Money Matters

Bessemer’s cloud industry update for CFOs with Byron Deeter

As part of Sage Intacct’s virtual Modern SaaS Finance Summit, Bessemer Venture Partners’ Byron Deeter discusses their State of the Cloud 2020 report and perspectives for CFOs guiding their companies into the rebound phase of the pandemic crisis. Access the full video and the other summit sessions here.

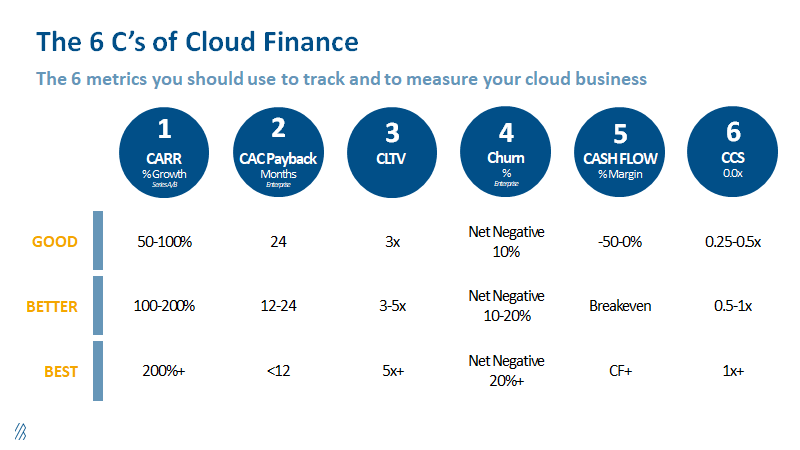

David Appel, Head of Software and SaaS at Sage Intacct, spoke with Byron Deeter about the cloud report, as well as the updated version of the Six C’s of Cloud Finance, including a new metric of the Cash Conversion Score. The “Six C’s” are the six metrics Bessemer recommends to track and measure your cloud or subscription business. Here are the top takeaways from their conversation.

-

There is still upside in the market

While there’s a lot of disruption happening right now, the trends in the cloud industry show a much broader growth trajectory over time. Bessemer’s research shows there’s great momentum you can build on as you transition from reaction to action in the coming months. Simply put, the early entrants into the cloud market conducted the experiments for us. They created sustainable, predictable business models that can be used today.

Byron Deeter explained the cloud industry’s exponential growth from the past two decades and its continued momentum in public cloud markets. In 2019, the SaaS crossed the $100 billion annual run rate. At the same time, infrastructure-as-a-service had a $100 billion annual revenue run rate as well. Byron pointed out one of the most impactful milestones: “Across all of those statistics, there’s really one number that I think of as the single most impressive, and that’s 94-percent. Ninety-four percent is the number of enterprises that use a cloud service today. It is truly a cloud-first world we live in . . . and the world is becoming software and tech-enabled. Cloud is eating software, and the cloud is taking over technology and the world itself.”

When you look at it from this perspective and see the size of the total addressable market (TAM) coupled with customers’ needs to manage costs differently right now, deploying software in a cloud model is essential for long-term success. Further detail can be found in Bessemer Venture Partners State of the Cloud 2020.

-

Follow these Six SaaS Metrics to Guide Your Business into the Recovery Phase

Bessemer Venture Partners developed a set of measurements they use to guide investment. While different weights apply to different businesses, they found that these metrics provide accurate “headlights for the business.” Investors can see whether a company’s business model is viable and whether it’s becoming efficient with scale.

The 6 C’s of Cloud Finance

#1 CARR: The Committed Annual Recurring Revenue (CARR) metric accurately evaluates the health of a SaaS business and shows its monthly and annual revenue cadence. CARR gives credit for signed deals and nets out known or projected churn. It’s the most insightful monthly view of the business.

#2 CAC Payback: How long does it take you to pay back your sales and marketing costs on a gross-margin basis? The CAC Payback metric refers to the all-in cost of sales, marketing, and customer success to land the business. Keep in mind that there are great businesses with very different characteristics and payback ranges, whether you have a payments-based business in the 20% gross margin range or a SaaS business that runs in the 80% or more range.

