Audit-ready: how technology is changing the nonprofit audit process

Conducting a nonprofit audit demonstrates your organization’s compliance with state, federal, and grantor guidelines, as well as the soundness and transparency of your financial processes. With increased competition for funding, an audit is an excellent way to demonstrate financial stewardship and maintain a strong reputation. Download the E-book: Accelerating Your Nonprofit Audit with Audit-Ready Financials […]

Conducting a nonprofit audit demonstrates your organization’s compliance with state, federal, and grantor guidelines, as well as the soundness and transparency of your financial processes. With increased competition for funding, an audit is an excellent way to demonstrate financial stewardship and maintain a strong reputation.

Download the E-book: Accelerating Your Nonprofit Audit with Audit-Ready Financials

Time is money. Being able to provide your auditor with complete, accurate, and easily accessible information may lower the cost of your audit. Fortunately, having the right financial management system in place makes it easier to work with your auditor. For example, when Koret Foundation adopted the Sage Intacct platform, it streamlined tax and audit reporting, enabling the organization to complete audits 60% faster and trim its audit costs by 20%.

In this article, we will discuss the importance of proper documentation for audits and examine eight ways technology can enhance the nonprofit audit process.

Documentation is critical for successful nonprofit audits

If there is one thing that can either ensure a successful audit, it is accurate financial documentation. In the audit process, the nonprofit organization will be responsible for providing the information the auditor requires. Not having that information ready and available can slow down the audit substantially.

There are other benefits to keeping good documentation of your financial transactions:

- Documentation can also help your organization demonstrate that you have met specific grantor requirements.

- For government grants, you will need specific documentation to prove your organization has followed CFR 200 cost principles.

- Proper documentation also helps meet internal requirements put in place by the board and by your organization’s policies.

- Documenting transactions maintains your organization’s internal control standards, helping to mitigate fraud and making sure each transaction is reasonable, acceptable, and within budget.

What kinds of documentation should be included in your financial recordkeeping? Key elements of each transaction include dollar amount, quantity, and information about the bid and the vendor. Documentation that supports those key elements includes items such as vendor invoices, contracts, and cash register receipts.

8 ways nonprofits can leverage technology to enhance audit processes

The key to a successful and cost-effective audit is having audit-ready financials that thoroughly document transactions and balances. Having the right nonprofit accounting system will help enforce documentation procedures while also saving your finance team time through automation. It will also have capabilities that make working with your auditor more seamless and efficient. Here are eight capabilities built into Sage Intacct that enhance the nonprofit audit process:

1. User access and permissions

Sage Intacct allows organizations to set different levels of access for individual users. Restrictions can also be defined by department and entity. This helps avoid errors in your data and reinforces your internal controls through the segregation of duties.

With Sage Intacct, the finance team can also grant read-only access for auditors to help save time and work together more effectively. GRAMMY Museum Mississippi found Sage Intacct’s sophisticated internal controls and read-only access options helped the organization maintain high accounting standards and easily pass all annual state and federal audits in under half the time.

Case Study – Cleveland Music Foundation

GRAMMY Museum Mississippi scales programming 400% through Sage Intacct’s modern processes and deeper insights

Samaritan House used to spend eight days pulling files, data, and reports together for audit preparation. With Sage Intacct, they eliminated those eight days by giving their auditor access to select and view the information needed.

Case Study – Samaritan House

Acclaimed nonprofit cuts audit prep time, trims payroll processing, and dramatically improves budget visibility and control using Sage software.

2. Audit logs and audit trails

Sage Intacct keeps an audit trail of all transactions entered, including date and time stamps and who entered each transaction. Additionally, the organizational audit log records every time data is created, accessed, or modified. During an audit, you never have to investigate who did what or when.

3. Smart rules and smart events

You can use smart rules to specify what data must be documented about a transaction or what authorization is required in order for a transaction to proceed. Smart rules either block or warn about transactions that don’t follow the rules, so finance can catch problems earlier.

Here are a few examples of smart rules. An organization could require all key elements of a transaction to be entered before it gets recorded. Certain types of transactions could prompt for an attachment, such as an invoice, to complete documentation. A rule could require transactions over a specified amount to receive additional authorization.

