10 KPIs to Unlock SaaS Business Growth: Achieve Market Dominance

Discover the top 10 KPIs for unlocking business growth in your SaaS company. Our blog outlines CFO metrics for subscription success.

As a SaaS CFO, business growth should ALWAYS be on your mind. But how do you measure and track your progress, let alone forecast future results? That’s where your key performance indicators (KPIs) come in.

In this blog, we dive deep into the world of SaaS KPIs and their importance in unlocking sustainable business growth. We’ll 1) Explore the significance of SaaS KPIs, 2) Discuss how to pick the right KPIs for your company, 3) Show you how to improve existing KPI strategies for better performance, and 4) Go through the top 10 SaaS growth metrics that every CFO should be tracking.

Let’s get started.

Understanding the concept of KPIs

Your key performance indicators (KPIs) provide crucial insights into your business performance.

They help you measure progress toward strategic goals, enabling you to identify what’s working and what isn’t, so you can double down on the former and reconsider the latter.

Your SaaS metrics help you:

- Track cash inflows and outflows to better plan for the future

- Forecast which product lines will be most successful in the long run

- Know how much money each of your subscribers generates on average

- Keep your most important buyers happy, maximizing subscription revenue

How can keeping a close eye on your SaaS metrics help you scale more seamlessly? Let’s take a look.

The role of KPIs in subscription business growth

Your KPIs serve as a guiding compass for your SaaS business, directing you towards the strategic decisions that will result in growth.

By identifying areas for improvement and optimization, KPIs help businesses stay on track and make informed decisions.

SaaS metrics are especially important for recurring revenue organizations. As we’ll cover a bit later in this post, a wide range of subscription and growth metrics are used to measure and scale recurring SaaS revenue.

Your metrics tell a financial story–or, really, a series of stories–but you have to listen to what they’re saying in order to benefit.

Your metrics streamline business growth by:

- Alerting you to trends in user behavior: Your metrics alert you to positive or negative customer usage trends early on. This is tremendously useful for getting in front of problems quickly, or making the most of a positive trend while it still has momentum.

- Helping you finetune your pricing: SaaS pricing offers a world of different choices. Forecasting your SaaS metrics lets you see the impact of different pricing decisions on your bottom line. Getting your pricing right is a huge part of maximizing renewals and overall cash flow.

- Showing you who your VIP customers are: Your KPIs show you which customer segments generate the lion’s share of your revenue. That data is essential for guiding your company’s sales and marketing efforts, optimizing customer success initiatives, and hitting your financial goals.

Now that you know why KPIs are vital for SaaS companies, let’s dive into our top 10 SaaS metrics for unlocking sustainable business growth.

1. Annual recurring revenue

Your annual recurring revenue (ARR) is the total subscription revenue that your company generates in a year. It’s a foundational metric, and practically every KPI we’re going to cover affects your ARR in one way or another.

A high ARR indicates that customers love your products, so it’s a top priority for investors. Keeping your ARR high and stable–both elements are essential–can help you hit your business goals faster and increase free cash flow for product development and market expansion.

2. Monthly recurring revenue

Monthly recurring revenue (MRR) refers to the monthly subscription revenue generated by your SaaS company. It gives you a useful snapshot of your short-term revenue, allowing you to monitor trends more effectively.

For instance, closely monitoring your MRR will quickly alert you to any upticks in churn or subscription downgrades. Your MRR is also crucial for analyzing the profitability of different customer segments–naturally, you’ll want to prioritize customers who contribute more than their fair share of monthly revenue.

Investors are likely to prefer companies with a high MRR, as it illustrates cash flow stability and greater financial predictability.

3. Activation rate

Your activation rate is the percentage of users who take a specific action that illustrates genuine customer use. You could think of it this way: a user activation is a step beyond a user signup.

So if your company has a product management SaaS, your “activation trigger” might be someone filling out a project outline. To find your activation rate for a specific period, first calculate the total number of users who completed your activation trigger. Then, divide that number by your total signups for the same period.

You could also have a few different activation points along your typical user journey. This helps triangulate UX issues that might be causing users to unsubscribe at a certain point, lowering your monthly and annual revenue.

4. Customer lifetime value

Customer lifetime value (CLV) is an extremely valuable piece of business intelligence. It shows you the total revenue a customer generates throughout their relationship with your company.

This data clarifies the long-term profitability of acquiring and retaining different types of customers, allowing you to construct your ideal buyer profile and maximize cash flow.

Accordingly, monitoring your CLV is important in optimizing marketing and sales strategies to attract high-value customers. It usually takes time, effort, and cash to acquire new SaaS users, but keeping a close eye on your CLV can guide your strategic efforts and help you cut expenditures in the process.

Regularly forecasting your CLV will keep you aware of whether your company is gaining and maintaining financial momentum.

5. Average revenue per user

Increasing your organization’s average revenue per user (ARPU) is crucial to your role as a SaaS CFO.

It’s much easier to boost cash flow by retaining existing users through superior service than constantly hunting down fresh business. Though both are important.

