Money Matters

VAT domestic reverse charge for construction: What accountants need to know

Read this for tips on how accountants can help clients with the VAT reverse charge for construction, which started on 1 March 2021.

The way HMRC collects VAT from construction firms has changed.

The VAT reverse charge was announced as part of the 2017 Budget to combat what HMRC estimates to be £100m of revenue lost each year through missing trader fraud.

On 1 March 2021, the VAT reverse charge for building and construction services came into force.

Read this article to find out what it means for your clients and how your accountancy practice can help them comply with the new legislation.

Here’s what it covers:

Who and what does the VAT reverse charge apply to?

What is the 5% disregard for VAT reverse charge?

What practical steps will my clients need to take?

How to help your clients with the VAT domestic reverse charge

Final tips on how you can add value to your clients

What are the key VAT changes?

HMRC has been working on the reverse charge over the past few years.

The aim is to tackle VAT fraud in the construction industry, specifically missing trader fraud, by making it the responsibility of the contractor or receiving sub-contractor to account to HMRC for VAT on applicable transactions.

In other words, a contractor no longer pays VAT over to their sub-contractor and instead pays it directly to HMRC via their own VAT return.

Its application is closely linked to the Construction Industry Scheme (CIS), which coincidentally was introduced just over 20 years ago.

Sage Accountant and Bookkeeper Hub

Use our hub for accountants and bookkeepers for tools, kits and support to help you and your clients.

Who and what does the VAT reverse charge apply to?

Any of your construction clients should have reviewed (or will have to do so now if they haven’t already) their relationships with their suppliers and customers to see which of their trading relationships are impacted by the reverse charge change.

Two key things to look out for when considering where the new rules need to be applied are:

- If the invoice is for services that fall within the CIS (both labour and materials) then the reverse charge applies – even if the sub-contractor is not registered for the CIS.

- The change only applies to individuals or businesses that are registered for VAT in the UK – it will not apply to end users, consumers (individuals), if the service is zero rated or if a sub-contractor is not registered for VAT.

There’s a more exhaustive list of services impacted by the domestic reverse charge on the HMRC website. This excludes services that are excluded from the CIS.

Once affected trading partners have been identified, businesses are advised to contact them.

For contractors, this means notifying sub-contractors that the reverse charge applies to services. If they haven’t already, contractors should do this now as the change impacts the cash flow of sub-contractors, which may lead to issues on projects.

In the absence of notification, sub-contractors should contact their customers for confirmation that the reverse charge will apply.

The reverse charge shouldn’t be applied to supplies to end users and intermediary supplier businesses. End users are deemed to be consumers or final purchasers of building and construction services.

End users may be registered for VAT and CIS, for example property developers who don’t make onward supplies of building and construction services.

In cases where sub-contractors are in doubt about their customer’s status as an end user, they should request confirmation in writing to determine if they need to apply the reverse charge to invoices.

Intermediary suppliers are VAT and CIS registered businesses that are connected or linked to end users.

