Money Matters

Here’s how to start a business if you haven’t the money – or confidence

Want to start a business but lacking in confidence or unsure about how much money you need? Read on for support and advice.

There are so many stories of entrepreneurs rising from humble backgrounds to achieve incredible success.

Prince Cofie Owusu started a takeaway business from his mother’s flat in south London. Trap Kitchen operated entirely online at first, offering delivery via Instagram. Owusu now has outlets in Manchester, Birmingham and London – with eyes on even more expansion.

Many of us have similar ambitions to earn an independent living in the place where we live. Others want to join the ongoing ecommerce revolution and sell online, with all the convenience this offers.

If you’ve been dreaming about creating a business, yet feel you lack the resources, confidence, or support then you’re not alone.

Here’s what we cover in this article:

Knocking Down Barriers: Empowering business builders in the UK’s most deprived communities

Side hustles: The zero-cost way to be an entrepreneur

How to get the confidence to start a business

How to get money for a business

Living the dream of running your own business

Knocking Down Barriers: Empowering business builders in the UK’s most deprived communities

Together with The Entrepreneurs Network, Sage spoke to 705 people in deprived areas of London and Newcastle who are open to the idea of starting a small business, along with 497 small-to-medium-sized enterprises (SMEs) in those areas.

The survey found there’s untapped entrepreneurial potential in deprived communities.

For example, more than four-in-ten respondents (43%) could, unprompted, name an idea for a business or side hustle.

This is a key first step on the road towards working for yourself.

Just under half the survey respondents earned less than £15,000 a year and only 25% were homeowners—far below the national average of 66%. One fifth had relied on benefits, 29% had been unemployed for more than six months, and a fifth had been furloughed during the coronavirus disruption.

The survey asked about their attitudes, ambitions, and fears relating to starting a business.

Here are some sample quotes of what people saw themselves doing:

- Crafts: “Making bespoke knitted items” or “handmade jewellery”

- Creative: “Writing short stories for publications” or “custom drawings for clothes lines”

- Fashion and beauty: “Hair styling, selling wigs and oils” or “opening an eyelash salon”.

You can probably add you own ideas here, based on your own hobbies, interests, skills or experiences. Or perhaps you simply want to try your hand at something new.

So, the question becomes: what’s stopping people from giving it a try?

