Money Matters

How to protect your cash flow in challenging times

Protecting your cash flow is really important for your business. Discover what you can try in order to get paid on time.

For many businesses, managing cash flow in 2020 has been a juggling act.

Between changing coronavirus (COVID-19) lockdown rules, late payments and constantly shifting government support schemes, business owners have found themselves pivoting on a monthly if not weekly basis in order to keep cash moving through their business.

Satago is an app that integrates with Sage to make cash flow management easier.

In this article, we’ll go over what Satago does and how you can use it to protect your cash flow during the pandemic and beyond.

Managing your debtors

Business owners who offer sale on credit will know the frustration of chasing customers for payment weeks and sometimes months after invoices are due.

Chasing payments is time-consuming and many businesses don’t have the bandwidth to put best-practice credit control procedures in place.

Satago solves this problem by chasing invoices for you.

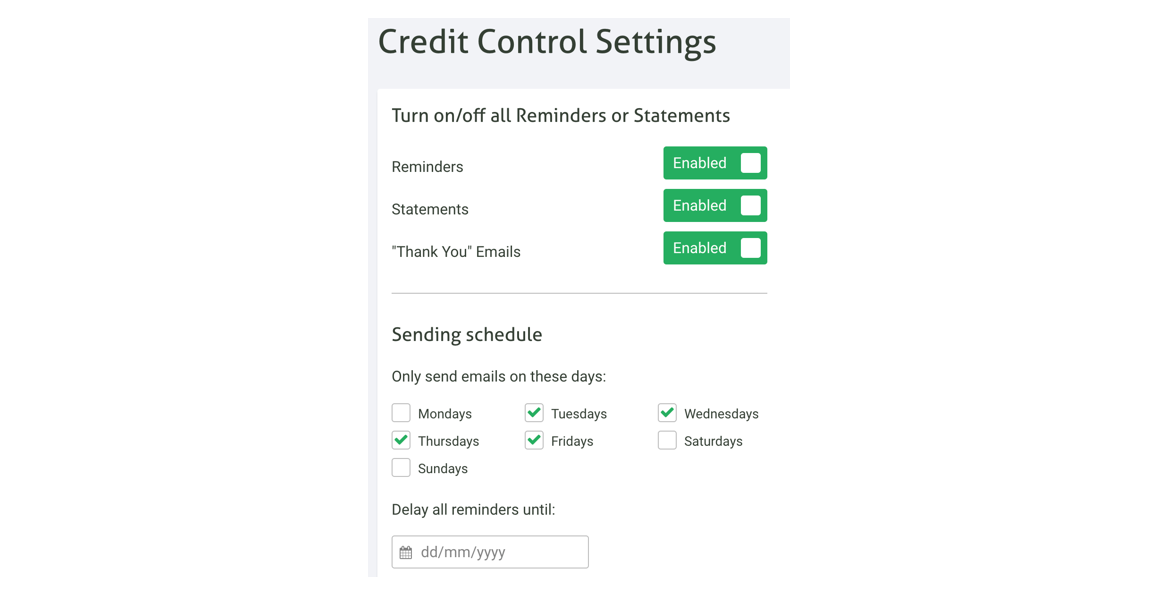

- The app integrates with your email provider and sends automated payment reminders, monthly statements and thank you emails to your customers from your own email address.

- Data such as the customer name, invoice amount and due date is pulled into the emails from your Sage accounting software.

- If you wish to add late fees to overdue invoices, Satago will calculate them for you in line with statutory limits and add them to your payment reminders.

- You can adjust the templates and sending schedule on a customer level.

Automating your payment reminders will save you time

With 62% of businesses suffering late or frozen payments as a result of the pandemic, effective credit control has become more important than ever.

Faster payments mean better cash flow for your business.

Understanding your customers

Unfortunately, the reason some businesses pay late is because they themselves are suffering from cash flow problems.

In worst case scenarios, a company might refuse payment altogether, leading to legal disputes that can be damaging to your business.

