Board reporting made easy: tips and strategies

Experience seamless board reporting and analytics for your SaaS business with our advanced automation software. Monitor key metrics, improve performance, and boost revenue.

For SaaS CFOs, the words “board reporting” can stir up a whole range of less-than-pleasant feelings. Reasons for this range from a lack of clarity around the board reporting process to technical causes like the tedium of putting together manual board reports.

If you know how to tackle it strategically, reporting to your board can go from a highly stressful experience to hassle-free and genuinely productive. This post will show you the key ingredients of high-level board reporting, explain the benefits of automating your board reporting, and more. Let’s dive in.

What is board reporting in SaaS finance, and what role do your key performance indicators play?

Board reporting is the process of presenting important information and updates to the board of directors of a company. These reports can cover financial performance, revenue trends, campaign forecasts, and other critical business info that helps the board make informed decisions. For CFOs, the first step in board reporting is helping other department leaders prepare a board pack.

The board of directors report, or board pack, is an essential document prepared and distributed before board meetings. It provides a comprehensive company performance overview, including the annual report, and helps the board members make informed decisions. When you’re preparing board packs, automated reporting can help save time and provide the most relevant information for decision-making.

Metrics are also vital to high-performance board meetings. By optimizing your relationship to your KPIs, you’ll be able to clearly and effectively tell your board the full financial story they need. Automated board management software can be a significant asset in that regard.

We’re going to cover an extremely useful acronym that helps finance leaders identify their most important board reporting metrics. Then we’ll go into more detail about KPIs related to your board reporting.

Know your essential board reporting dynamics: get the big picture with MUD

When preparing for a board meeting, the central question is: what do you report on? The obvious answer to that is your company’s financial progress. But you need to go much deeper than that to be effective. What are your company’s core financial drivers? What financial inputs will deliver outsized results if measured, tracked, and optimized across time?

To find their unique business drivers, SaaS CFOs use the acronym MUD. MUD stands for Meaningful Underlying (Business) Dynamics, the key points that help you understand what powers your profitability at a higher level. What provides business profitability and what provides value to your investors are indistinguishable, so it’s critical to really spend some time with this.

No two businesses are identical, but some common examples of important business dynamics for SaaS companies include:

- Market dynamics

- Contracts

- Go-to-market strategy

- Product line growth trajectories

MUD helps you understand the dynamics behind your business. The process of selecting SaaS metrics for board reporting is related but separate, and we’ll also cover that a bit later in this post. This process has ramifications that begin as early in the board reporting process as board pack preparation. After all, the more clear and thorough your board pack is, the less time you’ll have to spend catching everyone up. That means everyone present will have more bandwidth for creative strategizing.

How do meaningful dynamics make for high-quality board reporting?

Taking the time to identify your company’s unique underlying dynamics is critical for at least two different reasons. First, it provides invaluable clarity to your board reporting. Your board knows what’s been measured, why you’ve measured it, and its expected impact on your company’s financial performance. And even if the people to whom you’re presenting disagree with you on some points, being ultra-specific allows you to smooth out those disagreements in a productive way.

In addition to giving clarity to individual board meetings, this approach gives your board a sense of narrative continuity across time. In other words, they can follow your company’s financial arc like a compelling real story. Visual tools like charts and graphs play an important part in that.

Now we’ll go deeper into selecting the metrics that will provide the narrative framework and “plot movement” for your board meetings.

Choosing your board reporting SaaS metrics: a closer look at questions to ask and best practices

To determine which metrics best serve your purposes at board meetings, you need to closely examine your revenue model, growth stage, and overall business strategy. Remember, your choice of metrics will influence decisions made by everyone from the CEO to the executive director. Don’t rush through the process of selecting them.

Take a moment to ask yourself questions such as:

- Do we operate on subscriptions, license purchases, or both?

- Do we use monthly, annual, or multi-year service contracts?

- Do we sell B2C or B2B? If the latter, do we sell primarily to SMBs or enterprise clients?

- Are we a young company with high growth expectations or a mature firm with slower growth projections?