ARPPU (average revenue per paying user) is a similar metric with an important distinction. Your ARPPU tracks the average revenue generated by your paid subscribers. It provides further financial clarity for SaaS companies with free and paid users.

It’s never a bad idea to see if you can find your competitors’ ARPU. Regularly benchmarking against the competition can give you a sense of your overall progress.

6. Trial conversion rate

Your trial conversion rate measures the percentage of trial users who convert to paying customers. It reflects the overall effectiveness of your SaaS trial and whether there’s a strong product-market fit.

Paying attention to your conversion rate and optimizing your trial process can steadily increase cash flow while minimizing your CAC.

As with your revenue metrics, comparing your trial conversion rate against industry benchmarks provides valuable insight into your product performance.

Remember, the different types of KPIs all influence one another, leading to organic growth. For instance, a high trial conversion rate shows that users love your product. Satisfied users are far less likely to churn, raising your CLV, MRR, and ARR.

Satisfied users are also much more likely to take the next step in the customer journey: upgrading their subscription or purchasing more products.

There’s a specific metric for tracking that as well.

7. Expansion revenue

Expansion revenue refers to the additional revenue your company generates from upsells, cross-sells, or additional purchases made by your existing customers. Expansion revenue is often tracked on a monthly basis, and it’s called expansion MRR in that context.

Expansion revenue plays a crucial role in identifying opportunities for revenue growth within your existing customer base.

This reduces reliance on new customers to achieve business growth and is a great way to increase cash flow without hefty accompanying expenditures.

8. Customer growth rate

Your customer growth rate measures the percentage increase in your company’s total number of customers over a specific period of time.

This KPI reflects the success of your customer acquisition and retention efforts and can also shed light on strategic objectives for sales and marketing.

It enables you to track your company’s market penetration and competitiveness, giving you more control over revenue growth and can help you assess your organization’s ability to attract and retain new customers, which is essential for subscription cash flow.

Your customer growth rate is influenced by various factors such as:

- Quality of customer service

- Social media engagement

- Effective audience targeting

What other relevant KPIs for SaaS growth should you be paying attention to?

9. CAC payback period

The CAC payback period is a crucial metric for measuring the financial efficiency of your customer acquisition efforts. And just as importantly, it helps you ensure that your customer acquisition costs don’t spiral out of control.

This KPI measures the time your company takes to recover the cost of acquiring a customer. Your CAC payback period helps guide decision-making on resource allocation and SaaS budgeting.

It can be useful to think of your CAC, CLV, and CAC payback period as a distinct group of business metrics since they’re heavily related.

Monitoring and forecasting them in tandem is an excellent way to track your progress toward specific business goals related to growth and revenue.

10. Net promoter score

Net promoter score (NPS) is a vital KPI for gauging customer satisfaction.

You can find your NPS by asking your users a simple question: How likely are you to recommend our products to others? You then ask your users to rank their likelihood of recommending your company on a scale of one to ten.

From there, you group your responses into three categories:

- Promoters: Your promoters are the customers who love what you do. They’ll reply with a 9 or 10.

- Neutral: These customers will give you a 7 or 8. They may even like and keep using your product, but they’re not over the moon.

- Detractors: Your detractors will score between 0 and 6 and will likely churn soon unless you take corrective measures.

Finding your average NPS helps identify areas for improvement in product development, customer service or user support, enabling you to enhance your offerings and address pain points.

Your score also influences your overall cash flow from customer retention and word-of-mouth marketing.

Before we wrap up, let’s talk about how your relationship to your KPIs impacts the financial results you obtain from them. We’ll also talk about some best practices for improving your KPI monitoring.

Improving Existing KPI Strategies for Better SaaS Performance

As we’ve hopefully conveyed by now, tracking your SaaS metrics is vital to achieving financial success. But it isn’t the only variable in the equation.

Your department’s workflows, business processes, and even your company culture all play a large role in determining the effectiveness of your KPI usage.

Below are some of the most effective ways to transform your company’s relationship with its KPIs.

Create a KPI-centered business culture.

As someone in a leadership role, you should take responsibility for making sure everyone at your company understands the value of SaaS metrics.

To the extent that it makes sense for your organization, share your company’s KPI goals and your progress toward them with employees.

Doing so fosters transparency while boosting employee engagement at your company.

Switch to cloud accounting to streamline SaaS metrics visibility and accessibility.

When it comes to tracking and utilizing SaaS metrics, spreadsheet-based accounting is quickly becoming obsolete.

Cloud accounting software with AI gives finance leaders real-time access to their KPIs. Metrics are continuously updated in the cloud for up-to-the-second business intelligence, optimizing FP&A.

