With funding at an all-time high, should biotech startups hire a CFO sooner?

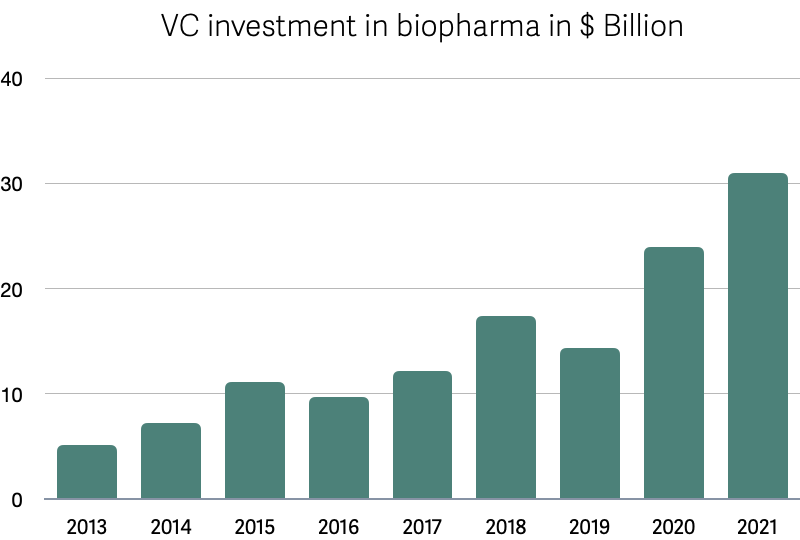

As 2021 is drawing to a close, it’s turning out to be the biggest year ever in biopharma venture capital, both in terms of total funding and the size of rounds. Biotech companies have raised over $32 billion in IPOs in 2021, with special-purpose acquisition companies accounting for one-third of IPOs while outperforming conventional IPOs by 2x in terms of capital raised.

Traditionally, most startups put off hiring senior finance leaders until they become more complex in terms of operations and prepare to go public or get acquired. But with funding rounds increasing and SPACs emerging as a viable path to IPO, startups are hiring key finance leaders sooner.

Biotech VC investments 2013-2021 (Source: https://www.baybridgebio.com/startup_database.html)

According to S&P Global Market Intelligence, the number of CFO appointments at U.S. startups that have raised $10-100 million in venture capital climbed 95% from mid-2020 to mid-2021. But why is this happening? Below, we will explore some critical trends in Biotech and how bringing finance leadership in-house earlier can make startups more successful in the short and long term.

Boom in Biotech IPOs

The 2021 record year came in the back of another record year, 2020. With interest rates remaining low and sustained interest in innovation and technology in the space, driven in part by Covid-19. As a result, average biotech stock prices rose 26% in 2020 and 20% in 2021. But while the industry enjoys continued attention, returns in the public market are starting to decline. Some executives may perceive their window of opportunity to be narrowing, pushing for IPOs earlier than they might otherwise.

But along with more funding and IPO aspirations, it is also the role of the CFO itself that might have something to do with companies opting to fill the position sooner.

Finance leaders get hired to gain a better handle on financials as companies raise larger funding rounds. In the past, that might have meant bringing in a CFO in Series C or later. But, according to venture capitalists, becoming a mature company more quickly also puts CFO hiring on a fast track: while companies hired a CFO 6-8 years after funding 10 years ago, they now fill the position after 4-5 years of inception.

CFO as Chief Strategist

While CFOs used to be the numbers person that provided their C-suite peers with the numbers to inform strategic decisions, modern finance leaders take on a much more proactive role, with broader mandates and continuous responsibilities to drive strong performance. Both founders and investors want more robust financial planning and analysis, audits, and spending oversight.

This mandate goes far beyond financial reporting and requires foundational work to be successful in the long run. For example, CFOs have a critical role in investor relations – an absolute necessity, especially in an industry primarily comprised of pre-revenue organizations. With a detailed understanding of key performance drivers of the business, CFOs are tasked with managing a company’s financial resources, defining its investor strategy, and helping communicate a company’s equity story.

As such, CFOs and business leaders share joint responsibility to ensure alignment of strategic priorities, enforce compliance standards, drive efficiencies, and ultimately improve the business’s productivity as a whole.

10 Reasons Biotech and Life Sciences Companies Choose Sage Intacct

This eBook describes the 10 top reasons biotech and life sciences companies choose Sage Intacct.

Managing Risks

Another sensible reason to bring in a CFO now is the large infusion of cash into the industry this year and the expectation of more volatility in financial markets in 2022. Putting internal controls and metrics in place now can provide the framework for a well-measured response to potential threats.

CFOs need to take an active role in addressing macroeconomic uncertainty, developing responses to adverse market scenarios and business continuity plans. This includes the identification of risk factors and monitoring risk exposure across the organization. Risk management is a critical aspect of finance leadership.

CFO as Change Agent

To fulfill the responsibilities as outlined above, the finance function cannot operate in a silo. With the increased strategic importance placed on the finance office, CFOs also need to help define an organizational structure that ensures clear roles and responsibilities and allows for enough flexibility to streamline processes. Bringing the CFO into an organization that already has formed processes in its absence will dramatically increase the time it takes for finance to perform to the best of its ability or even jeopardize the intended outcome of hiring the CFO in the first place.

Especially for a venture-driven business like a biotech company, ‘time is money’ rings even more true than in a revenue-generating organization.

Digital Transformation

Lastly, digital transformation presents an opportunity to combine finance and operational data more closely to enhance decision-making and planning. Finance is at the core of digital transformation initiatives, as the objective is to drive better, faster decisions with more confidence.

Digital technologies play a crucial role here as they allow CFOs to fulfill their laundry list of added responsibilities and free up time for the finance team to take them on. For example, finance leaders can use software to find patterns in data or identify weaknesses in their finance processes. Less time trying to spot errors in a spreadsheet means more time analyzing the problem and strategizing a solution.

Hiring CFOs soon here means building out a tech stack with finance and accounting at its foundation. It is this foundation that genuinely enables a metrics-driven organization and culture of financial responsibility. It’s often discussed but only takes on real meaning if there is a CFO who can drive that culture. CEOs should empower their finance leaders to do so. Hiring them early is the first step.

Ask the author a question or share your advice