Money Matters

How to make successful pension contributions

As an employer, dealing with pension contributions is one of your key responsibilities. In this article, you will find out how you can make sure your pension contributions are submitted correctly. It will also reveal the implications if your calculations are incorrect, both on the business and your employees – and how to avoid this.

Paying pension contributions correctly

Since the UK government introduced auto enrolment in 2012, it’s now a legal requirement for businesses to offer workplace pensions to their employees and make contributions to their pension pots. This is the case even if you only have one member of staff.

But dealing with pension contributions can be complicated and if you get them wrong, the pensions of your employees could be left short and your business may be fined.

And the negative connotations of such a fine could affect how your business is seen, both by your current employees and any future staff you’re looking to take on as you grow your company.

There’s an organisation in the UK that has a remit to oversee and regulate pension schemes, and deals with fines when necessary. It’s called The Pensions Regulator.

What is The Pensions Regulator?

The Pensions Regulator is tasked with making sure businesses and employers put their employees into a pension scheme, and that money is paid into it. It also has the role of making sure workplace pension schemes are run properly. The goal is for people to have the chance to save money so they have funds available when they retire.

The regulator has the remit to fine employers who fail to comply with workplace pension rules and according to The Times, more than 40,000 fines have been issued since the pensions were introduced in 2012.

One company that fell foul of The Pensions Regulator is Samuel Smith Old Brewery, one of the oldest breweries in the UK. In July 2018, the company and its chairman were fined almost £30,000 for refusing to hand over documents related to its pension scheme.

A lack of financial expertise can lead to pension underpayments

Pension underpayments

One problem that can occur for businesses when dealing with pension contributions is the issue of underpayments. They can happen when a business fails to allocate the right amount of money to the pensions of its employees.

But why do errors with pensions happen? A lack of financial expertise is one issue. Not having a clear understanding of how to deal with pension payments is another. It can be a complicated affair. As a business owner, the reason you got into business might have been to turn a passion into a business. Maybe you spotted a gap in the market and seized the opportunity to make money from it.

The one thing you probably didn’t anticipate is the admin side that comes with running your own business – and dealing with pension contributions is one of them when you start employing people.

Former pensions minister Baroness Altman shed light on pension underpayments recently, revealing she told The Pensions Regulator that pension contribution errors were being made.

“I have raised this with the regulator and they have admitted to me it’s an issue,” she said. “I hope we can persuade them to get on top of this and not wait for more errors. This is an area of serious concern.”

A spokesperson for the regulator responded, saying: “We’ve no evidence that indicates that there is any widespread issue of employers deducting the wrong level of contributions from their workers.”

However, you want to make sure your business is doing the right things when it comes to pension payments, so it pays to err on the side of caution when dealing with them.

Pension contribution levels

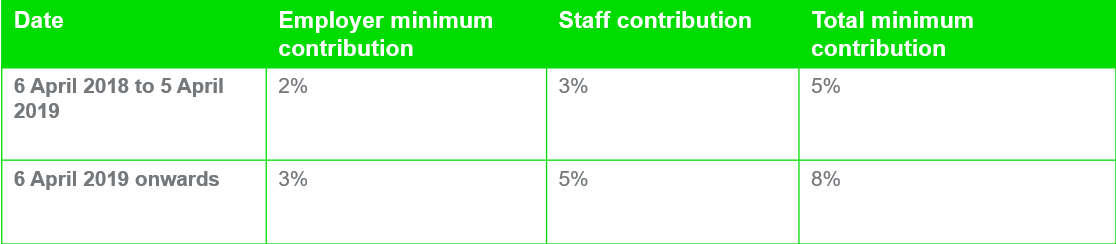

As an employer, it’s important to understand what your pension obligations are. To help you, here are the pension contribution levels for the 2018/19 tax year. The minimum contribution you need to make as an employer is 2%. The staff contribution is 3%. Therefore the total minimum contribution for this tax year is 5%.

In the 2019/20 tax year, pension contribution levels both for employers and employees are set to increase. From 6 April 2019, for employers the minimum contribution will be 3%.

The staff contribution will go up to 5%, meaning the total minimum contribution from 6 April 2019 onwards will be 8%. It’s worth noting that depending on the pension scheme you are using, the staff contribution rate may vary due to the type of tax relief that has been applied.

The chart below reiterates the pension contribution levels for the 2018/19 tax year and from 6 April 2019.

How payroll software can help make the correct pension contributions

One way for your business make the right pension contributions is by using payroll software. It will help you to make the correct calculations so you know the right money is allocated each month to your employees’ pensions.

When choosing your payroll software, make sure it’s right for your needs and can calculate how much you and your employees will have to pay in pension contributions. Check that it can automate as many tasks as you require it to. As well as sending the correct data to your pension provider, pick a solution that allows you to make payroll calculations for things like maternity leave and statutory sick pay.

And while we’re highlighting the benefits of using the correct payroll software, it’s worth making sure it’s compliant with RTI and allows you to keep the data that is needed for auto enrolment, including salaries and opt-outs. Did you know certain data must be kept for six years when it comes to auto enrolment?

The last thing you’ll want to make sure of is that your payroll software is provided by a trusted, reliable company that has experience with pension contributions and payroll.

Seek professional help with your pension contributions

If you’re a small business owner and dealing with pensions is new to you, it might be worth seeking outside help when dealing with contributions for your employee(s). A good accountant will be able to help you deal with workplace pensions while you focus on building your business.

There are also businesses with expertise in dealing with managing pensions and helping employers comply with pension rules. It might be worth researching which one could be a good fit for your requirements and paying them to keep you on the right path when it comes to your pension compliance.

Final thoughts on pension contributions

Getting your pension contributions right is important for a number of reasons but the main ones will be to make sure your business doesn’t get fined and so your employees have funds for their pensions when they retire.

Get the contributions correct and you’ll have a happy workforce, pleased in the knowledge that they can trust your business is managing their financial futures in the right way.

What are your stories of managing pension contributions for your employees? Let us know in the comments below.

The ultimate guide to auto enrolment

Everything you need to know about auto enrolment, re-enrolment and workplace pensions in one clear and concise guide.

This is fine for NEST, but I still have problems with Sage software not interacting with common UK pension providers, creating paperwork.