Tips for Navigating the Complexity of Nonprofit Financial Management

We examine some of the biggest demands nonprofits are facing today and provide the top five tips for navigating the complexity of nonprofit financial management.

Nonprofit finance teams are operating in a complex and stressful environment. To demonstrate good financial stewardship, there is increasing pressure to provide full transparency for compliance. The board, executives, donors, and government funders are demanding better visibility into financial and outcome metrics. That’s why organizations of all sizes—even small nonprofits—must find new ways to keep up with the complexity of accounting for funds, grants, projects, programs, and more while maintaining funding relationships and attracting new donors.

Complimentary e-book: The Nonprofit Finance Team Survival Guide

This article will examine some of the biggest demands nonprofits are facing today and provide the top five tips for navigating the complexity of nonprofit financial management.

Get your nonprofit finance team beyond surviving to thriving

Most nonprofits today are facing growing complexity while operating with limited staff and resources. “There’s a level of complexity here that is equivalent to what a major for-profit organization deals with,” noted Controller Nikki Jones of the Healthcare Businesswomen’s Association. When you combine these mounting pressures with a lean finance team to manage it all, the art of nonprofit financial management often results in a tremendous amount of stress and strain.

Nonprofit finance professionals face a constant barrage of reporting requests, compliance requirements, complex funding streams, and multifaceted organizational structures. As your organization grows in size and mission, you need flexible cloud-based accounting solutions that you can administer without IT. Fortunately, finance teams that leverage a best-in-class, cloud nonprofit financial management solution on their financial trek achieve greater visibility and ultimately ensure mission success with these five tips.

Tip #1: Check your foundation

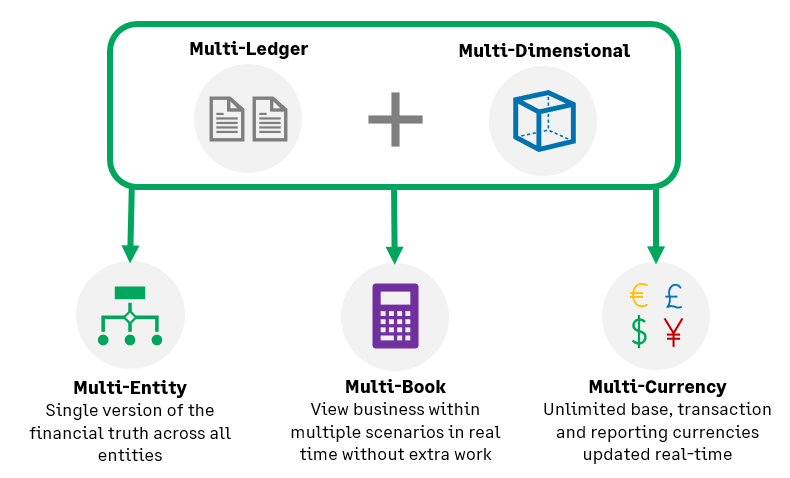

Nonprofit finance professionals know that it’s essential to track every dollar and view each one by multiple dimensions including fund, grant, program, project, and location. Then, it’s essential to deliver the right metrics and reports to meet the varying needs of your board of directors, executives, donors, grantors, and staff. All those dollars and all those dimensions can equal an ever-multiplying chart of accounts with thousands of unique account numbers if you’re using the wrong system.

The chart of accounts is the foundation for your nonprofit’s accounting system—and it’s the place where stewardship begins. Without a solid foundation, your trek will be full of obstacles and pitfalls. That’s why many nonprofit financial teams use a logic-based chart of accounts as a basis for their financial structure. A modern cloud-based solution allows you to use a table-driven chart of accounts which minimizes complexity, reduces the number of account codes, and puts the financial team on solid footing.

Tip #2: Study your path with enhanced visibility

For better visibility of what lies ahead, you need better data. The wrong financial reporting system can require too much manual data entry and even force you to use other tools to cobble together insights. When there’s urgency to get started on your journey, the finance team falls into survival mode and produces only the basic reports your organization needs. Plus, many accounting systems only provide backward looking reports that don’t provide any real-time insights or support predictive analysis.

Cloud nonprofit financial management solutions empower nonprofit finance teams to increase visibility with real-time information available anytime and anywhere. With an easy-to-use reporting system that filters, slices, and dices data, the finance team can quickly provide specific information to the right people at the right time—and in the right format. Flexible reporting capabilities provide a guided experience to help you filter, group, and organize data by the dimensions you want and build reports quickly.

Tip #3: Comply with the rules and enhance internal controls

Nonprofit finance teams not only need to see their path clearly, but they also need to know and follow the basic rules of the road. Poor internal controls or inadequate recordkeeping can throw grants and donations into jeopardy and put you at risk of non-compliance. Your nonprofit accounting system should centralize grant records and reports, tracking funding details and monitoring spending and budget as grants get used.

Cloud nonprofit financial management solutions help manage conditional grants, automating revenue recognition as milestones are achieved. These solutions also automatically create GAAP financial statements, FASB compliance reports, and Form 990 submissions to ensure compliance. A clear audit trail, roles-based security and automated compliance help enforce good internal controls so you can look ahead with an eye to future success.

Tip #4: Follow your true north with navigation tools

With the right navigation tools, nonprofit finance teams can unlock a new, strategic layer of functionality with dashboards. Think of dashboards like an empty trip itinerary where you can populate components to create a proposed route and slate of activities for your group. Once the right components are gathered, the information is presented visually in a way that’s tailored to a specific program, role, or functional area of your organization.

A real-time single source of financial truth provides the data including reports, metrics, KPIs, and approval statuses. Role-based dashboards present this information visually in the form of graphs or collaborative communication feeds so users can see key performance and financial information like real-time budget-to-actuals at a glance.

Tip #5: Measure outcomes and impact

Nonprofit financial professionals, donors, and funders are all driven by mission. To successfully achieve your mission, it’s essential to deliver accurate, timely information about program outcomes and demonstrate the impact your organization makes with each dollar of funding. That’s why it’s so important for nonprofit organizations to get to this point.

Without the ability to monitor outcomes and impact, you can’t tell the human side of the story, attract donors and funders, or effectively deliver your mission. Cloud nonprofit accounting software emboldens your team to track and report on both financial and non-financial information so you can see and report on outcomes—whether that is measured in patients treated or meals served.

Final thoughts

There’s no question that nonprofit financial management can be grueling, especially without the right foundation. Cloud-based technology gives nonprofits of all sizes access to the insights needed to stay on course toward mission success. A core fund accounting solution with a dimensional general ledger, access to real-time metrics, automated compliance, and internal controls and easy-to-use reporting and dashboards will champion your financial management with data-driven insights and decisions.

To find out how your organization can navigate the complexity of nonprofit financial management and stay focused on delivering outcomes, download The Nonprofit Finance Team Survival Guide.

The Nonprofit Finance Team Survival Guide

Find out what it takes for nonprofit finance teams to not only survive but thrive with our Ebook survival guide.

Ask the author a question or share your advice