How finance teams can use automation to save time on admin

Learn how finance teams can use automation and software to reduce time spent on manual tasks such as reconciliation, invoicing and credit control.

How much time is your finance team spending on business admin?

You might find it’s spending up to a day a week on repetitive, low-value-add tasks – like many other small businesses – which equates to a cost totalling thousands of pounds per year.

And money that’s lost due to a focus on completing admin tasks means you don’t have those finances to reinvest into your business.

Furthermore, the time you’re spending on manual processing is time you can’t spend on winning new business, selling to your existing base or providing excellent customer service.

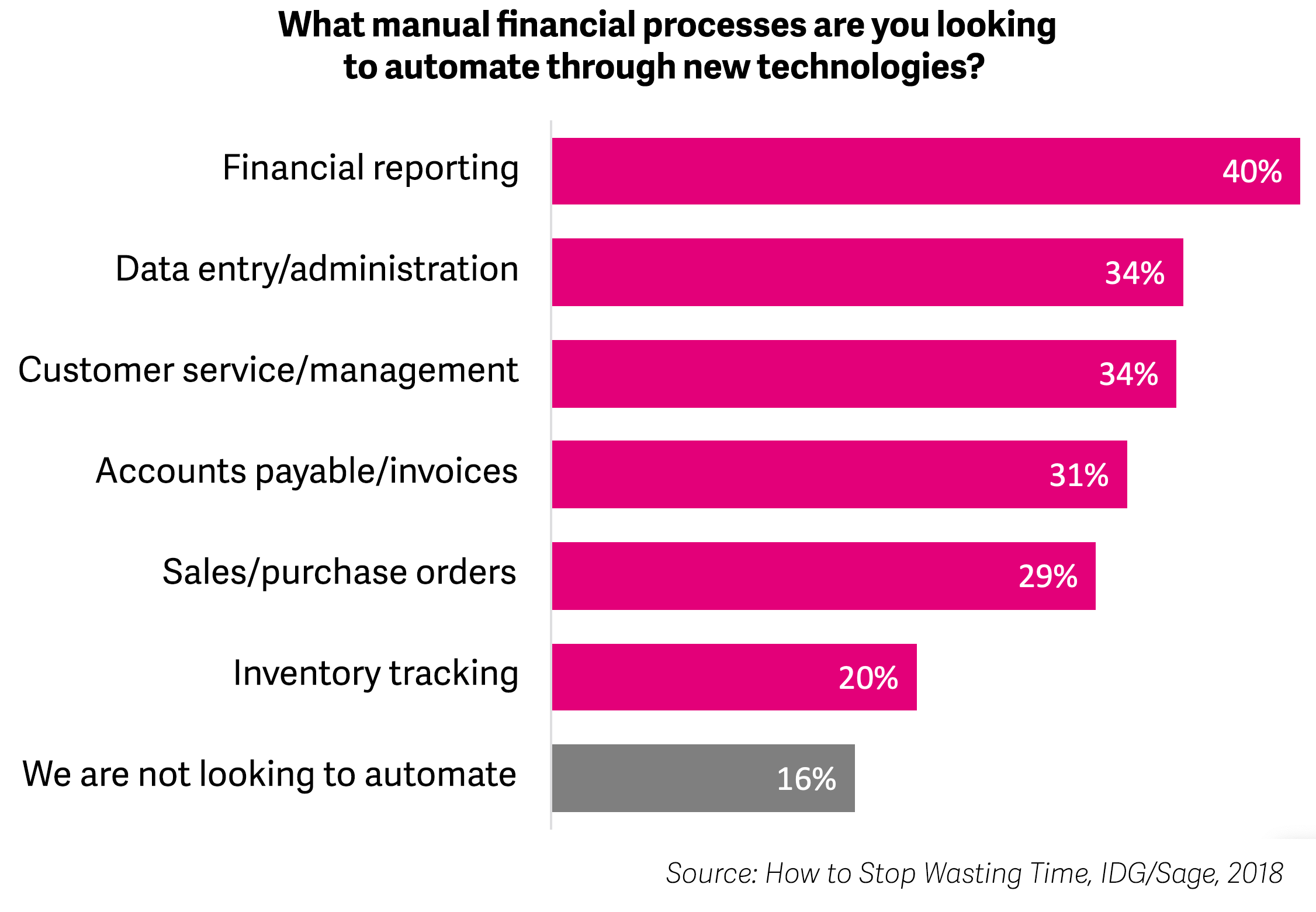

In association with IDG, Sage recently asked executives around the world what manual financial processes they’re looking to automate. The majority of those we spoke to worked in finance.

Financial reporting topped the list, followed by data entry/administration, and customer service/management.

All of these tasks can be significant drains on time and labour, and businesses have realised that automation is the way to gain a competitive edge moving forward.

Yet, according to the Office for National Statistics, almost one quarter of small firms (24%) admit they are not using electronic tools to manage what are largely repetitive, low-value processes within their finance teams.

By automating these processes, it’s possible to be more efficient and productive.

What is automation?

“Automation is about making the most of our human capabilities,” says Jen Stirrup, founder of Data Relish, a boutique data science and business intelligence consultancy.

“It does this by reducing and streamlining tasks that we are not very good at – but that computers are perfectly designed to do.”

In a finance office, this might be something like automatically reconciling payments with a bank account, or automating the capture of data from receipts and invoices.

Each of these frees up humans to do other things – but Stirrup explains that it’s not about removing people from the picture.

She says: “We’re looking to turn dials so we can make processes faster. But we also want a brake in there, so that if something is not correct, the human can come in and check or change a decision that the artificial intelligence has made.”

Sarah Gardener is head of outsourcing at Shaw Gibbs, a top 100 accountancy and financial planning practice, which has offices in Oxford and London. She helps larger and high-growth businesses, and their finance teams, to implement new technologies and automation apps.

