Sage Accounting updates: Finding key contacts and tracking business performance just got easier

Discover the latest Sage Accounting updates, including how you now can quickly and easily find your customer and supplier details.

As things start to open again, we want to ensure you have the information you need on hand to effectively support your business.

Be it needing to quickly access a customer’s information or getting a quick glance of how your business is tracking against previous periods or years, we’re constantly looking at ways to simplify administrative tasks for you.

In our latest Sage Accounting update, we cover the following topics:

Search for and find key contacts with less information

Visibility in how your business is performing

Invoice with attachments on the go

If you’re a construction contractor or subcontractor, we’ve got you covered

Got a product improvement idea?

Search for and find key contacts with less information

We know you’re busy and may not always remember all your customers’ details.

To make life a little bit simpler, you can now search for your Sage Accounting contacts and suppliers using key details such as your contact’s address (or partial address), their main or mobile phone number, or just their primary name helping you find them quickly.

And to save you the time and drudgery of trawling through transactions you can now search your audit trail report by transaction number to quickly track down the history of an entry.

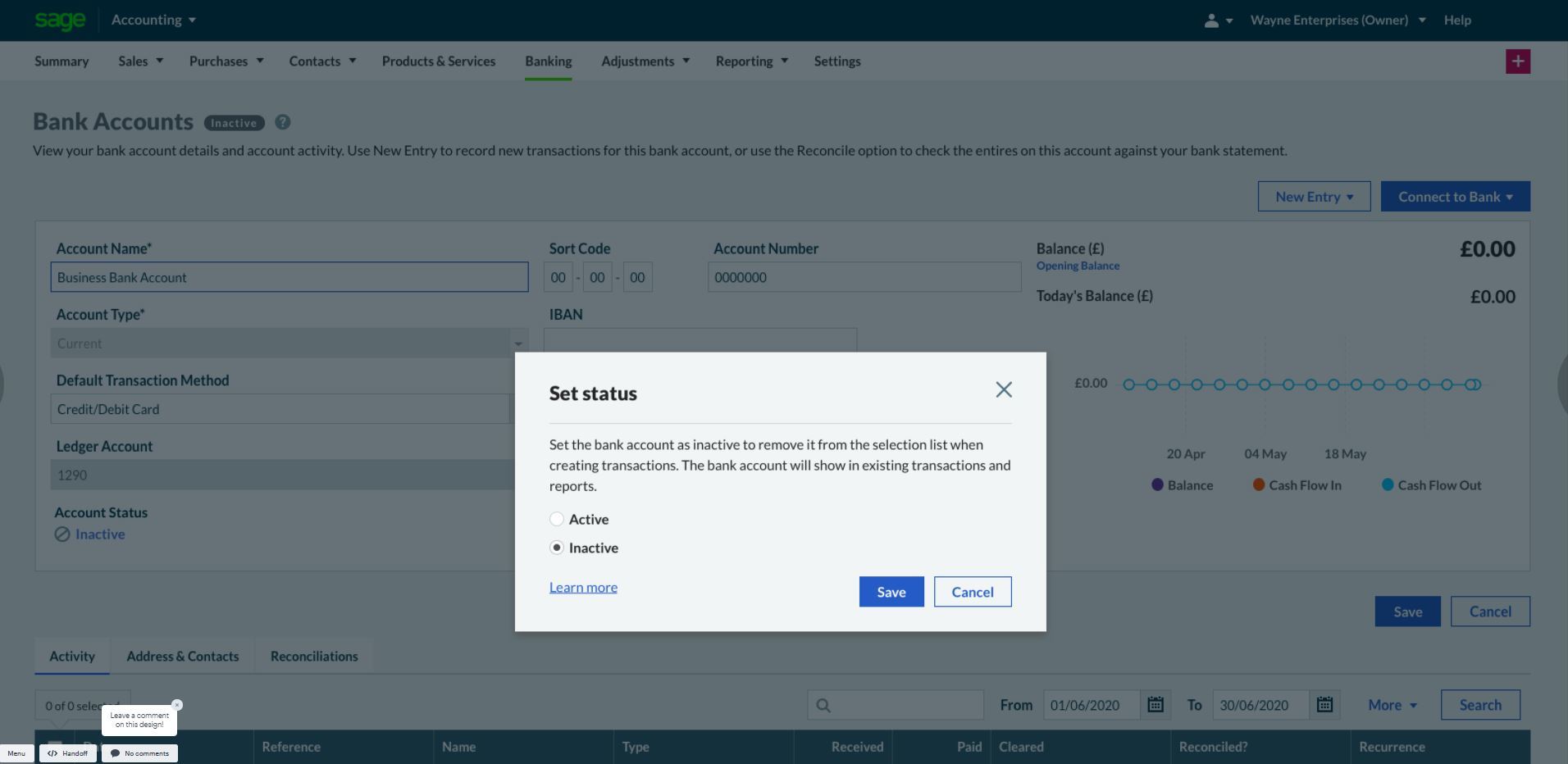

Simplify your banking

We know you’re constantly juggling tasks so to ensure you’re using the right bank accounts, we’ve introduced the option to mark unused or closed bank accounts as inactive.

This hides unused and closed bank accounts from your day-to-day transactions to reduce the risk of incorrectly selecting an old account, while ensuring they’re still available for audit purposes – and neatening up your banking page in the process.

