Boosting Cash Flow with Accounts Receivable Management

Improve your cash flow with effective accounts receivable management strategies. Learn how to optimize invoice processing and collections on our blog.

Cash flow and working capital are the lifeblood of any business. Optimizing both by managing accounts receivable is crucial to your role as a SaaS CFO.

Accounts receivable management allows you to take control of your cash flow by streamlining payments and invoicing and improving customer relations. However, managing the AR process can be challenging for many SaaS companies.

At the top of the list of difficulties are poor customer outreach, the use of manual processes, and a lack of real-time data evaluation on unpaid invoices.

In this blog post, we’ll dive into the world of accounts receivable management–from its definition to its challenges and how to streamline the entire process. We’ll also discuss the benefits of receivable automation and how it can optimize your AR and invoice management processes. So, let’s get started on boosting your cash flow with effective accounts receivable management.

What is accounts receivable management?

For SaaS companies, AR management is the process of tracking and collecting payments from any customer who has an unpaid invoice. It also encompasses sending payment reminders, spelling out payment terms and credit terms, and optimizing metrics like your receivable turnover ratio. Before going further, it’s important to note that a late invoice differs from unrecognized revenue.

Unrecognized revenue is money you’ve been paid by a customer but can’t yet put in your asset column because you haven’t fulfilled the service obligations attached to that payment.

By contrast, the AR process deals with bounced or delinquent payments for services you’ve already rendered. Now let’s look at some of the most important steps you can take to improve your accounts receivable process.

Top goals for the SaaS accounts receivable process

Managing accounts receivable is central to your responsibilities as a CFO and dramatically impacts your organization’s cash flow. However, tracking and collecting payments from every customer who owes you money can be challenging.

To help you navigate those challenges, we’ll look at some of the most important goals to aim for when optimizing your receivables and invoice collection.

Streamline your accounts receivable management to improve cash flow

Effective receivables management is crucial for maintaining healthy cash flow. To streamline the process, some good rules of thumb include:

- Implementing automated payment tracking systems.

- Offering incentives for early customer payments.

- Eliminating manual workflows and centralizing KPIs.

By proactively following these best practices, you can optimize your accounts receivable process, track KPIs, and reduce manual tasks. But in addition to streamlining your accounts receivable process, you should also aim to simplify it.

Simplify the accounts receivable process

Consider these two tactics to simplify your SaaS organization’s accounts receivable process.

Centralize your financial and AR data in the cloud.

Cloud-native accounting software helps finance leaders manage their receivables and account for every late invoice by giving teams instant data access. This is crucial since receivables are time-sensitive.

Automate invoicing and KPI tracking to save time.

Having your AR metrics and invoice information in one spot allows you or your team to instantly scan for problems. If any are found, they can be immediately addressed. If not, your team can get back to more profitable work than tracking down each unpaid invoice.

What else helps teams optimize the accounts receivable workflow and quickly collect invoice payments?

