Money Matters

Accelerate through the curve: 3 key SaaS strategies for growth in a downturn

Learn about three strategies that can help your software-as-a-service (SaaS) business during the coronavirus outbreak and beyond.

At the 2020 SaaStock event for B2B Software-as-a-Service (SaaS) leaders, David Appel, head of the software and SaaS vertical at Sage Intacct, took the (virtual) stage to offer some words of advice to SaaS businesses looking to accelerate out of the coronavirus (COVID-19) challenge.

His insight comes exclusively from conversations with the finance leaders of more than 120 leading SaaS companies.

1. Know your key metrics for ‘what-if’ scenario planning

Companies with good data can plan with confidence. “Whatever direction you thought you were heading in customer feedback, you’ve got to double down on what’s happening right now, because things have changed,” says Appel.

But in times of rapid change, and when budgets are tight, it is hard to know what to focus on. The cost of mistakes is higher.

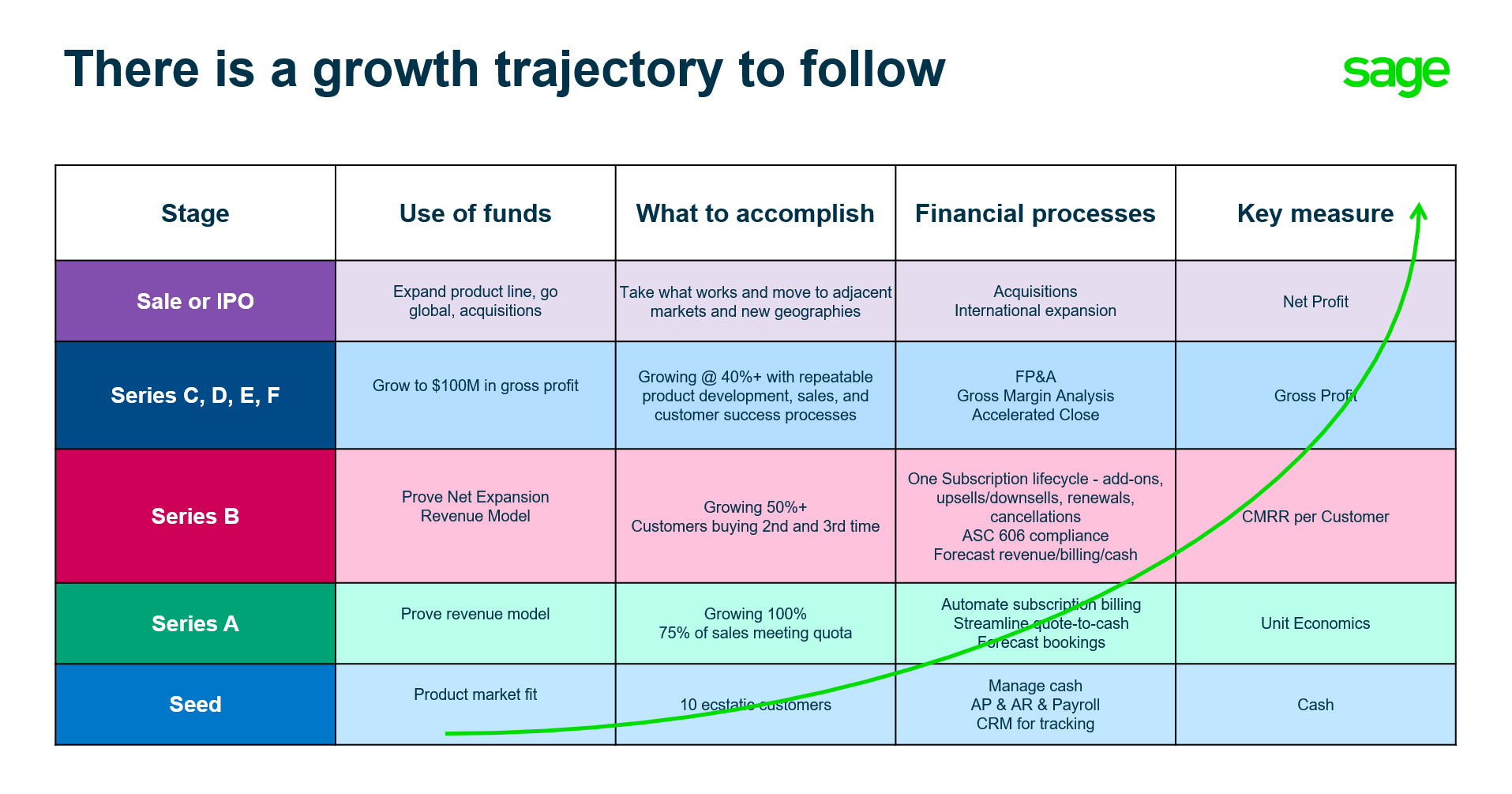

Alongside Jeff Epstein, (former CFO of Oracle and now finance operating partner at Bessemer Venture Partners), Appel has designed a simple model with the key milestones to accomplish according to the business’ stage of growth.