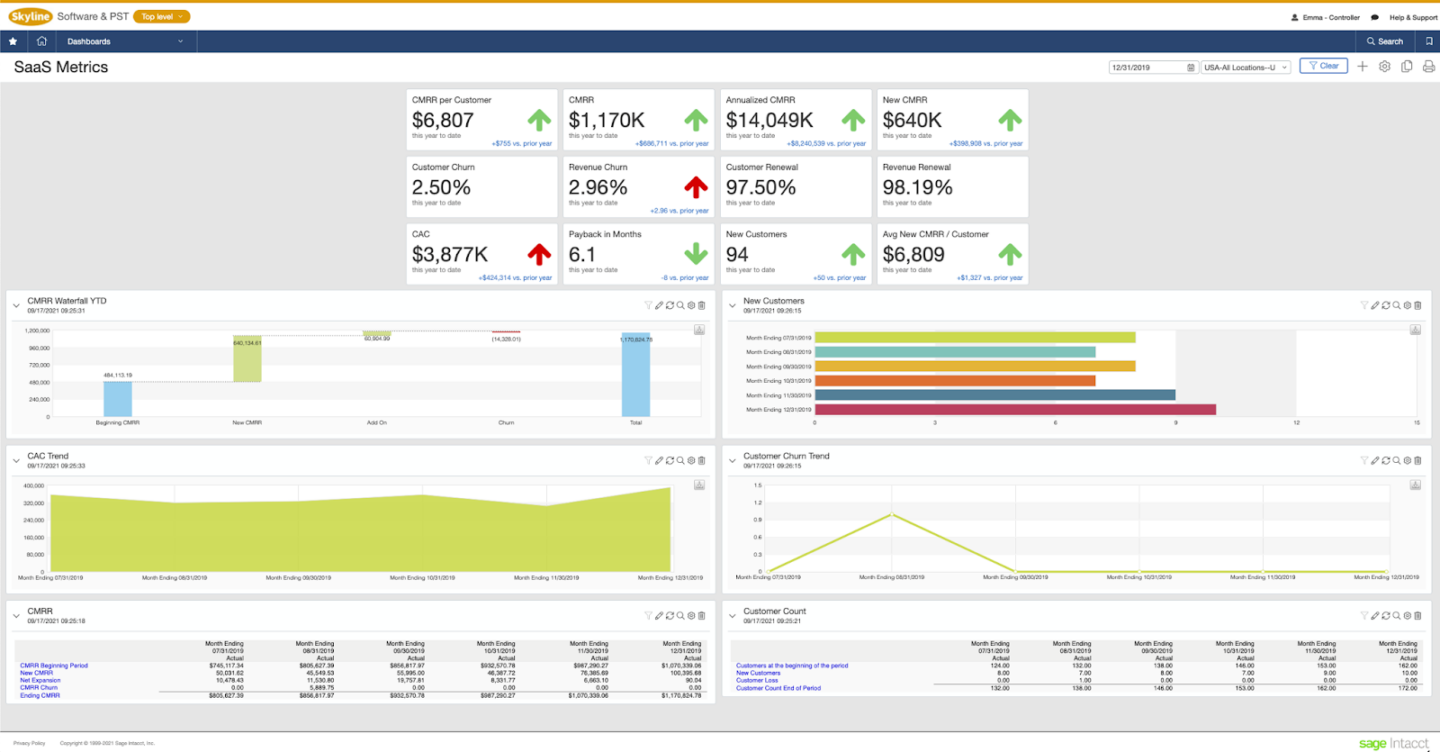

SaaS CFOs use automated dashboards in their board meetings and committee reports to access an exhaustive library of metrics and financial KPIs. There are two main categories of SaaS metrics you’ll want to incorporate into your board reporting–growth metrics and efficiency metrics.

Growth metrics vs. efficiency metrics (win market share and improve risk management by focusing on the right metrics)

For financial reporting purposes, your board will look for two primary metric categories that will influence their decision-making. Growth metrics paint a picture of how fast your company is expanding. Efficiency metrics, on the other hand, show your board how efficiently your company is using its capital and other resources.

Both categories offer some of the most critical information for board reporting. SaaS CFOs typically use accounting management software to present the full picture of their organization’s financial health with metrics from both categories.

However, growth metrics matter more for early-stage companies, and efficiency metrics take on more importance as organizations mature.