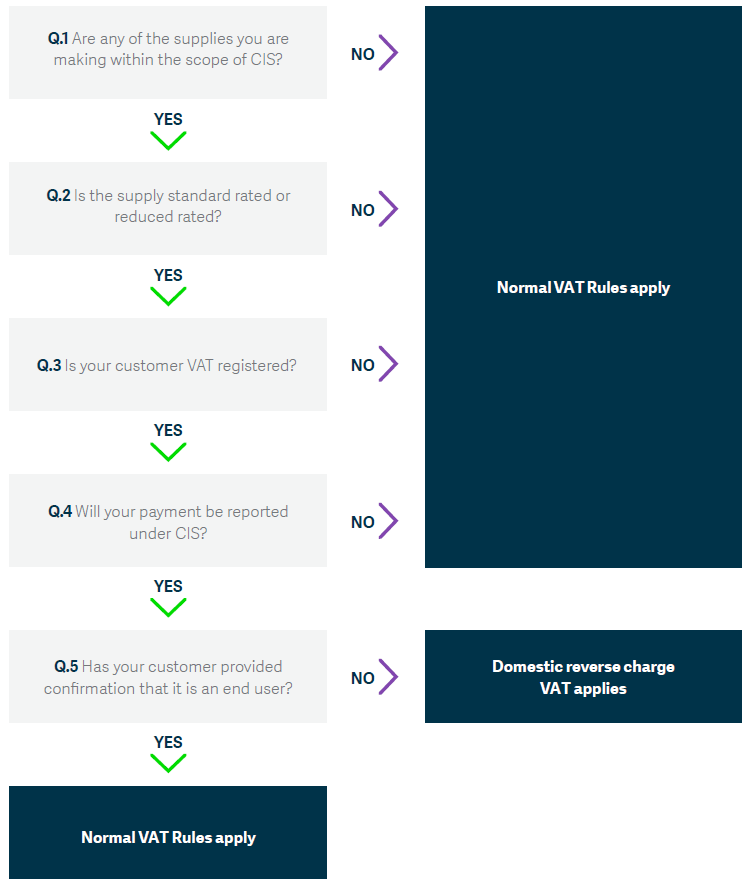

If your client is unsure about whether they need to apply the reverse charge, this flowchart should help:

What is the 5% disregard for VAT reverse charge?

The VAT reverse charge says certain work undertaken by a subcontractor must have the reverse charge applied if that work falls under the CIS.

A general list of the work that does fall under the CIS, and the work that doesn’t, can be found on the government’s website.

This is true if a subcontractor invoices for a mixture of work – so called mixed invoices – of which some falls under the CIS VAT reverse charge rules, but the rest doesn’t. In this case, the VAT reverse charge should be used.

But there’s an important exception.

If the component of the invoice for work that falls under the CIS VAT reverse charge rules is just 5% or less of the total amount invoiced, then the normal VAT rules are applied, and the CIS VAT reverse charge isn’t used.

For example, installing a security system doesn’t fall under the CIS reverse charge rules. Installing lighting does.

So, if an electrician were to visit a site to wire a security system and also took care of some lighting wiring while there, and the latter work represented 5% of less of the invoice amount, then the CIS VAT reverse charge should not be applied to the entire invoice.

But if the lighting wiring work was 10%, for example, then the VAT reverse charge should be applied to the entire invoice.

What practical steps will my clients need to take?

From an administrative perspective, the practical changes resulting from the VAT domestic reverse charge primarily impact the following three areas:

- Invoicing and payment

- VAT Returns

- Recording transactions

Invoicing and payment

Contractors

Payment to the sub-contractor now doesn’t include VAT as should be set out on the sub-contractor invoice. Instead, the contractor will pay the VAT directly to HMRC via their own VAT return.

This can still be reclaimed by the contractor in the usual manner, meaning the net impact is zero.

Where customers issue authenticated tax receipts or self-billing invoices, HMRC recommends the following wording is added:

“Reverse charge: We will account for and pay the output tax due to HMRC”

“Reverse charge: As the UK customer, we will pay the VAT due to HMRC”

Sub-contractors

Sub-contractors no longer need to include VAT in the amount payable on sales invoices.

However, sub-contractors are still required to clearly state how much VAT is due under the reverse charge or the rate of VAT if the VAT amount cannot be shown.

They are also required to make a note on the invoice to make it clear that the domestic reverse charge applies and that the customer is required to account for the VAT.

HMRC suggests something like the following:

“Reverse charge: VAT Act 1994 Section 55A applies”

“Reverse charge: S55 VATA 94 applies”

“Reverse charge: Customer to pay VAT to HMRC”