For example, at seed stage, entrepreneurs should focus on gaining 10 happy customers – and watch their cash.

Growing through series A, the priority is a highly efficient sales model with 75% of the sales team hitting quota:

With the right metrics and key performance indicators (KPIs), you can begin to plan for different ‘what-if’ scenarios.

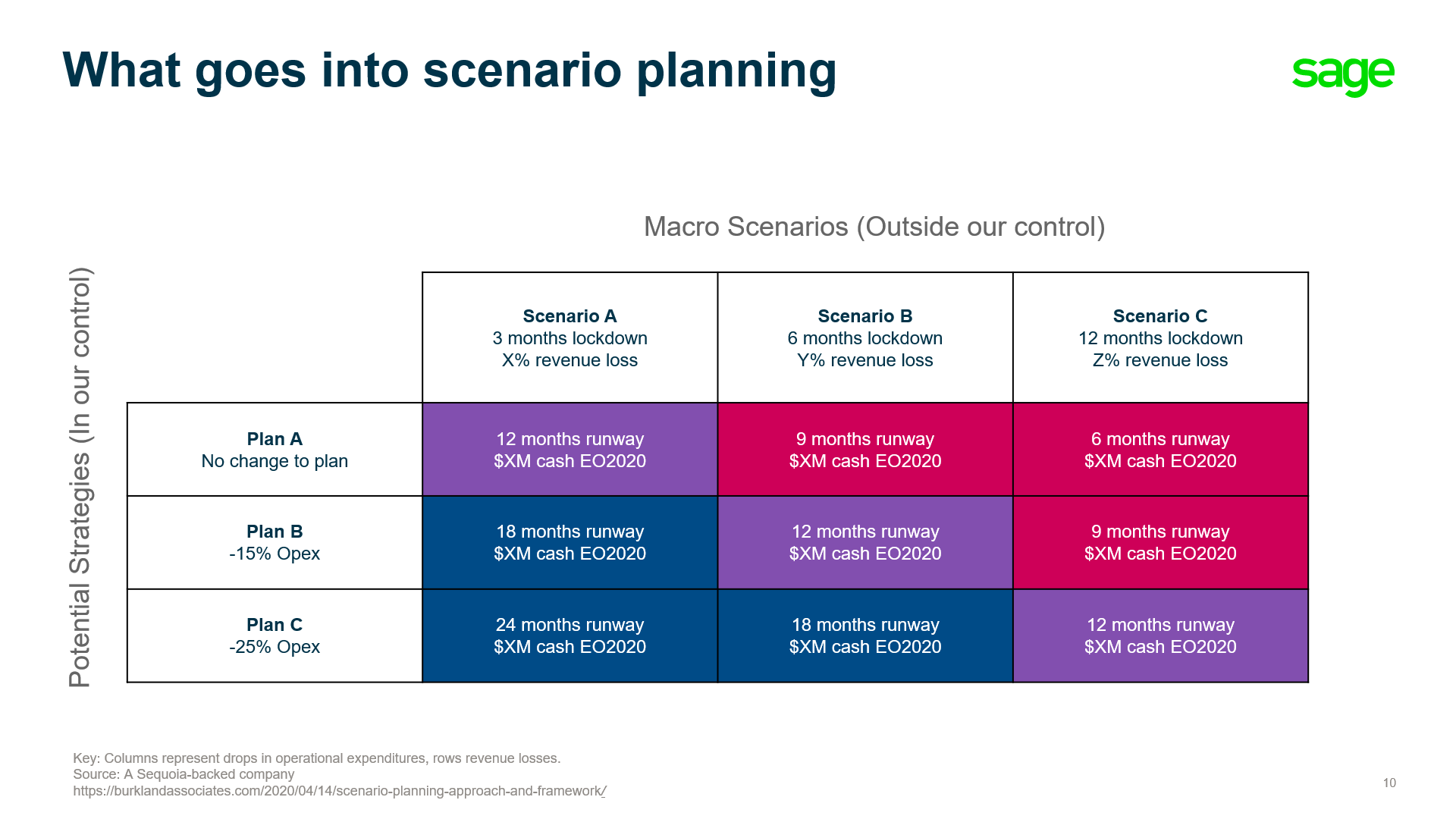

Most investors want their portfolios to have a runway of 12-24 months.

