How being a good debtor can revolutionise your business

Being a good debtor can bring all kinds of intangible benefits to your business. Here’s how to take control.

Every business owner or manager knows relationships with customers and/or clients are central to what they do. A happy customer or client is the most valuable asset.

But I’d like to suggest there’s another kind of relationship that business owners should cultivate and that can pay huge dividends if handled correctly. I’m talking about the people or organisations to which you owe money, such as your suppliers or creditors.

This might sound counter-intuitive. Why invest effort?

But there’s some solid wisdom and it goes far beyond simply managing your cash flow and balance sheet, or keeping your credit rating healthy.

Working to create a good relationship with those to whom you owe money can bring substantial intangible benefits that nonetheless have a real impact on the performance of your business.

By being a good debtor, you can also become a trusted customer or client, and receive the benefits therein. In this article, I will reveal why.

Big benefits

Think about it. Don’t you have your own natural bias towards the customers or clients of your business who pay regularly, and within the terms, without fail?

Aren’t they the customers for whom you’ve always got time when they call or email? And, of course, aren’t they the ones with whom you’re happy to do further business—perhaps even at a preferential rate just because they’re reliable and hassle-free?

Customers or clients who are tardy in their payments and demand constant attention are expensive to a business in terms of resources.

Why spend your valuable time chasing payments, or the time for your staff, when you could be focusing on your core tasks that you enjoy and build the business in the process?

So, why wouldn’t your own suppliers or other creditors view you preferentially if you not just stick to the rules agreed, such as terms of payment, but also actively seek the smoothest relationship?

Here are some benefits to being a good customer:

- Superior negotiating power: Creditors measure good customers through credit ratings and businesses use this to their advantage to negotiate the best interest rates on financing. However, a good customer is also best placed to negotiate the very best prices from suppliers—not just when placing that initial order but renegotiating at any time to take advantage of this “good customer collateral” that’s been built up.

- Better terms: If you can demonstrate that you stick to the terms agreed during each payment cycle then you’re much more likely to be able to negotiate more favourable terms moving forward. Think about the benefits to your cash flow if you could switch from 30-day terms to 60 or even 90 days. The cash could be freed up for that important equipment investment, for example, or even to fund expansion plans.

It’s not even as if you have to try hard to stand out against the competition when it comes to being a good customer. Late payments are depressingly common.

According to research by Sage, more than a third of businesses have no reason for late payments. Meanwhile, 22% of respondents in the survey said they only pay invoices at certain times of the year.

How to be a good customer

Ok, so I admit all this talk of becoming a trusted customer is all well and good, but how do you go about doing it?

You need to have full visibility into your business finances. More than this, you need to transition your processes and methodologies so you’re always prepared to take advantage of this visibility, because it really is one of the key lesser-known weapons in today’s competitive business world.

Again, this is more than merely monitoring your balance sheet every day, or knowing your cash flow situation. It’s about having fine-grained insight into just about every aspect of your accounts payable and receivable, whenever you need it.

It’s about seeing this data presented in a way that’s accessible and easy for you to understand and digest within seconds.

If you’re looking to get better rates from one of your suppliers, for example, wouldn’t it be great to see instantly the dates and amounts paid to that supplier over the past year?

Wouldn’t it be useful to contrast those figures against your total outgoings or other suppliers to see what kind of benefits could be had from renegotiated prices and terms?

What we’re talking about here is the use of business intelligence (BI) tools, such as financial reports and dashboards.

Once the preserve of large businesses, nowadays even the smallest company can take advantage of BI within their accounting software. And considering that doing so can be revolutionary, there’s really no excuse not to.

