Money Matters

Coronavirus Self-Employment Income Support Scheme: What you need to know

Learn about details of the extended Self-Employment Income Support Scheme (SEISS) and the grants that are available to self-employed workers.

When it was introduced in March 2020, the Self-Employment Income Support Scheme (SEISS) was a lifeline for the self-employed and brought similar salary financial assistance as offered to furloughed employees, in the form of two one off payments.

In November 2020, the SEISS was extended so that it provided grants for two further consecutive three-month periods, running into 2021.

Then in the 2021 Budget, the SEISS was extended again to create a fifth and final grant payment.

The third, fourth and fifth SEISS grants are as follows:

Third SEISS grant: November 2020 to January 2021

You could claim up to 80% of three months of your average trading profits, capped at £7,500.

You could apply as of 30 November 2020. The closing date for applications was 29 January 2021.

Fourth SEISS grant: February 2021 to April 2021

You can claim up to 80% of three months of your average profits, capped at £7,500.

You can apply from late April 2021. The closing date for applications is 31 May 2021.

Fifth SEISS grant: May 2021 to October 2021

The fifth grant changes the rules slightly because it’s based on how much your income has diminished across April 2020 – April 2021 as a result of coronavirus.

It’s not yet clear how HMRC will determine this, and the claim dates have not yet been announced either, but the grant’s value is as follows:

- 80% of 3 months’ average trading profits, capped at £7,500, if you have a turnover reduction of 30% or more.

- 30% of 3 months’ average trading profits, capped at £2,850, if you have a turnover reduction of less than 30%.

Claiming SEISS grants

Eligible self-employed people could claim grants for the third grant if their average trading profit had been impacted by coronavirus.

You didn’t need to have claimed a SEISS grant up until that point, but you did need to have fulfilled the eligibility criteria when the SEISS originally started back in March 2020.

In other words, you only qualified for the grant if you’ve carried on a trade in the tax years 2018/19 and 2019/20.

The fourth and fifth SEISS grants change the rules.

It’s no longer necessary to have traded in the 2018/19 financial year. Claims are opened up to those who’ve traded in the tax years 2019-20 and 2020-21.

In other words, those newer to self-employment are now included.

However, you will need to have submitted your 2019-20 Self Assessment tax return by 2 March 2021.

Unlike some other government coronavirus schemes, the SEISS grants are not loans, so they don’t have to be paid back (outside of situations where they’re been claimed fraudulently).

The grants are considered declarable income just like any other, though, so are still subject to the usual tax and National Insurance deductions.

Read this article to determine if you’re eligible for the SEISS, what you’re likely to receive, and when. Here’s what it covers:

Am I eligible for the Self-Employment Income Support Scheme?

Who isn’t eligible for the SEISS grants?

Can I continue to work while apply for, or after receiving, the SEISS grant?

How do I apply for the scheme?

When will I receive the grants?

What admin or paperwork requirements does the SEISS have?

Other coronavirus measures for self-employed workers

Am I eligible for the Self-Employment Income Support Scheme?

To claim the third grant, you had to have been eligible for the first two grants that began back in March 2020 – even if you didn’t claim them.

You’ll also need to make a declaration as part of the grant claim process that either you’re currently actively trading but are impacted by reduced demand due to coronavirus, or were previously trading but are temporarily unable to do so due to the pandemic.

For the fourth and fifth grants, eligibility changes if you’re claiming for the first time because HMRC will attempt to get in touch with you by phone to discuss your eligibility.

Initially, they’ll write to you to inform you of this call. The call won’t be identified as HMRC, so will appear as “withheld”.

How much do I get?

Two remaining SEISS grants are available as the publication of this blog in March 2021.

The four SEISS grant covers the period of February 2021 to April 2021. You can claim up to 80% of three months of your average profits, capped at £7,500. You can apply as of late April 2021. The closing date for applications is 31 May 2021.