She says there are now fewer barriers preventing small and medium-sized enterprises (SMEs) from applying the same smart thinking in their own operations.

Gardener says: “Implementing IT solutions can be a complex area, and one time when getting advice from an independent third party with specialist experience could be very worthwhile.

“It’s also important to remember that even once you’ve implemented automation, you will still need someone to manage the use and integration of new systems.

“Using apps is one thing but to really add value, you also need to interpret the data that comes out of them. This real-time insight helps with business planning, which is a genuine value-add.”

Discover the new Sage Accounting

Try our award-winning accounting software for small businesses and sole traders. Get paid faster, track cash flow and automate admin to free up time to focus on the work that matters most.

How my finance team started automating

Shaz Nawaz owns and runs AA Accountants, a chartered accountancy practice in Peterborough. Here, he explains how he introduced automation to his work in finance.

“It started a decade ago,” says Nawaz. “We thought about the mundane, regular and repetitive tasks that – let’s be honest – nobody likes doing. For us, a big part of these tasks is getting financial data from people.

“My team just wasn’t excited by this.

“So, we made a list of things that we repeat and that are regular enough for us to invest in coming up with something better.

“It’s been a game-changer.

“We realised there wouldn’t be one piece of software that does it all, so we’ve built a technology stack to fix different parts of the business.

“For example, we use a customer relationship manager to work with prospective new business. We have them fill in a questionnaire, and then they get a chance to book a meeting.

“Once they’ve booked, they get reminders and emails to attend. That whole process is automated.

“Once they’re onboard, we use practice management software for our workflow – including sending information like reminders to them, and other communications.

“Clients can again book meetings without the need for one of us to add it to the diary.

“We use software to automatically upload any financial documentation we receive to the accounting software, and we’re now working with clients to get read-only access to their bank account.

“Those working in finance should realise, as we did, that you can’t go crazy with automation. There has to be a certain amount of interaction.

“For example, we automate the booking of meetings – but we still have those meetings, and clients still want that interaction.

“It’s important to them – and us too.

“But automation means we can be the trusted adviser. It frees up the time to let that happen.”

Six tasks your finance team can automate now

There are tasks that can be automated now within your finance team with the use of the right software. Let’s follow the flow of money into and through a business.

1. Job costings

The first stage of selling a product or service is creating a quotation or estimate. This includes accounting for inventory, overheads and labour. It can be a complex process, particularly when there are several teams involved.

Before you know it, your people are duplicating effort by manually writing down data and then keying it into a system, and finance teams cannot easily generate useful reports.

Within accounting software, quotations can not only be easily created and then sent automatically to clients, but you and others can track those that have been won, lost or expired.

2. Collecting data

The team providing the goods or service will no doubt create expenses, for which they’ll hand you receipts, and you might find yourself in receipt of paperwork such as a purchase order to authorise the work.

Inputting this data can be time consuming, but the use of software such as AutoEntry can help. It lets you scan things such as receipts or invoices and then transfer the data automatically into your accounting system.

It’s been reported that this is so effective, it can reduce work that formerly took days down to a matter of hours.

Additionally, some accounting software lets your staff who are out and about, perhaps meeting customers and clients, snap a picture of a receipt at the point of purchase using their phone.

Once this is done, the data is then transferred automatically into the accounting solution.

3. Invoicing

Once the goods or service are provided, an invoice must be sent.

If you’ve created a quote within your accounting software, as mentioned earlier, it can be converted automatically into an invoice, with all the details filled in.

And because the correct invoice templates are available the accounting software, sending out a high-quality and complete invoice can be done in seconds – with no need to collect details from anybody concerned.

Details such as invoice numbers are automatically generated and tracked within the software.

4. Collecting payment

If your goods or services are delivered onsite then you can integrate a payment solution, such as a card reader, with your accounting software.

This means the team that’s out and about can collect payment there and then, removing the need to chase payments – and significantly boosting your company’s cash flow.

Alternatively, accounting software lets you set up alternative payment methods, while you can create standing orders or direct debits to make regular payments seamless.

This benefits not just the finance team but also the wider business because the team doesn’t have to create and authorise individual payments, or even worry about tracking invoices they receive.

5. Credit control

Of course, sometimes there’s no getting away from issuing an invoice and then waiting for payment.

But the use of good accounting software can help because it can send automated reminders to clients – both shortly before the invoice is due, and once the terms have expired.

This significantly reduces the work of the finance team and the stress of ensuring the cash flow is maintained.

6. Reconciliation

Once you receive the payment, it’s necessary to match the entry in the bank account with the relevant invoice in your system.

Reconciliation can be a massive drain of resources for any finance office.

So, why not automate? With many accounting packages, it’s possible to create rules that mean regular payments automatically get matched to their invoices.

Additionally, the introduction of artificial intelligence means accounting software can match up one-off or otherwise discrete payments too.

Of course, someone from your team will still have to check the reconciliation – but there’s a huge time and labour difference between peering at two lists and matching things up, and simply checking that an existing reconciliation is correct.

Summing up automation

For finance teams exploring the shift towards automation, it might be wise to contact Be the Business. This is a UK government-backed, not-for-profit organisation that offers free help and advice on how to streamline processes to maximise productivity.

For more ambitious programmes, it might be worth considering outsourcing the task to an experienced expert accountant with a successful track record. Check out the Institute of Chartered Accountants in England and Wales.

Automation presents an exciting opportunity to get ahead but make sure you manage it well. As Gardener adds: “Technology is just an enabler. People will always do business with people.”

Editor’s note: This article was first published in January 2020 and has been updated for relevance.

Small business toolkit

Get your free guide, business plan template and cash flow forecast template to help you manage your business and achieve your goals.