Ensure frequent communication for accounts receivable

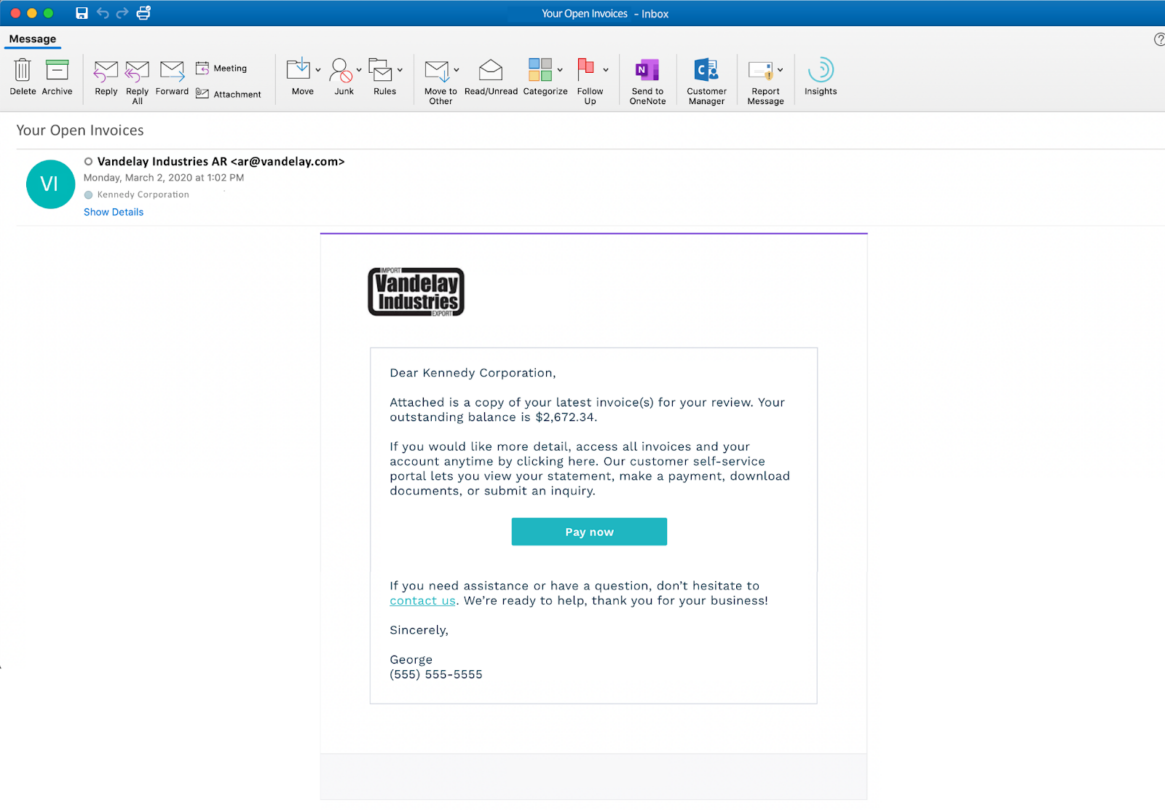

Communication is a critical component of effective receivables and invoice management. Automated SaaS accounting software immediately sends a dunning email to a customer after a failed payment or billing problem.

Essentially, this is a quick and friendly notification that their card bounced, asking them to update their payment info, and letting them know you’ll try the charge again in a few days. It’s also an excellent opportunity to remind them to update their contact information.

You can set up additional follow-ups if you’d like an extra layer of customer communication. After all, sometimes people miss the email the first time around. Dunning messages are essential to keeping your AR performance where you need it to be.

Invest in customer service and payment flexibility

Investing in excellent customer service is also essential, so remember to have your customer success team reach out occasionally even when things are going well. Additionally, clear payment and billing terms cut back on customer confusion and disputes.

These days, many SaaS organizations are also going the extra mile for their customers by increasing payment method flexibility. Beyond allowing for more traditional approaches like credit cards, paper checks and ACH payments, some companies are going the digital route and accepting online payments through:

- Apple Pay

- Amazon Payments

- PayPal

- Express Checkout

Accounts receivable automation helps accounting departments streamline billing and receivable workflows while slashing bad debt. But how do you and your AR team begin that process?

Getting started with accounts receivable automation software

Especially in SaaS companies, what takes place in the finance department significantly impacts the entire organization. This means that implementing automation should be discussed with your colleagues in other departments and approached in a way that lays out the benefits for everyone at the company.

Let’s walk through a few ways finance and accounting leaders can ensure a smooth transition from manual to automated accounts receivable management.

Explain the end goal: boosting cash flow

Optimizing accounts receivable requires streamlining your receivables management and invoice processes effectively. As a CFO, you have insight and understanding into this that other stakeholders and department heads at your company might lack.

They don’t have the same experience or perspective, so you need to explain why financial automation is so critical. In a nutshell, automating this portion of your business turns the accounts receivable management process from a reactive one into a proactive one.

Putting automated systems in place to keep your cash flow healthy means there’s more available capital for everyone’s various campaigns and projects. If it happens, a budget shortfall caused by poorly managed receivables will impact everyone at the company. Think of accounts receivable automation as a digital net your company uses to capture cash before it slips away.

Decide on payment and billing channels to aggregate

Automating your accounts receivable process saves considerable time by aggregating your various payment channels. The manual accounts receivable process involves employees backtracking through a virtual maze of different channels to verify and track down late payments.

Automation completely reverses this by centralizing all billing and invoice data in the cloud. SaaS companies who use a diverse range of payment methods–a web portal, email payment links, and various EDI payments–can easily track and manage remittances in one spot.

Keep your accounts receivable metrics in mind

Metrics and KPIs are an indispensable part of staying on top of SaaS financial performance. Automating the receivable and invoice processes allows you to easily check your real-time status against where you’d ideally like to be.

In particular, a few of the most critical metrics to track include your:

- Average days delinquent: Your ADD tells you the average time between a payment going delinquent and when it eventually gets paid. Automating this metric helps you easily spot high-risk customers.

