Strategy, Legal & Operations

Starting a business? Here’s how to stop the tax burden killing it

Aware of the tax burden on businesses? Did you know smaller and newer businesses pay as tax a much larger proportion of their profits compared to larger, more established companies? That’s the finding of a new report from Sage that spoke to more than 3,000 companies across 11 countries.

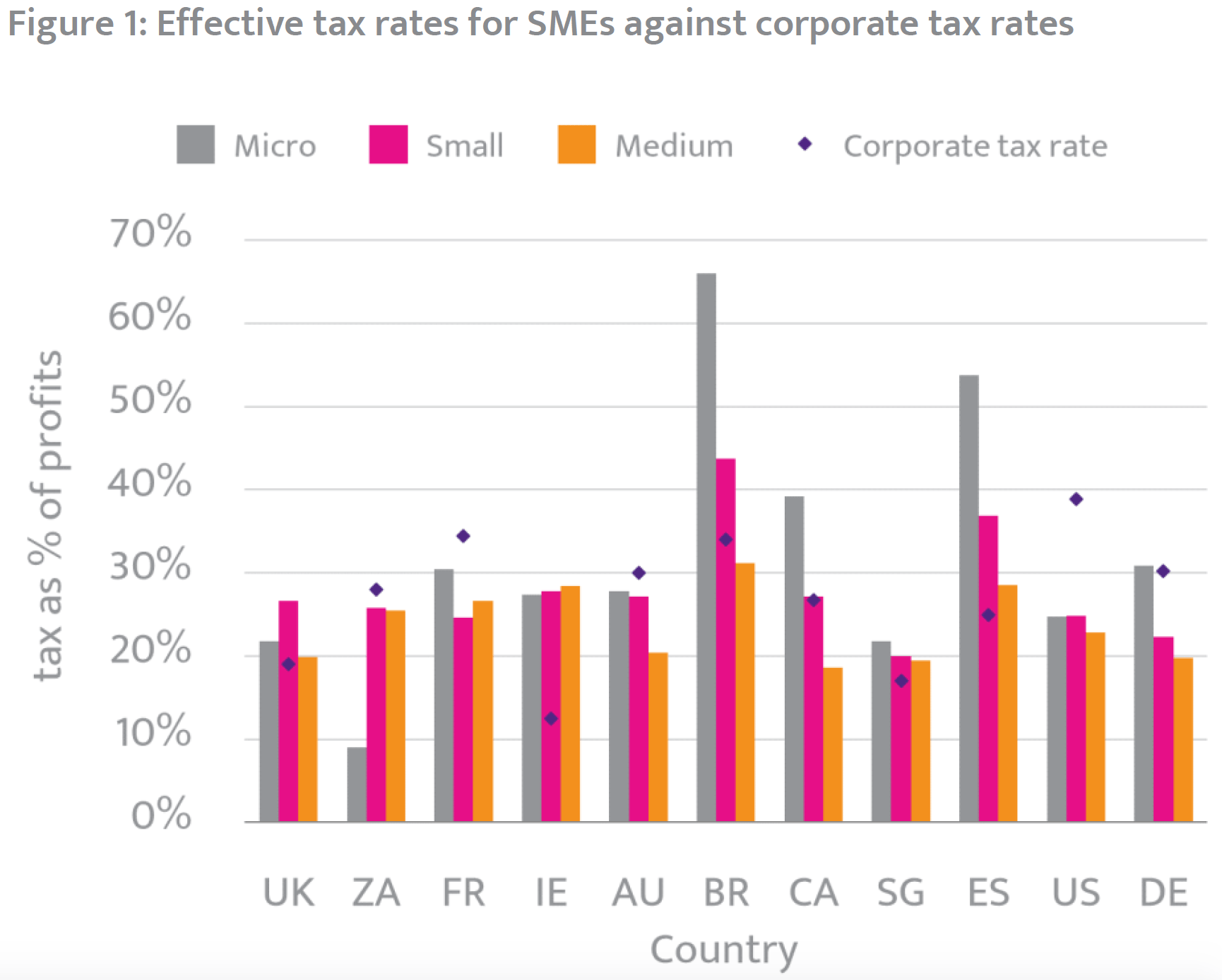

A Taxing Problem: The Impact of Tax on Small Businesses found the total tax paid by small businesses does not always align with the headline corporation tax requirements within each country.

For example, new and smaller companies typically sacrifice profit for all-out growth, yet they still face an identical corporate tax regime compared to medium and large businesses. This means medium or larger well-established companies can operate with an inherent competitive advantage.

The report finds that, when compared to profit, the total tax bill facing smaller and newer businesses in many parts of Europe is likely to be effectively higher than the corporate tax rate. Those businesses with 10-49 employees, identified as “small” within the report, are particularly hard hit in countries such as the UK, Ireland and Spain. See Figure 1 below.

This occurs despite governments sometimes offering “breaks” for younger and/or smaller companies.

