Technology & Innovation

Tips and tricks for streamlining nonprofit form 990 reporting

This article will explore some of the ways your nonprofit organization can save time and improve the quality of your Form 990 reporting by automating financial reporting. We’ll also share tips for presenting your organization as transparent, accountable stewards of funds.

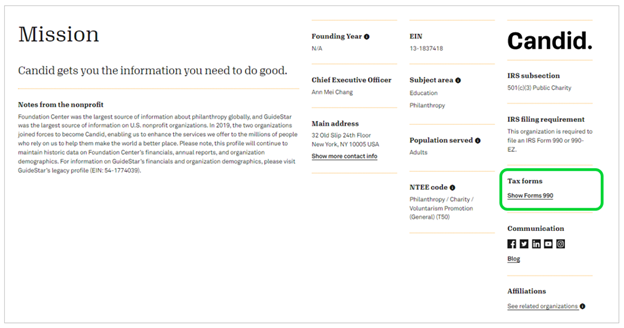

Tax-exempt nonprofit organizations do not have to pay federal taxes on most income, but they do have to file Form 990, an informational return, with the IRS. According to the IRS, Form 990 is the “primary tool for gathering information about tax-exempt organizations, educating organizations about tax law requirements, and promoting compliance.” To nonprofit organizations, this form is also a vehicle to share information about mission accomplishments and increase the transparency of their financial management.

Free e-book: Achieving real-time visibility with nonprofit financial reporting and dashboards

This article will explore some of the ways your nonprofit organization can save time and improve the quality of your Form 990 reporting by automating financial reporting. We’ll also share tips for presenting your organization as transparent, accountable stewards of funds.

Form 990 filing requirements

A tax-exempt organization must file Form 990 annually unless an exception applies. Depending on the amount of gross receipts and total assets, an organization will file either Form 990, Form 990-EZ, or Form 990-PF. Organizations with less than $50,000 in gross receipts can file the annual notice Form 990-N. It is important to not only file Form 990 annually, but also to ensure timely filing to retain tax-exempt status and avoid costly penalties. Most states also rely on this form to perform oversight and satisfy state income tax filing requirements.

If your organization is tax-exempt, why is Form 990 important?

Form 990 is open for public inspection and therefore provides an opportunity for your organization to tell your story, show how contributions are used, and how it manages expenses. An accurate return is not only important from a financial management and compliance perspective, but it can also serve as a valuable resource to attract additional funding. Form 990 reporting helps donors and funders evaluate organizations and find those they think will be the best stewards of their contributions.

Tag unrelated business income to gain real-time visibility and ease the compliance burden

Form 990 reporting can be time-consuming and complicated for nonprofit finance teams—especially when you aren’t quite sure how to track or account for a particular revenue stream. Unrelated business income (UBI) is one of those pain points for tax-exempt nonprofit organizations. According to the National Council of Nonprofits, any income-producing activities considered unrelated to your charitable or exempt purposes may result in taxable income.

When a tax-exempt nonprofit earns income through an activity that is commercial in nature (for example, sale of goods, space rental, or advertising), and that activity is “regularly carried on,” then this revenue may be taxable income. That’s why it’s important for your finance team to know where income is coming from so it can be tracked, recorded, and reported accurately. Tax-exempt nonprofits that generate UBI will also have to file IRS Form 990-T, the “Exempt Organization Business Income Tax Return.”

Fortunately, the right financial management technology and automated reporting can make Form 990 reporting of UBI much easier. New funding streams be tagged in a dimensional database and accounts making them easier to track and evaluate for UBI. For example, you can set up your financial report to have a separate dimension for exempt revenue, excluded revenue, and UBI—that way, you can easily search for those account groups and report on them in Form 990. Additionally, you can include attachments to document the rationale and process for reporting new lines of revenue that may be unrelated taxable business income. Your finance team can also add a review of UBI to your monthly close checklist so you always know where you stand.

Simplify functional expenses reporting

A Statement of Functional Expenses is one of the standard reports in a nonprofit audit, and it is used to show how expenses are incurred for each functional area of your nonprofit organization. To complete your Form 990, you’ll need to report expenses based on how they fall within these three categories:

- Program services including any costs associated with executing mission-driven programs and services.

- Administration and management such as operational expenses like rent, salaries, utilities, and supplies.

- Fundraising including the costs directly tied to raising money.

These expenses don’t always fall squarely into a sole category and therefore must be allocated using a clear and consistent process. For example, nonprofit personnel often spread their time over multiple functions. Using modern nonprofit accounting software, you can simplify tracking of a full-time employee that spends three days per week working in the office for administrative purposes and two days per week in the field providing a mission-driven service. In this case, 40% of their salary would be allocated to program expenses and 60% would be allocated to administrative expenses.

Using software like dynamic allocations, it’s very easy to see your original postings, because all allocations are completed on a user-defined book. But if you’re doing your allocations at the end of the period, or even less frequently, you don’t have the visibility you need to ensure compliance. In particular, you need to be able to get back to the unallocated numbers when we’re talking about allocations for federal and state awards.

With functional expenses reporting, there are a few additional considerations that may or may not apply to your organization:

- Negotiated indirect cost rate allowance: If you have a lot of federal grants, you might be used to filing a different functional expenses report for financial reporting with your funding agencies than you had with Form 990. But now, financial reporting rules have been aligned and all nonprofit organizations are required to create a Statement of Functional Expenses report. It is considered an auditable statement.

- Contra revenue accounts: Automating the tracking and reporting of contra revenue also ensures accurate and compliant reporting. A very common mistake occurs when nonprofits include only expense accounts but leave out contra revenue. For example, with special events, it is common for income and expenses to be netted together in the top part of the income statement. It’s not shown in one of your functions. So, you will need to add expenses back in and show their function—in the case of special events, the function would be fundraising.

Final thoughts

Form 990 reporting can be time-consuming and complicated for nonprofit finance teams. But it’s important to get it right. When sharing your mission accomplishments, be sure to tell your story using language from fundraising solicitations, your annual report, or work with your marketing team. Be sure to provide reach and outcome metrics so donors easily understand your impact.

With changing regulations and donors demanding more financial transparency than ever, nonprofit finance leaders must find ways to ensure their Form 990 reporting is thorough, accurate, and compliant.

Free e-book: Achieving real-time visibility with nonprofit financial reporting and dashboards

Ask the author a question or share your advice