4. Approval policies

Sage Intacct lets you set separate purchasing workflows for various types of transactions, including different approval policies. For example, you can set up a different approval policy for credit card requests than for standard purchase requisitions. You can have multiple workflows as well for different dollar amounts. Having effective approval policies and workflows is another important form of internal control.

5. Dimension relationships

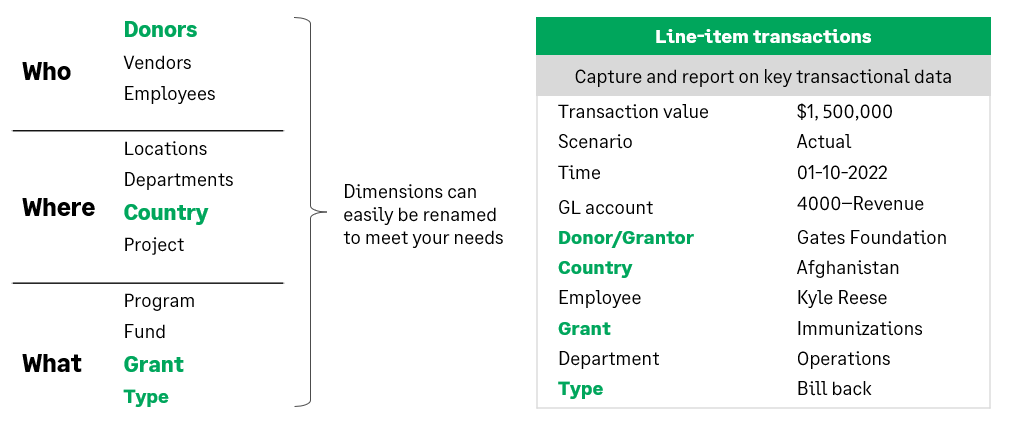

Sage Intacct utilizes a dimensional database to track and report on financial and operational data while maintaining a clean, simple chart of accounts. Sage Intacct Dimensions enable you to “tag” transactions as well as operational data with dimension values instead of assigning transactions to hard-coded individual accounts. You can also specify relationships between dimensions to add more control and accuracy to your financial documentation.

For example, if an accountant is adding a transaction and selects a department, they could be limited to choosing from a specific set of grants in the next drop-down menu.

6. Spend management

Sage Intacct Spend Management helps organizations govern their spending against budget. It automatically checks spend transactions against budget availability and enforces spending limits. When Montana Hospital Association (MHA), adopted Sage Intacct, they were able to increase their visibility into spending and save $100,000 per year without having to add headcount.

7. Custom fields

Nonprofits receiving federal funds often need to keep additional documentation. Sage Intacct offers custom fields to help you capture details needed for Schedule of Expenditures of Federal Awards (SEFA) reporting. You can set custom fields to record CFDA number, grant award number, special conditions of the grant, funding agency, and close-out instructions.

8. Embedded communications

When you keep all communication about financial transactions within the financial management system, it provides clarity and a complete record. Sage Intacct Collaborate makes it easy to communicate right inside Sage Intacct to resolve specific journal entries, accounts, projects, invoices, purchase requisitions, and more. This way, no important details are trapped in the email system. When an auditor is reviewing a transaction, they glean the full context of how decisions were made within your team. If given permission to access the system, the auditor can also use Sage Intacct Collaborate to ask questions.

“One of the things that we do is give our auditor view-only access to our Sage Intacct system. He can go in and, if he wanted to, audit every single transaction. He doesn’t do that, but it’s there. It cuts down on the time I need to spend with him on audits. He’s got the access, and it makes our audit go so much quicker. I can do an audit in one week with Sage Intacct. Can you believe it? A week. That is huge!”

Donna Dickt, Executive Director, NATCO

Learn how to achieve an expedient and cost-effective audit

Audits are an important way to demonstrate your organization’s financial stewardship and accountability. The right technology can help speed up your audit preparation process, improve your documentation, and potentially lower the costs associated with your audit. Download the Accelerating Your Nonprofit Audit with Audit-Ready Financials E-book to learn more about how to establish solid accounting processes, automate financial statement preparation, provide clear audit trails, and ensure proper documentation for a successful audit.

Accelerating Your Nonprofit Audit with Audit-Ready Financials

Download