Side hustles: The zero-cost way to be an entrepreneur

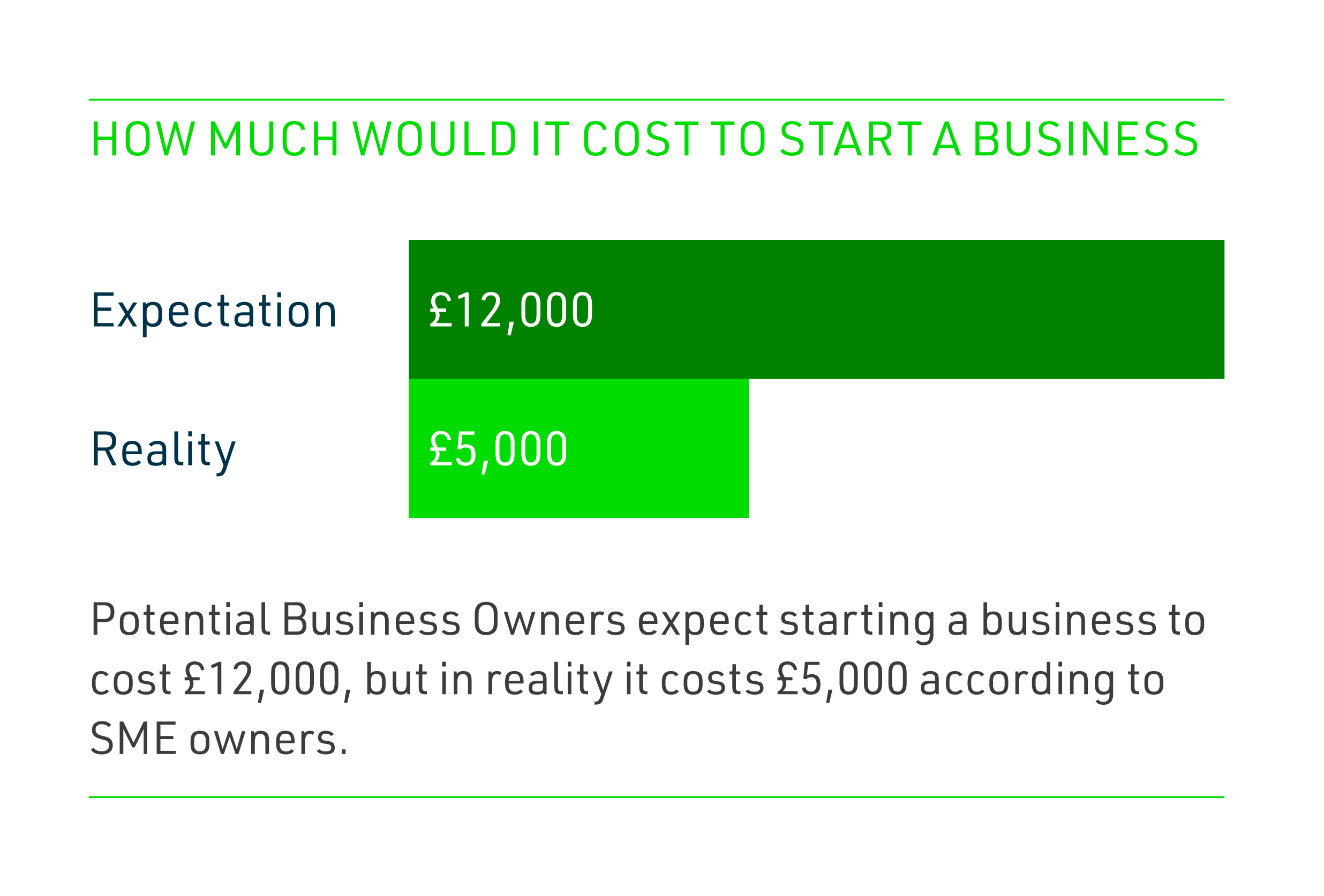

The survey respondents were pragmatic in their outlook, saying that they believed it would take on average £12,000 to get started in business.

But do you even need money to start a business?

In reality, and as so many entrepreneurs have shown, starting a business requires something most of us either have already, or can create.

Time.

You don’t have to go all in with this kind of investment. Lots of people have side hustles nowadays. People carve out time in evenings and weekends, around work and family commitments.

Here’s what side hustler Sara Quayle says. She uses her experience as a full-time health and safety adviser to sell online first aid courses for families and childminders through Sara Quayle Safety & First Aid Training:

“A side hustle gives you a safety net, which is important, especially in this environment. Also, the extra money allows me to reinvest and come up with new courses and a better product.

“I enjoy it. I enjoy being able to make money and have a little bit extra there to spend on, for example, the children or a nice pair of shoes.”

The beauty of a side hustle is that you can walk away if you want to or put the idea on hold if life takes you in other directions. Or you can treat it as a way to test your idea, before building it out to a full-time, ongoing business.

If you’re selling what you make on sites such as eBay or Etsy then there’s zero financial outlay required until the sale has completed.

If you’re selling a service, such as dog walking or cleaning, then social media sites like Facebook can help you reach potential local customers, again with zero outlay.

Getting your taxes right

Our survey also revealed that just over a quarter of potential independent earners lacked confidence when it came to paying and filing taxes.

Here’s what some of the potential independent earners said:

- “I am unsure and afraid of the administrative side of the business especially the taxes I have to pay.” – Chantal

- “The administrative side of starting a business is a barrier as I need to research taxes and other admin duties I would need to stay on top of. Never doing this before leaves a lot of uncertainty. I think this would be difficult for me at first.” – Matt

Yet some of the SMEs the survey spoke were more optimistic, having been through it already:

- “The administration element was challenging however there are so many resources available… I will seek assistance for taxation though as I’m aware of the ramifications of going wrong in this area.” – Jamie

Taxes and accounting are something to be aware of but not something that should stop you following your dreams.

The basic facts are that a spreadsheet can record what you earn in the very early days, and should log what you spend too (if anything). Keep any receipts for items you buy.

You need to pay tax and National Insurance contributions on anything you earn; it doesn’t matter if you earn money as a side hustle, or as a full-time affair.

If you’ve already got a full-time job and run a side hustle alongside it then what you earn still has to be declared to HMRC, and you’ll still potentially have to pay tax and National Insurance on it.

A good rule of thumb is to set aside 30% of what you earn each year in a savings account or similar.

What you end up owing will probably be less than this. But it’s definitely better to have too much saved and available at tax time, compared with not having enough.

There is one exception, which is that if you earn less than £1,000 in a year from your business then it’s effectively tax-free. You haven’t even got to let HMRC know. This is called the trading allowance.

When it comes to registering for tax, even that costs nothing. You’ll be classed as a sole trader and you can register for zero cost.