There’s a “fifth and final” SEISS grant that will cover the period May 2021 to September 2021. This covers a five-month period, unlike the previous grants, that have covered just three months for each claim.

The fifth grant changes the rules slightly what you’ll receive is based on how much your income has diminished across April 2020 – April 2021 as a result of coronavirus.

It’s not yet clear how HMRC will determine this, and the claim dates have not yet been announced either. We’ll update this article when the information is known.

The fifth’s grant’s value is as follows:

- 80% of 3 months’ average trading profits, capped at £7,500, if you have a turnover reduction of 30% or more.

- 30% of 3 months’ average trading profits, capped at £2,850, if you have a turnover reduction of less than 30%.

Each SEISS grant is paid in a lump sum after application, rather than in monthly instalments.

To work out how much you should receive for the third grant, the government calculated the average of your trading profit across the years you traded during the 2016/17, 2017/18 and 2018/19 tax years (that is, it added up your trading profits then divided by the number of years you traded in).

For the fourth and fifth grants, the 2019/20 year are used too for this calculation.

Then it produces a monthly figure from this by dividing by 12.

This figure is multiplied by three, or five, depending on the grant. 80% or 30% of this is then calculated, up to the caps mentioned earlier, depending on which grant you’re claiming and your eligibility.

If any of your Self Assessment returns have been amended or had a contract settlement applied after 6pm on 26 March 2020, the government will use the earlier, unamended version(s) for its calculations.

The grants are taxed, just like your regular income. In other words, the income must be declared along with other income sources in your Self Assessment tax return.

You’ll then pay any tax due as you would usually. But you can also offset losses against them too, as usual.

If you claim tax credits, the grants will need to be listed in your tax credit claim as income.

Who isn’t eligible for the SEISS grants?

You’re not eligible for the remaining fourth and fifth SEISS grants if any of the following apply (note that this is based on guidance for the earlier grants and we’re awaiting full guidance on the fourth and fifth grant eligibility rules):

- You haven’t been trading for long enough, which is to say, you did not carry on a trade in the tax year 2019/20 and submit a Self Assessment return. This means those who’ve very recently started out as a sole trader can’t claim.

- Your trading profits were more than £50,000.

- You aren’t self-employed, or in a partnership, or don’t intend to be in the future. It’s not enough to merely be enrolled for Self Assessment and to have undertaken self-employment work or have a role in a partnership at some point. You must be trading now and intend to do so in the 2021/22 tax year too.

- You failed to submit a Self Assessment tax return for the 2019/2020 tax year by 2 March 2021.

- You haven’t lost trading profits due to the coronavirus outbreak. During your application process, HMRC requires you to legally declare you are adversely affected, and it may attempt to retrieve the grants if it believes your application is fraudulent.

- Less than 50% of your income came from your self-employment or partnership for both tax year 2019/20.

Can I continue to work while apply for, or after receiving, the SEISS grant?

Yes, you can continue to trade despite applying for or receiving the SEISS grants.

Similarly, the amount you can claim for each time is not affected by any work you’ve done, are doing now, or will do in the future.

This is a significant difference from the similar Coronavirus Job Retention Scheme, which employers are using for the same period, where furloughed employees are not allowed to work or provide any services for the employer who furloughed them (but are allowed to work for other employers).

In other words, you may find that your furloughed employees are unable to work for you if you use the Job Retention Scheme to full-time furlough them, but you can continue to work within your business under the SEISS scheme.

The government says that, even though you apply for and receive the SEISS grants, you can also start a new trade or take on other employment. This includes voluntary work, or your duties if you’re a reservist in the armed forces.

How do I apply for the scheme?

HMRC’s online portal for making applications opened on 30 November 2020.

You must apply for the scheme yourself. A third party, such as your accountant or financial adviser, can’t do it on your behalf.

It’s vital to note that, unlike some of the other coronavirus-related grants from the UK government, receiving the SEISS grant money is not automatic.

If you don’t apply, you will not receive it.