You must therefore create multiple scenarios based on your honest opinion of the reality around revenue loss (or gain), changes to operational expense (Opex), churn, and cash.

Again, Appel has worked with leading venture firms to identify the trajectory and process for building a successful business.

First Round Capital created a streamlined 3×3 scenario matrix:

Appel pointed out that: “Along with accessibility to the right metrics, it’s crucial to have the right culture to generate the best assessments.

“Do a gut-check with your leaders – can you trust each other to be honest with your scenario assessments, such that the board can ultimately reach a decision on direction?

“If you’ve been sticking your head in the sand on those potentially challenging conversations, it needs to stop. Get advice from a peer, the board, or an investor, and find a way to mend that relationship.

“Along with accessibility to the right metrics, it’s crucial to have the right culture to generate the best assessments”

“The only way to ride through all the volatility is to have the team be comfortable having difficult conversations and making tough decisions together.

“It means you need to be vulnerable to be successful.”

2. Build confidence to invest, while others pause

Companies with effective scenario planning will have the confidence to reinvest and to attract further funding to support that additional investment.

It may seem counterintuitive to invest in the current environment.

Yet, following an analysis of recovery patterns after the dotcom bubble and the 2007-08 recession, Goldman Sachs discovered that: “Sales revenues of businesses with high reinvestment rates [capital expenditures (Capex)/depreciation] grow more quickly than businesses with low rates.”

Where a SaaS business should invest will largely depend on the business and its growth stage (see the ‘there is a growth trajectory to follow’ image above).

However, there are some big, safe bets.

You may remember Marc Andreessen of A16Z’s famous comment that “software is eating the world”. Today, the cloud is eating software.

By 2025, cloud delivery will be in the majority across the entire software market.

Appel says: “Regardless of the unpredictability in business today, people are going to want automation, and they’re going to want it delivered via the cloud.

“Every SaaS business should realise that cloud migration is a reliable macro trend that will help them out.”

3. Get ahead of the curve with innovative products and better business metrics

When the world changes around you, chances are your products will have to change too.

This may just be an evolution but the status quo is unlikely to be sustainable or truly take advantage of emerging opportunities.

Appel says: “Smart businesses are investing in expanding their product offerings. They’re spending time with customers to identify their evolving and new product requirements, then investing in R&D to deliver the next round of their products that meet market demand.”

Product development, business growth and investment are possible.

“Smart businesses are investing in expanding their product offerings”