If your turnover goes above £85,000 then you’ll also need to register for VAT, and again that’s free—although when your turnover gets to that level then it’s probably time to get the expert help of an accountant.

How to get the confidence to start a business

Sadly, a lack of confidence was a recurring theme in the Knocking Down Barriers survey. Almost two-thirds (62%) of those the survey spoke to were doubtful they could start a business.

The irony here is that many knew people who might be able to help.

Friends, perhaps, or family members.

But here, again, the survey found a crippling lack of confidence: 58% knew someone who they could turn to for advice, but fewer than half had actually reached out.

However, as with so many things in life, confidence comes after you make that first step.

For Sage Ambassador Autumn Rabbitts, Owner of Plumb and Rabbitts Cake Studio, that’s about having belief in your own unique abilities:

And for Ryan Panchoo, founder and CEO of doughnut business Borough 22, having a motivational goal in mind is the secret to long-term confidence:

Ben runs a small business. Here’s what he told the survey: “Finding the courage to start a business was one of the hardest aspects, I would say… So get a mentor or as much free friendly advice as you can to help you with the plunge and initial phases.”

Here are three steps that empower you to turn a business idea into reality.

1. Talk about it

As Ben says, the very first step is to externalise your idea, and seek input.

Bend the ear of anybody who will listen. Tell the shopkeeper, the bar staff, or even the bus driver. What have you got to lose?

Aim to develop your thoughts. Remain open and aim to refine your idea.

Not everybody will respond positively but try to listen and treat it as a learning exercise, even if that’s difficult.

2. Write it down

No, we’re not talking about creating a business plan. Not yet, anyway.

Just get something written down.

Get down some notes on your mobile whenever you can. Create a mission statement. Then describe in a sentence where you’d like to be in 12 months’ time.

List prices for your products, and how much of that will be profit.

Try to list costs, like materials you may have to buy. Don’t get too bogged down in one particular area.

Keep the notes broad, but do include necessary specifics.

3. Get professional help

As a general rule, governments are always keen to help people establish businesses.

The Business Support Helpline provides free advice, via phone, webchat or email in England, with equivalents in Wales, Scotland and Northern Ireland.

Regional growth hubs in England also offer advice and toolkits.

Or you might also speak to an accountant, with a view to getting their services. Often, they’re happy to share free advice, built up from experience with hundreds of clients running businesses just like yours.

How to get money for a business

So, let’s say you’ve proved your side hustle is feasible. People want what you offer, and you want to continue doing it. Perhaps you’re just starting but believe your idea is strong and you’re ready to go full time from day one.

The next step is to turn your idea into something more serious.

The Knocking Down Barriers survey respondents believed they’d need around £12,000 to start a business.

In fact, this is on the higher side of what’s probably needed initially. The SMEs in the survey thought it closer to £5,000.

Separate research into startup costs from a few years ago showed that even this might be an overestimate. Depending on industry, many businesses are typically founded on £1,000 initial capital.

The blocker is that only 14% of our survey respondents said they already had £12,000 available. Around a third (61%) believed they would need to take out a loan to get it. And 62% also responded that they were not sure it was even worth it financially.

People reported lacking confidence around accessing finance (27% of respondents).

Once again, much of this boils down to an issue with confidence. In the survey, 49% said they thought they would be rejected if they applied for a loan to start a business, for example.

The majority (60%) believed they would need to access external financing, but only a third (34%) felt comfortable taking out a loan. A quarter felt entirely uncomfortable doing so.

But here’s the thing: loans aren’t the only way to get money for a business.

The New Enterprise Allowance provides those on benefits (such as Jobseeker’s Allowance or Universal Credit) to get a weekly allowance of up to £1,274 in total across 26 weeks.

And other kinds of grants are available.

These often are built around individual circumstances, such as living in a certain area, or coming from a certain background. But potentially receiving free money is surely worth the time investment of searching a few sites and filling in application forms.

Try the J4bgrants, GrantFinder, and Grants Online websites.

What about crowdfunding?

This is where lots of people contribute a small amount. Often crowdfunding works by a business offering products for pre-order while they’re still in development.

But it’s a mistake to think crowdfunding relates only to selling products. Often crowdfunding sites are about investing in businesses. Sometimes the sites allow people to give money as a form of charity donation to what they consider worthy causes.

As just one example, Crowdfunder.co.uk lets you raise funds for community projects, causes and campaigns, or more. Social media you already use every day can then be used to promote your crowdfunding campaign, especially within your local community.