Two of the most significant SaaS growth metrics include:

1. Committed annual revenue: Your CARR measures your recurring subscription revenue for a particular financial year. It’s one of the most important metrics in board reporting.

2. Monthly recurring revenue: Think of your MRR as forming the monthly building blocks of your CARR. MRR is a vital board reporting metric. It helps you narrativize your annual financial performance by breaking it into measurable and influenceable segments.

Now let’s take a quick look at three important efficiency metrics for comparison purposes:

- Churn: For subscription companies, churn measures the percentage of users who unsubscribe from your services over a specific period. It’s considered an efficiency metric because customer retention is inseparable from running an efficient SaaS company.

- CAC to CLTV ratio: Your customer acquisition cost (CAC) represents the average amount spent obtaining each customer. Your customer lifetime value (CLTV) shows you how much money each customer spends with you before unsubscribing.

- Cash burn rate: Your cash burn rate indicates how quickly you’re running through your capital. Efficiently managing your burn rate by watching expenditures is a huge aspect of operating optimally as a CFO, and it’s sure to come up in your board reporting sooner or later.

Now let’s move on from the metrics behind effective board meetings to the tech and tools behind excellent board reporting.

Benefits of ERP automation for SaaS finance board reporting

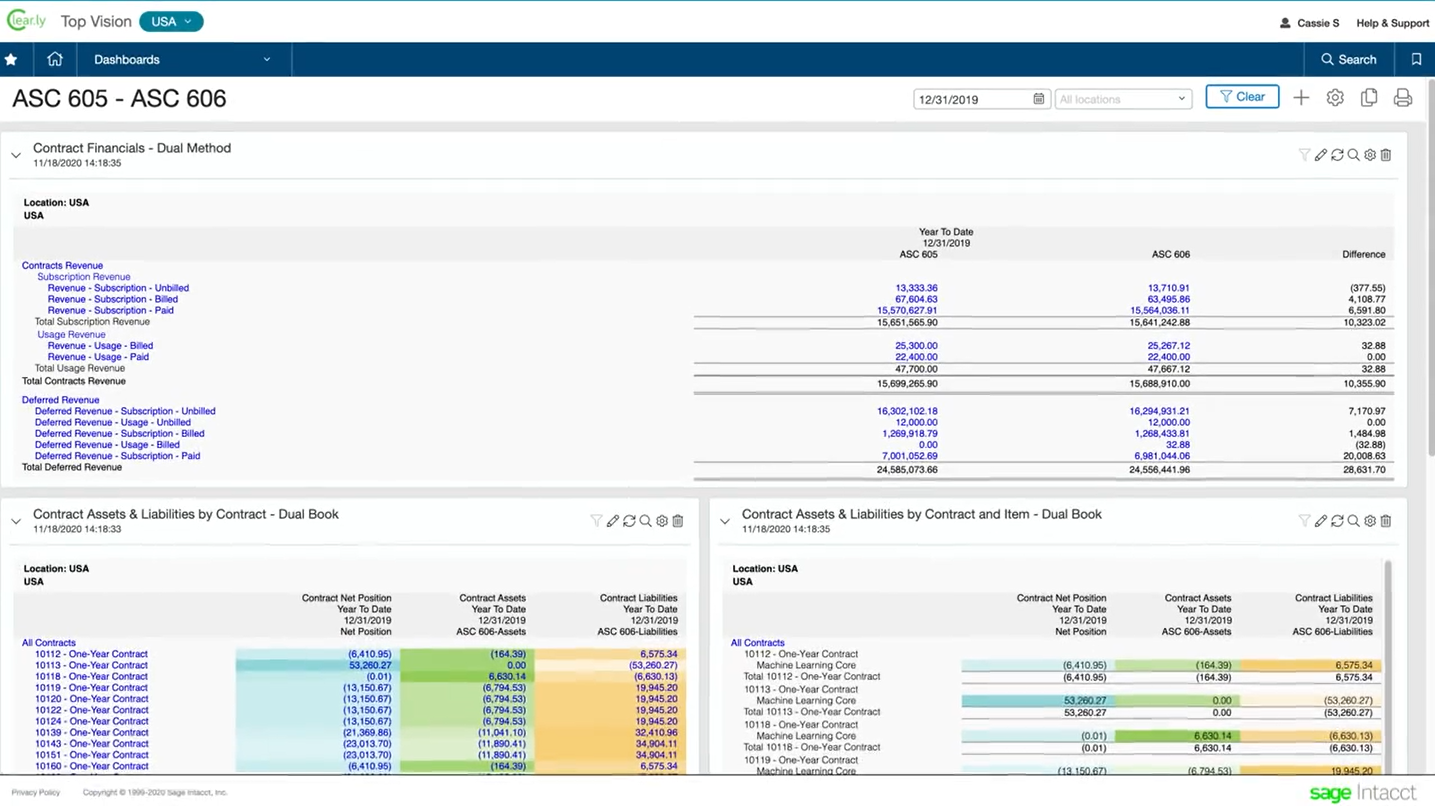

Automation enables SaaS CFOs to put together clear, effective, and accurate board presentations with a comprehensive range of financial information. Additionally, embracing automation can help you steer clear of any potential legal issue that might arise from accounting mistakes or compliance problems. (Your board certainly won’t thank you if ASC 606 mishaps occur on your watch.)

Cloud-based, automated reporting optimizes board meetings in several ways.

Automated reporting enhances options for metrics.

As we covered previously, SaaS metrics are part and parcel of effective board reporting and achieving profitability in general. Automated accounting suites give CFOs access to every metric they need to achieve productive board meeting outcomes by presenting their data clearly and compellingly with visual storytelling techniques.

Automated reporting enables financial storytelling.

Financial storytelling is essential for SaaS accounting departments. That holds equally true for your board reporting. Accounting software equipped with automation helps CFOs leverage data visualization tools like role-based dashboards, graphs, charts, and more.

Automated reporting maximizes forecast flexibility.

Accounting software equipped with automation improves your forecasting as well as your board reporting. Automated reporting makes it possible to quickly and easily take advantage of a variety of forecasting frameworks to answer different business questions your board might have.