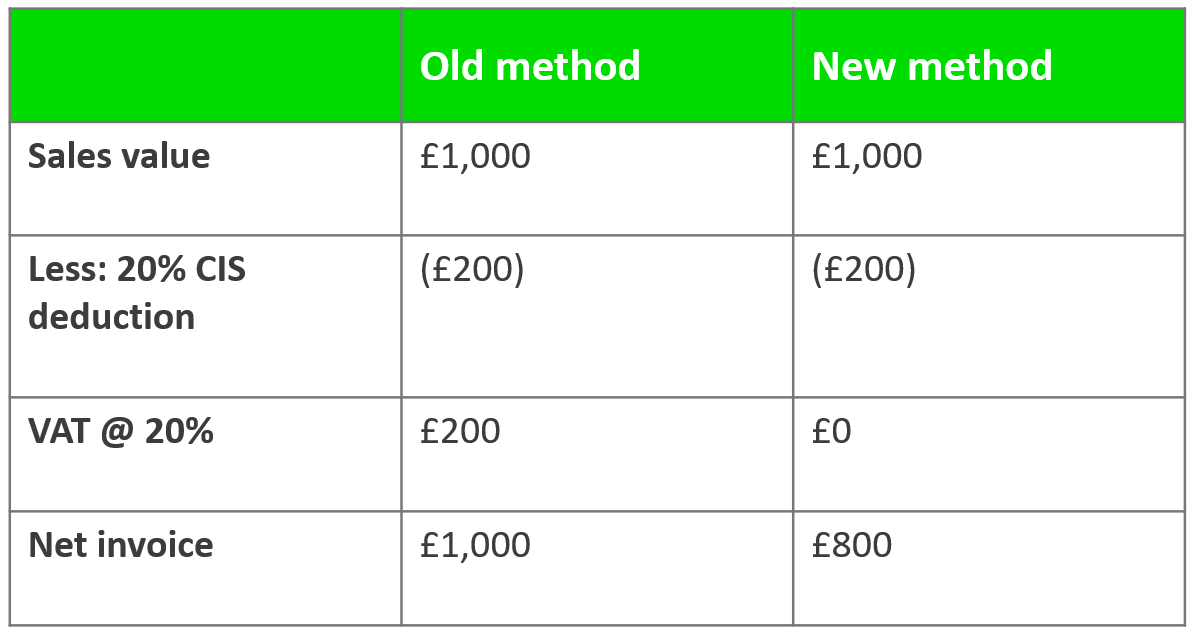

Where there is a CIS deduction, this should be included on the invoice. Here is an example of the change to sub-contractor invoicing:

Although sub-contractors are no longer collecting VAT, they are also no longer required to pay it over to HMRC meaning that, like the contractor, the net impact is zero.

However, the sub-contractor may well find that they are adversely affected from a cash flow perspective as they will no longer be holding on to this money before paying it over to HMRC – money that may be being used to support working capital.

VAT Returns

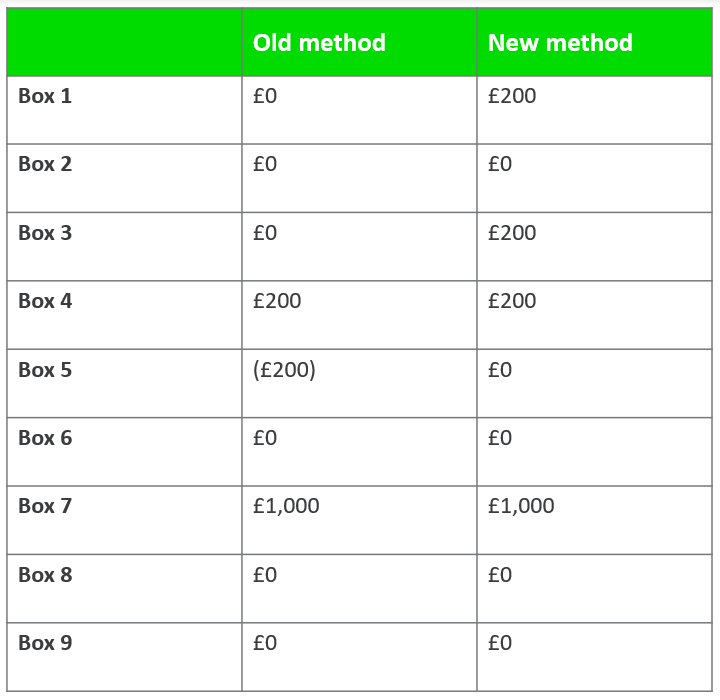

Contractors

The contractor should calculate the VAT due on the purchase at the relevant rate if this hasn’t been done by the sub-contractor.

This should be then be recorded as VAT on a sale and on a purchase.

This should be recorded in boxes 1 and boxes 4 on the contractor’s VAT Return.

Assuming the contractor is on the standard VAT scheme, here’s an example of the changes to completing a VAT Return based on the above invoice:

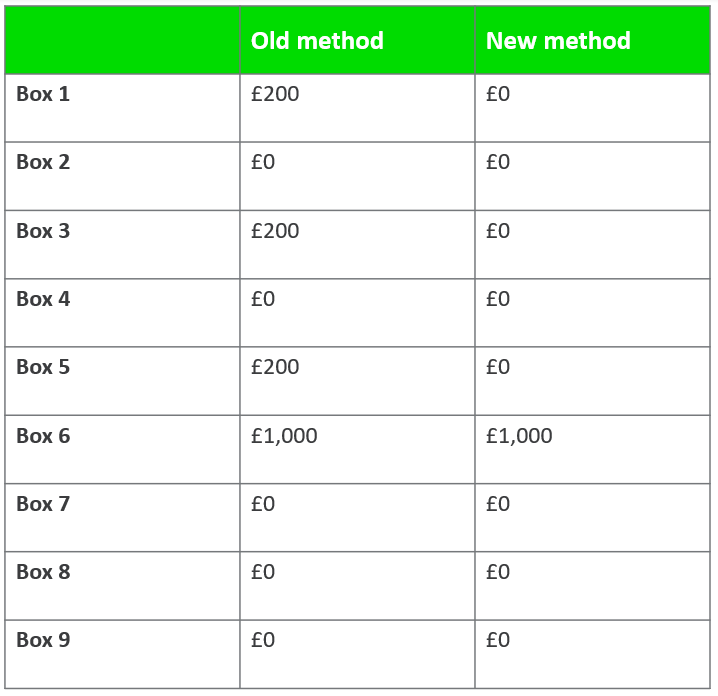

Sub-contractors

The sub-contractor no longer needs to record the VAT on sales when they are completing a VAT Return so no longer need to include the value in box 1.

Assuming the contractor is on the standard VAT scheme, here’s an example of the way VAT Returns should be completed now, based on the above invoice:

The above example focuses on a single transaction but assuming a sub-contractor’s trade is predominantly made up of sub-contracting work and the purchase of materials, they are likely to become ‘repayment traders’ whereby they VAT return is a net claim from HMRC rather than a net payment.

What you need to know about the flat rate scheme

One key thing to point out is that many sub-contractors who have minimal purchases and therefore minimal input tax to reclaim currently apply the flat rate scheme.

This allows them to apply a fixed rate percentage to gross turnover to determine VAT due and helps to simplify the process and manage cash flow.

However, transactions that fall within the remit of the reverse charge should be accounted for outside of the flat rate scheme and as a result, the scheme may no longer be beneficial for the sub-contractor.

While they no longer collect and pay VAT on the reverse charge transactions, they can also no longer reclaim input VAT on purchases as they would be able to under the standard scheme.

Read more about construction

- VAT domestic reverse charge for construction: 23 things you need to know

- Construction Industry Scheme: How VAT changes affect you

- VAT domestic reverse charge checklist for construction firms

Recording transactions

For contractors and sub-contractors, they need to check their accounting software to ensure it has construction reverse charge ability. In addition:

Contractors

There are changes to how they record VAT on reverse charge purchases as the coding for these will need to change.

Sub-contractors

There are changes to how they record VAT on reverse charge sales as the coding for these will need to change.

What are the key deadlines?

The implementation date for when the new rules will come into place was 1 March 2021.

This means that, in most cases, invoices raised after this date should apply the reverse charge if applicable even if the work was carried out prior to 1 March 2021.

HMRC has also stated a period of implementation during which it will apply a ‘light touch’ in dealing with any errors made, so long as people are trying to implement the new legislation and have acted in good faith.

How to help your clients with the VAT domestic reverse charge

As an accountant and adviser to construction businesses, make sure any construction clients are aware of the new legislation and are prepared to deal with the changes it will bring to their business.

If you haven’t already written to them or emailed them about the changes, make this a priority.

If they are a contractor, follow up to make sure they have written to sub-contractors to let them know about the changes.

Similarly, if they are a sub-contractor, they should start writing to customers to determine VAT treatment on sales.

Final tips on how you can add value to your clients

Tip 1

Identify those sub-contractors who are not registered for CIS (and therefore incur higher rate CIS deductions).

These clients are likely to be less well informed of the changes and may believe the new legislation doesn’t apply to them because they’re not registered for CIS. This isn’t the case.

If they make a supply that’s reported by the contractor under CIS then the legislation applies.

Tip 2

The cash flow of sub-contractors is likely to be impacted adversely by the new legislation, so start identifying these clients as soon as possible.

Ensure they are prepared and check their cash flow is robust.

Tip 3

As discussed, many sub-contractors may find they will become repayment traders. Repayment traders can apply to move to monthly returns to speed up repayment, which will help with cash flow.

So start identifying these clients and discuss the merits of moving to monthly returns.

Tip 4

Identify those sub-contractors who operate under the flat rate scheme and assess whether this is still beneficial or whether they should consider moving to the standard scheme.

Editor’s note: This article was first published in August 2019 and has been updated for relevance.

Tackling the Construction Industry Scheme with Sage Accounting

Learn about the Construction Industry Scheme and your legal responsibilities, and find out about the new VAT reverse charge for construction.

Ask the author a question or share your advice