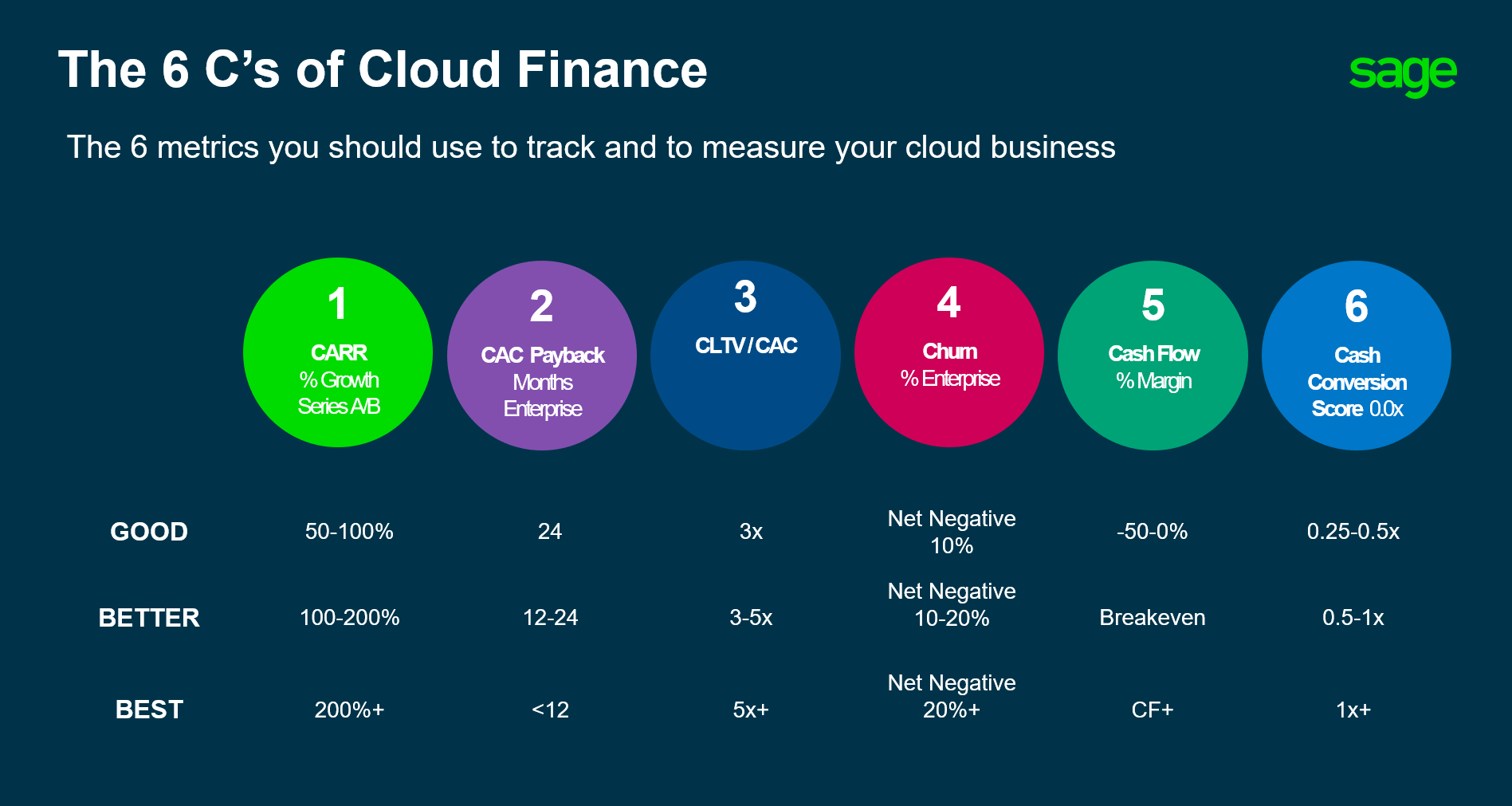

With the right SaaS metrics, you can engage investors who might otherwise look for safer bets. Here are the key finance metrics for a SaaS business:

- CARR: Committed Annual Recurring Revenues (reliable income net of churn)

- CAC Payback: The time taken in revenues achieved to pay back the cost of acquiring each new customer

- CLTV/CAC: Customer lifetime value over acquisition (i.e. profitability of the customer)

- Churn: Losses from lost or down selling customers (note also that lost customers don’t usually come back)

- Cash flow: Positive or negative, also dependent on development stage

- Cash Conversion Score: Ratio of CARR to capital invested – effectively an indicator of investor returns

