The RevOps and FP&A partnership in GTM planning

Do you know the secret ingredients to profitable GTM planning? If not, this post is for you.

Nailing your go-to-market (GTM) planning is crucial for driving efficient long-term revenue growth.

For SaaS companies, a well-executed GTM strategy hinges on strong collaboration between two teams:

In this post, we’ll explore how RevOps and FP&A can team up to create a profitable GTM strategy.

We’ll cover collaborative best practices, pitfalls to avoid, stakeholder dynamics, and more.

If you’ve been wondering how to take your company’s GTM planning to the next level, this post is for you.

Here’s what we’ll cover

- Why is the RevOps and FP&A relationship vital to GTM planning?

- What to avoid in the RevOps and FP&A collaboration

- The secret ingredients to a fruitful collaboration

- Understand key stakeholder dynamics

- Key points of agreement

- A shared understanding of risk

- Aim for objectivity at all costs

- Modern strategies for modern companies

Why is the RevOps and FP&A relationship vital to GTM planning?

Before we discuss the unique roles and responsibilities of both teams, we need to zoom out and consider the big picture.

Why are RevOps and FP&A working together, and how does their partnership impact GTM success?

RevOps pros are driven by questions such as, “Do we have enough pipeline to meet this quarter’s revenue commitment?

How will Sales, Marketing, and Customer Success work together to accelerate recurring revenue?”

FP&A, on the other hand, deals with profitability analysis, full year forecasting, and cash flow planning.

It handles board and investor strategies and usually has a longer-term view than RevOps.

What to avoid in the RevOps and FP&A collaboration

FP&A and RevOps have two equally important perspectives and sets of priorities. Without the involvement of both teams, your GTM strategy would suffer from serious blind spots.

However, these differences can also cause collaborative issues. Here are some things you’ll want to avoid:

Not prioritizing objectivity

When two teams come together to craft a strategy, it’s only natural that subjectivity and personal opinions creep in.

You’ll want to keep that to the bare minimum –data, where it’s available, will always beat not data driven opinions.

Arguing over who has the right numbers

When teams don’t use a single source of truth (SSOT) in their GTM planning, arguments can arise over whose numbers are right.

Collaborative and analytical difficulties are a predictable result of financial data silos. An SSOT keeps everyone on the same page.

Not balancing your time horizons

As we mentioned, FP&A tends to have a slightly longer strategic time horizon than Rev Ops.

This can lead to arguments about putting short-term goals ahead of long-term objectives and vice versa.

A great GTM plan accounts for both and sets out the trade offs made between the two.

If you can be aware of and reduce these issues, your GTM planning will run much more smoothly.

The secret ingredients to a fruitful collaboration

Now, let’s look at the other side of the coin. How can you build a rock-solid partnership?

Understand key stakeholder dynamics

Understanding where both teams are coming from is the first step in optimizing your GTM planning. Their differing perspectives and priorities have some inherent friction, but that’s not always bad.

If you understand the dynamics of both teams and their stakeholders, you can harness and use that tension to sharpen your collective decision-making.

FP&A represents the interests of your company’s board and investors, and RevOps represents the GTM team.

This is where the differences in time horizons come from, with FP&A favoring a longer view and RevOps a somewhat shorter-term one.

It’s also important to know what’s driving each team.

RevOps is more motivated by quotas and win rates, while FP&A is more focused efficiency, profitability and boosting long-term ROI.

The FP&A team wants to help the board meet its ambitious stretch goals.

Key points of agreement

For FP&A and RevOps leaders to harness these differences and use them as fuel, both teams need to align on three things.

1. Buyer’s journey and business model

A huge part of GTM planning boils down to two questions.

First, how does your company acquire new customers, whilst expanding its current customer base? Second, what does your buyer’s journey look like?

You’ll want to drill down into those aspects of your plan until they’re crystal clear to everyone and that each key component has been planned for.

2. KPIs and metrics

Next, you need to align on the KPIs you’ll use to define success. If both teams use different metrics to measure progress, you won’t make headway toward your goals.