- Days sales outstanding: One of the most vital billing metrics for any SaaS company is its DSO. This KPI shows how many days it takes on average to collect and process payments. In terms of fundraising and investor meetings, a low DSO is always the goal.

- Collection effectiveness index: Your CEI examines the effectiveness of your collection process for a given period and turns it into a percentage. Automation allows companies to quickly check their CEI whenever they need to.

As a SaaS CFO, improving your company’s AR performance falls to you. Let’s go through two quick strategies you can use to get on the fast track to improved receivables and invoice payment results.

Optimizing accounts receivable management: 2 strategies (and 2 roadblocks to cash flow)

When you’re overhauling your accounts receivable process, it can be useful to think in terms of goals to pursue and obstacles to avoid. Below are two of the most critical goals to be mindful of while automating your receivable workflow, followed by two hurdles you’ll need to navigate.

Prioritize AR and invoice payment forecasts

Forecasting your accounts receivable results and other financial data should be a central part of your overall process. Automating your forecasts will help you gain valuable clarity into your present performance relative to your desired near-term results.

You’ll also be able to answer important AR questions easily. Are certain billing methods or payment options resulting in outstanding invoices more frequently than others? Do certain customer segments tend to be higher risk?

Offer invoice discounts for early payment

You know what’s infinitely preferable to going through the collections process? Getting the money you’re owed early. For SaaS companies, a popular way of ensuring timely cash flow is by offering invoice discounts for early payments.

When companies spell out their policies in their payment and collections documentation, this is usually expressed as X/Y net 30. X is the percentage discount the customer will receive, and Y is the maximum number of days from the invoice date they can pay if they want that discount. Automating your receivable management can help with N30 setup, tracking, and documentation backup.

2 roadblocks to streamlining invoice payments and your accounts receivable process

There are no two ways about it: late invoice payments from customers hurt your bottom line. In sufficient quantities, they can even impact budgeting accuracy and liquidity rates. Disorganized invoice processes create confusion for customers and finance departments alike, which leads to late invoice payments and bad debt write-offs.

Two factors contribute to this vicious accounts receivable management cycle above all others. What are they?

Manual account receivable processes

Traditional accounts receivable management and invoice processes can have detrimental consequences. Human error from manual invoice mistakes can cause frequent delays in payment processing. Add problems with tracking payment status caused by manual data entry to that list, and it becomes easy to see how quickly things can get out of control.

By utilizing ERP automation for accounts receivable management, you accomplish three critical things. First, you unlock better results around invoice tracking because you can instantly find any invoice for a given period. Second, you minimize involuntary churn. And third, eliminating manual processes allows your team to devote their time to more profitable tasks.

Data silos keeping teams in the dark

When companies leave their accounting to manual methods, data silos are practically inevitable. When data gets siloed, separate teams assume responsibility for maintaining and updating specific data sets. Each team stores its own “silo” of data.

This is problematic because quickly finding and evaluating invoice and payment data is crucial for accounts receivable management. Swiftly solving invoice problems and keeping involuntary churn to a minimum requires constant access to refreshed and updated data. And you simply can’t expect that when you rely on manual accounting processes.

Receivable automation software dismantles data silos and connects teams and departments. Role-based dashboards facilitate quick screening of core receivables metrics such as your DSO and AR turnover ratio. As a general rule, the more integrated your organization’s payment and invoice data is, the more effective your accounts receivable management will be.

Streamline accounts receivable and boost cash flow today

Accounts receivable management is critical in helping SaaS organizations avoid late invoice payments. But it can be challenging due to poor communication, manual invoice processes, and difficulties with real-time data access.

Overcoming these hurdles is vital because the accounts receivable process directly or indirectly impacts every department in your organization. Beyond that, it’s crucial for minimizing bad debt, maintaining healthy investor relations, and enhancing fundraising results.

The Modern SaaS Finance Academy can help you and your finance team streamline every aspect of the AR process and much more. From nailing automation deployment to handling every stage of your company’s revenue cycle, the Academy features an entire roster of online courses taught by SaaS finance and accounting professionals. Patterned off the success of the Hubspot Academy, but built for SaaS CFOs, Controllers, FP&A, RevOps, and CEOs, it is free and offers the option of CPE credits.

Click here to join today.

Modern SaaS Finance Academy

The Modern SaaS Finance Academy is a free online training hub designed for CFOs, Controllers, FP&A, Revenue managers, Revenue Operations, and other members of the finance community in fast growth SaaS companies.