Technology & Innovation

Artificial intelligence in nonprofit finance: Should your organization lead or follow?

Learn how AI helps nonprofits increase efficiency, enhance compliance and gain a deeper understanding of financial performance.

Do you see artificial intelligence (AI) as a futuristic technology trend for the finance and accounting profession?

It’s time to rethink the role of AI at your organization. AI accounting tools are going mainstream according to a recent survey by Moss Adams and OnePoll.

The study revealed:

- 79% of accountants think AI assistance with job-related tasks is beneficial.

- 69% believe AI has a positive impact on the profession.

Most nonprofit finance professionals aren’t worried about AI, instead seeing it as an opportunity to offload least-favorite tasks and take on new challenges.

In fact, 64% of those surveyed believe the use of AI technology will augment rather than eliminate jobs.

Many also understand AI could help fill the shortage of skilled accountants by automating routine tasks and enabling accountants to focus more on strategic work—ultimately attracting more people to the profession.

Nonprofit finance professionals are also looking to AI tools to help meet evolving demands by enhancing nonprofit finance transformation.

While you still need to be your organization’s financial historian—studying historical data to find ways to improve tomorrow—today’s nonprofit finance leaders are also forward-looking advisors, evaluating real-time data, discovering important insights, and making flexible adjustments when opportunities or threats arise.

In this article, we’ll explore how AI helps nonprofits increase efficiency, enhance compliance, gain a deeper understanding of financial performance, and optimize financial strategies.

Read the e-book to learn how you can unlock the power of real-time data and automation so you can be more strategic in your analysis, planning, and decision making.

What is AI?

AI is transforming nonprofit financial management.

As a nonprofit finance leader, understand how AI can help your team streamline routine administrative tasks (such as data entry and reconciliations) and allow more time to be spent on mission-focused strategic planning and activities.

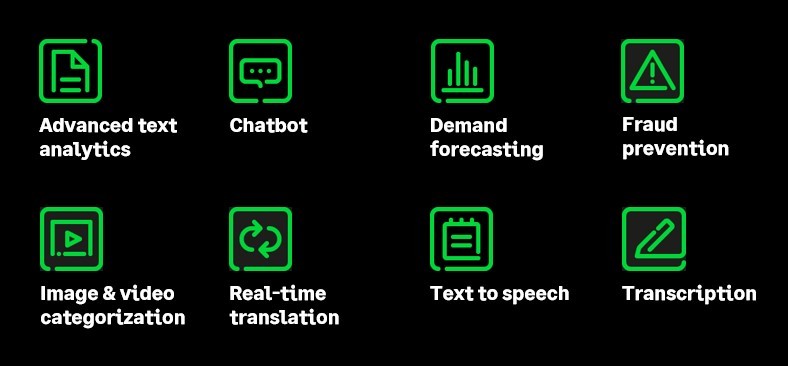

AI is an umbrella term that encompasses several technologies:

- Rule-based programs

- Robotic process automation

- Machine learning

- Deep learning

Robotic Process Automation (RPA) automates repetitive tasks to help save time for knowledge workers.

RPA can scrape data from the web, extract and process the content of different types of files, and make calculations. RPA can be found in any application that automatically moves and inserts data into the correct places on forms, contracts, and worksheets.

An example of RPA would be tax preparation software that extracts data from PDFs of W2s and 1099s, places it in the right spots on the 1040, and then performs tax calculations.

Deep learning is a branch of machine learning techniques where artificial neural networks—typically these are thought to be algorithms inspired by the human brain—learn from really large amounts of data.

Today, these algorithms power things like facial recognition or voice assistants such as Siri and Alexa and even speech translation systems such as Google Translate.

What will AI do for nonprofit finance leaders?

Instead of thinking of AI as just a technology, envision it as a way to augment our intelligence.

Every organization should be asking, ”How can we add this type of technology to our processes and use it to further our mission?”

Today’s finance leaders need more time to focus on strategic work. They need active insights ready at the right time to embolden decision-making and inform strategic direction so they can jump on new opportunities to expand mission impact.

This requires nonprofit accounting and financial management solutions embedded with powerful analytic capabilities.

In nonprofit organizations, AI will help nonprofit finance teams:

- Ingest documents like receipts, invoices, and time entries automatically and send information where it is needed.

- Automate reconciliations so the accounting staff only needs to deal with exceptions.

- Perform continuous accounting to eliminate the financial close.

- Catch any potential fraud or abuse much earlier.

- Learn from strategic insights trends in funding, costs, cash, and spend variances.

- Find anomalies in transaction data and bring them to your team’s attention for further outlier analysis.

- Audit 100% of your data efficiently.

The capabilities of AI technology continue to evolve, bringing new benefits to nonprofit organizations and their finance teams.

For example, adaptive AI is an emerging technology that delivers better outcomes faster by learning patterns from past experiences.

Adaptive AI adjusts for real-world changes by revising its own code. This presents an exciting opportunity for nonprofits to make better decisions faster, while remaining flexible to adjust to changing conditions in the future.

Nonprofit finance and AI…today, tomorrow, and in the future

Nonprofit leaders do not have to wait for these transformative benefits; there are a number of technologies already providing AI capabilities.

Today, we have plenty of computer processing power to automate all workflows and deal with massive datasets using unconstrained machine learning.

We have the connectivity and integration capabilities to empower zero latency analytics, available on demand at all times.

And cloud computing provides the scalability and elasticity to capture every transaction in real-time in full detail, allowing AI to help drive insights for finance leaders.

Sage Intacct Intelligent GL™ makes continuous accounting a reality today.

It brings in real-time transactions from across your organization—and even from other applications and finance institutions through open integration—to perform a continuous financial close.

Nonprofits are also using AI tools to fast-track fundraising outreach.

Through predictive modeling, AI is helping fundraisers optimize campaigns by finding potential donors, suggesting dynamic giving amounts and writing and automating thank you emails.

Additionally, many nonprofit finance teams are using AI to measure real-time impact and evaluate the performance of financial and program goals.

AI is providing support on program development by providing guidance along the way to reduce costs and optimize resources.

Will most nonprofits benefit from leading the way or following cautiously with AI?

Nonprofit finance leaders have to balance the benefits of transformation versus the costs of technology.

How do you know whether to embrace technological change early or later? Should you lead or follow with AI?

Let’s see what the cost versus benefit might look like.

AICPA & CIMA estimates manual finance functions mean organizations spend about 50% of their time on transaction processing and about 40% more of their time on controls and reporting.

That leaves less than 10% of time spent on strategy.

AI represents a transformational opportunity to turn that ratio on its head. Taking advantage of AI can help nonprofit finance leaders spend up to 50% of their time on strategy and utilize their teams in much more strategic roles.

First, try to identify the opportunities for AI transformation to help you drive forward your mission and benefit your community.

What options are available to you with a better tech stack? What vendor ecosystem will you need to support you in the future?

Even if your organization’s cost/benefit analysis for AI doesn’t warrant adopting new solutions today, keep an eye on technology to ensure you don’t fall behind in the future.

Final thoughts

Artificial intelligence promises to be the latest tool to help nonprofit finance teams do more with less, close the books faster, better forecast performance, and enhance strategic decision making.

Adopting AI can help nonprofits improve donor experience, create revenue growth, and enhance mission-critical operations.

Download The Road to Nonprofit Finance Transformation Success e-book to learn why nonprofits need digital finance transformation and see five real-world examples of nonprofits who successfully accomplished this mission.

Ask the author a question or share your advice