Free guides and webcasts

The softer side: 10 tips for selecting a cloud financials solution provider you can trust

Strong financial planning has always been essential for business survival and growth. Businesses need strong visibility into operating costs, revenues, and profitability to measure progress and make better decisions to succeed long-term.

Strong financial solutions make it possible for you to execute on these goals. The right solution can help your business to automate financials, streamline planning and budgeting operations, and provide the visibility you need to steer the business through changing market conditions.

The good news for small and medium businesses (SMBs) is that cloud-based financials solutions can give you these capabilities without the hassles of deploying and managing hardware, software, and infrastructure in house.

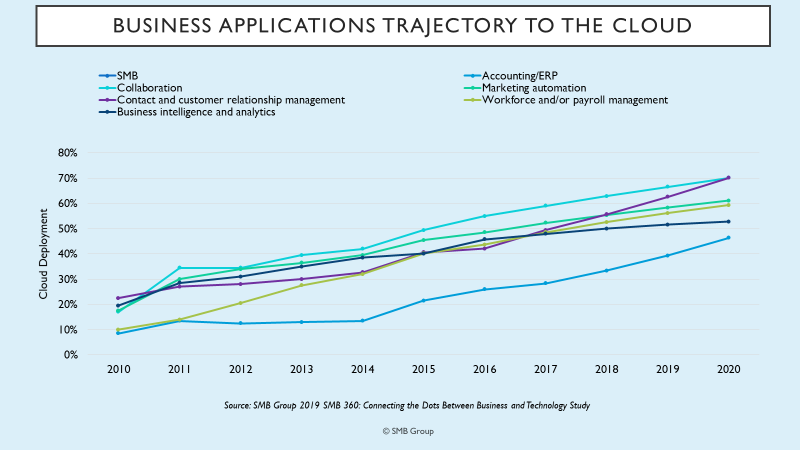

These and other benefits enabled by the cloud model, such as continual access to real-time, consistent information, frequent updates, and continuous innovation, are increasingly making cloud deployment the obvious choice for many SMBs. While ERP cloud adoption has trailed in other areas, it’s poised to catch up quickly as businesses get more comfortable with the cloud model.

Of course, you need to make sure that the solution you select will support the must-haves for your business today and provide you with access to new capabilities you’ll need in the future. But, once you’ve created a short-list of solutions based on functionality, it’s just as important to look at the softer side of what different providers can bring to the table.

The softer side of cloud-based financials solutions: selecting a provider you can trust

These qualities are usually more difficult to quantify than things such as features and price. But they can often make or break your satisfaction with the solution you ultimately select.

At the end of the day, you want to work with a provider you can trust—one that will work with you to ensure that you’re getting the results you need from the solution and will help your company navigate through change and uncertainty.

10 tips for selecting a cloud financials solution provider you can trust

While no litmus test guarantees a provider meets this standard, several factors provide good indicators that the provider will “have your back” after they clinch the sale. As you assess different alternatives, tune into how well different providers match up on the areas below. Does the provider:

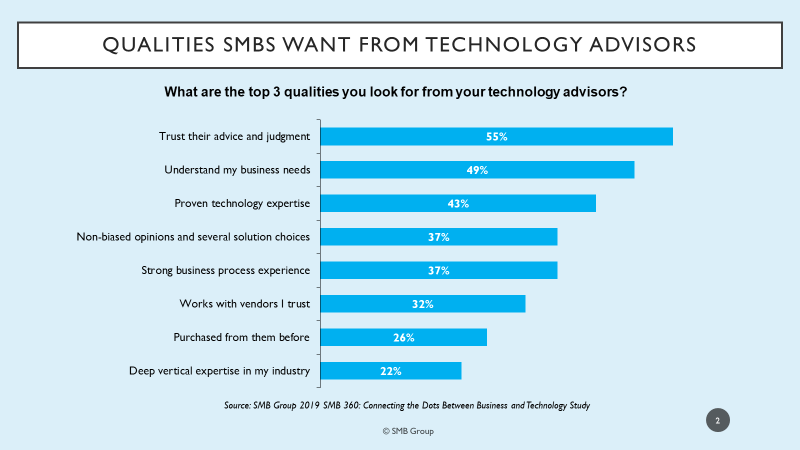

- Listen to understand your business requirements? Every business has unique issues and priorities. Providers should take the time to thoroughly understand yours.

