5 new year’s resolutions every nonprofit CFO should make in 2023

With the books closed on 2022, it is time to plan how to optimize your organization’s mission impact in 2023. As always, you will need to make the most of every dollar of funding, support your staff’s productivity, and develop new and better ways to deliver services. To put it another way, nonprofit CFOs need […]

With the books closed on 2022, it is time to plan how to optimize your organization’s mission impact in 2023. As always, you will need to make the most of every dollar of funding, support your staff’s productivity, and develop new and better ways to deliver services. To put it another way, nonprofit CFOs need to declare their 2023 New Year’s Resolutions and then dig in to make change happen.

Download The Road to Nonprofit Finance Transformation Success e-book

Nonprofit CFOs can leverage the power of nonprofit finance transformation to help their organizations make the best possible decisions about how to use resources and tactics to achieve greater mission impact. Real-time data visibility, automation, and connectivity combine to give decision makers more information, better reporting, and new insights. In this article, we will examine five finance transformation resolutions nonprofit CFOs can achieve in 2023 with a cloud financial management solution like Sage Intacct.

Resolution #1: Automate workflows for savings and efficiency

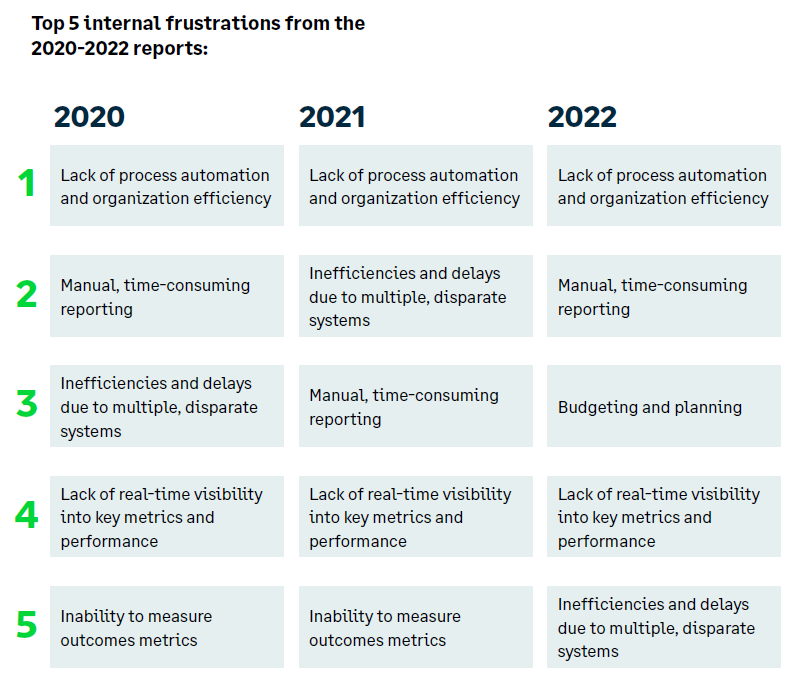

Every CFO knows about the primary benefits of automation: increased efficiency, better accuracy, better utilization of staff, and time savings. But finding the right ways to automate and the best systems to implement is tricky. Many, if not most, nonprofit organizations still are not receiving the full benefits of automation. According to the 2022 Nonprofit Technology Trends Report, the top internal frustration for nonprofit financial leaders is the lack of process automation and organization efficiency. This has been the top concern for nonprofit CFOs for three years running.

2022 Nonprofit Technology Trends Report

2022 Nonprofit Technology Trends Report

When nonprofits adopt a modern cloud financial management system, like Sage Intacct, they can achieve significant financial transformation. Workflows automated in the cloud allow data to flow into the accounting system more easily from other systems. Staff located anywhere in the world can input and update data and others can see that information in real time. Workflows requiring approvals, such as large expenditures, have rules that automate routing to approvers.

When University Clinical Health chose to move its financial management to the cloud with Sage Intacct, the nonprofit healthcare organization was able to save more than $500,000 per year in staff and IT costs. The finance team freed eight days each month by automating workflows for invoicing, accounts receivable, and reporting.

“With the time we’re saving from mundane processes, we’re able to focus on really understanding what drives our business and monitoring key trends, such as the rising expense of medical supplies and medications. Now we’re truly a partner to the business—helping make strategic decisions about how to get our costs down as well as where to invest in new ventures as we enter growth mode.”

~ Timothy Carlew, Controller, University Clinical Health

Resolution #2: Transform financial reporting

Nonprofit finance teams spend too much time on manual data entry and monthly reporting. One in five organizations spends a full 40+ hour week completing reporting each month. That is at least 12 weeks every year spent on reporting—25% of staff time is stuck on manual data entry and wrangling spreadsheets.

Nonprofit finance transformation offers a better way. Cloud-based nonprofit accounting eliminates spreadsheets and speeds up monthly close. It also improves the accuracy and timeliness of financial reporting, so decision-makers always benefit from fresh data and insights. Sage Intacct transforms reporting with a dimensional chart of accounts and best-in-class reporting that lets you slice and dice data to get to the most important details for your organization.

Using Sage Intacct automated reporting, Sandals Church was able to accelerate the monthly close by 450% and save hundreds of hours each year. What used to take up to 45 days to complete now takes just 10 days, leaving staff and leaders with more time for important strategic work.

