father lying on the floor, convulsing.

Molly grabs her father’s tablet and makes a video call to her mother to tell her that Daddy is sick. She turns the tablet around so mum can see.

As it happens, mum is a nurse so immediately calls an ambulance. Unfortunately, Molly’s father had a stroke but the great news is that he is now recovering.

Molly was never taught how to make a video call. She had never made one before. But she just knew what to do. She either learned it by watching others, or she figured it out for herself.

Can there be a starker demonstration of the technical divide? Ken is perplexed by the basic stuff, which is literally second nature for Molly.

Molly is your customer of tomorrow.

When they come into your firm and they want a job, the millennial/Gen-Zers expect the latest technology.

It’s not optional. It’s part of how they exist.

It’ll require a very different workforce than has been in existence up until now.

IBM’s Institute for Business Value surveyed millennials. It found people in that demographic want to:

- Make a positive impact on their organisation

- Work with a diverse group of people

- Do work they’re passionate about

- Become an expert in their field.

Millennials won’t give up. They won’t settle for less than this.

What all of this means

What are the additional skills that accountants are going to need going forward?

Obviously, technological literacy is important. But what I hear from accountants is: “I can’t keep up. There are so many new apps coming on to the market every single day.”

One way to make this seemingly complex challenge simpler is the following:

Focus on an industry or vertical. Your chances of keeping up with the technology will be a million times greater.

In other words, if you’re trying to be all things to all business types, you’re not going to be able to make it work. This is a key difference when it comes to technology literacy, compared with five or 10 years ago.

Business advisory services remain incredibly important – anticipating the needs of your customers and talking to them about where they are going.

Business don’t want financial work alone, which looks back and tells them what they did last month, last quarter or last year.

They want advisory services that are forward-looking.

In the Practice of Now report, we make some predictions about what a practice will look like around 2030. Here they are:

- No manual data entry: Data will flow automatically from clients and their bank accounts into the accountants’ accounting software. Manually keying data will become rare, with legislation such as the digitisation of tax and payroll, forcing businesses to change.

- Real-time relationships: The relationship between an accountant and their client will be near-instant. The accountant will have a real-time view of their client’s business and will be able to interact with that client in real-time. The accountant will be a trusted partner or even a constantly present companion.

- Proactive alerts and notifications: Accountants will know instantly when things change for a client. For example, the accountant will be alerted when their client suddenly incurs a lot of bad debt resulting from a big order placed by the client’s customer whose credit rating is low.

- Pre-emptive problem solving: Accountants’ time will be spent proactively looking at business problems and seeing errors before they manifest themselves into year-end error corrections.

- Higher fees – but better value: Accountants will charge more to clients than they do today because of their increased value due to their advisory services. Fees might not grow by that much, of course, but accountants will be able to monetise better.

When do you think you’ll be putting any of them into practice?

Editor’s note: This article was first published in June 2019 and has been updated for relevance.

The Practice of Now

Discover how accountants and bookkeepers are preparing for the future and learn what you can do now to keep your practice successful.

Ask the author a question or share your advice