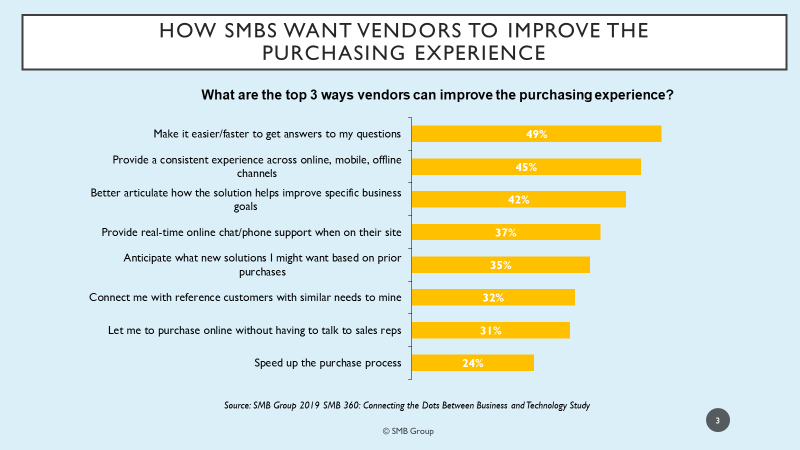

- Answer all of your questions? This sounds like it should be a given, right? But the number one way that SMBs say vendors can improve the purchase experience is by doing a better job of answering questions. In the case of financials, your entire business will rely on the solution—making it doubly important for providers to provide easy to understand answers to all of your questions about the solution, business practices, pricing, security, and any other questions you may have so you aren’t left with any nagging doubts.

- Connect you to reference customers? Ask the provider to connect you with companies similar to your own so you can get first-hand insights about their experiences with the solution. Of course, you’ll want to check customer ratings on online sites as well.

- Have a positive company culture? Check sites such as Glassdoor to see what employees are saying about the company. A company that cares about and values employees is also more likely to have the same perspective about its customers. And happy employees are much more likely to go the distance for their customers.

- Speak the language of finance fluently? Having a good percentage of CPAs, CFOs, and finance professionals on staff ensures that the provider not only “speaks finance” but also understands how to build solutions tailored to the requirements of financial users.

- Have endorsements from financials standards bodies, such as the AICPA (in the U.S.), or the International Federation of Accountants Company (outside of US)? These bodies set high standards for accounting software that help ensure peace of mind.

- Offer an easy to understand, comprehensive contract? Contracts should include service-level guarantees that spell out minimum acceptable performance levels uptime, response time, and other performance variables. They should also include data security and business continuity provisions, such certifications that validate security, backup and business continuity procedures, and data ownership and return processes. The provider should also be able to make adjustments as needed to conform to your company’s security requirements and clarify their liability for any damages due to security breaches.

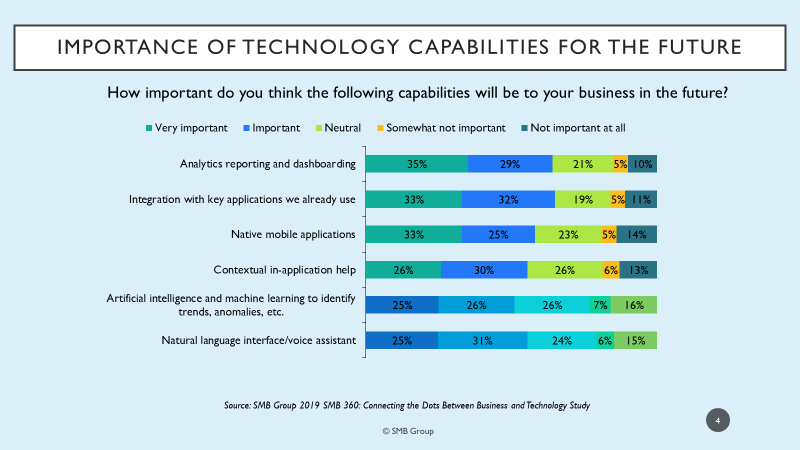

- Provide a clear roadmap to the future? The only constant is change, and innovation will provide your company with a competitive edge. Examine how the provider is modernizing reporting and analytics; improving mobile and integration capabilities; and using artificial intelligence and machine learning, natural language processing, and other technologies to help you get more value from the solution.

- Have an active, robust partner ecosystem? No one vendor can do it all for any business. But engaged partners can fill in the gaps with complementary services and products, such as planning, implementation, integration, customization, onsite support, and more.

- Make it easy for you to figure out where the buck stops? Avoid finger-pointing issues down the road by choosing a provider that clearly defines roles and responsibilities.

Perspective:

Many cloud-based financial management vendors are vying for your business. Assessing functionality and price may be where you start your evaluation process, but it shouldn’t end there.

Providers that take a customer-centric approach in the buying process are more likely to also have your back once they’ve won your business. Look for those that are easy to do business with—and take the time to provide you with the knowledge and connections you need to make the best choice and get the best outcomes.

Ask the author a question or share your advice