Reporting becomes even more complex when you have to wait for information from multiple entities or locations and then consolidate financial results. And international nonprofit organizations add currency complexities on top. Sage Intacct provides multi-entity and multi-currency global consolidation capability that handles decentralized payables, inter-entity transactions, and multiple currencies with ease.

“Because we have Sage Intacct to manage the day-to-day, we don’t need to worry much about financial accuracy and instead focus more on strategic goals and more effectively managing finances.”

~ Amber Cheong, Director of Finance, Sandals Church

Resolution #3: Gain real-time visibility into performance

Cloud-based financial management offers nonprofit CFOs the ability to gain real-time visibility into every aspect of financial performance and outcomes. Armed with greater visibility and keen insights, CFOs, and other nonprofit leaders can stop reacting to problems and instead anticipate them and navigate to better outcomes. Real-time visibility empowers CFOs to lean into change and become much more proactive.

Dashboards provide leaders with an especially easy way to stay on top of organizational data. Trends and insights become much easier to spot with dashboards. Sage Intacct includes role-based dashboards that can be customized easily, so you can choose the most important financial KPIs and outcome metrics to keep an eye on. For even more predictive analysis, Sage Intacct Interactive Visual Explorer helps you speed time-to-insights with more than 200+ prebuilt data visualizations to interactively explore your data.

This role-based CFO dashboard features multiple at-a-glance data visualizations chosen specifically for the role and the unique needs of the organization.

After implementing Sage Intacct, Seattle Indian Health Board has grown revenue by 80% by leveraging the real-time visibility of dashboards to help track more than 140 grants. The organization created dashboards for 45 different users to enable better decision-making.

“Sage Intacct dashboards have allowed me to just have more time to look at other areas of the organization where I can start building new reporting. I can start being what my role is, which is a CFO who looks through the front windshield, as opposed to a CFO who is always looking through the rear-view mirror.”

~ Ben Luety, CFO, Seattle Indian Health Board

Resolution #4: Improve connectivity to eliminate data silos

A lack of data connectivity between key systems reduces visibility and hampers growth. In today’s environment, no one has time to sit and rekey information from one system to another. Too much manual data entry leads to accuracy issues and slows down reporting.

Fortunately, cloud financial management applications such as Sage Intacct facilitate integration to other systems. Sage Intacct connects easily to other best-in-class application partners found on the Sage Intacct Marketplace. In this way, organizations can automate the flow of data between their accounting system and other systems, including AP and AR automation, budgeting and planning, expense reporting, CRM, and more.

To support its rapid growth, DonorsChoose replaced its siloed Blackbaud accounting system with Sage Intacct cloud financial management. Improving connectivity with fundraising, procurement, customer support, file storage, and expense reporting enabled the finance team to improve efficiency by 20% and save 50+ hours per month on revenue recognition, reporting, and accounts payable.

“One of the biggest struggles we had before moving to Sage Intacct would be revenue recognition for our corporate grants. The two systems didn’t talk to each other. One of the benefits of Sage Intacct has been our Salesforce integration. Our partnership team uses Salesforce to post grants received, and finance goes in to review the documentation. With the click of a button, we’re able to post the revenue to Sage Intacct. When the payment comes in, we post the payment to Sage Intacct and that flows directly to Salesforce. So, both teams are on the same page and have full visibility into the grant lifecycle.”

~ Taylor Chang, Vice President, DonorsChoose

Resolution #5: Spark more collaboration for greater mission impact

Nonprofit finance transformation can help the finance staff work more efficiently together. It also enables the finance function to interact more effectively with other parts of the organization. When everyone who needs information can easily access it, accountability grows. Features such as audit trails, notes, and messaging within Sage Intacct help enhance transparency and foster better communication.

Sage Intacct Collaborate helps speed up accounting processes and keeps everyone on the same page when questions arise around journal entries, accounts, projects, invoices, purchase requisitions, and more. Messaging is centralized within the accounting system rather than lost in email threads. Collaborate provides an instant one-click record of the complete context of the issue and its resolution.

Before United Way of Central Indiana adopted Sage Intacct for accounting, the finance team struggled to produce timely reporting for the board and funders. Now that everyone in the organization uses Sage Intacct, finance collaborates more effectively with both internal and external stakeholders, ultimately producing greater community impact.

“Our finance team is no longer just task-oriented; we’re much more forward-thinking, which is wonderful. As a result, collaboration across the organization has increased tenfold. Everyone from our community impact department to fundraising, to the volunteer center, is coming to us to ask questions and plan for the future of United Way of Central Indiana.”

~ Lynn Auffart, Senior Director of Finance, United Way of Central Indiana

Conclusion

Make 2023 a year of improved performance and outcomes leading to greater mission impact. Unlock the power of real-time data and automation to reveal better insights and inform your decision-making. Nonprofit CFOs can leverage cloud-based finance transformation to accelerate and enhance automation, reporting, connectivity, visibility and collaboration. To learn more, please download The Roadmap to Nonprofit Finance Transformation Success e-book.

About the author

Nancy Master

Nancy Master is a senior nonprofit industry marketing manager at Sage Intacct, dedicated to providing solutions for nonprofits.

From accounting software for churches, community development, education, healthcare, governments to foundations and philanthropic organizations, Sage Intacct offers comprehensive tools to support mission success.

With over 15 years of experience in software marketing and nearly 20 years of experience working with a human services nonprofit organization, Nancy is passionate about helping nonprofits achieve their goals.