Technology & Innovation

Biotech financing outlook 2023 Q&A: funding highs and lows

The biotech market has seen an unprecedented influx of funding in since Covid-19, and 2022 was still one of the strongest years on record in terms of Biotech funding. So where does that leave things for 2023? Richard Murphey from Bay Bridge Bio answers our Q & A to summarize the funding environment over the last couple of years and give us a look at what’s ahead for 2023.

After a brutal 18 months, biotech stocks finally seemed to recover in February, only to be dragged down again by the overall market developments of still-rising inflation, and a Federal Reserve determined to continue raising interest rates.

The biotech market has seen an unprecedented influx of funding in since Covid-19, and 2022 was still one of the strongest years on record in terms of Biotech funding.

So where does that leave things for 2023?

Richard Murphey from Bay Bridge Bio answers our Q & A to summarize the funding environment over the last couple of years and give us a look at what’s ahead for 2023.

Q. Can you give us a recap of the biotech market for 2022, with a roundup of the year?

A.

2022 was a bit of a rough year for biotech, but the good news is that in terms of the overall funding, it was still one of the strongest years on record. Going through the tally of M&A, venture funding, the IPO market, and public market, it’ll set the stage for what to expect in 2023.

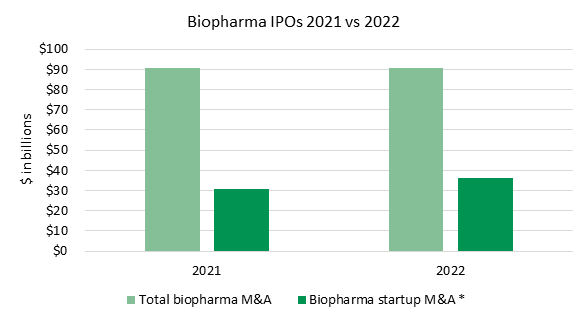

* includes startups that recently went public; excludes Horizon Therapeutics

Total biopharma M&A from Evaluate Vantage: https://www.evaluate.com/vantage/articles/insights/ma/biopharmas-bolt-bonanza-set-continue

Other data from Bay Bridge Bio

Starting with M&A, it was a relative bright spot in-line with 2021. There were about $90 billions of M&As for biopharma companies in both years. And in terms of M&A of venture-backed companies, including those recently public, about $36 billion in 2022 compared to about $31 billion in 2021. Making the M&A market fairly stable and a comparative bright spot in relation to public markets.

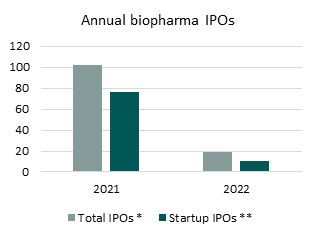

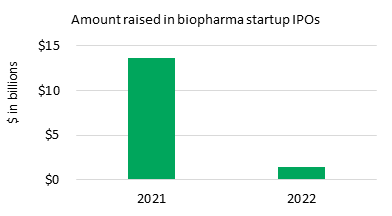

Moving to the public markets, the IPO market had a rough year. In 2021, there were more than 100 biopharma IPOs on Western exchanges, including 76 venture-backed startup IPOs, and biopharma companies. Those IPOs of startups raised $13.6 billion total in 2022.

* includes IPOs on western exchanges

** includes startups that raised over $50M in their IPOs on NYSE and NASDAQ

Includes startups that raised over $50M in their IPOs on NYSE and NASDAQ

2022 in contrast, had just 19 IPOs total, and only 10 of those were startup IPOs that raised over $50 million. The overall tally of money raised by startups and IPOs went from $13.6 billion in 2021 to $1.4 billion in 2022.

The IPO market is taking a step back with its worst year since 2012. The loss of $12 billion in IPO proceeds for biopharma startups was the biggest on record in the history of the industry.

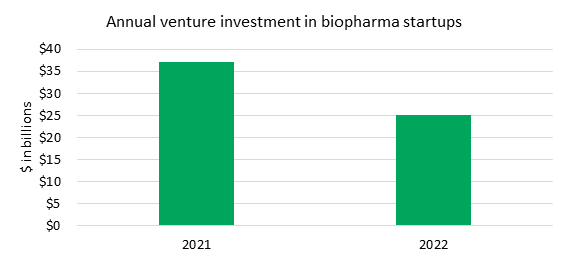

That drop in IPO activity has filtered through to the private markets. We saw $25 billion in VC investment in biopharma startups in 2022, which is down about 33% from 2021. A drop, but not quite as dramatic as in the IPO market.

That still puts 2022 in one of the top 3 years ever for biopharma of venture investment. Now, things could change in 2023, depending on the public markets. And the public markets did not have a great year in 2022 on an absolute basis. But on a relative basis to the rest of the market, it was better than in 2021.

In 2021, the XBI was down 20%, whereas the S&P500 was up 27%—biopharma was very much underperforming. And then in 2022, the XBI was down 26%, but the S&P was down 19%. On a relative basis, biopharma held up a little bit better in 2022 on the public markets.