If you’re unable to claim online (because of disability, for example), contact HMRC by phone for more guidance, on 0800 024 1222.

The government asks that, outside of this, applicants don’t contact HMRC to enquire about the grants because it’s busy supporting many other queries.

To apply online, you’ll need the following information to hand:

- Your Self Assessment Unique Taxpayer Reference (UTR). This will be on your Self Assessment documentation.

- Your National Insurance number.

- The Government Gateway user ID and password that you ordinarily use to login the Self Assessment online services. If you haven’t already got one, you will be invited to create one by utilising the government’s SEISS eligibility service. Bear in mind this will require you to prove your identity, which could require details from personal documents such as your passport or driving licence.

The bank sort code and account number where you wish the money to be paid. You might want to inquire with the bank that they accept BACS payments for that particular account, although most UK banks do.

When will I receive the grants?

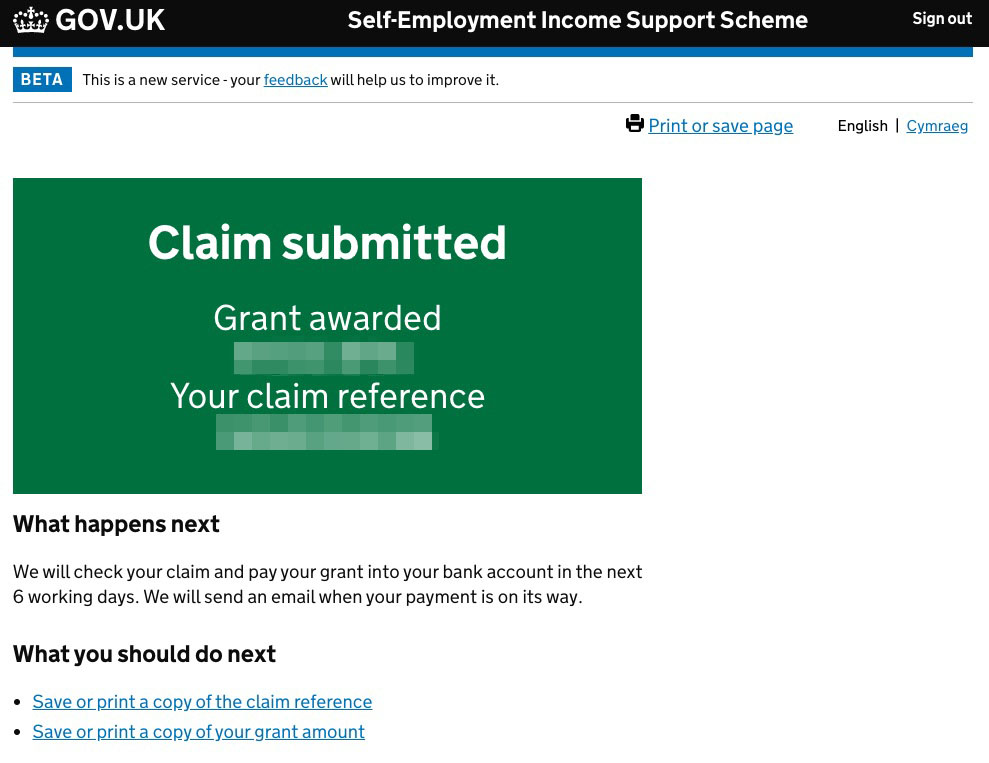

If previous grant payments are any measure, the money should be received within six working days after you apply online.

The entirety of each grant is paid in a single lump sum, rather than in monthly instalments.

Details from HMRC on the SEISS grant that you’ll receive

What admin or paperwork requirements does the SEISS have?

You need to keep the documentation relating to SEISS with your other Self Assessment records, as per existing requirements to keep records for five years.

You should keep the records relating to the amount claimed, the claim reference number, and any evidence that your business has been adversely affected by the coronavirus outbreak (cancelled orders, for example).