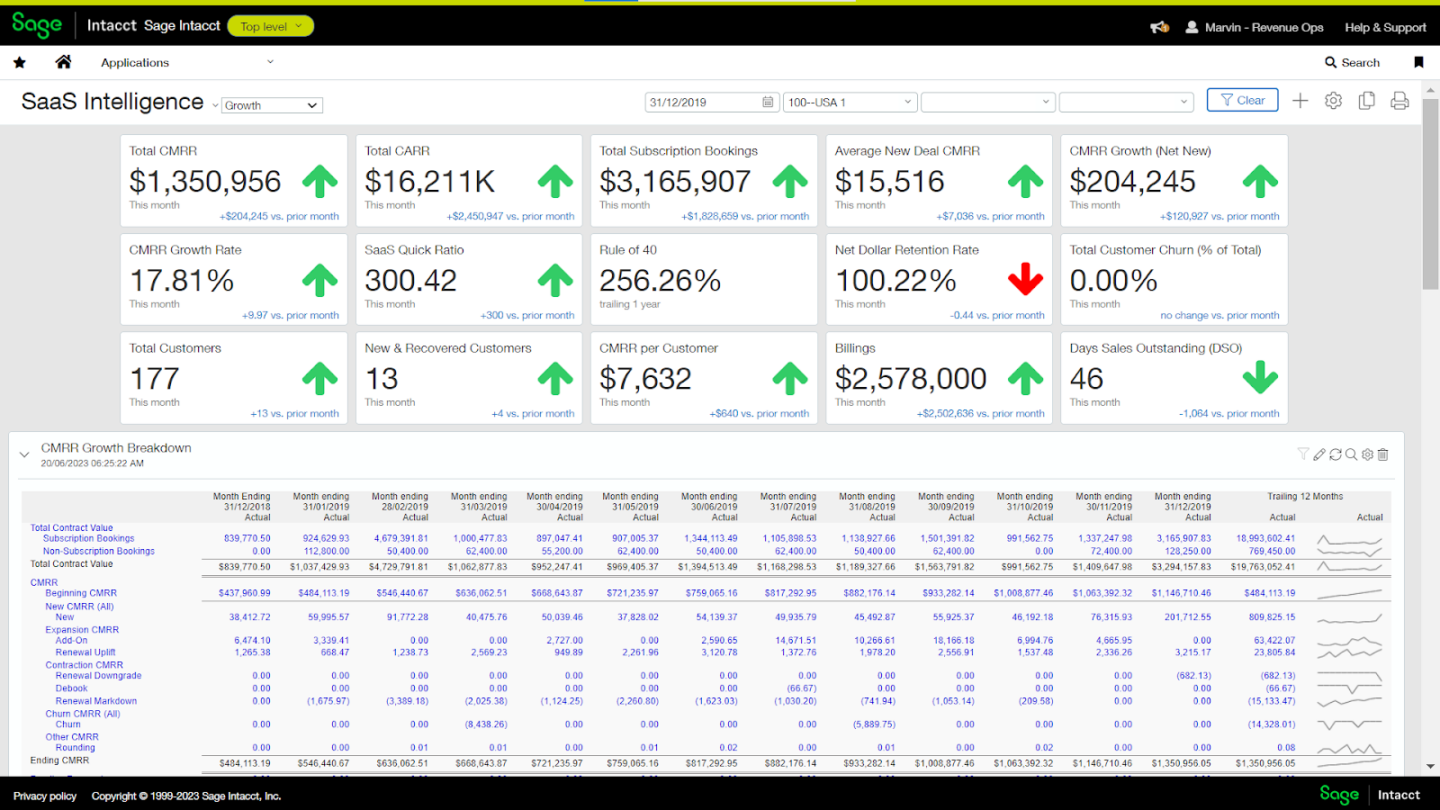

Embrace role-based dashboards for KPI management.

Role-based dashboards group all your important metrics into a single convenient screen view. KPI dashboards in cloud accounting software are also fully customizable, enabling others at your organization to map them to their unique daily needs.

The SaaS industry moves fast, and role-based dashboards are built to keep up. Why would you scroll through spreadsheets when you could just glance at a user-friendly screen?

Take control of your financial future with automated forecasts.

As a CFO, you’re probably well aware of the financial value of forecasting. Planning for your company’s financial future is key to achieving business growth and sustainable subscription cash flow.

What you might not know is that financial forecasting has advanced by leaps and bounds in recent years.

SaaS forecasts built with AI accounting software can create dynamic forecast models that change in real time with surrounding financial conditions. All the necessary model documentation is securely stored in the cloud in case of an audit.

Automated SaaS forecasts are less expensive than their manual counterparts while delivering longer-ranging, more accurate results.

With KPIs, you can achieve business growth in any environment

Your KPIs offer a firm foundation on which to build your financial success. By staying rooted in your SaaS metrics while making financial decisions, you can streamline user growth no matter what’s happening around you.Your metrics can do a lot. To discover how they can even help you unlock sustainable growth during tough times, check out our ebook: Navigating the Market Downturn with Better SaaS Metrics.

Navigating the Market Downturn with Better SaaS Metrics

Learn how your metrics and KPIs can guide you to market dominance in any financial climate by checking out our ebook for SaaS CFOs.