Digging into an example

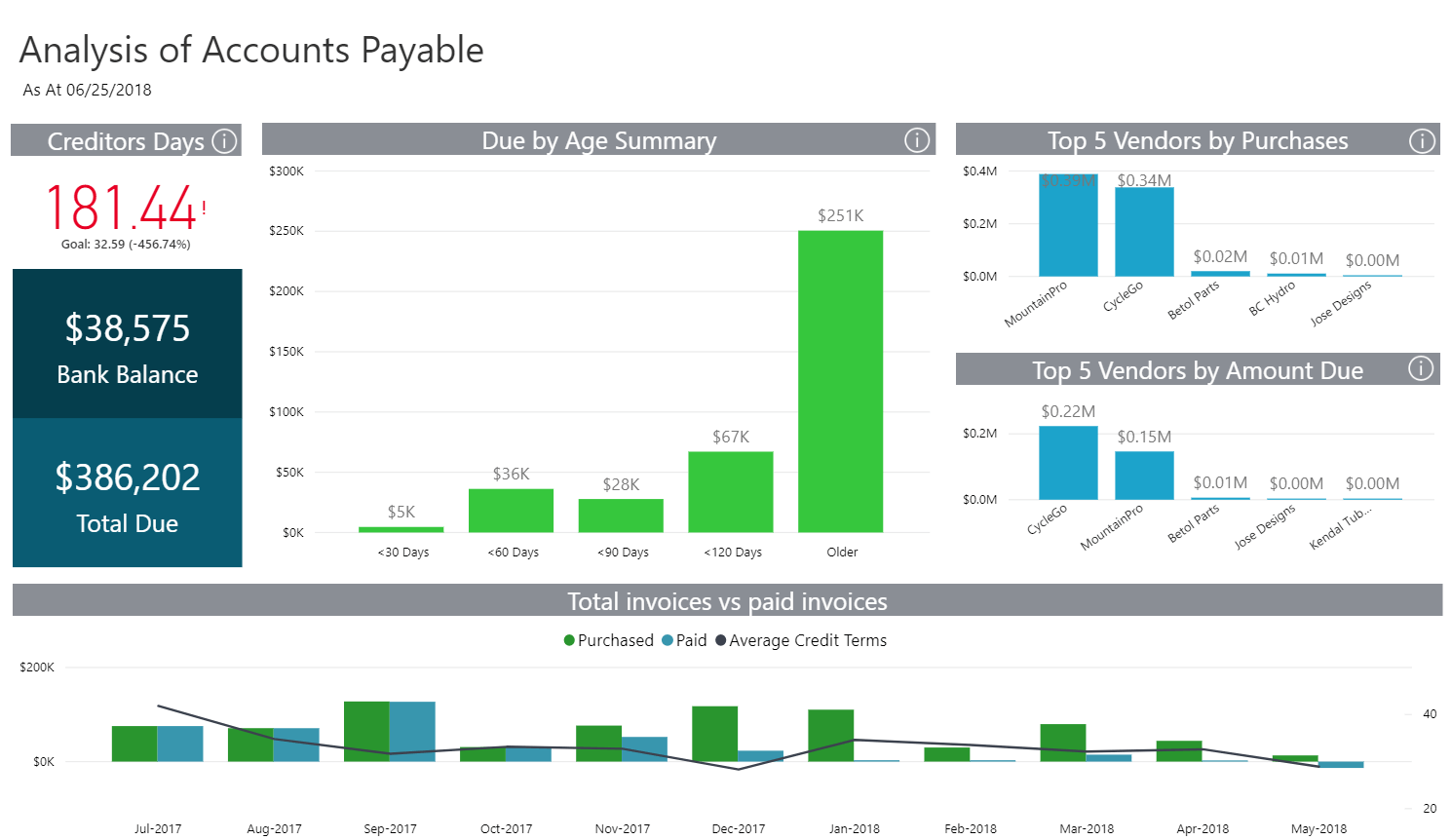

Below you can see an example of an accounts payable dashboard and information for a fictional bicycle retailer. Of importance is the number at the top left. This is the Creditors Days figure, and it shows as 181.44. It’s in the red.

This means that on average, the company is paying its creditors every 181.44 days compared to the average credit terms of 32.59 (listed beneath in the goals figures).

Clearly this isn’t healthy, and not conducive to becoming a trusted customer. More information is needed. The business owner needs urgently to know the who, where, what and when about these payments.

If we move across to the Due By Age Summary graph, we see the total amount outstanding to creditors, as well as for how long it’s been outstanding.

