Free guides and webcasts

Ministry Intelligence: Next Generation Church Financial Reporting

Learn how Sage Intacct Ministry Intelligence can help improve your church management system and help you stay on top of your finances.

When thinking about the financial health of your church and ministries, it is important to start with faith. Faith is the foundation of congregational giving, and it guides your church’s spending decisions and investment activities. Faith also changes how you measure, consider, and utilize the finances your church is responsible for stewarding. Church finance leaders must find new ways to continuously monitor financial health and get the right insights from church financial reporting to support strategic decision-making and long-term sustainability.

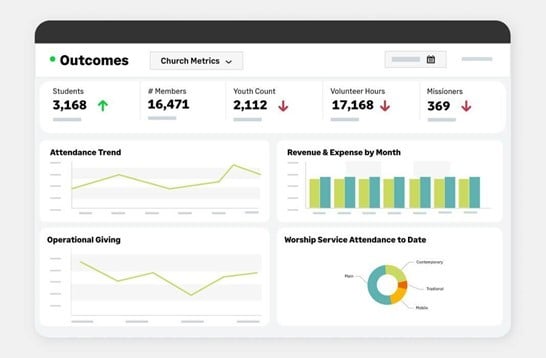

Introducing Sage Intacct Ministry Intelligence

It can be challenging to keep track of donations and expenses and follow church financial reporting best practices if you lack modern financial management tools. To ensure good stewardship, enhance ministry outcomes, and strengthen financial sustainability, leaders of faith-based organizations can leverage a new financial management tool. Sage Intacct Ministry Intelligence brings together the detailed giving data from any church management system with revenue and expense data in the Sage Intacct financial management system, giving church finance leaders the real-time insight needed to elevate their ministry.

If you are a congregation finance leader, you know how frustrating it can be to manage multiple systems and data sets. To ensure your organization is making the biggest impact possible, continue reading to learn six best practices for church and ministry financial management.

1. Understand your funding model and revenue sources

Do you have a clear understanding of your ministry’s financial situation? Best practices for church financial reporting require that the finance team accurately tracks revenue—that includes how much the average member donates as well as other sources of revenue your church may have.

Your church needs to know answers to questions like:

- How are people giving and who are your biggest givers?

- How much money is available in unrestricted funds?

- How much of your funding is reliable? For example, can you count on recurring funds?

- Does your church have a track record of bringing in a certain amount or type of funds?

Sage Intacct Ministry Intelligence takes the guesswork out of tracking key performance indicators by providing pre-packaged metrics based on industry best practices. Through dashboards and reports, track giving trends like total giving, first-time or continued giving, giver retention rate, sustaining versus ad-hoc giving, top givers, and more. Your leadership team can visualize congregational giving and fundraising trends with at-a-glance dashboards such as the giving analysis dashboard shown below. Utilize these metrics to realize insights for key financial decision-making like expanding programs, building new locations, or improving oversight on multiple locations.

Example: Sage Ministry Intelligence giving analysis dashboard.

“We now trust our reports and the accuracy of our data, which has helped us to operate more efficiently and effectively. With accurate financial data now at our fingertips, we can make financial decisions more quickly, which is a game-changer for our organization.”

~ Kelly Benton, Director of Accounting, Church of the Highlands

2. Take a sustainable approach to budgeting

To take your ministry to the next level and overcome any financial challenges at your church, it’s important to create and maintain a realistic budget. A budget provides the financial data to predict expenses, support decisions on resource allocations, and plan fundraising activities. A budget should be a living document that guides the congregation’s activities but also allows you to make necessary adjustments.

As you prepare your budget, it’s important to get the right insights from church financial reporting to support strategic decision-making. You’ll need to know the trends in your congregation’s attendance and giving as well as expense categories like personnel, facilities, and administrative costs.