If you haven’t calculated your CAC Payback yet, it’s something to focus on now. You want to know the health of your business against the most current lagging and leading indicators.

#3 CLTV/CAC: Byron described this third metric as “that interplay between customer acquisition cost with the customer lifetime value equation.” CLTV is taking the same margin adjustment for CAC to determine the value of the customer throughout the customer relationship, mapping out the expected lifetime and factoring in churn dynamics.

In today’s volatility, CFOs are trying to find ways to unlock capital and create more enterprise value in the long term. By calculating the CLTV/CAC equation, you can see if your customers produce a long-term profit multiple that exceeds the cost to acquire them. Byron shared, “It needs to be a meaningful multiple because your cost of capital as a private company or a young public company tends to be very high. And so, the good, better, best framework basically says you need to have at least a three times payback on each customer you eventually land to have a viable business. And of course, the numbers can be lower and work, [but] not a lot lower. . . because you’re loaning these customers the money and the product early and you’re getting it back over time.”

#4 CHURN: Churn is the single biggest driver of lifetime free cash flow for a business. You need to measure both gross and net churn for a complete picture. Gross churn is logo loss, the percentage of your customers lost by cohort over time. Net churn is dollar-based, the amount of churn net any upsells or expansions. Ideally, customer expansion and upsells exceed churn. Some good businesses can thrive with gross churn as high as 30% and net churn as high as twenty percent.

Churn is a metric everyone is watching closely right now. If you’re running at a solid gross margin, your customers are generating cash for you. This leads right into the fifth and sixth metrics to help you evaluate your finance strategy in the coming months.

#5 CASH FLOW: Make sure to look at cash flow for the efficiency element of the business and ways to gain leverage with your cashflow. The closer you can get towards the cash flow break-even point or even cash flow positive, you can control your own destiny and reinvest in areas where your competitors can’t.

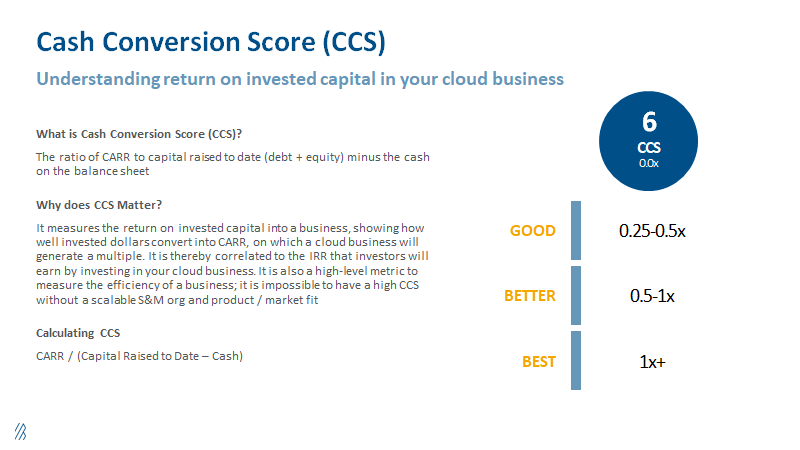

#6 CASH CONVERSION: Your cash conversion score represents the investment return on the capital you’ve put into the business. It’s the ratio of the CARR to total capital raised to date. You’re netting out the unused cash on the balance sheet. The cash conversion score essentially shows how well-invested the dollars have been that convert into CARR. It is another compelling indicator, calculated quarterly or annually, that helps you understand how efficient you are with the capital invested into the business.

According to Byron, “It’s a great long-term indicator of overall cash efficiency and business mindset for the teams and companies.”

These six C’s of cloud finance allow you to create a comprehensive scorecard for your business. The market-validated good, better, best ratios give you benchmarks to strive for as CFOs. While we all have to batten down the hatches right now, it’s also possible to create new opportunities.

Ask the author a question or share your advice