Q. What does that mean for this year? Where do you see things going?

A.

The outlook for biopharma startups in funding in 2023 will depend a lot on the broader economy. It will depend on the pace of inflation and on whether or not there’s a recession, and how severe that recession is. The Fed’s response to that potential recession will also come into play.

But if things continue as people expect them to with maybe a mild recession and potentially a Fed pivot in the back half of this year, it seems like 2023 will be the year when the public market issues start to trickle into the earlier-stage venture markets.

Over the last decade, the IPO market has been the major source of liquidity and returns for venture investors. These investors were able to flip a lot of companies that were private onto the public market through IPOs at attractive valuations.

That was a great business for those venture investors. But as the IPO market has disappeared, that poses a challenge for that model. There’s also a little bit of a lag between when the public market gets hit and when private markets hit. The IPO markets started to slow down in Q3 of 2021, and it came to a halt essentially by the second quarter of 2022.

But crossover investing stayed strong until early 2022, then it sharply declined, and is now at a low level. The early stage in the Series A market has been strong throughout 2022. It’s still at levels that are comparable to what we saw in 2021, but 2023 might be the year when we see that lag finally trickling through to private markets. They too might start to feel a little bit more of the pain that public investors have seen over the last year or so.

Of course, if public markets recover, then things will be different, but if the status quo holds, then the early-stage venture market will see a bit of an adjustment in our assessment.

Q. Will that make it harder to start a new biotech company?

A.

We think so. But the good news is that there is still a lot of money available. Early-stage venture funds have raised massive capital in 2020 and 2021, and they still have a lot of that left. The big question though is how they will deploy it.

Will they hold that money and use it to support their existing portfolio, or will they continue to invest in in new companies? It helps to take a step back and think through like where these venture investors are, and how their business has been affected by the crash in the IPO market.

The mid- to late-stage venture market was the most immediately impacted by the IPO slowdown. These funds would invest in the last private round of a company, help them go public, and then they would make a profit in in doing so.

But that model doesn’t really work if there’s no IPO market. And that’s part of the reason why you’ve seen the crossover in the Series B market deteriorate over the last year. The early-stage market is a little more insulated, but it isn’t immune to these challenges.

To put numbers on things, over the last few years these seed or Series A investors were able to invest in the companies and then take them public, 3 years later, at a billion-dollar valuation.

And this wasn’t a rare thing. The best funds could take 30% or 50% of their series A investments public within 3-5 years and make money in that short timeframe with more appreciation once the companies were public.

That was a great business for them, and they oriented their whole investing practice around this IPO machine. But when this IPO machine is stopped, they need to figure out what they’re going to do with all these early-stage investments they made at high valuations.

What’s going to happen to a lot of these companies, is that it will be harder to raise venture funding in the later stages because the crossover investors have stepped back. The IPO market has shut down. So that’s not an option for many of these companies.

M&A is potentially an option, but as we’ve seen over the last year, a lot of the big pharma companies are able to buy fairly advanced, maybe even clinical-stage companies on the public markets at prices that are comparable to, or maybe even lower than, these early-stage private companies.

Many funds may look at these facts and say, “Hey, we’re going to hold our capital a little bit, reserve it to protect our existing portfolio companies, and maybe not do as many deals.”

On the other hand, some funds may decide to build companies because others are stepping back. This is a great opportunity. Some pharma companies in particular will view this as a compelling time to do more partnerships with early-stage companies with interesting science and platforms. And that could lead to some very fruitful relationships this year.

Q. Taking the example of M&A, what do investors care about? Is it all in the research or are there also considerations like does this company have a good handle on their costs? How much do they spend with their vendors? To what degree do business fundamentals play a role in the evaluation of a company?

A.

When investors have to circle the wagon and discuss which companies they’re going to be able to commit further capital to, a lot of that does come down to who’s going to make the best use of funding.

When you have to make tough decisions about prioritization of programs and devoting value to your company, it’s hard to do that if you don’t know where your money’s going today. Especially if you don’t know how much you’re spending on assets or programs versus how much you’re spending on the platform.

If a company is going to make a strategic change, or a financial change, or double-down on something that they really believe in, it helps. It’s essential to know how much you’re already investing in different lines of your business before you can make a reasonable change to that, that funding strategy, or capital-allocation strategy.

And if you’re on the board of a company and you’re trying to think about how you want to deploy your next amount of capital, you need to know how much it’s going to cost to fund 1 program versus another.

Having really good data on that is essential to making these kind of strategic financing decisions.

Final summary

To sum up, 2023 looks to be a tricky year for biotech financing as the recession threat looms over the market. To ensure your business is ready for these changes, get software that guarantees access to your business data at a glance, from anywhere.

Choosing the right cloud-based accounting and ERP software can help prepare your biotech business for financing, by giving you a unified front- and back-office overview to see every expenditure clearly, and assess the state of your finances at any time. It can also provide you with the data-reporting tools you need to impress investors, even during a recession.

Ask the author a question or share your advice