Money Matters

7 top tips for filing your Self Assessment tax return

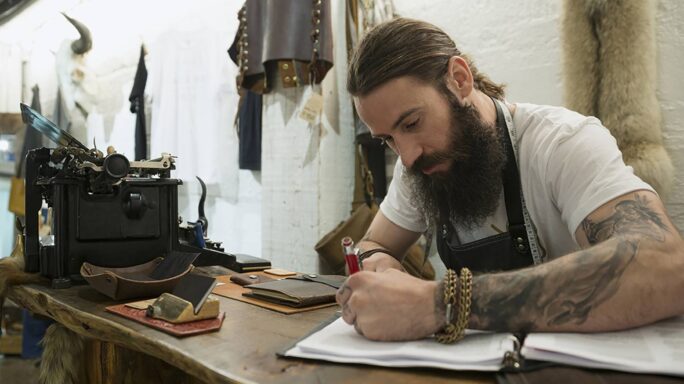

For many businesses, filing a Self Assessment tax return can feel like a burden. Read on for seven top tips on how to keep things simple.

Running your own business and being your own boss is a fantastic route to go down.

But one task you might need to manage is submitting a tax return.

Filing taxes when self-employed can feel daunting and confusing, and you need to know the facts around Self Assessment before you start.

Self Assessment is a system that HMRC uses to collect information needed to calculate how much income tax you should pay. And if you’re running a small business instead of getting a traditional salary, you need to work out how much you owe.

In this article, we share seven top tips to help you complete your Self Assessment tax return.

We’ve pulled together advice from HMRC and Shaw Gibbs—a top 100 accountancy and financial planning practice with offices in Oxford and London.

And there’s a bonus tip from one of our Sage Business Experts, too.

Here’s what we cover:

2. Be clear on the expenses you can claim back

3. Don’t be afraid to ask for help

4. Register for Self Assessment

Bonus tip: Don’t leave it to the last minute

Final thoughts on filing in your tax return

1. Get your house in order

Completing a Self Assessment tax return is much easier if you’ve kept good records.

Use a separate business bank account, as well as accounting software to track your income and expenses throughout the year rather than leaving it all to the last minute.

Keep good records (such as bank statements or receipts) to fill in your tax return correctly.

2. Be clear on the expenses you can claim back

When submitting a tax return, the more legitimate allowable expenses you can claim, with accompanying evidence, the less tax you will pay because you can offset costs against profit.

It’s worth getting advice from an accountant or a tax adviser on any big purchases such as cars and vans.

3. Don’t be afraid to ask for help

Getting Self Assessment tax return advice early can make a huge difference to your business. Accountants often ‘pay for themselves’—highlighting tax efficiencies can be worth more than the cost of their services.

Good accountants will spot potential mistakes, reducing the risk of you having to face an audit by HMRC, and possible penalties for getting your tax return wrong.

According to Shaw Gibbs, if you consider getting help, it’s worth appointing an adviser early to easily file your Self Assessment tax return on time.

Most businesses complete and submit their tax returns during the same period (typically in December and January). If you leave it late, you might struggle to find an accountant who can support you.

It’s also worth checking out free forms and help sheets, webinars and other resources on the HMRC website.

Let your business thrive with an expert on your side

Explore the Sage Accountant and Bookkeeper directory to find an expert suited to your location, industry, and business needs. Connecting with a powerful partner is just a few clicks away.

4. Register for Self Assessment

Before filing taxes as a self-employed person, you’ll need to register with HMRC as either self-employed, not self-employed, or as a partner or partnership. The process varies according to your status.

Make sure you leave up to 20 working days for HMRC to process your application and give yourself plenty of time before the deadline to complete your return.

Once you register, you’ll be sent a Unique Taxpayer Reference (UTR), which you will need when you file your return.

You can choose whether to file your Self Assessment tax return by post or online—the latter allows you to save drafts, review returns and print tax calculations.

If completing your tax return online, you’ll need to register for online services first. HMRC will send you an activation code. Allow up to a week for this to arrive.

You’ll need to input the UTR, activation code and your postcode in the Government Gateway or GOV.UK Verify.

Once you’re registered to use the system, you’ll need all your tax records, dividend vouchers, receipts, and other information to complete the online form.

You can save your progress at any time and return to complete the form later.

5. Have a clear plan

What’s the best way to do tax return planning? Avoid filing a tax return under pressure.

The deadline for paper returns is 31 October 2023. Online tax returns need to be completed by midnight on 31 January 2024. And tax must be paid by midnight on 31 January 2024 for the previous tax year ending 5 April.

Make sure you allow enough time to complete and submit your Self Assessment tax return so you can avoid late filing penalties.

You’ll get a penalty of £100 if your tax return is up to three months late. And you’ll have to pay more if it’s later than that, or if you pay your tax bill late. HMRC will also charge interest on late payments.

No one needs that.

6. Filling in your form

Many of the questions in the Self Assessment tax return form are similar. If it’s the first time you’re submitting one, it may be worth reading through everything first before you start to fill it in.

That way, you can see what information goes in each section and complete the task more quickly.

When working online, tax calculators will work out how much you owe. The amount will depend on your income tax bands. For some people, the tax will be deducted automatically from wages and pensions.

If you have additional income, such as a second property that you rent out, you’ll need to fill in an extra section.

There’s also a different rate for Capital Gains Tax if you need to pay it—if you sell shares or a second home, for example.

When you’re ready to submit, just go through it again to check your self-employed tax return details are correct.

7. Get ahead of the game

According to Shaw Gibbs, if you need to send a Self Assessment tax return, it’s worth submitting it as soon as possible after 6 April in any tax year so you can plan your finances for the year around any tax liabilities or refunds.

The easiest way to do tax return accounting is through an accountant or through software automation services.

Robert Shadbolt, a personal tax adviser with Shaw Gibbs, says: “There are a lot of tax allowances that go unclaimed every year.

“A tax adviser knows what these are and can help you to be more tax-efficient—for example, suggesting you use the Trading Allowance.

“Accountants can advise on the best course of action on big decisions or purchases, such as gifting assets to family members, selling second properties and making significant pension contributions.

“Accountants can also easily spot mistakes and misclaimed expenses—items that are not wholly and exclusively for the running of a business.”

Bonus tip: Don’t leave it to the last minute

Steve Johnson, a Sage Business Expert and the owner of Graphite Web Solutions, says: “While there is a deadline to complete your Self Assessment tax return, there is no need to leave it until 31 January as that piles the pressure on and can increase stress.

“Try to get your accounts completed close to your year-end as that will give you the time to complete your tax return. Then you can relax knowing it’s all done.

“Moreover, you can focus on your new year promotions rather than worry about getting your tax return in.

“Personally, from day one of running my own business, I decided to use an accountant to submit my return for me—that way, he collates all the information, asks me to check it and then ensures it is completed and submitted around June or July.”

Final thoughts on filing your tax return

By following this Self Assessment tax return advice, we hope you’ll find it easier to complete your tax return, so you can focus on what you do best—running your business.

Editor’s note: This article was first published in November 2019 and has been updated for relevance.

This blog offers invaluable tips for navigating the self-assessment tax return process seamlessly. From organizing documents to understanding deadlines, it provides essential guidance for individuals managing their taxes. Following these tips can help minimize stress and ensure compliance with HMRC requirements. Whether you’re a freelancer, small business owner, or self-employed individual, these insights are sure to streamline your tax filing experience.

Thanks for the article! Was helpful to learn about tax return filing tips.