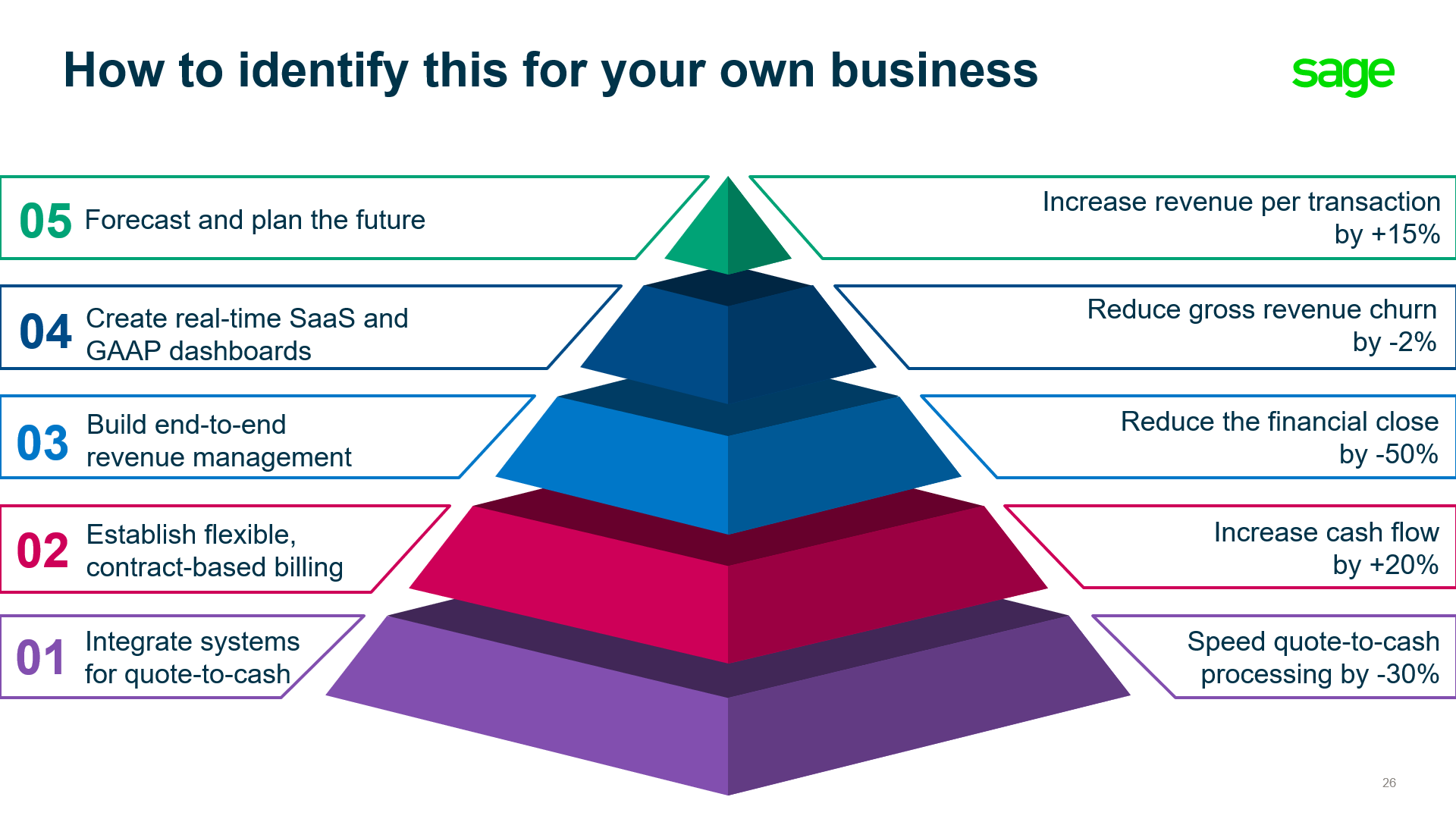

To accurately obtain those metrics and apply them across the business, here are five steps for CFOs and technologists to collaborate on:

1. Integrate quote-to-cash

The more that you can get contract quotes immediately into the financial system, the more your cash flow visibility and associated data will improve.

As you build a repeatable sales model, this will tell you what’s working (or not) in a systematic, shareable way.

2. Establish flexible, contract-based billing

On top of that, you can then build multiple types of billing model, based upon how you’re bringing value.

3. Build end-to-end revenue management

Recognised, as opposed to deferred, revenue has a significant impact on post-money valuation for a company.

4. Create dashboards

By automating the quote, billing and revenue, you have all the data you need. You can then publish executive dashboards for your leadership team to understand the position of the company on the 6 Cs, revenue and cash.

That data will drive hiring decisions, investment flows, strategies to outflank your competition.

5. Forecast and plan for the future

When you have the data, get predictive using AI technology and then add financial planning and analysis (FP&A) technology to execute the scenario planning that will define your future.

Final thoughts

While the current challenges are different than the 2008 Great Recession, there are clear lessons to learn from the companies that succeeded in spite of the economic difficulties. They employed defensive cost-cutting with offensive selective investments.

There are also these three key strategies – knowing your key metrics; building confidence to invest; getting ahead of the curve – for SaaS finance professionals who want to be proactive and help drive their businesses forward.

We all hope for a fast, safe transition to a new normal as soon as possible. Preparing for that is the focus of great SaaS finance leaders.

Whatever that eventual scenario looks like, you can get the metrics and financial tools to recover even faster than the companies you’re battling in the marketplace.

Managing SaaS metrics through the company growth lifecycle

Learn about the key metrics that are required to fully understand the health of your SaaS company and determine the best ways to optimise the business.

Ask the author a question or share your advice