6 takeaways from the G2 crowd grid for revenue management

When it comes to revenue recognition and ASC606, finance executives at SaaS and subscription companies face many challenges. There are complexities regarding revenue and billing models, how well aligned sales and finance are on deal terms, and the changing rules from ASC 605 to ASC 606. Thankfully, financial management systems have come a long way […]

When it comes to revenue recognition and ASC606, finance executives at SaaS and subscription companies face many challenges. There are complexities regarding revenue and billing models, how well aligned sales and finance are on deal terms, and the changing rules from ASC 605 to ASC 606.

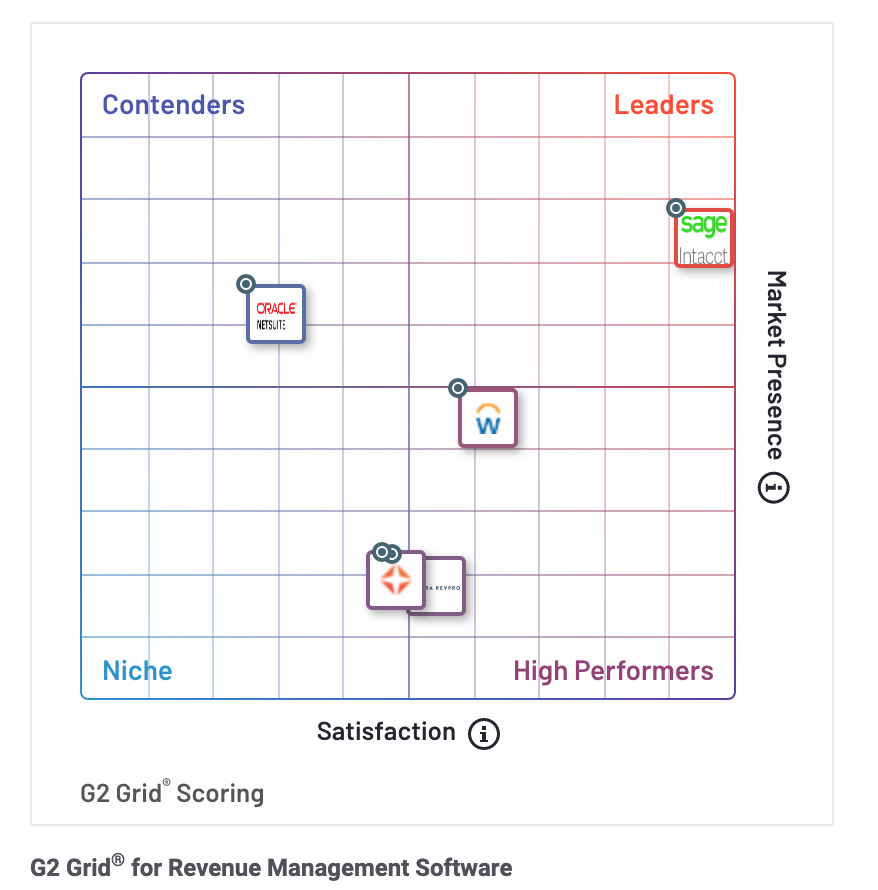

Thankfully, financial management systems have come a long way in helping to mitigate these issues. Of course, not all solutions deliver the same benefits, making it hard to determine the right solution for your business. G2 Crowd offers a Grid to compare the top revenue management software vendors based on customer reviews posted to their website. They asked your finance executive peers to submit feedback based on how well solutions track pricing details for individual or groups of products and services or how well they monitor revenue per customer, contract, or project, as well as other criteria.

Sage Intacct was rated the Highest Performer on the Grid. Here are six key aspects to revenue management that we’ve drawn from comments in the reviews and below we’ve shared what Sage Intacct customers have to say about how they solve these issues with our software.

Automating off spreadsheets and QuickBooks

“As a SaaS company, Sage Intacct’s revenue recognition module is a game changer for me. We went straight from spreadsheets to this robust system to manage our rev rec on our contracts.” Read the full review.

“The automated revenue recognition and the reporting function are among my favorite features. We have 18,000 transactions a year in AR that drive revenue schedules and around 12,000 customers. Sage Intacct allows us to automate a lot of the process as well as improve our audit.” Read the full review.

Integrating with the contract in Salesforce

“Integration with the Salesforce is pretty slick. Our Sales Reps can see all Sales Orders, Invoices and Payments in SFDC. Intacct is extremely flexible and provides relatively easy access to information.” Read the full review.

“The biggest benefit is the direct link to SFDC. We are fully integrated with using SFDC in our sales org as well as our customer success team. The ability for the information to flow from Intacct to SFDC seamlessly is a true business game changer and has allowed C level execs to utilize the information from both systems in a much more concise and thorough manner.” Read the full review.

Handling ASC 606

“They are constantly improving their modules and capabilities. Working at a SaaS company, revenue has been a hot topic with 606, and Intacct is becoming very robust in being able to handle the new standard.” Read the full review.

Speeding the close to have the time to get strategic

“Speed of Analysis. I am better able to collate and synchronize customer data faster with the help of Sage Intacct. Revenue management has never been easier.” Read the full review.

Increase cash flow

“Reduced the staff needed to process invoices for recurring revenue. Improved cash collections with more accurate invoicing.” Read the full review.

Faster deferred revenue reporting

“The revenue recognition feature is game changing. Previously we were using excel spreadsheets due to utilizing Quickbooks as our accounting software. Since upgrading to Intacct we have decreased the time spent reconciling deferred revenue from 1.5 days down to 2 hours.” Read the full review.

“We have gained efficiencies in processing revenue transactions, as well as better visibility to our revenue waterfall which enables us to have more accurate revenue forecasts.” Read the full review.

The positive feedback we heard from our customers is all the more telling when NetSuite received feedback like this.

“Sometimes NetSuite’s automated processes can make visibility a little more complicated than I would like. For example, advanced revenue recognition results in a loss of easy visibility of the sales hitting revenue.” Read the full review.

Top 3 points of impact

Sage Intacct receives consistent feedback that there are three places we best help:

- One complete picture of the Subscription Contract between Salesforce CPQ and the financials—It all starts with a native integration with Salesforce.com and Salesforce CPQ. This allows you to seamlessly pass account and order information, with real-time synching on the account master and product catalog.

- See and calculate commission expense on the contract—Having the billing line items integrated and automated allows you to do automated revenue recognition. By tracking the performance obligations and variable considerations over the term of the contract, in both ASC 605 and ASC 606, you can understand the impact to revenue recognition and expense amortization, particularly with commissions.

- Forecasting of revenue schedules—When all of this upstream work is automated, it allows you to post to the general ledger with an unlimited number of dimensions, incorporating both GAAP and SaaS data from statistical accounts. This in turn supplies the data for real-time SaaS dashboards, so that finance give the profit and loss leaders the information they need on the 5 Cs and other SaaS metrics, such as unit economics, CLTV, net and gross churn, and CAC.

Thank you to our customers for trusting us to work together on this critical component to scaling a fast-growing subscription business. If you wish to learn more about how Sage Intacct can help you, please check out our Software Industry Resources.