However, businesses in Europe might pity microbusinesses in Brazil, where tax as a percentage of profits pushes towards a surely prohibitive 70%.

The higher effective tax rate doesn’t help when young businesses already face a precarious cash flow situation, with requirements to purchase initial stock or capital investiture for machinery or other equipment.

Taxation – in all its forms – can have a significant impact on the continued viability of a company and can represent a huge barrier to entry or growth.

To provide context to this issue, SMEs typically account for the majority of a country’s employment. Any regime, accidental or deliberate, that discourages individuals from starting new businesses is ultimately detrimental to the country as a whole so needs to be addressed.

Finding a solution

Speaking to Sage Advice Newsroom, Chas Roy-Chowdhury, head of taxation at accountant trade body ACCA, mentions an often-discussed “tax gap”, in which governments don’t receive what they’re owed.

“But there’s also probably a negative tax gap,” he says. “It goes the other way, where small companies haven’t taken advantage of the allowances they’re entitled to.”

Smaller businesses, for example, might not even know about capital allowances they’re entitled to when investing in assets such as plant machinery. They might not understand the VAT system and how registering can save money – or how registering too late can lead to a sudden high tax bill and even fines.

Very small businesses might not realise they can get a tax deduction for space in their home used for business – from a back-bedroom office, to storing stock in a garage.

Chas points out that while individuals might be used to the tax office correcting mistakes and even providing rebates when it comes to personal income tax, the rules are simply different for businesses.

He says: “If a business doesn’t take a certain deduction for capital items they’ve bought then HMRC don’t necessarily have to come back to them. It’s the business’s choice whether they take a deduction or not, so it’s very much up to them to get it right.”

It isn’t just the cost of tax that can be the issue. Business tax is simply complex and again this can take even the bravest new business owner by surprise. This is supported by the report’s data, which says significant working days each year are spent on tax-related accounting – ranging from 0.5% in Singapore to more than 4% in the US.

“The tax system is a minefield,” adds Chas. “It’s just a totally different language. The more governments around the world can do to simplify tax, rather than giving lip service, the better it’s going to be.”

Having an understanding of your tax obligations will really help your business

Five tips for new and smaller businesses to reduce the tax burden

However, there’s little doubt that tax considerations should be at least near the top of the admin list for anybody starting a new business. Here are five tips for getting started.

1. Consult an accountant

Although a daunting prospect – and perhaps financially so for newbie businesses with limited cash – many accountants offer a free initial consultation session for potential new clients.

Accountant trade bodies such as ACCA will help you find accredited members. “It could be the best 30 minutes or hour you get free in your life,” says Chas. Ongoing advice might be an unwanted business expense, he adds, “but it could be a lot more money to get it wrong!”

2. Be the wise fool

There will be a certain amount of red tape involved in any business and, yes, it might be significant and take you away from the core tasks of building your business.

Rallying against the situation won’t provide a solution and nor will simply ignoring it or putting it off. Getting outside help from an accountant or bookkeeper can help but you’ll still need to know at least aware of the terminology and background information.

“Go into this with your eyes open rather than with rose-tinted glasses,” Chas advises.

3. Plan for tax from day one

Most individuals aren’t trained to consider tax directly when they’re employees thanks to deductions at source, such as PAYE in the UK. Even most freelance workers simply put aside a percentage of earnings with the anticipation that it will be enough to pay the yearly or quarterly demands.

However, a business owner needs to know about tax from the first day of operation. It won’t take most VAT-eligible businesses very long to reach the threshold of £85,000 in turnover, for example (and note that the figure there is turnover, not profit or assets).

4. Don’t make assumptions

You might have heard about tax relief schemes for new or high-growth businesses, or heard about grants from local or national governments, or other bodies.

But often these come with significant and complicated qualifying strings attached, and therefore assuming you qualify can be a costly mistake – although if it’s worth it you might also choose to adjust your business structure so that you do in fact qualify.

However, both routes require you to be fully informed as early as possible and, again, consulting qualified third parties might help. You might find your local government offers a small business adviser, for example, as might your bank.

5. Speak up if you get into trouble

Not being able to pay your tax bill is a casebook example of insolvency but try not to panic if it happens to you. Speak to your accountant as soon as possible, or talk to an insolvency practitioner. There might be solutions.

HMRC’s Time to Pay system, for example, can offer a way out of the hole – but only for what HMRC call “viable” businesses, and you’ll only get a finite time to cover the debt (definitely no more than a year and often less).

Some businesses assume that if they can’t pay then the taxman will accept an offer in return for the business remaining in operation. Sadly, this isn’t true.

In fact, the government will probably add interest to the amount owed and if you ultimately can’t pay then it will very likely attempt to liquidate your business if nobody else already has.

A Taxing Problem

Struggling with the effects of tax on your business? You're not alone. Learn more about the impact of tax on small businesses by reading our free report.

Ask the author a question or share your advice