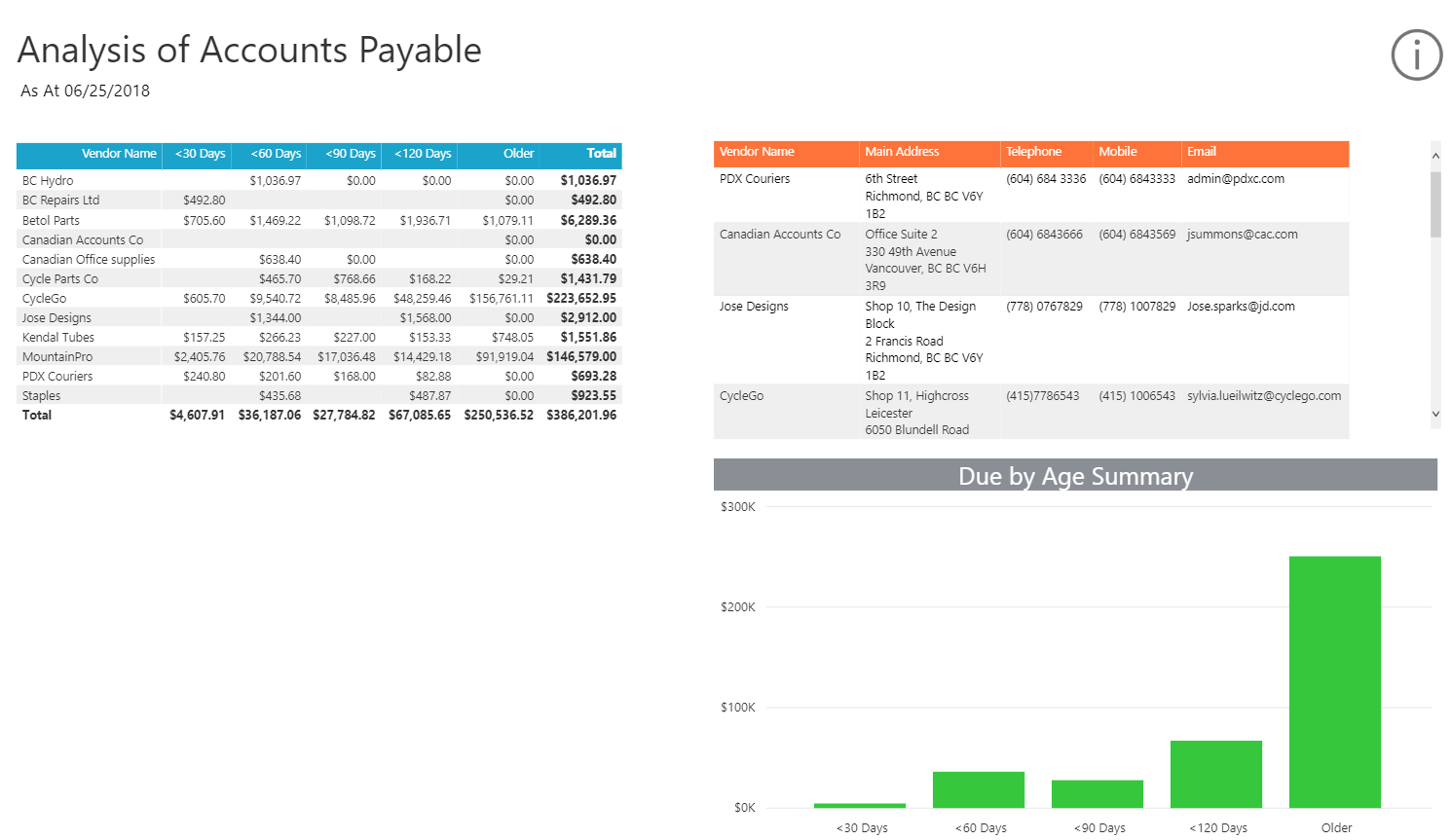

In this example, we’re able to see straight away there’s $251k sitting in the Older Than 120 Days column. By clicking this, the owner can drill down into this summary and view how much is owed, and to whom, as well as the number of days the amounts have been outstanding.

The owner will see that most of the outstanding amount in Older Than 120 Days is split between two companies: CycleGo and MountainPro.

If they then right-click on the specific supplier and click on Drill Through, they’re able to immediately drill down to the specific supplier information.

For example, they’re able to determine who the contact person for CycleGo is, and what invoices are due and overdue.

Looking at this dashboard, they may realise there was a whole lot of stock that was sent back, which hasn’t been adjusted yet by the supplier. This explains the massive amount sitting in the Older Than 120 Days column.

Conclusion on being a good debtor

Good business advice for business owners or managers has always been to keep on top of the balance/profit and loss sheet, and to know the cash flow position at all times.

But this advice is out of date in our modern world.

Businesses generate data on a minute-by-minute basis and this should be exploited to provide insights that bring real business benefits in terms of improved customer and client relationships. That in turn brings better negotiation potential.

As we’ve shown, it would be a mistake to believe this is about delving into arcane terminology or technologies.

With business intelligence reports and dashboards, the information is right there and is easy to understand by just about anybody. Digging down into the data is as simple as clicking or tapping on graphs or tables.

With this kind of power on offer, why wouldn’t you take advantage of it—and revolutionise the way you do business?

A basic guide to interactive dashboards for small business

Want to know how to use data to make the right decisions so you can grow your business? Download this free guide and learn how business intelligence tools can reveal insights that will keep your business moving.