Living the dream of running your own business

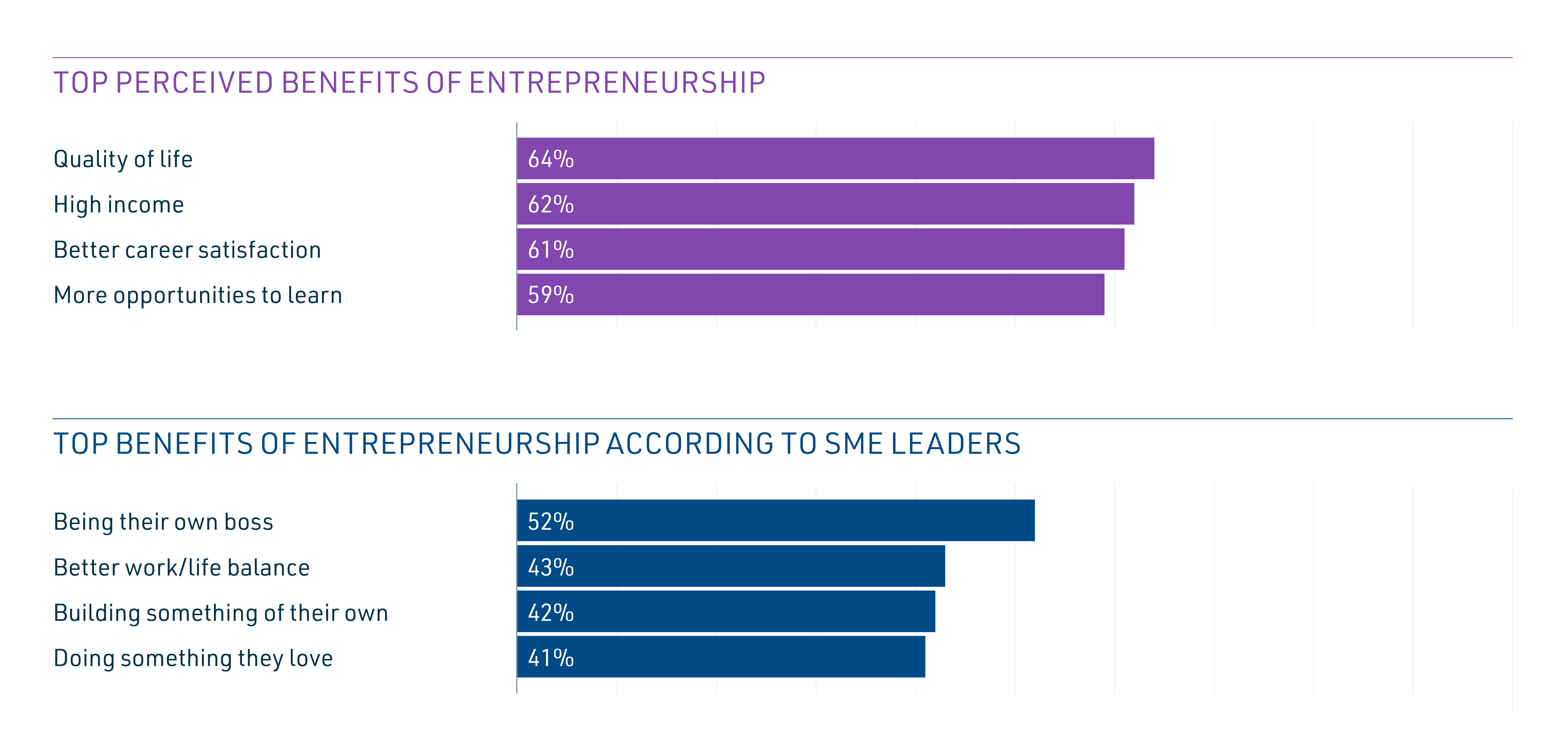

The Knocking Down Barriers survey respondents listed better quality of life (64%), a higher income (62%), and better career satisfaction (61%) as the top benefits of starting a business.

It’s not just about money. Having more control over their lives and the having ability to do something they love were seen to be as important.

To this end, Sage has announced a three-year, multimillion-pound UK partnership with MyKindaFuture to provide training and mentorship to disadvantaged and underrepresented young people via Jobcentre Plus.

In the survey, 73% of the established SME owners surveyed say they had access to a mentor and more than half have sought their advice.

If you can tap into your ideas and ambitions for business then everybody wins. Your business will undoubtedly employ people locally as it expands, helping others in a similar situation to your own.

Find out more

Get in touch with MyKindaFuture to find out more about taking your next entrepreneurial steps with confidence.

Discover more about the research, Knocking Down Barriers: empowering business builders in the UK’s most deprived communities.

Ask the author a question or share your advice