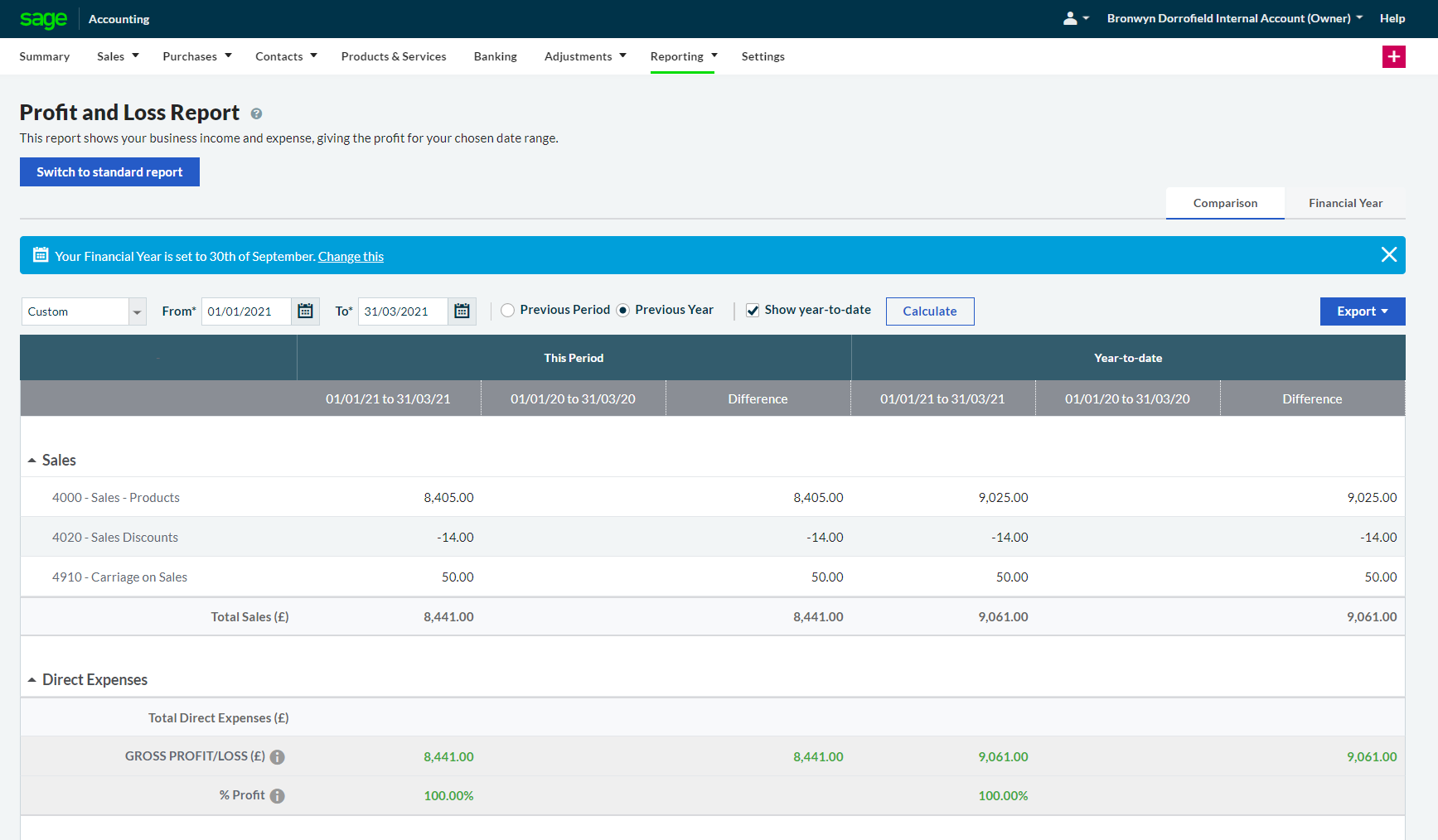

Visibility in how your business is performing

To monitor how your business is performing against the previous periods or years, you now have easy access to a comparative profit and loss report, showing a monthly rolling breakdown of your figures, and the ability to run a comparison against previous or prior periods.

This ensures you have the backing to make informed business decisions.

For additional report customisation or to create a new report (either online or in Excel) you can launch Sage Intelligence from the bottom of the profit and loss report page.

We’re also excited to welcome some additional reporting apps to the Sage Marketplace to ensure your unique reporting demands are met.

- Syft helps you take actions that improve revenue and reduce costs with powerful visualisations, reports, insights and AI capabilities.

- Joiin automates the way you consolidate financial, sales and key performance indicator (KPI) data – allowing you to create beautiful reports featuring essential insights that can be accessed on any device, anywhere.

Invoice with attachments on the go

We want you to make the most of your time – which is why you can now use any device (mobile, tablet, laptop, desktop) to invoice your customers with the supporting attachments.

You can simply take a photo of your completed job and attach it to your customer invoice while on the job, fast-tracking your invoice and payment process.