We’ll take a quick tour of 2 different forecasting frameworks you could use for your next board meeting.

2 templates for automated reporting and forecasting: increase financial flexibility by using different frameworks

One of the best things about automation is that it enables you to present to your board on different angles of your company’s likely revenue performance. This helps your board get the best possible idea of your future finances.

Below are two of the most popular forecasting methods that CFOs use in automated board reporting.

1. Length of sales cycle forecasting.

This forecasting method averages out the time it takes for each lead to convert. It’s useful for helping you gauge the closing likelihood of each deal as it progresses through time. If your average sales cycle is three months and your sales team has been talking to a lead for a month, that lead has a 33% chance of closing at that point.

2. Lead-driven forecasting.

Lead-driven forecasts look at the source of each lead. For instance, some leads might have come from an email blast, some might have heard of you on social, and some might be organic web traffic. This forecasting tactic assigns each lead category a probability score based on historical data, giving you a snapshot of how likely they are to buy.

Cloud-native financial reporting makes board meetings seamless. There’s a lot on the line at every board meeting, and relying on outdated manual processes can easily cause problems. When you give your board a first-class reporting experience through automation, it reflects well on your entire company.

Maximize your transparency, effectiveness, and profitability at every board meeting

Whether you’re an early-stage startup, a late-stage SaaS organization, or somewhere in between, no board meeting should ever be wasted. Board reporting represents a crucial opportunity to chart the course of your company in the most profitable way possible. Quickly and effectively getting on the same page as your board during a presentation can make all the difference in achieving a productive outcome.

Expertly curated by SaaS finance and accounting leaders, the academy offers digital courses on a huge selection of cutting-edge topics. Online lessons include succeeding in your first 90 days as CFO and beyond, using financial storytelling for board and investor meetings, advanced forecasting techniques, and many other essential SaaS finance topics. Patterned off the success of the Hubspot Academy, but built for SaaS CFOs, Controllers, FP&A, RevOps, and CEOs, it is free and offers the option of CPE credits.

You can sign up today by clicking here.

Modern SaaS Finance Academy

The Modern SaaS Finance Academy is a free online training hub designed for CFOs, Controllers, FP&A, Revenue managers, Revenue Operations, and other members of the finance community in fast growth SaaS companies.