Cloud accounting software helps you collaborate in real-time across the organization to make better, faster, more informed decisions with modern planning, budgeting, forecasting, what-if scenario modeling, and reporting. Sage Intacct Ministry Intelligence reveals critical insights needed for financial decision-making, like expanding programs or opening new campuses.

3. Ensure your operations are generating a positive cash flow

Cash management is important to get a complete picture of your cash flow and working capital. Where does the cash come from in your congregation? Where is it going? To demonstrate good stewardship of your funds, it’s important to ensure your church gets consolidated views of cash trends as well as revenue and expenses by location. Know your liquidity (cash on hand divided by monthly expenses), working capital ratio, and reserve ratio.

Keeping tabs on these metrics will help you maintain positive cash flow and know how long your church could sustain services if funding suddenly declines. Gaining visibility into these metrics also helps you know how much you need to set aside in cash reserves for unexpected expenses.

Designed specifically for congregation financial reporting, Sage Intacct Ministry Intelligence helps you stay on top of your cash flow. All your data and metrics are available anytime, anywhere from any browser, so you can continuously monitor the financial health of your operations and increase collaboration across the leadership team.

4. Protect integrity and enhance transparency with detailed expense tracking

Church finance teams can sometimes struggle to predict when expense categories will threaten sustainability. What happens when one component of your budget becomes so disproportionate that it jeopardizes the future of your faith ministry? Your team needs real-time insights into details and the ability to report on administrative overhead, program- and fundraising-related spending, debt management, and facilities costs.

Financial decisions rely on good and timely information. And financial stewardship relies on transparency. It’s essential for church financial reporting to show the real costs of your ministries so you can ask the right questions at the right time and enrich conversations with congregants about fundraising needs, program expansion, and facilities.

Transforming finance with modern cloud church accounting software means gaining the ability to see key performance indicators in real time. That’s crucial for proactive management and strategic decision-making.

5. Practice good stewardship with reporting on financial and operational metrics

Reporting is essential to the successful management of performance. To do this, church finance teams need both financial and operational metrics. Financial metrics include income statements and balance sheets and must be accurate since they are used to inform regulators, church leaders, and members.

The second type of metric that’s important to track for performance is your operational metrics. These could be accounting or financial in nature, or they could be measuring operational or impact aspects of your performance and may be statistical in nature. You may be measuring program outcomes by campus for a specific grant or costs per member served. The ability to capture and combine key financial, operational, and statistical metrics and data is essential to good decision-making and ultimately good stewardship.

“Our old system couldn’t create a report that had all the data we needed, so we had to build several reports manually. Now with Sage Intacct, we can generate a single report with a one-page recap of our financials, a second page for campus-level consolidations, and then additional pages for individual campus or ministry reports. Having this kind of flexible and robust reporting helps us be more productive while making sure all our data ties together correctly.”

~ Glenn Wood, Pastor of Church Administration, Seacoast Church

6. Improve connectivity by eliminating data silos

If your congregation is experiencing a lack of data connectivity between your operational and financial systems, then your visibility is clouded. No one has time to sit and rekey information from one system to another. Too much manual data entry in church financial reporting leads to accuracy issues, slows down reporting, and hampers growth.

Sage Intacct Ministry Intelligence allows for seamless reconciliations and audits. Automatic flow of operational and financial data eliminates error-prone manual process and improves accuracy. The flexible integration between Sage Intacct and your church management system provides a reliable view of data in one single location.

Final Thoughts

Communities rely on churches, congregations, and faith-based ministries. To elevate your ministry and ensure sustainable growth, your technology strategy should include a cloud church accounting software solution that seamlessly integrates revenue and expense data with detailed giving data from your church management system. Gaining real-time visibility into income, expense, and outcomes data will empower you to continuously monitor congregation health and improve strategic decision-making.

Download the Benefits of Cloud Accounting Software for Congregations and Faith Ministries e-book below to learn the top five technology frustrations church finance leaders are facing today and five reasons a cloud-based church accounting solution will help.

Ask the author a question or share your advice