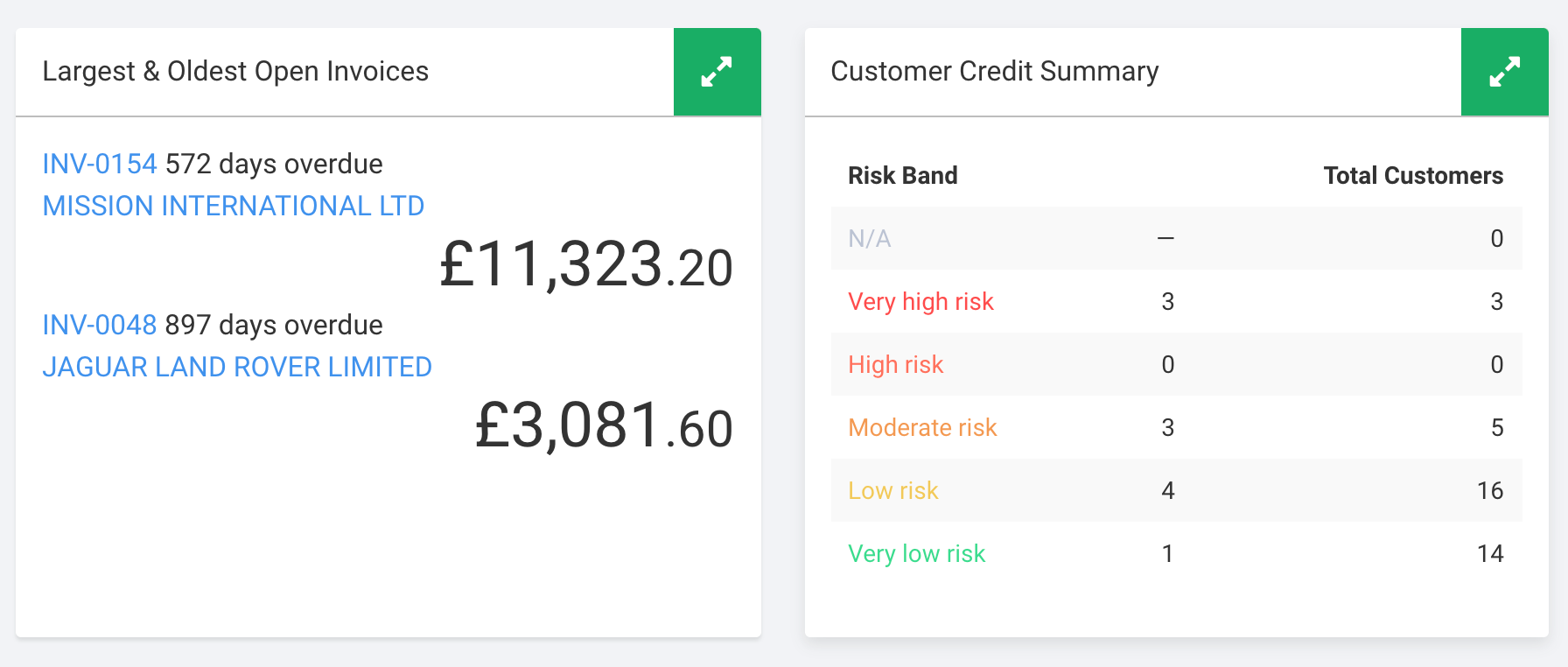

Satago helps you avoid these scenarios by providing you with information on your new and existing customers, including their credit score, risk band and previous payment history.

You can use this insight to protect your business from the risk of late and non-payment.

- Use Satago to find out the average time a prospective customer takes to pay their invoices.

- View a customer’s complete credit report, including their financials and group structure, at the touch of a button.

- View all your aged debtors in one place and receive notifications if an invoice becomes overdue or if a customer breaches their credit limit.

Stay on top of your invoices with ease

Financing your business

Even with the best credit control procedures in place, your business may experience cash gaps from time to time, particularly if you have customers on longer payment terms.

In this instance, it can be helpful to free up cash from your unpaid invoices early using invoice finance.

Invoice finance is a fast and reliable way to keep your cash flow moving while you wait for your clients to pay.

Satago offers selective invoice finance, meaning you can advance cash from your unpaid invoices on a case-by-case basis with no long-term contract.

The app will show you which of your invoices are eligible for finance based on Satago’s criteria, the amount you can advance and the cost, all within the app.

Simply click to apply and once approved you will receive the advance in your bank account in a matter of hours.

Satago’s risk insight and credit control tools, along with optional bad debt protection, give you added security.

This makes invoice finance a reliable way to cover cash gaps and access the funds you need to scale your business.

Satago in practice

Shaign Hancock is the owner of MG Cannon, a car accident repair company. A Sage user, he was introduced to Satago in March 2020.

“During the first lockdown with all our workshop staff on furlough and the doors closed, we took the opportunity to catch up with our ‘aged debt’ and look at our systems,” says Hancock.

“Satago was introduced to me over the telephone by Sage when I quizzed them to find out how we could manage our credit control in a sharper way. We have never looked back.”

Satago has helped Hancock get a better overview of his company’s debtors and improve his relationship with clients.

“We can send automatic statements and reminders in a friendly way,” he says. “We can now identify issues at an early stage, rather than letting them run on.”

Despite the pressures of coronavirus, Hancock feels positive about the future.

“Not a lot of good has come out of this pandemic, but it has enabled us to have a good look at our business and link up with new partners to make us stronger and more efficient. Satago has played a big part in this.”

Final thoughts

Credit control, risk analysis and access to finance are essential for maintaining a healthy cash flow. Satago offers all three features in one app, making cash management more accessible to businesses, no matter their size.

As we face one of the biggest economic challenges of a generation, tools such as Satago will make it easier for businesses to weather the storm.

“SMEs are the backbone of the economy,” says Sinead McHale, Satago’s CEO. “Their survival is vital for the communities where they operate and the families that rely on them. Their social and economic importance cannot be overstated.”

The Art of Being Paid

Chasing invoice payments doesn’t have to be painful. Use this kit to answer a few questions about your customers so you understand their payment drivers, then read our advice on how to flex your style for each, calling techniques and much more.

Ask the author a question or share your advice