It’s essential to be clear about the KPIs you’ll use to guide your decision-making. In addition, an established cadence of KPI tracking and review of performance against the plan is critical.

What gets measured gets managed, after all.

3. Your SSOT

The third point of agreement in your GTM planning is your SSOT.

Everyone should use the same data source for updates and insights, and you should adhere to that ruthlessly.

Data silos spell disaster for any GTM strategy, and an SSOT is your best remedy. Opt for a cloud accounting solution that supplies real-time financial updates.

Also important are integrations to CRM, and a good linkage between the finance system of record and the planning tool.

A shared understanding of risk

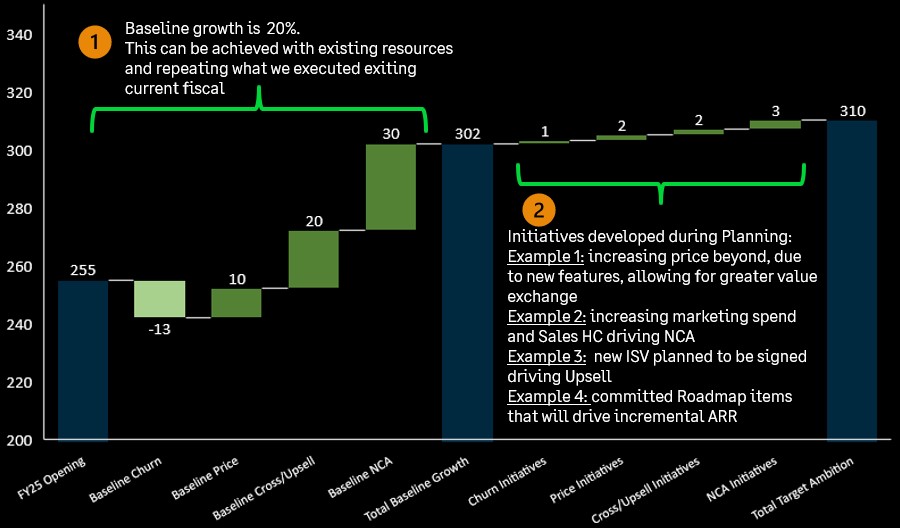

There should be minimal debate between FP&A and Rev Ops about the baseline growth the business can achieve, so long as there is some historical data and relevant external benchmarks – most companies have this unless they are very early start ups.

The baseline growth is typically defined as the level of growth that can be achieved in the future with the existing resources.

This represents low risk growth, where there is a clear and proven path to delivery.

A strong level of alignment around the baseline growth, allows the teams to spend most of the thinking time on initiatives to accelerate beyond the baseline growth.

Initiatives are by definition more subjective, more risky as they are unproven at the next level of scale, or are dependent on, for example, entering a new market or introducing a new motion to expand growth etc.

Having a methodical approach to risk like this increases transparency around where the risk is & allows teams to have a more objective discussion around risks and rewards, in the areas where most of the time should be spent.

Aim for objectivity at all costs

Our last tip for maximizing GTM success is to be objective despite any temptations to the contrary.

Any time people tackle a mission in groups, it’s unavoidable that some will think their ideas are superior or that they have a better grasp of the big picture.

Objectivity helps maintain cohesion and cool heads, and always yields the best results.

In your GTM planning, leverage historical trends as much as possible. And use external benchmarks to guide your thinking.

Sites like OpexEngine.com can be extremely useful in helping you benchmark against industry standards.

Modern strategies for modern companies

We talked about GTM planning and a whole lot more at the Modern SaaS Finance Forum last month.

Over two thousand SaaS industry leaders, investors, and experts digitally gathered on June 5th to explore what SaaS finance success looks like in 2024 and beyond.

The full-day forum was hosted by Sage Intacct, with finance leaders from top companies sharing their tools and strategies.

The conference was divided into 20-minute presentations with three learning tracks for CFOs, Controllers, and RevOps leaders at SaaS, high tech, and AI companies.

Due to the great feedback we received, we’ve decided to make the conference sessions digitally available for free.