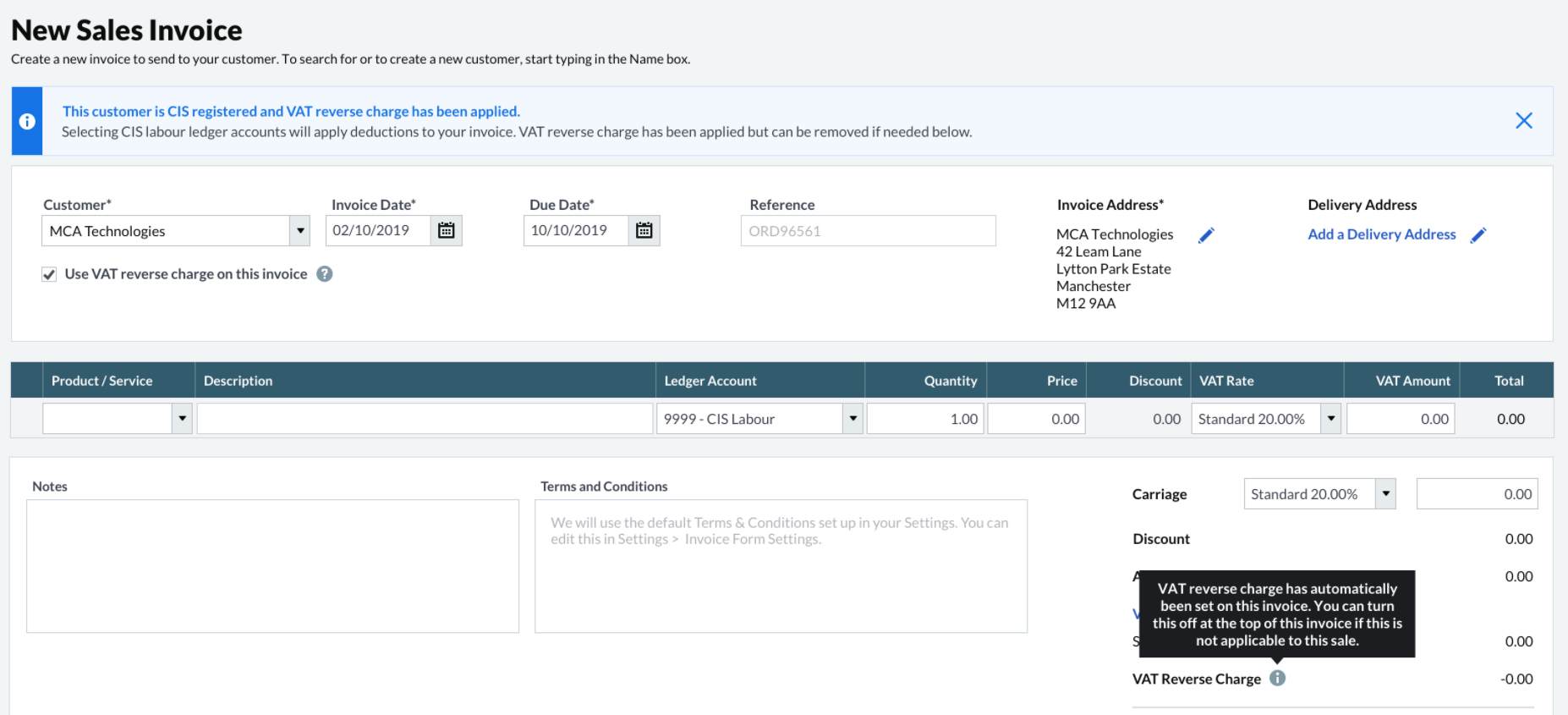

If you’re a construction contractor or subcontractor, we’ve got you covered

To take the stress out of remembering to reflect or apportion the correct reverse charge to your Construction Industry Scheme (CIS) transactions, we’ve automatically updated all VAT registered contacts to use reverse charge VAT.

For subcontractors, this means we’ve automated when the reverse charge applies and we’ll guide you on how to correctly reflect this so you’re submitting the correct invoice first time round and your invoice can be stacked for payment.

And for contractors, this means correctly apportioning and reporting on the correct reverse charge, as well as cutting down the admin nightmare of going back and forth with subcontractors on invoices that aren’t showing the percentage reverse charge legally required.

Get added functionality with our new partner apps that integrate directly with Sage Accounting, bringing you more tools that help you get the job done.

- Tradify streamlines and automates your job tracking, from enquiry to payment. Reduce admin hours in scheduling, payroll, CIS and more.

- QuoteOnSite allows you to create, send and track detailed and professional proposals that are automatically converted to invoices in Sage Accounting.

Power through payslips

If you’re using Sage Payroll or your team has grown and you’re looking for a way to support your employees, you are now able to host your payslips on the Employee Portal.

This gives your employees access to their payslips anytime, anywhere, and from any device. With a quick and easy one-time set up, you can get up and running in no time and give payroll pressure the slip.

Got a product improvement idea?

We’re committed to continuously listening, empathising, and solving the Sage Accounting issues that matter most to you.

One of the ways we’re doing this is by asking you to share your requests and ideas with us on the Accounting Ideas portal (accessed from Give Feedback/Share your Ideas section in Sage Accounting) – or you can vote on other ideas that have already been submitted.

We’ll then keep you updated on the ideas you’ve contributed to.

Final thoughts

With the information you need on hand we hope you freed up to spend more time doing the things you enjoy!

To use them, simply log in to Sage Accounting (or take a free trial if you want to start bossing your business finances).

7 ways to take control of your business

Want to know how you can boss it at your business? Read this guide for top tips to help you master your business admin and truly take control.