Remember that the reason for keeping the records in this way is to explain to HMRC what your situation was should it investigate for any reason. So, the more evidence you save, the easier this will be.

Other coronavirus measures for self-employed workers

There are other coronavirus emergency measures that the government has put in place that might help you, as a self-employed individual or member of a partnership.

Deferred income tax payments

Self Assessment payments that were due on 31 July 2020 and also in January 2021 can be paid back across the 2021 calendar year.

It’s accessed by making a request using the HMRC Time to Pay Scheme.

If you’re self-employed and struggling to meet outstanding tax obligations due to financial difficulties, you can contact HMRC to see if you’re eligible for support.

Contact HMRC on the special coronavirus helpline: 0800 0159 559.

Grants for businesses

If you run a brick-and-mortar business, which is to say your business is eligible to pay rates (even if it doesn’t), you might find your local authority is offering grants or rates relief.

You should contact it directly to speak to them.

Coronavirus loan schemes

The Recovery Loan Scheme is open to businesses that have been impacted due to coronavirus. It replaces the previous Bounce Back Loan and Coronavirus Business Interruption Loan Scheme.

The new scheme will remain open for applications until 31 December 2021.

Although the loans are offered by commercial lenders, the government underwrites the loans, making them more widely available to those who might not normally be able to apply.

Conclusion on self-employment support

If you’re self-employed or in a business partnership, it’s worth making use of every government scheme that you’re eligible for.

Additionally, it’s vital to keep up with announcements and developments because the government is announcing additional measures on a regular basis.

Editor’s note: This article was first published in March 2020 and has been updated for relevance.

Managing uncertainty

Get some top tips to help you create business continuity plans that will keep your company moving during uncertain times.

i did’nt claim the 3rd grant. what will happen? can i still claim it?

We need to know what portal to apply to for the job retention scheme.

will pubs be getting further non refundable grants (wales)

Hi

I’ve received the grant from the self employment income support scheme and was wondering if l then went into full time employment would l have to pay back the money I have already been given ?

Hi Helen,

This is something HMRC will need to look into for you. You can contact them directly to discuss this on 0800 328 5644.

Regards,

Paul

Sage UKI

Is there any update on the Self Employed Scheme being extended past June 20

Hi Jayne,

Thanks for your patience. This article has been updated with details covering the extension of the Self-Employment Income Support Scheme.

Thanks, Stacey

I’d like to find out if I may claim income support. I’m a writer and though I don’t make any profits from that type of work I’d like to ask if there may be any possible government support. I’m now subscribed to a translation web site, which may be a possibility for occasional earnings in the future but nothing is guaranteed. I claim universal credit. I’m a single tenant who rents a council property (one bed flat) and I keep a small dog as a pet.

Hi Lisa. Unfortunately the SEISS grant is based on previous earnings via self-assessment, so if you don’t have that then you can’t claim. I suggest you consult the Citizens’ Advice Bureau (CAB) to see if they can take a look at your finances, and work out the best support for you.

Hi Lisa,

This is something HMRC will need to look into for you. You can contact them directly to discuss this on 0800 169 0350.

Regards,

Paul

Sage UKI

I work and my husband is self employed. Can we apply for universal credit as well as the self employment scheme?

Hi Shirley. The SEISS grant should be considered just like any income from your husband’s trade. So whether you can get universal credit will depend on your personal circumstances and how much the government give your husband for the SEISS grant.

The government say you’ll need to “report the grant… as self-employed income any Universal Credit claims,” and that, “the grant should be treated as income received on the day it’s paid for any Universal Credit claims”.

Hi Shirley,

This is something HMRC will need to look into for you. You can contact them directly to discuss this on 0800 328 5644.

Regards,

Paul

Sage UKI

I have been allocated a figure for my grant payment from previous three years net profits to be paid in six days is this amount for one month or a total for three months

Hi Mike,

This is something HMRC will need to look into for you. You can contact them directly to discuss this on 0800 328 5644.

Regards,

Sean

Sage UKI